Valspar CEO: Not Interested In Buying DuPont Coatings Business

February 14 2012 - 1:01PM

Dow Jones News

Valspar Corp. (VAL), the U.S. paint maker, on Tuesday ruled

itself out of bidding for the $3 billion coatings business that

DuPont Co. (DD) is looking to sell.

Gary E. Hendrickson, chief executive of Minneapolis-based

Valspar, said the DuPont unit was "a little too big a bite for us"

as the company reported better-than-expected fiscal first quarter

earnings and raised its full-year guidance.

Merger and acquisition activity in the chemicals sector has

intensified in recent months, and DuPont hired Credit Suisse Group

AG to lead the potential sale of its performance coatings unit,

according to people familiar with the situation.

Large paint manufacturers, such as Akzo Nobel NV of the

Netherlands, and private-equity firms are seen as potential

buyers.

Hendrickson, speaking to analysts on a conference call, said the

company still faced a sluggish U.S. housing market as well as other

demand "challenges, notably in Europe and China.

The Chinese market is expected to pick up in the second half of

the year after a flat performance in the latest quarter, and

Valspar also sees costs for raw materials such as the titanium

dioxide used to whiten paint rising by mid-single digits this

year.

.Valspar, which has a market value of $4.3 billion, reported

profit of $55.8 million for the quarter to Jan. 27 compared with

$33.4 million a year earlier. Per-share earnings rose to 58 cents,

10 cents ahead of consensus, from 34 cents.

The company raised its full-year profit guidance range by a dime

to $2.92 to $3.12 per share.

The stock was recently up 5.4% at $46.41, having reached an

all-time high earlier in the session.

-By Doug Cameron, Dow Jones Newswires; 312-750-4135;

doug.cameron@dowjones.com

(Tess Stynes contributed to this article.)

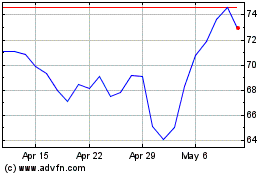

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

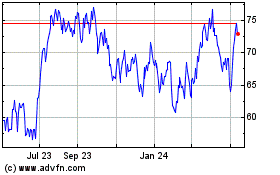

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024