• Strong growth in streaming and subscriptions for

UMG

• The difficult situation for Canal+ channels1

in France offset by Canal+ Group’s other operations, in

particular in international markets

Regulatory News:

Vivendi (Paris:VIV):

Note: This press release contains unaudited consolidated

earnings established under IFRS, which were approved by Vivendi’s

Management Board on May 9, 2016, reviewed by the Vivendi Audit

Committee on May 10, 2016, and by Vivendi’s Supervisory Board on

May 11, 2016.

2016 first quarter key

figures2

Changeyear-on-year

Change at constantcurrency andperimeter3

year-on-year

€2,491 M

NS

-1.4%

IFRS measures

- EBIT4

- Earnings attributable to Vivendi SA shareowners4

€968 M

€862 M

x8.3

x25.9

Adjusted measures5

€228 M +4.5% +9.9%

€213 M -2.5% +3.6%

€99 M -27.3%

Excluding the unfavorable tax impact of

€41M related to the reversal of reserve followingsettlement of the

Liberty Media litigation, adjusted net income4 was

€140 M (+3.1%)

Cash

+€4.8bn vs. +€6.4bn as of December 31,

2015

Vivendi's Supervisory Board met today under the chairmanship of

Vincent Bolloré and reviewed the Group’s Condensed Financial

Statements for the first quarter ended March 31, 2016, which were

approved by the Management Board on May 9, 2016.

Revenues remained stable at €2.491 billion (-1.4% at

constant currency and perimeter compared to the first quarter of

2015). At constant currency and perimeter, income from

operations was up 9.9% and EBITA up 3.6% due to

restructuring charges. Universal Music Group’s growth resulted from

the significant increase in streaming and subscriptions, tempered

by the significant decrease in download revenues. The good

performance of Canal+ Group’s international pay-TV operations was

offset by increased losses suffered by Canal+ channels in

France.

These channels are negatively impacted by a difficult economic

environment, increased competition from national and international

players, and the skyrocketing prices for certain broadcasting

rights. A major transformation plan has been implemented over the

past months to restore value to the offer and to tailor it for each

customer segment. Efficiency and cost control measures have also

been put into place. Furthermore, Canal+ Group and beIN Sports

entered into an exclusive distribution agreement. This agreement,

which requires the approval of the French Competition Authority,

would be beneficial to beIN Sports, which would benefit from

Canal+’s distribution strength, as well as to the customers of both

companies who would have access to a comprehensive offering.

Adjusted net income was a profit of €99 million, down

27.3%. Adjusted net income would have amounted to €140 million, up

3.1% excluding the negative non-recurring tax impact of €41 million

due to the reversal of reserve following settlement of the Liberty

Media litigation (settlement agreement entered into in February

2016). Adjusted net income per share was €0.08, compared to €0.10

for the same period in 2015.

Earnings attributable to Vivendi SA shareowners amounted

to €862 million, compared to €33 million for the first quarter of

2015, thanks to the €576 million capital gain before taxes related

to the sale of the remaining interest in Activision Blizzard in

January 2016 and the reversal of reserve for €240 million following

settlement of the Liberty Media litigation. Earnings per share

attributable to Vivendi SA shareowners amounted to €0.66, compared

to €0.02 for the same period in 2015.

The Group's net cash position as of March 31, 2016

amounted to €4.8 billion, compared to €6.4 billion as of December

31, 2015. This change resulted in particular from the payment in

February of an interim dividend of €1 per share, representing an

aggregate payment of approximately €1.32 billion.

A world leader in media and content with a

strong presence in Southern Europe

In recent months, Vivendi consolidated its positions in the

production and distribution of content by making acquisitions

through Studiocanal of interests in several TV production companies

in Spain and in the United Kingdom (33% of Bambu Producciones, 20%

of Urban Myth Films and 20% of SunnyMarchTV). In February 2016, the

Group completed its acquisition of a 26.2% interest in Banijay

Group, one of the world's largest producers and distributors of

television programs.

In addition, Vivendi has entered into a strategic and industrial

agreement with Mediaset, a leader in free-to-air and pay TV in

Italy and Spain. Under this agreement6, Vivendi will swap a 3.5%

interest in Vivendi in exchange for a 3.5% interest in Mediaset and

100% of the share capital of the pay-TV company Mediaset Premium.

Vivendi and Mediaset intend to form an international partnership to

produce and distribute audiovisual programs and develop an

"over-the-top" (OTT) Internet TV platform.

In France, Vivendi will acquire a minority interest of 15% in

Groupe Fnac7 in the context of a cooperation project dedicated to

cultural activities.

Vivendi has confirmed its intention to be a long-term

shareholder of Telecom Italia in which it currently holds 24.7% of

the ordinary shares. As an industrial investor, it intends to

support the development of this transalpine operator by providing

its expertise and accelerating its content distribution activities.

The Group also holds 0.95% of Telefonica, which will allow it to

expand its content distribution network, particularly in Latin

America.

A major producer of mobile content

The Group intends to increase its original content creation

activities, including for mobile devices as the consumption of

short formats on mobile devices explodes.

Through its subsidiary Vivendi Content, the Group launched

Studio+, the first global offering of premium series for mobile

devices. Studio+ will produce exclusive premium series created

specifically for smartphones and tablets as well as a dedicated

App. Immediately upon its launch, Studio+ will offer 25 complete

original series. Among other parts of the world, Studio+ will be

available in Latin America in a few months thanks to a cooperation

with Telefonica.

Video games, a growing content

sector

Vivendi filed a public tender offer for the shares of Gameloft

(after crossing the 30% legal threshold in the share capital on

February 18, 2016) and has invested in Ubisoft (holding a 17.7%

interest as of April 27, 2016), two leading video game companies.

These investments are part of a strategic vision of operational

convergence between Vivendi’s content and platforms and the games

produced by these two companies.

Comments on Business Highlights

Universal Music Group

Universal Music Group’s (UMG) revenues were €1,119 million, up

0.6% at constant currency compared to the first quarter of 2015

(+1.9% on an actual basis).

Recorded music revenues grew 0.5% at constant currency thanks to

growth in subscription and streaming revenues (+59.7%) despite the

accelerated decline in download sales and the continued decrease in

physical sales.

Music publishing revenues grew 0.3% at constant currency, while

merchandising and other revenues declined by 6.9% at constant

currency due to lower touring activity.

Recorded music best sellers for the first quarter of 2016

included carryover sales from Justin Bieber and The Weeknd, as well

as new releases from Rihanna and the Japanese artist Tsuyoshi

Nagabuchi.

UMG’s income from operations was €102 million, up 18.6% at

constant currency compared to the first quarter of 2015 (+15.8% on

an actual basis) after adjusting for restructuring charges, as a

result of lower operating expenses, due to a softer release

schedule compared to the first quarter of 2015.

UMG’s EBITA was €79 million, marginally down 0.2% at constant

currency compared to the first quarter of 2015 (-4.0% on an actual

basis) as the benefits of higher revenues and cost savings were

offset by increased restructuring charges.

Canal+ Group

Canal+ Group’s revenues amounted to €1,328 million, down 3.1%

compared to the first quarter of 2015 (-2.8% at constant currency).

Canal+ Group had a total of 15.4 million subscriptions, a

year-on-year increase of 170,000, driven by the very strong

performance of pay-TV operations in Africa. In France,

subscriptions (with commitment) continued to decline to 8.276

million as of March 31, 2016, representing a decrease of 183,000

over the quarter.

Revenues from pay-TV operations in mainland France were notably

impacted by fewer subscriptions, despite a slight increase in ARPU.

International pay-TV revenues increased, thanks to growth in the

individual subscriber base, notably in Africa where Canal+ Group

had 500,000 more subscribers compared to the end of March 2015. In

February, Canal+ and Iroko launched in Africa Iroko+, a video on

demand service dedicated to mobile phones offering subscribers over

1,500 hours of videos in French.

Advertising revenues from free-to-air channels, up 11.5%

compared to the first quarter of 2015, benefited from the strong

audiences of D8 and D17. At the end of March 2016, D8 was once

again the leading DTT channel in France holding a 5% share of its

primary target audience of 25-49 year olds.

Studiocanal’s revenues were down compared to the first quarter

of 2015, which period notably benefited from the successful

theatrical release of Shaun the Sheep in Germany and the video

releases of Paddington and The Imitation Game in the United

Kingdom.

Canal+ Group’s income from operations increased by 6.4% to

€164 million, compared to €154 million for the first

quarter of 2015, and EBITA rose year-on-year to €169 million,

compared to €165 million for the first quarter of 2015. This

slight increase was driven by the strong development of

international pay-TV operations, as well as the favorable, but

temporary, impact of the phasing of costs. Canal+ channels in

France suffered an operating loss of €59 million, compared to

€50 million for the first quarter of 2015.

Vivendi Village

Vivendi Village’s revenues amounted to €25 million, up 2.4%

compared to the first quarter of 2015 (-6.9% at constant currency

and perimeter). Several new entities joined Vivendi Village last

year, including Le Théâtre de l‘Oeuvre in Paris and Radionomy.

MyBestPro recorded a particularly good performance during the

quarter.

Over the same period, Vivendi Village’s income from operation

was a loss of €4 million, related to new projects’ development

costs. Vivendi Village aims to serve as a laboratory for ideas and

a place for experimentation for the entire Vivendi Group thanks to

the flexibility of its small organizational structures.

In the coming months, Vivendi Village will launch CanalOlympia,

a network of cinema and performance venues in Central and Western

Africa. The opening of the first of these venues will take place on

June 14, 2016 in Yaoundé, Cameroon.

A number of initiatives have also been taken at L’Olympia to

expand target audiences at the iconic Paris music hall, including

hosting the "Olympia by Night" concerts in late evenings and

organizing a photo exhibition "The Olympia, yesterday, today and

tomorrow" during the day.

For its part, Watchever, a video-on-demand subscriptions service

in Germany, continues to diversify and expand its offer and

services. It is developing a mobile application which will enable

it to distribute the Studio+ premium series in the coming

months.

For additional information, please refer to the “Financial

Report and Unaudited Condensed Financial Statements for the first

quarter ended March 31, 2016” which will be released later online

on Vivendi’s website (www.vivendi.com).

About Vivendi

Vivendi is an integrated media and content group. The company

operates businesses throughout the media value chain, from talent

discovery to the creation, production and distribution of content.

The main subsidiaries of Vivendi comprise Canal+ Group and

Universal Music Group. Canal+ Group is the leading pay-TV operator

in France, and also serves markets in Africa, Poland and Vietnam.

Canal+ Group’s operations include Studiocanal, a leading European

player in production, sales and distribution of film and TV series.

Universal Music Group is the world leader in recorded music, music

publishing and merchandising, with more than 50 labels covering all

genres. A separate division, Vivendi Village, brings together

Vivendi Ticketing (ticketing in the UK, the U.S and France),

MyBestPro (experts counseling), Watchever (subscription

video-on-demand), Radionomy (digital radio), the Paris-based

concert venue L’Olympia, the future CanalOlympia venues in Africa

and the Theatre de l‘Oeuvre in Paris. With 3.5 billion videos

viewed each month, Dailymotion is one of the biggest video content

aggregation and distribution platforms in the world.

www.vivendi.com, www.cultureswithvivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to the

financial condition, results of operations, business, strategy,

plans and outlook of Vivendi, including the impact of certain

transactions and the payment of dividends and distributions as well

as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:Arnaud de PuyfontaineChief Executive

OfficerHervé PhilippeMember of the Management Board and

Chief Financial Officer

Date: Wednesday, May 11, 20166:00pm Paris time – 5:00pm

London time – 12:00pm New York time

Media invited on a listen-only basis.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)The conference will be held in

English.

Numbers to dial:UK + 44 (0) 203 427 19 08US +

1 646 254 33 88France + 33 (0) 170 99 42 77Access Code:

8516142

Numbers for replay :UK + 44 (0) 203 427

0598US + 1 347 366 9565France: + 33 (0) 174 20

28 00Access code: 8516142

On our website www.vivendi.com will be available dial-in

numbers for the conference call and for replay (14 days), an audio

webcast and the slides of the presentation.

APPENDIX I

VIVENDI

CONSOLIDATED STATEMENT OF

EARNINGS

(IFRS, unaudited)

Three months ended March 31,

%Change

2016 2015

Revenues 2,491 2,492 -

Cost of revenues (1,510) (1,510) Selling, general and

administrative expenses excluding amortization of intangible assets

acquired through business combinations (747) (757) Restructuring

charges (21) (7) Amortization of intangible assets acquired through

business combinations (55) (98) Reversal of reserve related to the

Liberty Media litigation in the United States 240 - Other income

580 1 Other charges (10) (4)

EBIT 968 117 x

8.3 Income from equity affiliates (13) (6) Interest (8) (5)

Income from investments 1 9 Other financial income 6 12 Other

financial charges (13) (18)

Earnings from continuing operations

before provision for income taxes 941 109 x

8.7 Provision for income taxes (65) (76)

Earnings from

continuing operations 876 33 x 27.0

Earnings from discontinued operations (1) 17

Earnings

875 50 x 17.7 Non-controlling interests (13)

(17)

Earnings attributable to Vivendi SA shareowners

862 33 x 25.9 of which earnings from

continuing operations attributable to Vivendi SA shareowners

863 16 x 52.9 Earnings attributable to Vivendi

SA shareowners per share - basic 0.66 0.02 Earnings attributable to

Vivendi SA shareowners per share - diluted 0.66 0.02

In millions of euros, per share amounts in euros.

Nota:

As a reminder, GVT (sold in 2015) has been reported as a

discontinued operation in compliance with IFRS 5. In practice,

income and charges from these businesses have been reported as

follows:

- GVT’s contribution, until its effective

divestiture on May 28, 2015, to each line of Vivendi’s Consolidated

Statement of Earnings as well as any capital gain recognized has

been reported on the line “Earnings from discontinued operations”;

and

- the share of net income and the capital

gain recognized as a result of the completed divestiture have been

excluded from Vivendi’s adjusted net income.

For any additional information, please refer to the “Financial

Report and Unaudited Condensed Financial Statements for the first

quarter ended March 31, 2016“», which will be released online later

on Vivendi’s website (www.vivendi.com).

APPENDIX II

VIVENDI

ADJUSTED STATEMENT OF EARNINGS

(IFRS, unaudited)

Three months ended March 31,

%Change

2016 2015

Revenues 2,491 2,492 -

Income from operations 228 218 + 4.5%

EBITA 213 218 - 2.5% Income from equity

affiliates (13) (6) Interest (8) (5) Income from investments 1 9

Adjusted earnings from continuing operations before provision for

income taxes 193 216 - 10.7% Provision for income taxes (78) (61)

Adjusted net income before non-controlling interests 115 155 -

25.8% Non-controlling interests (16) (19)

Adjusted net

income 99 136 - 27.3% Adjusted net

income per share - basic 0.08 0.10 Adjusted net income per share -

diluted 0.08 0.10

In millions of euros, per share amounts in euros.

The reconciliation of EBIT to EBITA and to income from

operations, as well as of earnings attributable to Vivendi SA

shareowners to adjusted net income is presented in the Appendix

IV.

APPENDIX III

VIVENDI

REVENUES, INCOME FROM OPERATIONS AND

EBITA

BY BUSINESS SEGMENT

(IFRS, unaudited)

Three months ended March

31, (in millions of euros) 2016 2015 % Change

% Change atconstantcurrency

% Change atconstantcurrency andperimeter

(a)

Revenues Universal Music Group 1,119 1,097 +1.9% +0.6% +0.6%

Canal+ Group 1,328 1,370 -3.1% -2.8% -2.8% Vivendi Village 25 25

+2.4% +2.8% -6.9% New Initiatives 30 - Elimination of intersegment

transactions (11) -

Total Vivendi

2,491 2,492 - -0.5% -1.4%

Income from operations Universal Music Group 102 88 +15.8%

+18.6% +18.6% Canal+ Group 164 154 +6.4% +7.0% +7.0% Vivendi

Village (4) 4 na na na New Initiatives (9) - Corporate (25) (28)

Total Vivendi 228 218

+4.5% +6.2% +9.9% EBITA

Universal Music Group 79 82 -4.0% -0.2% -0.2% Canal+ Group 169 165

+2.7% +3.3% +3.3% Vivendi Village - 4 na na na New Initiatives (10)

- Corporate (25) (33)

Total Vivendi

213 218 -2.5% -0.6% +3.6%

na: not applicable.

- Constant perimeter reflects the impacts

of the acquisitions of Dailymotion on June 30, 2015 within New

Initiatives and of Radionomy on December 17, 2015 within Vivendi

Village.

The reconciliation of EBIT to EBITA and to income from

operations is presented in the Appendix IV.

APPENDIX IV VIVENDI RECONCILIATION OF NON-GAAP

MEASURES

IN STATEMENT OF EARNINGS

(IFRS, unaudited)

Income from operations, adjusted earnings before interest and

income taxes (EBITA), and adjusted net income, non-GAAP measures,

should be considered in addition to, and not as a substitute for,

other GAAP measures of operating and financial performance. Vivendi

considers these to be relevant indicators of the group’s operating

and financial performance. Vivendi Management uses income from

operations, EBITA and adjusted net income for reporting, management

and planning purposes because they provide a better illustration of

the underlying performance of continuing operations by excluding

most non-recurring and non-operating items.

Three months ended March 31, (in millions of euros)

2016 2015

EBIT (a) 968 117 Adjustments

Amortization of intangible assets acquired through business

combinations 55 98 Impairment losses on intangible assets acquired

through business combinations (a) - - Reversal of reserve related

to the Liberty Media litigation in the United States (a) (240) -

Other income (a) (580) (1) Other charges (a) 10 4

EBITA

213 218 Adjustments Restructuring charges (a) 21 7

Charges related to equity-settled share-based compensation plans 2

2 Other non-current operating charges and income (8) (9)

Income

from operations 228 218

Three months ended March 31, (in millions of euros) 2016 2015

Earnings attributable to Vivendi SA shareowners (a)

862 33 Adjustments Amortization of intangible assets

acquired through business combinations 55 98 Reversal of reserve

related to the Liberty Media litigation in the United States (a)

(240) - Other income (a) (580) (1) Other charges (a) 10 4 Other

financial income (a) (6) (12) Other financial charges (a) 13 18

Earnings from discontinued operations (a) 1 (17) Change in deferred

tax asset related to Vivendi SA's French Tax Group and to the

Consolidated Global Profit Tax Systems 1 44 Non-recurring items

related to provision for income taxes 2 2 Provision for income

taxes on adjustments (16) (31) Non-controlling interests on

adjustments (3) (2)

Adjusted net income 99 136

a. As reported in the Consolidated Statement of Earnings.

APPENDIX V

VIVENDI

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(IFRS, unaudited)

(in millions of euros)

March 31, 2016(unaudited)

December 31,2015

ASSETS Goodwill 10,004 10,177 Non-current content assets

2,201 2,286 Other intangible assets 213 224 Property, plant and

equipment 711 737 Investments in equity affiliates 3,934 3,435

Non-current financial assets 1,953 4,132 Deferred tax assets 671

622

Non-current assets 19,687 21,613

Inventories 118 117 Current tax receivables 428 653 Current content

assets 950 1,088 Trade accounts receivable and other 1,899 2,139

Current financial assets 944 1,111 Cash and cash equivalents 6,372

8,225

Current assets 10,711 13,333

TOTAL ASSETS 30,398 34,946

EQUITY AND LIABILITIES Share capital 7,526 7,526 Additional

paid-in capital 5,342 5,343 Treasury shares (1,859) (702) Retained

earnings and other 8,701 8,687

Vivendi SA shareowners'

equity 19,710 20,854 Non-controlling interests

244 232

Total equity 19,954 21,086

Non-current provisions 1,686 2,679 Long-term borrowings and other

financial liabilities 796 1,555 Deferred tax liabilities 658 705

Other non-current liabilities 72 105

Non-current liabilities

3,212 5,044 Current provisions 330 363

Short-term borrowings and other financial liabilities 1,703 1,383

Trade accounts payable and other 5,097 6,737 Current tax payables

102 333

Current liabilities 7,232 8,816

Total liabilities 10,444 13,860

TOTAL EQUITY AND LIABILITIES 30,398 34,946

1 Canal+, Canal+ Cinéma, Canal+ Sport, Canal+ Séries, Canal+

Family and Canal+ Décalé.

2 In compliance with IFRS 5, GVT (sold on May 28, 2015), has

been reported as a discontinued operation. In practice, income and

charges from this business have been reported as follows:

- GVT’s contribution until its effective

divestiture, to each line of Vivendi’s Consolidated Statement of

Earnings has been reported on the line “Earnings from discontinued

operations”; and

- the share of net income and the capital

gain recognized as a result of the divestiture have been excluded

from Vivendi’s adjusted net income.

3 Constant perimeter allows for the restatement of the impacts

of the acquisitions of Dailymotion on June 30, 2015 and Radionomy

on December 17, 2015.

4 A reconciliation of EBIT to EBITA and to income from

operations, as well as a reconciliation of earnings attributable to

Vivendi SA shareowners to adjusted net income, are presented in

Appendix IV.

5 Non GAAP measures.

6 This transaction is subject to approval by the relevant

regulatory authorities.

7 Agreement submitted to the vote of Groupe Fnac’s General

Shareholders’ Meeting.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160511006472/en/

MediaParisJean-Louis Erneux+33 (0)1 71 71 15

84Solange Maulini+33 (0) 1 71 71 11 73orLondonTim Burt

(Teneo Strategy)+44 20 7240 2486orInvestor

RelationsParisLaurent Mairot+33 (0) 1 71 71 35 13Julien

Dellys+33 (0) 1 71 71 13 30

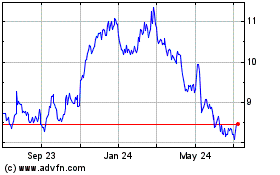

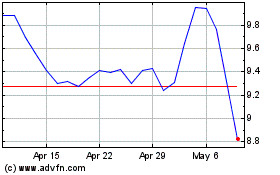

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024