US Treasury Intends Selling Warrants In SunTrust, Webster

May 25 2011 - 4:29PM

Dow Jones News

The U.S. Treasury Department says it intends to sell warrant

positions in two companies under a program designed to bail out

Wall Street.

Treasury Wednesday announced its intention to dispose of warrant

positions in Sun Trust Banks Inc. (STI) and Webster Financial Corp.

(WBS).

Treasury received the warrants in consideration for investments

made under the Troubled Asset Relief Program. Each company has

repurchased Treasury's preferred stock investment.

Over the next several weeks, Treasury intends to conduct

auctions to sell the warrant positions. The warrants will be sold

through public offerings, using a method that sets a market price

by allowing investors to submit bids above a minimum price

specified for each auction.

Treasury has 17.9 million warrants in Sun Trust and 3.28 million

in Webster.

The strike price on one set of SunTrust warrants, 11.89 million,

is $44.15, with an expiration date of Nov. 14, 2018. The strike

price on the other set, 6.01 million, is $33.70, with an expiration

date of Dec. 31, 2018.

The strike price on the Webster warrants is $18.28, with an

expiration date of Nov. 21, 2018.

-By Jeff Bater, Dow Jones Newswires; 202 862 9249; jeff.bater@dowjones.com

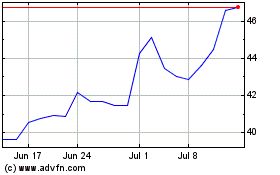

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Aug 2024 to Sep 2024

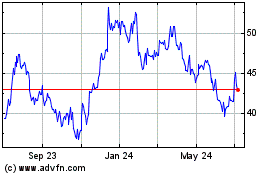

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Sep 2023 to Sep 2024