U.S. Bancorp Profit, Revenue Rise on Loans

January 18 2017 - 7:54AM

Dow Jones News

By Austen Hufford

U.S. Bancorp said profit and revenue increased in its fourth

quarter on higher loans.

The results came just after the company said Tuesday that Chief

Executive Richard Davis would step down and be succeeded by Andrew

Cecere, the firm's president and chief operating officer, in a

long-signaled succession at the Minneapolis-based bank.

The bank, the seventh-largest in the U.S. by assets and the

largest regional bank, posted earnings of $1.48 billion, up

slightly from the prior-year period. On a per-share basis, earnings

rose to 82 cents from 80 cents.

Revenue, a combination of net interest income and fee-based

income, rose 4.3% to $5.44 billion. Analysts had expected 81 cents

a share in earnings and $5.36 billion in revenue, according to

Thomson Reuters.

Results in the quarter were driven by loan growth and increased

fee-based revenue -- with higher payment-services revenue, trust

and investment management fees and mortgage banking revenue --

which were partially offset by higher expenses linked to increased

compensation.

Fee-based revenue grew 3.9% and was also helped by increased

card revenue and increased merchant processing fees.

At the Minneapolis-based bank's average total loans grew 6.2%

from last year as average total deposits grew 11.8%.

Net interest margin, an important measure of lending

profitability, fell from last year to 2.98% from 3.06%, but was

unchanged from the previous quarter.

Shares, which have increased 17% in the last three months, were

inactive in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 18, 2017 07:39 ET (12:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

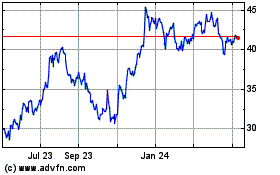

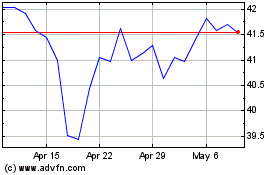

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024