Barry Callebaut Turns Bullish on Chocolate Outlook -- 2nd Update

April 06 2016 - 7:02AM

Dow Jones News

By John Revill

ZURICH--Barry Callebaut AG is confident of taking a bigger chunk

of the chocolate market, strengthening its position as the world's

largest supplier now that global demand is showing signs of

recovery.

The Zurich-based company, the maker of the chocolate that goes

into Oreo cookies, is seeing demand stabilize in many markets, said

Chief Executive Antoine de Saint-Affrique.

"The long term forecast for the confectionary market is 1.8%

growth, and we see a stabilization of markets altogether," Mr. de

Saint-Affrique said.

Growth in Barry Callebaut's sales volumes to restaurants as well

as to food, ice-cream and drinks manufacturers like Mondelez

International Inc. and Unilever NV contrast with shrinking global

demand for confectionary, particularly in some emerging

markets.

"The interesting thing is the decline in some ways is slowing

down, or getting better," said Mr. de Saint-Affrique.

The comments followed Barry Callebaut's announcement of a 19%

drop in net profit for the six months to Feb. 29 to 107.9 million

francs ($112.7 million) from a year earlier on a 5.6% fall in

revenue to 3.42 billion francs.

Fiscal first-half sales volumes rose by 4.5%, a contrast with

the 2.6% decline in the global confectionary market measured by

market research company Nielsen.

"In the global confectionary market, volumes are still negative,

but the value is going up," said Mr. de Saint-Affrique. "Six months

ago we were at -5%, so the trend is improving bit by bit."

Mr. Saint-Affrique's bullish outlook cheered up investors, with

Barry Callebaut stock rising more than 6% in early trading in

Zurich.

Barry Callebaut's first-half results would have been better had

it not been for the strong Swiss franc. Revenue rose 12% in local

currencies.

The franc has soared in value over the past year against the

euro since the Swiss central bank scrapped a long-standing limit on

the currency's value early last year. Barry Callebaut said it

suffered a "severe" impact in converting its foreign profit back

into Swiss francs.

Sales growth was also tempered by the company reducing some

sales in the cocoa business, with less profitable contracts phased

out. Mr. de Saint-Affrique said Barry Callebaut would be more

"picky" in future.

Management would also continue to look at bolt-on acquisitions,

particularly of companies that make high-end chocolate used by

chefs for desserts, he said.

Mr. de Saint-Affrique said he expected a "small deficit" in the

cocoa market this season, with demand outstripping supply, but that

it wouldn't threaten the overall supply-demand picture for the

bean, which is largely produced in West Africa.

Dry weather and a strong seasonal harmattan wind, which dries

out cocoa pods, have stoked fears of a shortage in the mid-crop,

the second and smaller of the region's two annual harvests.

"We don't foresee a major structural tension when it comes to

supply," he said.

In February, the International Cocoa Organization also forecast

a cocoa deficit for the 2015-16 season of 113,00 metric tons,

attributing the drop to dry weather in West Africa.

Katherine Dunn contributed to this article.

Write to John Revill at john.revill@wsj.com

(END) Dow Jones Newswires

April 06, 2016 06:47 ET (10:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

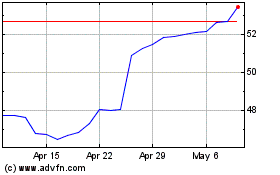

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

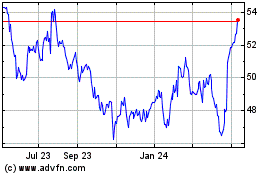

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024