UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) July 28, 2015

Waters Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

| 01-14010 |

|

13-3668640 |

| (Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 34 Maple Street, Milford, Massachusetts |

|

01757 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(508) 478-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition |

On July 28, 2015, Waters Corporation

announced its results of operations for the quarter ended July 4, 2015. A copy of the related press release is attached hereto as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference in its entirety.

Item 9.01 Financial Statements and Exhibits

Exhibit 99.1 Waters Corporation press release dated July 28, 2015 for the quarter ended July 4, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WATERS CORPORATION |

|

|

|

|

| Dated: July 28, 2015 |

|

|

|

By: |

|

/s/ Eugene G. Cassis |

|

|

|

|

|

|

Name: |

|

Eugene G. Cassis |

|

|

|

|

|

|

Title: |

|

Corporate Vice President and Chief Financial Officer |

Exhibit 99.1

For Immediate Release

Contact: John Lynch, Vice President,

Treasurer and Investor Relations, 508-482-2314

Waters Reports Second Quarter 2015 Financial Results

Milford, Massachusetts, July 28, 2015 - Waters Corporation (NYSE/WAT) reported today second quarter 2015 sales of $495 million, an increase of 3% in

comparison to sales of $482 million in the second quarter of 2014. Foreign currency translation reduced sales growth by 7%. On a GAAP basis, earnings per diluted share (EPS) for the second quarter of 2015 were $1.27 compared to $1.13 for the second

quarter of 2014. On a non-GAAP basis, including the adjustments in the attached reconciliation, EPS were up 8% to $1.32 compared to $1.22 in the prior year quarter. A description and reconciliation of GAAP to non-GAAP EPS is attached and can be

found on the Company’s website at http://www.waters.com under the caption “Investors”.

Through the first six months of 2015, sales

for the Company were $955 million, up 5% compared with sales of $912 million in the first six months of 2014. Foreign currency translation decreased sales growth during the first half of 2015 by 7%. On a GAAP basis, EPS for the first six months of

2015 were $2.41 compared to $1.95 for the comparable period in 2014. On a non-GAAP basis and including adjustments on the attached reconciliation, EPS were $2.52 in the first six months of 2015 as compared to $2.13 in 2014.

Commenting on the quarter, Douglas A. Berthiaume, Chairman, President, and Chief Executive Officer, said, “Our strong performance in the second quarter

and first half of 2015 demonstrates the power of our technology-focused strategy and commitment to customer support. It also showcases our ability to continuously bring new innovations into the market while maintaining strong margins and strong free

cash flow.”

As communicated in a prior press release, Waters Corporation will webcast its second quarter 2015 financial results conference call this

morning, July 28, 2015 at 8:30 a.m. eastern time. To listen to the call, connect to www.waters.com, choose “Investor Relations” and click on the “Live Webcast”. A replay will be available through August 4, 2015 at

midnight eastern time, similarly by webcast and also by phone at 203-369-1489.

About Waters Corporation

For over 50 years, Waters Corporation (NYSE/WAT) has created business advantages for laboratory-dependent organizations by delivering practical and

sustainable innovation to enable significant advancements in such areas as healthcare delivery, environmental management, food safety and water quality worldwide.

Pioneering a connected portfolio of separations science, laboratory information management, mass spectrometry and

thermal analysis, Waters technology breakthroughs and laboratory solutions provide an enduring platform for customer success.

With revenue of $1.99

billion in 2014, Waters is driving scientific discovery and operational excellence for customers worldwide.

CAUTIONARY STATEMENT

This release may contain “forward-looking” statements regarding future results and events. For this purpose, any statements that are not statements

of historical fact may be deemed forward-looking statements. Without limiting the foregoing, the words, “feels”, “believes”, “anticipates”, “plans”, “expects”, “intends”,

“suggests”, “appears”, “estimates”, “projects”, and similar expressions, whether in the negative or affirmative, are intended to identify forward-looking statements. The Company’s actual future results

may differ significantly from the results discussed in the forward-looking statements within this release for a variety of reasons, including and without limitation, uncertainties relating to organizational/leadership transition plans; foreign

exchange rate fluctuations potentially affecting translation of the Company’s future non-U.S. operating results; the impact on demand among the Company’s various market sectors from economic, sovereign and political uncertainties;

fluctuations in expenditures by the Company’s customers, in particular large pharmaceutical companies; introduction of competing products by other companies and loss of market share; pressures on prices from competitors and/or customers;

regulatory, economic and competitive obstacles to new product introductions; other changes in demand from the effect of mergers and acquisitions by the Company’s customers; increased regulatory burdens as the Company’s business evolves,

especially with respect to the U.S. Food and Drug Administration and U.S. Environmental Protection Agency, among others; shifts in taxable income in jurisdictions with different effective tax rates; the outcome of tax examinations or changes in

respective country legislation affecting the Company’s effective tax rate; the ability to access capital, maintain liquidity and service our debt in volatile market conditions, particularly in the U.S., as a large portion of the Company’s

cash is held and operating cash flows are generated outside the U.S.; environmental and logistical obstacles affecting the distribution of products and risks associated with lawsuits and other legal actions, particularly involving claims for

infringement of patents and other intellectual property rights. Such factors and others are discussed more fully in the sections entitled “Forward-Looking Statements” and “Risk Factors” of the Company’s annual report on Form

10-K for the year ended December 31, 2014 and Form 10-Q for the period ended April 4, 2015 as filed with the Securities and Exchange Commission, which “Forward-Looking Statements” and “Risk Factors” discussions are

incorporated by reference in this release. The forward-looking statements included in this release represent the Company’s estimates or views as of the date of this release report and should not be relied upon as representing the Company’s

estimates or views as of any date subsequent to the date of this release.

Waters Corporation and Subsidiaries

Condensed Unclassified Consolidated Balance Sheets

(In thousands and unaudited)

|

|

|

|

|

|

|

|

|

| |

|

July 4, 2015 |

|

|

December 31, 2014 |

|

|

|

|

| Cash, cash equivalents and investments |

|

|

2,208,893 |

|

|

|

2,055,388 |

|

| Accounts receivable |

|

|

406,583 |

|

|

|

433,616 |

|

| Inventories |

|

|

272,932 |

|

|

|

246,430 |

|

| Property, plant and equipment, net |

|

|

324,896 |

|

|

|

321,583 |

|

| Intangible assets, net |

|

|

223,160 |

|

|

|

232,371 |

|

| Goodwill |

|

|

353,340 |

|

|

|

354,838 |

|

| Other assets |

|

|

239,040 |

|

|

|

233,708 |

|

| Total assets |

|

|

4,028,844 |

|

|

|

3,877,934 |

|

|

|

|

| Notes payable and debt |

|

|

1,560,297 |

|

|

|

1,465,243 |

|

| Other liabilities |

|

|

535,949 |

|

|

|

518,025 |

|

| Total liabilities |

|

|

2,096,246 |

|

|

|

1,983,268 |

|

|

|

|

| Total equity |

|

|

1,932,598 |

|

|

|

1,894,666 |

|

| Total liabilities and equity |

|

|

4,028,844 |

|

|

|

3,877,934 |

|

Waters Corporation and Subsidiaries

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

July 4, 2015 |

|

|

June 28, 2014 |

|

|

July 4, 2015 |

|

|

June 28, 2014 |

|

|

|

|

|

|

| Net sales |

|

$ |

494,740 |

|

|

$ |

481,801 |

|

|

$ |

955,144 |

|

|

$ |

912,309 |

|

| Cost of sales |

|

|

208,707 |

|

|

|

201,853 |

|

|

|

397,953 |

|

|

|

389,572 |

|

|

|

|

|

|

| Gross profit |

|

|

286,033 |

|

|

|

279,948 |

|

|

|

557,191 |

|

|

|

522,737 |

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

122,660 |

|

|

|

131,930 |

|

|

|

242,411 |

|

|

|

258,565 |

|

| Research and development expenses |

|

|

30,555 |

|

|

|

26,977 |

|

|

|

59,506 |

|

|

|

51,723 |

|

| Purchased intangibles amortization |

|

|

2,500 |

|

|

|

2,646 |

|

|

|

4,974 |

|

|

|

5,293 |

|

|

|

|

|

|

| Operating income |

|

|

130,318 |

|

|

|

118,395 |

|

|

|

250,300 |

|

|

|

207,156 |

|

|

|

|

|

|

| Interest expense, net |

|

|

(6,546 |

) |

|

|

(6,271 |

) |

|

|

(13,181 |

) |

|

|

(12,302 |

) |

|

|

|

|

|

| Income from operations before income taxes |

|

|

123,772 |

|

|

|

112,124 |

|

|

|

237,119 |

|

|

|

194,854 |

|

|

|

|

|

|

| Provision for income tax expense |

|

|

18,115 |

|

|

|

15,595 |

|

|

|

35,401 |

|

|

|

28,023 |

|

|

|

|

|

|

| Net income |

|

$ |

105,657 |

|

|

$ |

96,529 |

|

|

$ |

201,718 |

|

|

$ |

166,831 |

|

|

|

|

|

|

| Net income per basic common share |

|

$ |

1.28 |

|

|

$ |

1.14 |

|

|

$ |

2.44 |

|

|

$ |

1.97 |

|

|

|

|

|

|

| Weighted-average number of basic common shares |

|

|

82,564 |

|

|

|

84,462 |

|

|

|

82,798 |

|

|

|

84,731 |

|

|

|

|

|

|

| Net income per diluted common share |

|

$ |

1.27 |

|

|

$ |

1.13 |

|

|

$ |

2.41 |

|

|

$ |

1.95 |

|

|

|

|

|

|

| Weighted-average number of diluted common shares and equivalents |

|

|

83,332 |

|

|

|

85,177 |

|

|

|

83,551 |

|

|

|

85,538 |

|

Waters Corporation and Subsidiaries

Quarterly Reconciliation of GAAP to Adjusted Non-GAAP Financials

(in thousands, except per share data)

The

2015 and 2014 adjusted amounts presented below are used by the management of the Company to measure operating performance against prior periods and forecasts and are not in accordance with generally accepted accounting principles (GAAP). These

Non-GAAP amounts should be considered supplemental to, and not a substitute for, financial performance in accordance with GAAP. The Company believes that the use of Non-GAAP measures, such as Adjusted Non-GAAP Earnings Per Share (EPS) and Adjusted

Non-GAAP Operating Income, helps management and investors gain a better understanding of the Company’s core operating results, and is consistent with how management measures performance for purposes of executive compensation and forecasts the

Company’s performance. The reconciliation identifies items management has excluded as non-operational items. Management has excluded the following items:

| |

* |

Purchased Intangibles Amortization was excluded to allow for comparisons of operating results that are consistent over periods of time. |

| |

* |

Restructuring Costs, Asset Impairments, Acquisition-Related Costs and Other One-Time Costs were excluded as the Company believes that costs to consolidate operations, reduce overhead and complete acquisitions are

infrequent or unusual and are not indicative of normal operating costs. |

| |

* |

Infrequent Income Tax Items were excluded as these costs and benefits are typically the result of audit examination settlements, updates in management’s assessment of ongoing examinations or other unusual tax items

and are not indicative of the Company’s normal or future income tax expense. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

July 4, 2015 |

|

|

June 28, 2014 |

|

|

July 4, 2015 |

|

|

June 28, 2014 |

|

|

|

|

|

|

| GAAP Selling and Administrative Expenses (including Purchased Intangibles Amortization) |

|

$ |

(125,160 |

) |

|

$ |

(134,576 |

) |

|

$ |

(247,385 |

) |

|

$ |

(263,858 |

) |

| Purchased Intangibles Amortization |

|

|

2,500 |

|

|

|

2,646 |

|

|

|

4,974 |

|

|

|

5,293 |

|

| Restructuring Costs, Asset Impairments, Acquisition-Related Costs & Other One-Time Costs |

|

|

2,016 |

|

|

|

6,048 |

|

|

|

3,288 |

|

|

|

14,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP Selling & Administrative Expenses |

|

$ |

(120,644 |

) |

|

$ |

(125,882 |

) |

|

$ |

(239,123 |

) |

|

$ |

(244,199 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Operating Income |

|

$ |

130,318 |

|

|

$ |

118,395 |

|

|

$ |

250,300 |

|

|

$ |

207,156 |

|

| Purchased Intangibles Amortization |

|

|

2,500 |

|

|

|

2,646 |

|

|

|

4,974 |

|

|

|

5,293 |

|

| Restructuring Costs, Asset Impairments, Acquisition-Related Costs & Other One-Time Costs |

|

|

2,016 |

|

|

|

6,048 |

|

|

|

3,288 |

|

|

|

14,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP Operating Income |

|

$ |

134,834 |

|

|

$ |

127,089 |

|

|

$ |

258,562 |

|

|

$ |

226,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Provision for Income Tax Expense |

|

$ |

(18,115 |

) |

|

$ |

(15,595 |

) |

|

$ |

(35,401 |

) |

|

$ |

(28,023 |

) |

| Purchased Intangibles Amortization |

|

|

(717 |

) |

|

|

(759 |

) |

|

|

(1,421 |

) |

|

|

(1,502 |

) |

| Restructuring Costs, Asset Impairments, Acquisition-Related Costs & Other One-Time Costs |

|

|

(636 |

) |

|

|

(1,444 |

) |

|

|

(999 |

) |

|

|

(4,204 |

) |

| Infrequent Income Tax Items |

|

|

793 |

|

|

|

850 |

|

|

|

3,199 |

|

|

|

1,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP Provision for Income Tax Expense |

|

$ |

(18,675 |

) |

|

$ |

(16,948 |

) |

|

$ |

(34,622 |

) |

|

$ |

(32,022 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net Income |

|

$ |

105,657 |

|

|

$ |

96,529 |

|

|

$ |

201,718 |

|

|

$ |

166,831 |

|

| Purchased Intangibles Amortization |

|

|

1,783 |

|

|

|

1,887 |

|

|

|

3,553 |

|

|

|

3,791 |

|

| Restructuring Costs, Asset Impairments, Acquisition-Related Costs & Other One-Time Costs |

|

|

1,380 |

|

|

|

4,604 |

|

|

|

2,289 |

|

|

|

10,162 |

|

| Infrequent Income Tax Items |

|

|

793 |

|

|

|

850 |

|

|

|

3,199 |

|

|

|

1,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP Net Income |

|

$ |

109,613 |

|

|

$ |

103,870 |

|

|

$ |

210,759 |

|

|

$ |

182,491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP EPS |

|

$ |

1.27 |

|

|

$ |

1.13 |

|

|

$ |

2.41 |

|

|

$ |

1.95 |

|

| Purchased Intangibles Amortization |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.04 |

|

| Restructuring Costs, Asset Impairments, Acquisition-Related Costs & Other One-Time Costs |

|

|

0.02 |

|

|

|

0.05 |

|

|

|

0.03 |

|

|

|

0.12 |

|

| Infrequent Income Tax Items |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Non-GAAP EPS |

|

$ |

1.32 |

|

|

$ |

1.22 |

|

|

$ |

2.52 |

|

|

$ |

2.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

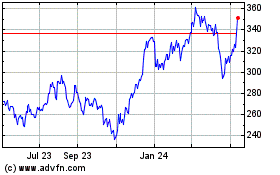

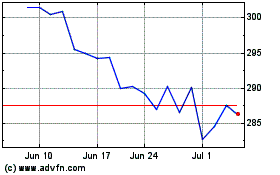

Waters (NYSE:WAT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Waters (NYSE:WAT)

Historical Stock Chart

From Sep 2023 to Sep 2024