Valero Energy Profit Falls 55%

October 25 2016 - 10:52AM

Dow Jones News

By Tess Stynes

Valero Energy Corp. said its third-quarter earnings fell 55% as

its refining business was hit by weaker margins for gasoline and

other refined products.

Narrower discounts on domestic crudes compared with other crudes

and higher costs related to biofuel blending requirements also

weighed on results.

However, per-share earnings, excluding certain items, and

revenue topped expectations. Shares rose 2.6% to $57.64 in early

trading.

Over all, Valero Energy reported a profit of $613 million, or

$1.33 a share, down from $1.38 billion, or $2.79 a share, a year

earlier. Excluding items, per-share earnings were $1.24. Revenue

decreased 13% to $19.65 billion.

Analysts expected adjusted per-share profit of 93 cents and

revenue of $16.62 billion, according to FactSet.

U.S. refiners haven't been benefiting as much from regional

price differences for crude lately as domestic production has

fallen and the country is allowing crude exports. New pipelines

also have smoothed out price differences between regions.

The company expects that its 2016 capital expenditures will come

in $200 million below its previous guidance of $2.6 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 25, 2016 10:37 ET (14:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

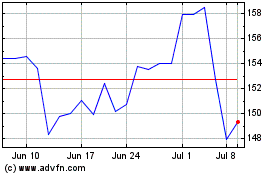

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Apr 2023 to Apr 2024