Sherwin-Williams, Valspar Say Merger Is on Track to Close by End of First Quarter

December 19 2016 - 11:09AM

Dow Jones News

By Joshua Jamerson

Paint makers Sherwin-Williams Co. and Valspar Corp. affirmed

Monday that their tie-up is on track to close on schedule by the

end of the first quarter, seeking to put to rest what the firms

called "unfounded market rumors" about regulatory pushback.

The companies specifically addressed the prospects of the

marriage passing regulatory muster without Sherwin-Williams

divesting itself of a large chunk of its business.

"Given the complementary nature of the businesses and the

benefits this transaction will provide to customers,

Sherwin-Williams and Valspar continue to believe that no or minimal

divestitures should be required to complete the transaction," the

companies said in a statement.

In March, Sherwin-Williams agreed to pay more than $9 billion in

cash for Valspar in a deal valued at a 35% premium to Valspar's

closing price at the time. In a nuanced way to handle antitrust

risk, the deal includes an unusual clause to slash the $113-a-share

purchase price should antitrust regulators demand aggressive

divestitures.

If Sherwin is forced to sell businesses representing more than

$650 million of Valspar's 2015 revenue, the price drops by $8 a

share. Sherwin could walk away entirely if divestitures climb to

$1.5 billion of revenue, a provision that is more common.

In Monday morning trading, Valspar stock fell 1.4% to

$103.07.

The transaction, which has been approved by Valspar

shareholders, is subject to customary closing conditions and

regulatory approvals. The company said Monday that it is still in

discussions with regulators.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

December 19, 2016 10:54 ET (15:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

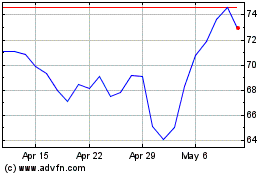

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

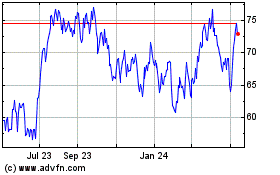

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024