Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

April, 2015

Vale S.A.

Avenida Graça Aranha, No. 26

20030-900 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

(Check One) Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

(Check One) Yes o No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

(Check One) Yes o No x

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

(Check One) Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .

Table of Contents

Interim Financial Statements

March 31, 2015

IFRS

Filed with the CVM, SEC and HKEx on

April 30, 2015

1

Table of Contents

Report of independent registered public accounting firm

|

|

KPMG Auditores Independentes

Av. Almirante Barroso, 52 - 4º

20031-000 - Rio de Janeiro, RJ - Brasil

Caixa Postal 2888

20001-970 - Rio de Janeiro, RJ - Brasil |

|

Central Tel

Fax

Internet |

55 (21) 3515-9400

55 (21) 3515-9000

www.kpmg.com.br |

Report of independent registered public accounting firm

To the Board of Directors and Stockholders of

Vale S.A.

Rio de Janeiro - RJ

We have reviewed the accompanying condensed consolidated balance sheet of Vale S.A. (“the Company”) and its subsidiaries as of March 31, 2015 and the related condensed consolidated statements of loss, comprehensive loss, changes in stockholders’ equity and cash flows for the tree-month period then ended. These condensed consolidated financial statements are responsibility of Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express an audit opinion.

Based on our review, we are not aware of any material modification that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with the International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

We have previously audited, in accordance with standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Vale S.A. and its subsidiaries as of December 31, 2014, and the related consolidated statements of income, comprehensive income, stockholders’ equity and cash flows for the year then ended, and in our report dated February 25, 2015, we expressed an unqualified opinion on those consolidated financial statements.

The condensed consolidated financial statement of the Company for the quarter ended March 31, 2014 presented for comparison purposes, were reviewed by other independent auditors, who issued an unqualified report dated April 30, 2014.

KPMG Auditores Independentes

Rio de Janeiro, Brazil

April 29, 2015

|

|

|

KPMG Auditores Independentes, uma sociedade simples brasileira e firma-membro da rede KPMG de firmas-membro independentes e afiliadas à KPMG International Cooperative (“KPMG International”), uma entidade suíça. |

|

KPMG Auditores Independentes, a Brazilian entity and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. |

3

Table of Contents

Condensed Consolidated Balance Sheet

In millions of United States dollars

|

|

|

Notes |

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

8 |

|

3,684 |

|

3,974 |

|

|

Financial investments |

|

|

|

1 |

|

148 |

|

|

Derivative financial instruments |

|

23 |

|

189 |

|

166 |

|

|

Accounts receivable |

|

9 |

|

2,291 |

|

3,275 |

|

|

Related parties |

|

30 |

|

522 |

|

579 |

|

|

Inventories |

|

10 |

|

4,064 |

|

4,501 |

|

|

Prepaid income taxes |

|

|

|

1,284 |

|

1,581 |

|

|

Recoverable taxes |

|

11 |

|

1,548 |

|

1,700 |

|

|

Others |

|

|

|

740 |

|

670 |

|

|

|

|

|

|

14,323 |

|

16,594 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets held for sale |

|

6 |

|

3,380 |

|

3,640 |

|

|

|

|

|

|

17,703 |

|

20,234 |

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Related parties |

|

30 |

|

23 |

|

35 |

|

|

Loans and financing |

|

|

|

217 |

|

229 |

|

|

Judicial deposits |

|

17 |

(c) |

1,102 |

|

1,269 |

|

|

Recoverable income taxes |

|

|

|

455 |

|

478 |

|

|

Deferred income taxes |

|

19 |

|

4,374 |

|

3,976 |

|

|

Recoverable taxes |

|

11 |

|

434 |

|

401 |

|

|

Derivative financial instruments |

|

23 |

|

34 |

|

87 |

|

|

Others |

|

|

|

662 |

|

705 |

|

|

|

|

|

|

7,301 |

|

7,180 |

|

|

|

|

|

|

|

|

|

|

|

Investments |

|

12 |

|

3,812 |

|

4,133 |

|

|

Intangible assets, net |

|

13 |

|

6,026 |

|

6,820 |

|

|

Property, plant and equipment, net |

|

14 |

|

69,708 |

|

78,122 |

|

|

|

|

|

|

86,847 |

|

96,255 |

|

|

Total |

|

|

|

104,550 |

|

116,489 |

|

4

Table of Contents

Condensed Consolidated Balance Sheet

In millions of United States dollars

(continued)

|

|

|

Notes |

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

|

|

(unaudited) |

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Suppliers and contractors |

|

|

|

3,429 |

|

4,354 |

|

|

Payroll and related charges |

|

|

|

526 |

|

1,163 |

|

|

Derivative financial instruments |

|

23 |

|

904 |

|

1,416 |

|

|

Loans and financing |

|

15 |

|

3,195 |

|

1,419 |

|

|

Related parties |

|

30 |

|

267 |

|

306 |

|

|

Income taxes - Settlement program |

|

18 |

|

388 |

|

457 |

|

|

Taxes payable and royalties |

|

|

|

471 |

|

550 |

|

|

Provision for income taxes |

|

|

|

171 |

|

353 |

|

|

Employee postretirement obligations |

|

20 |

(a) |

68 |

|

67 |

|

|

Asset retirement obligations |

|

16 |

|

124 |

|

136 |

|

|

Others |

|

|

|

339 |

|

405 |

|

|

|

|

|

|

9,882 |

|

10,626 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities associated with non-current assets held for sale |

|

6 |

|

144 |

|

111 |

|

|

|

|

|

|

10,026 |

|

10,737 |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Derivative financial instruments |

|

23 |

|

2,496 |

|

1,610 |

|

|

Loans and financing |

|

15 |

|

25,292 |

|

27,388 |

|

|

Related parties |

|

30 |

|

90 |

|

109 |

|

|

Employee postretirement obligations |

|

20 |

(a) |

2,121 |

|

2,236 |

|

|

Provisions for litigation |

|

17 |

(a) |

1,087 |

|

1,282 |

|

|

Income taxes - Settlement program |

|

18 |

|

4,876 |

|

5,863 |

|

|

Deferred income taxes |

|

19 |

|

3,099 |

|

3,341 |

|

|

Asset retirement obligations |

|

16 |

|

2,888 |

|

3,233 |

|

|

Participative stockholders’ debentures |

|

29 |

(c) |

1,165 |

|

1,726 |

|

|

Redeemable noncontrolling interest |

|

|

|

196 |

|

243 |

|

|

Deferred revenue - Gold stream |

|

28 |

|

1,841 |

|

1,323 |

|

|

Others |

|

|

|

1,056 |

|

1,077 |

|

|

|

|

|

|

46,207 |

|

49,431 |

|

|

Total liabilities |

|

|

|

56,233 |

|

60,168 |

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

24 |

|

|

|

|

|

|

Preferred class A stock — 7,200,000,000 no-par-value shares authorized and 2,027,127,718 shares issued |

|

|

|

23,089 |

|

23,089 |

|

|

Common stock — 3,600,000,000 no-par-value shares authorized and 3,217,188,402 shares issued |

|

|

|

38,525 |

|

38,525 |

|

|

Treasury stock — 59,405,792 preferred and 31,535,402 common shares |

|

|

|

(1,477 |

) |

(1,477 |

) |

|

Results from operations with noncontrolling stockholders |

|

|

|

(451 |

) |

(449 |

) |

|

Results on conversion of shares |

|

|

|

(152 |

) |

(152 |

) |

|

Unrealized fair value gain (losses) |

|

|

|

(1,547 |

) |

(1,713 |

) |

|

Cumulative translation adjustments |

|

|

|

(24,393 |

) |

(22,686 |

) |

|

Profit reserves |

|

|

|

13,575 |

|

19,985 |

|

|

Total company stockholders’ equity |

|

|

|

47,169 |

|

55,122 |

|

|

Noncontrolling stockholders’ interests |

|

|

|

1,148 |

|

1,199 |

|

|

Total stockholders’ equity |

|

|

|

48,317 |

|

56,321 |

|

|

Total liabilities and stockholders’ equity |

|

|

|

104,550 |

|

116,489 |

|

The accompanying notes are an integral part of these interim financial statements.

5

Table of Contents

Condensed Consolidated Statement of Income

In millions of United States dollars, except as otherwise stated

|

|

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

Notes |

|

March 31, 2015 |

|

March 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

Net operating revenue |

|

25 |

(c) |

6,240 |

|

9,503 |

|

|

Cost of goods sold and services rendered |

|

26 |

(a) |

(5,168 |

) |

(5,590 |

) |

|

Gross profit |

|

|

|

1,072 |

|

3,913 |

|

|

|

|

|

|

|

|

|

|

|

Operating (expenses) income |

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

26 |

(b) |

(195 |

) |

(282 |

) |

|

Research and evaluation expenses |

|

|

|

(119 |

) |

(145 |

) |

|

Pre operating and stoppage operation |

|

|

|

(264 |

) |

(248 |

) |

|

Other operating expenses, net |

|

26 |

(c) |

46 |

|

(217 |

) |

|

|

|

|

|

(532 |

) |

(892 |

) |

|

Gain on measurement or sale of non-current assets |

|

6 |

|

193 |

|

— |

|

|

Operating income |

|

|

|

733 |

|

3,021 |

|

|

|

|

|

|

|

|

|

|

|

Financial income |

|

27 |

|

2,350 |

|

1,339 |

|

|

Financial expenses |

|

27 |

|

(6,860 |

) |

(1,190 |

) |

|

Equity results from joint ventures and associates |

|

12 |

|

(271 |

) |

195 |

|

|

Results on sale or disposal of investments from joint ventures and associates |

|

6 |

|

18 |

|

— |

|

|

Net income (loss) before income taxes |

|

|

|

(4,030 |

) |

3,365 |

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

19 |

|

|

|

|

|

|

Current tax |

|

|

|

(70 |

) |

(928 |

) |

|

Deferred tax |

|

|

|

930 |

|

(61 |

) |

|

|

|

|

|

860 |

|

(989 |

) |

|

Net income (loss) |

|

|

|

(3,170 |

) |

2,376 |

|

|

Loss attributable to noncontrolling interests |

|

|

|

(52 |

) |

(139 |

) |

|

Net income (loss) attributable to the Company’s stockholders |

|

|

|

(3,118 |

) |

2,515 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to the Company’s stockholders: |

|

|

|

|

|

|

|

|

Basic and diluted earnings per share: |

|

24 |

(b) |

|

|

|

|

|

Preferred share (USD) |

|

|

|

(0.61 |

) |

0.49 |

|

|

Common share (USD) |

|

|

|

(0.61 |

) |

0.49 |

|

The accompanying notes are an integral part of these interim financial statements.

6

Table of Contents

Condensed Consolidated Statement of Comprehensive Income

In millions of United States dollars

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

March 31, 2015 |

|

March 31, 2014 |

|

|

Net income (loss) |

|

(3,170 |

) |

2,376 |

|

|

Other comprehensive income |

|

|

|

|

|

|

Items that will not be reclassified subsequently to income |

|

|

|

|

|

|

Cumulative translation adjustments |

|

(9,494 |

) |

2,311 |

|

|

|

|

|

|

|

|

|

Retirement benefit obligations |

|

|

|

|

|

|

Gross balance for the period |

|

(101 |

) |

24 |

|

|

Effect of taxes |

|

50 |

|

(3 |

) |

|

Equity results from joint ventures and associates, net taxes |

|

— |

|

1 |

|

|

|

|

(51 |

) |

22 |

|

|

Total items that will not be reclassified subsequently to income |

|

(9,545 |

) |

2,333 |

|

|

|

|

|

|

|

|

|

Items that will be reclassified subsequently to income |

|

|

|

|

|

|

Cumulative translation adjustments |

|

|

|

|

|

|

Gross balance for the period |

|

4,593 |

|

(1,765 |

) |

|

|

|

|

|

|

|

|

Cash flow hedge |

|

|

|

|

|

|

Gross balance for the period |

|

260 |

|

(4 |

) |

|

Effect of taxes |

|

— |

|

3 |

|

|

Equity results from joint ventures and associates, net taxes |

|

(2 |

) |

— |

|

|

Transfer of realized results to income, net of taxes |

|

(145 |

) |

(16 |

) |

|

|

|

113 |

|

(17 |

) |

|

Total of items that will be reclassified subsequently to income |

|

4,706 |

|

(1,782 |

) |

|

Total comprehensive income (loss) |

|

(8,009 |

) |

2,927 |

|

|

Comprehensive loss attributable to noncontrolling interests |

|

(58 |

) |

(141 |

) |

|

Comprehensive income (loss) attributable to the Company’s stockholders |

|

(7,951 |

) |

3,068 |

|

|

|

|

(8,009 |

) |

2,927 |

|

The accompanying notes are an integral part of these interim financial statements.

7

Table of Contents

Condensed Consolidated Statement of Changes in Stockholders’ Equity

In millions of United States dollars

|

|

|

Three-months period ended |

|

|

|

|

Capital |

|

Results on

conversion of

shares |

|

Results from

operation with

noncontrolling

stockholders |

|

Profit

reserves |

|

Treasury

stocks |

|

Unrealized fair

value gain

(losses) |

|

Cumulative

translation

adjustments |

|

Retained

earnings |

|

Total

Company

stockholder’s

equity |

|

Noncontrolling

stockholders’

interests |

|

Total

stockholder’s

equity |

|

|

December 31, 2013 |

|

60,578 |

|

(152 |

) |

(400 |

) |

29,566 |

|

(4,477 |

) |

(1,202 |

) |

(20,588 |

) |

— |

|

63,325 |

|

1,611 |

|

64,936 |

|

|

Net income (loss) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,515 |

|

2,515 |

|

(139 |

) |

2,376 |

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement benefit obligations |

|

— |

|

— |

|

— |

|

— |

|

— |

|

22 |

|

— |

|

— |

|

22 |

|

— |

|

22 |

|

|

Cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(17 |

) |

— |

|

— |

|

(17 |

) |

— |

|

(17 |

) |

|

Translation adjustments |

|

— |

|

— |

|

— |

|

1,040 |

|

— |

|

(22 |

) |

(566 |

) |

96 |

|

548 |

|

(2 |

) |

546 |

|

|

Contribution and distribution to stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capitalization of noncontrolling stockholders advances |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

38 |

|

38 |

|

|

Dividends of noncontrolling stockholders |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(2 |

) |

(2 |

) |

|

March 31, 2014 (unaudited) |

|

60,578 |

|

(152 |

) |

(400 |

) |

30,606 |

|

(4,477 |

) |

(1,219 |

) |

(21,154 |

) |

2,611 |

|

66,393 |

|

1,506 |

|

67,899 |

|

|

|

|

Three-months period ended |

|

|

|

|

Capital |

|

Results on

conversion of

shares |

|

Results from

operation with

noncontrolling

stockholders |

|

Profit

reserves |

|

Treasury

stocks |

|

Unrealized fair

value gain

(losses) |

|

Cumulative

translation

adjustments |

|

Retained

earnings |

|

Total

Company

stockholder’s

equity |

|

Noncontrolling

stockholders’

interests |

|

Total

stockholder’s

equity |

|

|

December 31, 2014 |

|

61,614 |

|

(152 |

) |

(449 |

) |

19,985 |

|

(1,477 |

) |

(1,713 |

) |

(22,686 |

) |

— |

|

55,122 |

|

1,199 |

|

56,321 |

|

|

Loss |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(3,118 |

) |

(3,118 |

) |

(52 |

) |

(3,170 |

) |

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement benefit obligations |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(51 |

) |

— |

|

— |

|

(51 |

) |

— |

|

(51 |

) |

|

Cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

— |

|

113 |

|

— |

|

— |

|

113 |

|

— |

|

113 |

|

|

Translation adjustments |

|

— |

|

— |

|

— |

|

(3,437 |

) |

— |

|

104 |

|

(1,707 |

) |

145 |

|

(4,895 |

) |

(6 |

) |

(4,901 |

) |

|

Contribution and distribution to stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions and disposal of participation of noncontrolling stockholders |

|

— |

|

— |

|

(2 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

(2 |

) |

2 |

|

— |

|

|

Capitalization of noncontrolling stockholders advances |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

7 |

|

7 |

|

|

Dividends of noncontrolling stockholders |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(2 |

) |

(2 |

) |

|

March 31, 2015 (unaudited) |

|

61,614 |

|

(152 |

) |

(451 |

) |

16,548 |

|

(1,477 |

) |

(1,547 |

) |

(24,393 |

) |

(2,973 |

) |

47,169 |

|

1,148 |

|

48,317 |

|

The accompanying notes are an integral part of these interim financial statements.

8

Table of Contents

Condensed Consolidated Statement of Cash Flow

In millions of United States dollars

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

March 31, 2015 |

|

March 31, 2014 |

|

|

Cash flow from operating activities: |

|

|

|

|

|

|

Net income (loss) |

|

(3,170 |

) |

2,376 |

|

|

Adjustments for: |

|

|

|

|

|

|

Equity results from joint ventures and associates |

|

271 |

|

(195 |

) |

|

Gain on measurement or sale of non-current assets |

|

(211 |

) |

— |

|

|

Gain on disposal of property, plant and equipment and intangibles |

|

(215 |

) |

— |

|

|

Depreciation, amortization and depletion |

|

1,035 |

|

1,026 |

|

|

Deferred income taxes |

|

(930 |

) |

61 |

|

|

Foreign exchange and indexation, net |

|

3,290 |

|

(311 |

) |

|

Unrealized derivative losses, net |

|

803 |

|

(195 |

) |

|

Participative stockholders’ debentures |

|

(275 |

) |

22 |

|

|

Others |

|

(348 |

) |

9 |

|

|

Decrease (increase) in assets: |

|

|

|

|

|

|

Accounts receivable |

|

817 |

|

1,822 |

|

|

Inventories |

|

189 |

|

(811 |

) |

|

Recoverable taxes |

|

(149 |

) |

765 |

|

|

Others |

|

(59 |

) |

53 |

|

|

Increase (decrease) in liabilities: |

|

|

|

|

|

|

Suppliers and contractors |

|

(387 |

) |

20 |

|

|

Payroll and related charges |

|

(567 |

) |

(594 |

) |

|

Taxes and contributions |

|

148 |

|

(99 |

) |

|

Deferred revenue - Gold stream |

|

532 |

|

— |

|

|

Income taxes - Settlement program |

|

35 |

|

47 |

|

|

Others |

|

(278 |

) |

86 |

|

|

Net cash provided by operating activities |

|

531 |

|

4,082 |

|

|

|

|

|

|

|

|

|

Cash flow from investing activities: |

|

|

|

|

|

|

Financial investments redeemed |

|

145 |

|

1 |

|

|

Loans and advances granted |

|

(5 |

) |

(97 |

) |

|

Guarantees and deposits granted |

|

(26 |

) |

(32 |

) |

|

Additions to investments |

|

(10 |

) |

(121 |

) |

|

Acquisition of subsidiary (note 7(b)) |

|

(90 |

) |

— |

|

|

Additions to property, plant and equipment and intangible |

|

(2,200 |

) |

(2,383 |

) |

|

Dividends and interest on capital received from joint ventures and associates |

|

27 |

|

11 |

|

|

Proceeds from disposal of assets and investments |

|

107 |

|

— |

|

|

Proceeds from gold stream transaction |

|

368 |

|

— |

|

|

Net cash used in investing activities |

|

(1,684 |

) |

(2,621 |

) |

|

|

|

|

|

|

|

|

Cash flow from financing activities: |

|

|

|

|

|

|

Loans and financing |

|

|

|

|

|

|

Additions |

|

1,342 |

|

651 |

|

|

Repayments |

|

(301 |

) |

(293 |

) |

|

Repayments to stockholders: |

|

|

|

|

|

|

Dividends and interest on capital attributed to noncontrolling interest |

|

(3 |

) |

— |

|

|

Net cash provided by (used in) financing activities |

|

1,038 |

|

358 |

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

(115 |

) |

1,819 |

|

|

Cash and cash equivalents in the beginning of the period |

|

3,974 |

|

5,321 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(175 |

) |

42 |

|

|

Cash and cash equivalents at end of the period |

|

3,684 |

|

7,182 |

|

|

|

|

|

|

|

|

|

Cash paid during the period for (i): |

|

|

|

|

|

|

Interest on loans and financing |

|

(471 |

) |

(453 |

) |

|

Income taxes |

|

(244 |

) |

(159 |

) |

|

Income taxes - Settlement program |

|

(106 |

) |

(118 |

) |

|

Derivatives settlement |

|

(657 |

) |

17 |

|

|

Non-cash transactions: |

|

|

|

|

|

|

Additions to property, plant and equipment - interest capitalization |

|

196 |

|

15 |

|

(i) Amounts paid are classified as cash flows from operating activities.

The accompanying notes are an integral part of these interim financial statements.

9

Table of Contents

Selected Notes to Interim Financial Statements

Expressed in millions of United States dollar, unless otherwise stated

1. Corporate information

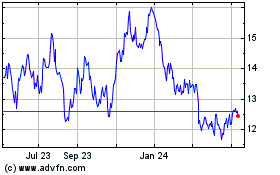

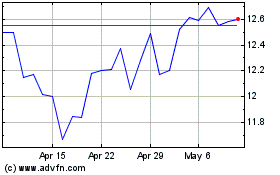

Vale S.A. (the “Parent Company”) is a public company headquartered at 26, Av. Graça Aranha, Rio de Janeiro, Brazil with securities traded on the stock exchanges of São Paulo (“BM&F BOVESPA”), New York (“NYSE”), Paris (“NYSE Euronext”) and Hong Kong (“HKEx”).

Vale S.A. and its direct and indirect subsidiaries (“Vale”, “Group” or “Company”) are principally engaged in the research, production and sale of iron ore and pellets, nickel, fertilizer, copper, coal, manganese, ferroalloys, cobalt, platinum group metals and precious metals. The Company also operates in the segments of energy and steel. The information by segment is presented in note 25.

2. Summary of the main accounting practices and accounting estimates

a) Basis of presentation

The condensed consolidated interim financial statements of the Company (“interim financial statements”) have been prepared in accordance with IAS 34 Interim Financial Reporting of the International Financial Reporting Standards (“IFRS”) as adopted by the International Accounting Standards Board (“IASB”).

The interim financial statements have been prepared under the historical cost convention as adjusted to reflect: (i) the fair value of held for trading financial instruments measured at fair value through the statement of income or available-for-sale financial instruments measured at fair value through the statement of comprehensive income; and (ii) impairment of assets.

These interim financial statements have been reviewed, not audited. However, principles, estimates, accounting practices, measurement methods and standards adopted are consistent with those presented on the financial statements for the year ended December 31, 2014. These interim financial statements were prepared by Vale to update users about relevant information presented in the period and should be read in conjunction with the financial statements for the year ended December 31, 2014.

The Company evaluated subsequent events through April 29, 2015, which is the date the interim financial statements were approved by the Board of Directors.

b) Functional currency and presentation currency

The interim financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity operates (“functional currency”), which in the case of the Parent Company is the Brazilian Real (“BRL” or “R$”). For presentation purposes, these interim financial statements are presented in United States dollar (“USD” or “US$”) as the Company believes that this is how international investors analyze the interim financial statements.

Operations in other currencies are translated into the functional currency using the actual exchange rates in force on the respective transactions dates. The foreign exchange gains and losses resulting from the translation at the exchange rates in force at the end of the period are recognized in the statement of income as financial expense or financial income. The exceptions are transactions for which gains and losses are recognized in the comprehensive income.

The statement of income and balance sheet of the Group’s entities which functional currency is different from the presentation currency are translated into the presentation currency as follows: (i) assets, liabilities and stockholders’ equity (except components described in item (iii)) are translated at the closing rate at the balance sheet date; (ii) income and expenses are translated at the average exchange rates, except for specific transactions that, considering their significance, are translated at the rate at the transaction date and; (iii) capital, capital reserves and treasury stock are translated at the rate at the date of each transaction. All resulting exchange differences are recognized in comprehensive income as cumulative translation adjustment, and transferred to the statement of income when the operations are realized.

10

Table of Contents

The exchange rates of the major currencies that impact the operations are:

|

|

|

Exchange rates used for conversions into Brazilian reais |

|

|

|

|

Closing rate as of |

|

Average rate for the three-months period ended |

|

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

March 31, 2015 |

|

March 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

(unaudited) |

|

(unaudited) |

|

|

US dollar (“US$”) |

|

3.2080 |

|

2.6562 |

|

2.8702 |

|

2.3652 |

|

|

Canadian dollar (“CAD”) |

|

2.5292 |

|

2.2920 |

|

2.3120 |

|

2.1456 |

|

|

Australian dollar (“AUD”) |

|

2.4464 |

|

2.1765 |

|

2.2543 |

|

2.1222 |

|

|

Euro (“EUR” or “€”) |

|

3.4457 |

|

3.2270 |

|

3.2212 |

|

3.2399 |

|

3. Critical accounting estimates and judgment

The critical accounting estimates and judgment are the same as those adopted when preparing the financial statements for the year ended December 31, 2014.

4. Accounting standards issued but not yet effective

The standards and interpretations issued by IASB but not yet effective are disclosed below:

IFRS 9 Financial instruments - In July 2014 the IASB issued IFRS 9 — Financial instruments, sets out the requirements for recognizing and measuring financial assets, financial liabilities and some contracts to buy or sell non-financial items. This Standard replaces IAS 39 Financial Instruments: Recognition and Measurement. The adoption will be required from January 1, 2018 and the Company is currently analyzing potential impacts regarding this pronouncement on the financial statements.

IFRS 15 Revenue from contracts with customers - In May 2014 the IASB issued IFRS 15 statement - Revenue from Contracts with customers, sets out the requirements for revenue recognition that apply to all contracts with customer (except for contracts that are within the scope of the Standards on leases, insurance contracts and financial instruments), and replaces the current pronouncements IAS 18 - revenue, IAS 11 - Construction contracts and interpretations related to revenue recognition. The principle core in that framework is that a company should recognize revenue to depict the transfer of promised goods or services to the customer in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The adoption will be required from January 1, 2017 and the Company is currently analyzing potential impacts regarding this pronouncement on the financial statements.

5. Risk management

There was no significant change in relation to risk management policies disclosed in the financial statements for the year ended December 31, 2014.

6. Non-current assets and liabilities held for sale

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

Nacala |

|

Energy |

|

Nacala |

|

Total |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Non-current assets held for sale |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

5 |

|

— |

|

8 |

|

8 |

|

|

Other current assets |

|

169 |

|

— |

|

157 |

|

157 |

|

|

Investments |

|

— |

|

88 |

|

— |

|

88 |

|

|

Property, plant and equipment, net |

|

3,206 |

|

477 |

|

2,910 |

|

3,387 |

|

|

Total assets |

|

3,380 |

|

565 |

|

3,075 |

|

3,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities associated with non-current assets held for sale |

|

|

|

|

|

|

|

|

|

|

Suppliers and contractors |

|

128 |

|

— |

|

54 |

|

54 |

|

|

Other current liabilities |

|

16 |

|

— |

|

57 |

|

57 |

|

|

Total liabilities |

|

144 |

|

— |

|

111 |

|

111 |

|

|

Net assets held for sale |

|

3,236 |

|

565 |

|

2,964 |

|

3,529 |

|

11

Table of Contents

Nacala logistic corridor (“Nacala”)

In December 2014, the Company signed an agreement with Mitsui & Co., Ltd. (“Mitsui”) to sell 50% of its stake of 70% in the Nacala corridor, Nacala is a combination of railroad and port concessions under construction located in Mozambique and Malawi.

After completion of the transaction, Vale will share control of Nacala with Mitsui and therefore will not consolidate the assets, liabilities and results of those entities. The net asset was transferred to assets held for sale with no impact in the statement of income.

Energy generation assets

In December 2013, the Company signed agreements with CEMIG Geração e Transmissão S.A. (“CEMIG GT”), as follows:

(a) A new entity Aliança Norte Participações S.A., was incorporated and Vale contributed its 9% investment in Norte Energia S.A. (“Norte Energia”), which is the company in charge of construction and operation of the Belo Monte Hydroelectric facility. Vale committed to sell 49% and share control of the new entity to CEMIG GT. In the first quarter of 2015, after receiving all regulatory approvals and other customary precedent conditions the Company concluded the transaction and received cash proceeds of US$97, recognizing US$18 as a result on sale of investment in associates in the income statement.

(b) A new entity Aliança Geração de Energia S.A. (“Aliança Geração”) was incorporated and Vale committed to contribute its shares over several power generation assets which use to supply energy for the Company’s operations. In exchange CEMIG GT committed to contribute its stakes in some of its power generation assets. In the first quarter of 2015, after receiving all regulatory approvals and other customary precedent conditions, the exchange of assets was completed and Vale holds 55% and shares control of the new entity with CEMIG GT. A long term contract was signed between Vale and Aliança Geração for the energy supply. Due to the completion of this transaction, the Company (i) derecognized the assets held for sale related to this transaction; (ii) recognized as investment its share in the joint venture Aliança Geração; and (iii) recognized US$193 in the income statement as a gain on measurement or sales of non-current asset based on the fair value of the transferred by CEMIG GT. This transaction has no cash proceeds or disbursements.

7. Acquisitions and divestitures

a) Divestiture of VBG-Vale BSGR Limited (“VBG”)

VBG is the holding company which held the Simandou mining rights located in Guinea. In April 2014, the Government of Guinea revoked VBG mining rights, without any finding of wrongdoing on the part of Vale. During 2014, as a result of the loss of the mining rights, Vale recognized full impairment of the assets related to VBG. During the first quarter of 2015, the Company sold its stake on VBG to its partner in the project and kept its right to any recoverable amount it may derive from the Simandou project by the partner. The transaction had no impact in cash or in the statement of income.

b) Acquisition of Facon Construção e Mineração S.A. (“Facon”)

During the first quarter of 2015, the Company acquired all shares of Facon, a wholly owned subsidiary of Fagundes Construção e Mineração S.A. (“FCM”). FCM is a logistic service provider for Vale Fertilizantes S.A. The Facon business was carved out from FCM with assets and liabilities directly related to the Vale Fertilizantes S.A. business being transferred to it. The purchase price allocation based on the fair values of acquired assets and liabilities was calculated on studies performed by the Company. Subsequently, Facon was merged to Vale Fertilizantes S.A.

|

Purchase price |

|

90 |

|

|

Book value of property, plant and equipment |

|

77 |

|

|

Book value of other assets acquired and liabilities assumed, net |

|

(69 |

) |

|

Adjustment to fair value of property, plant and equipment and mining rights |

|

43 |

|

|

Goodwill |

|

39 |

|

12

Table of Contents

8. Cash and cash equivalents

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

|

Cash and bank deposits |

|

2,347 |

|

2,109 |

|

|

Short-term investments |

|

1,337 |

|

1,865 |

|

|

|

|

3,684 |

|

3,974 |

|

Cash and cash equivalents includes cash, immediately redeemable deposits and short-term investments with an insignificant risk of changes in value and readily convertible to cash, part in Brazilian Real, indexed to the Brazilian Interbank Interest rate (“DI Rate”or”CDI”) and part denominated in US dollar, mainly time deposits.

9. Accounts receivable

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

|

Ferrous minerals |

|

1,309 |

|

2,155 |

|

|

Coal |

|

104 |

|

122 |

|

|

Base metals |

|

733 |

|

777 |

|

|

Fertilizers |

|

162 |

|

136 |

|

|

Others |

|

57 |

|

172 |

|

|

|

|

2,365 |

|

3,362 |

|

|

|

|

|

|

|

|

|

Provision for doubtful debts |

|

(74 |

) |

(87 |

) |

|

|

|

2,291 |

|

3,275 |

|

Accounts receivable related to the steel sector represented 74.17% and 77.97% of total receivables on March 31, 2015 and December 31, 2014, respectively.

No individual customer represents over 10% of receivables or revenues.

The provision for doubtful debts recorded in the consolidated statement of income as at March 31, 2015 and 2014 totaled US$2 and US23, respectively. The Company recognized write-offs as at March 31, 2015 and 2014 in the amount of US$0 and US$2, respectively.

13

Table of Contents

10. Inventories

Inventories are comprised as follows:

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

|

Inventories of products |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ferrous minerals |

|

|

|

|

|

|

Iron ore |

|

936 |

|

1,110 |

|

|

Pellets |

|

81 |

|

187 |

|

|

Manganese and ferroalloys |

|

55 |

|

69 |

|

|

|

|

1,072 |

|

1,366 |

|

|

|

|

|

|

|

|

|

Coal |

|

144 |

|

155 |

|

|

|

|

|

|

|

|

|

Base metals |

|

|

|

|

|

|

Nickel and other products |

|

1,319 |

|

1,435 |

|

|

Copper |

|

29 |

|

26 |

|

|

|

|

1,348 |

|

1,461 |

|

|

Fertilizers |

|

|

|

|

|

|

Potash |

|

17 |

|

12 |

|

|

Phosphates |

|

337 |

|

309 |

|

|

Nitrogen |

|

15 |

|

23 |

|

|

|

|

369 |

|

344 |

|

|

Other products |

|

5 |

|

4 |

|

|

Total of inventories of products |

|

2,938 |

|

3,330 |

|

|

|

|

|

|

|

|

|

Inventories of consumables |

|

1,126 |

|

1,171 |

|

|

Total |

|

4,064 |

|

4,501 |

|

As of March 31, 2015 consolidated inventories are stated net of provisions for nickel and coal products in the amount of US$42 (US$19 as of December 31, 2014) and US$325 (US$285 as of December 31, 2014), respectively.

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

March 31, 2015 |

|

March 31, 2014 |

|

|

Inventories of products |

|

|

|

|

|

|

Balance at beginning of the period |

|

3,330 |

|

2,896 |

|

|

Production and acquisition |

|

4,590 |

|

4,958 |

|

|

Transfer from inventories of consumables |

|

705 |

|

810 |

|

|

Cost of goods sold |

|

(5,022 |

) |

(5,326 |

) |

|

Provision for market value adjustment |

|

(63 |

) |

(14 |

) |

|

Translation adjustments |

|

(602 |

) |

122 |

|

|

Balance at end of the period |

|

2,938 |

|

3,446 |

|

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

March 31, 2015 |

|

March 31, 2014 |

|

|

Inventories of consumables |

|

|

|

|

|

|

Balance at beginning of the period |

|

1,171 |

|

1,229 |

|

|

Acquisition |

|

858 |

|

844 |

|

|

Transfer to inventories of products |

|

(705 |

) |

(810 |

) |

|

Transfer to held for sale |

|

(1 |

) |

— |

|

|

Translation adjustments |

|

(197 |

) |

45 |

|

|

Balance at end of the period |

|

1,126 |

|

1,308 |

|

14

Table of Contents

11. Recoverable taxes

The recoverable taxes, net of provision for losses on tax credits, are as follows:

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

|

Value-added tax |

|

1,002 |

|

1,057 |

|

|

Brazilian federal contributions |

|

952 |

|

1,010 |

|

|

Others |

|

28 |

|

34 |

|

|

Total |

|

1,982 |

|

2,101 |

|

|

|

|

|

|

|

|

|

Current |

|

1,548 |

|

1,700 |

|

|

Non-current |

|

434 |

|

401 |

|

|

Total |

|

1,982 |

|

2,101 |

|

12. Investments

The changes of investments in associates and joint ventures are as follow:

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

March 31, 2015 |

|

March 31, 2014 |

|

|

Balance at beginning of the period |

|

4,133 |

|

3,584 |

|

|

Aquisitions (i) |

|

579 |

|

— |

|

|

Additions |

|

10 |

|

121 |

|

|

Transfer due to acquisition of control |

|

— |

|

79 |

|

|

Translation adjustment |

|

(605 |

) |

122 |

|

|

Equity results on statement of income |

|

(271 |

) |

195 |

|

|

Equity results on statement of comprehensive income |

|

(2 |

) |

1 |

|

|

Dividends declared |

|

(27 |

) |

(42 |

) |

|

Transfer to held for sale |

|

(5 |

) |

— |

|

|

Transfer to held for sale - VLI S.A. |

|

— |

|

1,255 |

|

|

Balance at end of the period |

|

3,812 |

|

5,315 |

|

(i) Refers to Aliança Geração de Energia S.A., see note 6.

15

Table of Contents

Investments (Continued)

|

|

|

|

|

|

|

Investments |

|

Equity results |

|

Received dividends |

|

|

|

|

|

|

% voting |

|

As of |

|

Three-months period ended (unaudited) |

|

|

Joint ventures and associates |

|

% ownership |

|

capital |

|

March 31, 2015 |

|

December 31, 2014 |

|

March 31, 2015 |

|

March 31, 2014 |

|

March 31, 2015 |

|

March 31, 2014 |

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Ferrous minerals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baovale Mineração S.A. |

|

50.00 |

|

50.00 |

|

15 |

|

16 |

|

1 |

|

1 |

|

— |

|

— |

|

|

Companhia Coreano-Brasileira de Pelotização |

|

50.00 |

|

50.00 |

|

74 |

|

86 |

|

4 |

|

8 |

|

— |

|

— |

|

|

Companhia Hispano-Brasileira de Pelotização (i) |

|

50.89 |

|

51.00 |

|

64 |

|

80 |

|

4 |

|

3 |

|

13 |

|

11 |

|

|

Companhia Ítalo-Brasileira de Pelotização (i) |

|

50.90 |

|

51.00 |

|

43 |

|

61 |

|

5 |

|

4 |

|

13 |

|

— |

|

|

Companhia Nipo-Brasileira de Pelotização (i) |

|

51.00 |

|

51.11 |

|

128 |

|

142 |

|

11 |

|

13 |

|

— |

|

— |

|

|

Minas da Serra Geral S.A. |

|

50.00 |

|

50.00 |

|

17 |

|

20 |

|

— |

|

1 |

|

— |

|

— |

|

|

MRS Logística S.A. |

|

47.59 |

|

46.75 |

|

431 |

|

510 |

|

9 |

|

14 |

|

— |

|

— |

|

|

Samarco Mineração S.A. |

|

50.00 |

|

50.00 |

|

2 |

|

200 |

|

(173 |

) |

174 |

|

— |

|

— |

|

|

VLI S.A. |

|

37.61 |

|

37.61 |

|

908 |

|

1,109 |

|

(3 |

) |

— |

|

— |

|

— |

|

|

Zhuhai YPM Pellet Co. |

|

25.00 |

|

25.00 |

|

21 |

|

24 |

|

— |

|

— |

|

— |

|

— |

|

|

Others |

|

|

|

|

|

— |

|

— |

|

— |

|

(1 |

) |

— |

|

— |

|

|

|

|

|

|

|

|

1,703 |

|

2,248 |

|

(142 |

) |

217 |

|

26 |

|

11 |

|

|

Coal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Henan Longyu Energy Resources Co., Ltd. |

|

25.00 |

|

25.00 |

|

356 |

|

355 |

|

— |

|

12 |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base metals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Korea Nickel Corp. |

|

25.00 |

|

25.00 |

|

19 |

|

21 |

|

(1 |

) |

(1 |

) |

— |

|

— |

|

|

Teal Minerals Inc. |

|

50.00 |

|

50.00 |

|

189 |

|

194 |

|

(4 |

) |

(5 |

) |

— |

|

— |

|

|

|

|

|

|

|

|

208 |

|

215 |

|

(5 |

) |

(6 |

) |

— |

|

— |

|

|

Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aliança Geração de Energia S.A. |

|

55.00 |

|

55.00 |

|

568 |

|

— |

|

1 |

|

— |

|

— |

|

— |

|

|

Aliança Norte Energia Participações S.A. |

|

51.00 |

|

51.00 |

|

82 |

|

— |

|

2 |

|

— |

|

— |

|

— |

|

|

California Steel Industries, Inc. |

|

50.00 |

|

50.00 |

|

179 |

|

184 |

|

(5 |

) |

2 |

|

— |

|

— |

|

|

Companhia Siderúrgica do Pecém (ii) |

|

50.00 |

|

50.00 |

|

488 |

|

725 |

|

(120 |

) |

(3 |

) |

— |

|

— |

|

|

Mineração Rio Grande do Norte S.A. |

|

40.00 |

|

40.00 |

|

72 |

|

91 |

|

(3 |

) |

6 |

|

— |

|

— |

|

|

Norte Energia S.A. (ii) (iii) |

|

— |

|

— |

|

— |

|

91 |

|

— |

|

— |

|

— |

|

— |

|

|

Thyssenkrupp Companhia Siderúrgica do Atlântico Ltd. |

|

26.87 |

|

26.87 |

|

154 |

|

205 |

|

— |

|

(18 |

) |

— |

|

— |

|

|

Others |

|

|

|

|

|

2 |

|

19 |

|

1 |

|

(15 |

) |

1 |

|

— |

|

|

|

|

|

|

|

|

1,545 |

|

1,315 |

|

(124 |

) |

(28 |

) |

1 |

|

— |

|

|

Total |

|

|

|

|

|

3,812 |

|

4,133 |

|

(271 |

) |

195 |

|

27 |

|

11 |

|

(i) Although the Company held majority of the voting capital, the entities are accounted under equity method due to existing veto rights held by other stockholders.

(ii) Pre-operational stage.

(iii) The Company’s interest in Norte Energia S.A. is indirectly owned by Aliança Norte Energia Participações S.A. (note 6).

16

Table of Contents

13. Intangible assets

|

|

|

March 31, 2015 (unaudited) |

|

December 31, 2014 |

|

|

|

|

Cost |

|

Amortization |

|

Net |

|

Cost |

|

Amortization |

|

Net |

|

|

Indefinite useful life |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

3,394 |

|

— |

|

3,394 |

|

3,760 |

|

— |

|

3,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finite useful life |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

2,925 |

|

(1,033 |

) |

1,892 |

|

3,421 |

|

(1,208 |

) |

2,213 |

|

|

Right of use |

|

466 |

|

(209 |

) |

257 |

|

518 |

|

(221 |

) |

297 |

|

|

Software |

|

1,189 |

|

(706 |

) |

483 |

|

1,356 |

|

(806 |

) |

550 |

|

|

|

|

4,580 |

|

(1,948 |

) |

2,632 |

|

5,295 |

|

(2,235 |

) |

3,060 |

|

|

Total |

|

7,974 |

|

(1,948 |

) |

6,026 |

|

9,055 |

|

(2,235 |

) |

6,820 |

|

The table below shows the changes of intangible assets:

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

Goodwill |

|

Concessions |

|

Right of use |

|

Software |

|

Total |

|

|

Balance on December 31, 2013 |

|

4,140 |

|

1,907 |

|

253 |

|

571 |

|

6,871 |

|

|

Additions |

|

— |

|

184 |

|

— |

|

5 |

|

189 |

|

|

Disposals |

|

— |

|

(3 |

) |

— |

|

— |

|

(3 |

) |

|

Amortization |

|

— |

|

(45 |

) |

(7 |

) |

(14 |

) |

(66 |

) |

|

Translation adjustment |

|

36 |

|

73 |

|

(5 |

) |

(1 |

) |

103 |

|

|

Balance on March 31, 2014 (unaudited) |

|

4,176 |

|

2,116 |

|

241 |

|

561 |

|

7,094 |

|

|

|

|

Three-months period ended (unaudited) |

|

|

|

|

Goodwill |

|

Concessions |

|

Right of use |

|

Software |

|

Total |

|

|

Balance on December 31, 2014 |

|

3,760 |

|

2,213 |

|

297 |

|

550 |

|

6,820 |

|

|

Additions |

|

— |

|

122 |

|

— |

|

74 |

|

196 |

|

|

Disposals |

|

— |

|

(13 |

) |

— |

|

— |

|

(13 |

) |

|

Amortization |

|

— |

|

(42 |

) |

(11 |

) |

(44 |

) |

(97 |

) |

|

Translation adjustment |

|

(405 |

) |

(388 |

) |

(29 |

) |

(97 |

) |

(919 |

) |

|

Acquisition of subsidiary (note 7(b)) |

|

39 |

|

— |

|

— |

|

— |

|

39 |

|

|

Balance on March 31, 2015 (unaudited) |

|

3,394 |

|

1,892 |

|

257 |

|

483 |

|

6,026 |

|

17

Table of Contents

14. Property, plant and equipment

|

|

|

March 31, 2015 (unaudited) |

|

December 31, 2014 |

|

|

|

|

Cost |

|

Accumulated

Depreciation |

|

Net |

|

Cost |

|

Accumulated

Depreciation |

|

Net |

|

|

Land |

|

923 |

|

— |

|

923 |

|

1,069 |

|

— |

|

1,069 |

|

|

Buildings |

|

13,766 |

|

(2,424 |

) |

11,342 |

|

14,144 |

|

(2,490 |

) |

11,654 |

|

|

Facilities |

|

14,637 |

|

(4,817 |

) |

9,820 |

|

15,749 |

|

(4,936 |

) |

10,813 |

|

|

Equipment |

|

13,711 |

|

(4,745 |

) |

8,966 |

|

14,381 |

|

(5,094 |

) |

9,287 |

|

|

Mineral properties |

|

18,288 |

|

(5,613 |

) |

12,675 |

|

20,965 |

|

(6,036 |

) |

14,929 |

|

|

Others |

|

13,851 |

|

(3,870 |

) |

9,981 |

|

14,888 |

|

(3,934 |

) |

10,954 |

|

|

Construction in progress |

|

16,001 |

|

— |

|

16,001 |

|

19,416 |

|

— |

|

19,416 |

|

|

|

|

91,177 |

|

(21,469 |

) |

69,708 |

|

100,612 |

|

(22,490 |

) |

78,122 |

|

Property, plant and equipment (net book value) pledged as guarantees for judicial claims on March 31, 2015 and December 31, 2014 were to US$51 and US$63, respectively.

The table below shows the movement of property, plant and equipment:

|

|

|

Three-months period ended |

|

|

|

|

Land |

|

Building |

|

Facilities |

|

Equipment |

|

Mineral

properties |

|

Others |

|

Constructions

in progress |

|

Total |

|

|

Balance on December 31, 2013 |

|

945 |

|

7,785 |

|

10,937 |

|

8,404 |

|

16,276 |

|

10,519 |

|

26,799 |

|

81,665 |

|

|

Additions (i) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,209 |

|

2,209 |

|

|

Disposals |

|

— |

|

(10 |

) |

(3 |

) |

(4 |

) |

(58 |

) |

(29 |

) |

(19 |

) |

(123 |

) |

|

Depreciation and amortization |

|

— |

|

(76 |

) |

(267 |

) |

(304 |

) |

(222 |

) |

(185 |

) |

— |

|

(1,054 |

) |

|

Translation adjustment |

|

100 |

|

192 |

|

115 |

|

28 |

|

(98 |

) |

513 |

|

215 |

|

1,065 |

|

|

Transfers |

|

58 |

|

293 |

|

1,732 |

|

283 |

|

300 |

|

301 |

|

(2,967 |

) |

— |

|

|

Balance on March 31, 2014 (unaudited) |

|

1,103 |

|

8,184 |

|

12,514 |

|

8,407 |

|

16,198 |

|

11,119 |

|

26,237 |

|

83,762 |

|

|

|

|

Three-months period ended |

|

|

|

|

Land |

|

Building |

|

Facilities |

|

Equipment |

|

Mineral

properties |

|

Others |

|

Constructions

in progress |

|

Total |

|

|

Balance on December 31, 2014 |

|

1,069 |

|

11,654 |

|

10,813 |

|

9,287 |

|

14,929 |

|

10,954 |

|

19,416 |

|

78,122 |

|

|

Additions (i) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,097 |

|

2,097 |

|

|

Disposals |

|

— |

|

(5 |

) |

(1 |

) |

(5 |

) |

(151 |

) |

(6 |

) |

(2 |

) |

(170 |

) |

|

Depreciation and amortization |

|

— |

|

(135 |

) |

(208 |

) |

(308 |

) |

(217 |

) |

(198 |

) |

— |

|

(1,066 |

) |

|

Translation adjustment |

|

(156 |

) |

(1,623 |

) |

(1,558 |

) |

(935 |

) |

(1,429 |

) |

(1,285 |

) |

(2,409 |

) |

(9,395 |

) |

|

Transfers |

|

10 |

|

1,451 |

|

774 |

|

926 |

|

(457 |

) |

397 |

|

(3,101 |

) |

— |

|

|

Acquisition of subsidiary (note 7(b)) |

|

— |

|

— |

|

— |

|

1 |

|

— |

|

119 |

|

— |

|

120 |

|

|

Balance on March 31, 2015 (unaudited) |

|

923 |

|

11,342 |

|

9,820 |

|

8,966 |

|

12,675 |

|

9,981 |

|

16,001 |

|

69,708 |

|

(i) Includes interest capitalized and ARO, see cash flow.

15. Loans and financing

a) Total debt

|

|

|

Current liabilities |

|

Non-current liabilities |

|

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

March 31, 2015 |

|

December 31, 2014 |

|

|

|

|

(unaudited) |

|

|

|

(unaudited) |

|

|

|

|

Debt contracts in the international markets |

|

|

|

|

|

|

|

|

|

|

Floating rates in: |

|

|

|

|

|

|

|

|

|

|

US dollars |

|

262 |

|

358 |

|

5,199 |

|

5,095 |

|

|

Others currencies |

|

|

|

|

|

3 |

|

2 |

|

|

Fixed rates in: |

|

|

|

|

|

|

|

|

|

|

US dollars |

|

2,115 |

|

69 |

|

12,140 |

|

13,239 |

|

|

Euro |

|

— |

|

— |

|

1,611 |

|

1,822 |

|

|

Accrued charges |

|

211 |

|

334 |

|

— |

|

— |

|

|

|

|

2,588 |

|

761 |

|

18,953 |

|

20,158 |

|

|

Debt contracts in Brazil |

|

|

|

|

|

|

|

|

|

|

Floating rates in: |

|

|

|

|

|

|

|

|

|

|

Brazilian Reais, indexed to TJLP, TR, IPCA, IGP-M and CDI |

|

247 |

|

296 |

|

4,516 |

|

5,503 |

|

|

Basket of currencies and US dollars indexed to LIBOR |

|

222 |

|

211 |

|

1,533 |

|

1,364 |

|

|

Fixed rates in: |

|

|

|

|

|

|

|

|

|

|

Brazilian Reais |

|

45 |

|

48 |

|

290 |

|

363 |

|

|

Accrued charges |

|

93 |

|

103 |

|

— |

|

— |

|

|

|

|

607 |

|

658 |

|

6,339 |

|

7,230 |

|

|

|

|

3,195 |

|

1,419 |

|

25,292 |

|

27,388 |

|

18

Table of Contents

Below are the future flows of debt payments (principal and interest) per nature of funding:

|

|

|

Bank loans (i) |

|

Capital market (i) |

|

Development

agencies (i) |

|

Debt principal (i) |

|

Estimated future

payments of

interest (ii) |

|

|

2015 |

|

1,078 |

|

— |

|

633 |

|

1,711 |

|

996 |

|