FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 5/6/2015

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

29 Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F Ö Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes No Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The

attached material is being furnished to the Securities and Exchange Commission

pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934,

as amended.

This

report contains a summary of the resolutions adopted in the annual and

extraordinary general meetings of shareholders of Ternium S.A., both held on May 6, 2015.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

TERNIUM S.A.

By: /s/ Arturo Sporleder

Name: Arturo Sporleder

Title: Secretary of the

Board of Directors

Dated:

May 6, 2015

Summary of the resolutions adopted in the Annual General Meeting of Shareholders of TERNIUM S.A. (the “Company”) held on May 6, 2015, at 2:30 p.m. (Luxembourg time) (the “Annual Meeting”), at 29, avenue de la Porte-Neuve, L-2227 Luxembourg

Annual Meeting

1. Consideration of the Board of Directors’ and independent auditor’s reports on the Company’s consolidated financial statements. Approval of the Company’s consolidated financial statements as of 31 December 2014 and 2013 and for the years ended 31 December 2014, 2013 and 2012.

The Meeting resolved to approve the Company’s consolidated financial statements as of 31 December 2014 and 2013 and for the years ended 31 December 2014, 2013 and 2012.

2. Consideration of the independent auditor’s report on the Company’s annual accounts. Approval of the Company’s annual accounts as at 31 December 2014.

The Meeting resolved to approve the Company’s annual accounts as at 31 December 2014.

3. Allocation of results and approval of dividend payment for the year ended 31 December 2014.

The Meeting resolved (i) to approve a dividend, payable in U.S. dollars, on 15 May 2015, in the amount of USD 0.09 per share issued and outstanding (or USD 0.9 per ADR), (ii) to authorize the Board of Directors to determine or amend, in its discretion, any of the terms and conditions of such dividend payment, including the applicable record date, (iii) that the aggregate amount of USD 176,676,909.84 (which is net of the Company's shares held by the subsidiary Ternium International Inc.) to be distributed as dividend on 15 May 2015, be paid from the Company’s retained earnings reserve, and (iv) that the loss of the year ended 31 December 2014, be absorbed by the Company’s retained earnings account

4. Discharge of the members of the Board of Directors for the exercise of their mandate during the year ended 31 December 2014.

The Meeting resolved to discharge all those who were members of the Board of Directors during the year ended 31 December 2014, from any liability in connection with the management of the Company’s affairs during such year.

5. Election of the members of the Board of Directors.

The Meeting resolved to reduce the number of members of the Board of Directors to eight and to re-appoint Messrs. Ubaldo Aguirre, Roberto Bonatti, Carlos Alberto Condorelli, Pedro Pablo Kuczynski, Adrian Lajous, Gianfelice Mario Rocca, Paolo Rocca and Daniel Agustin Novegil to the Board of Directors, each to hold office until the next annual general meeting of shareholders that will be convened to decide on the 2015 accounts.

6.

Authorization of the compensation

of members of the Board of Directors.

The Meeting resolved that each of the members of the

Board of Directors receive an amount of USD 85,000.00 as compensation for his

services during the fiscal year 2015, and that the Chairman of the Board of

Directors receive, further, an additional fee of USD 295,000.00; and that each

of the members of the Board of Directors who are members of the Audit Committee

receive an additional fee of USD 55,000.00, and that the Chairman of such Audit

Committee receive, further, an additional fee of USD 10,000.00. In all cases,

the approved compensation will be net of any applicable Luxembourg social

security charges.

7.

Appointment of the independent

auditors for the fiscal year ending 31 December 2015, and approval of their

fees.

The Meeting resolved to (i) appoint PricewaterhouseCoopers, Société

coopérative, Cabinet de révision agréé, as the Company’s independent

auditors for the fiscal year ending 31 December 31, 2015, to be engaged until

the next annual general meeting of shareholders that will be convened to decide

on the 2015 accounts; and (ii) approve the independent auditors’ fees for

audit, audit-related and other services to be rendered during the fiscal year

ending 31 December 2015, broken-down into eight currencies (Argentine Pesos, Brazilian

Reais, Colombian Pesos, Euro, Mexican Pesos, Swiss Francs, Uruguayan Pesos, and

U.S. Dollars), up to a maximum amount for each currency equal to ARS

15,769,259.00; BRL 22,476.00; COP 243,174,993.00; EUR 582,666.00; MXN

12,582,031.00; CHF 27,500.00; UYU 2,645,081.00 and USD 162,400.00, and to

authorize the Audit Committee to approve any increase or reallocation of the

independent auditors’ fees as may be necessary, appropriate or desirable under

the circumstances.

8.

Authorization to the Company, or any

subsidiary, to from time to time purchase, acquire or receive securities of the

Company, in accordance with Article 49-2 of the Luxembourg law of 10 August

1915 and with applicable laws and regulations.

The Meeting resolved to (i) renew the authorization to the Company

and to the Company’s subsidiaries to acquire, from time to time, Shares,

granted by the Annual General Meeting of Shareholders held on 3 June 2010, (ii)

grant all powers to the Board of Directors and to the board of directors or

other governing bodies of the Company’s subsidiaries, in each case with powers

to delegate in accordance with applicable laws, the Articles or the articles of

association or other applicable organizational documents of the relevant

Company’s subsidiary, to decide on and implement this authorization, to define,

if necessary, the terms and procedures for carrying out any purchase,

acquisition or reception of Shares, and, in particular, to place any stock

exchange orders, conclude any agreements, including, without limitation, for

keeping registers of purchases and sales of Shares, make any declarations to

the applicable regulatory authorities, carry out all formalities and,

generally, do all such other acts and things as may be necessary, appropriate

or desirable for the purposes aforesaid; and (iii) authorize the Board of

Directors to delegate to its Chairman, with the latter having the option to

sub-delegate to any other person(s), the performance of the actions entrusted

to the Board of Directors, pursuant to, or in connection with, this

authorization

9.

Authorization to the Board of

Directors to delegate the day-to-day management of the Company’s business to

one or more of its members

The Meeting resolved to authorize the Board of Directors to delegate

the management of the Company’s day-to-day business and the authority to

represent and bind the Company with his sole signature in such day-to-day

management to Mr. Daniel Agustin Novegil, and to appoint Mr. Novegil as Chief

Executive Officer (Administrateur Délégué) of the Company.

10. Authorization to the Board of Directors to appoint one or more of

its members as the Company’s attorney-in-fact.

The Meeting

resolved to authorize the Board of Directors to appoint any or all members of

the Board of Directors from time to time as the Company’s attorney-in-fact,

delegating to such directors any management powers (including, without

limitation, any day-to-day management powers) to the extent the Board of

Directors may deem appropriate in connection therewith, this authorization to

be valid until expressly revoked by the Company’s General Shareholders Meeting;

it being understood, for the avoidance of doubt, that this authorization does

not impair nor limit in any way the powers of the Board of Directors to appoint

any non-members of the Board of Directors as attorneys-in-fact of the Company

pursuant to the provisions of article 10.1(iii) of the Articles

Summary of the

resolutions adopted in the Annual Extraordinary General Meeting of Shareholders

of TERNIUM S.A. (the “Company”) held on May 6, 2015, at 2:30 p.m. (Luxembourg

time) (the “Annual Meeting”), at 29, avenue de la Porte-Neuve, L-2227

Luxembourg

Annual

Extraordinary General Meeting

1. Decision

on the renewal of the authorized share capital of the Company and related

authorizations and waivers by:

a. the

renewal of the validity period of the Company’s authorized share capital for a

period starting on the date of the Extraordinary General Meeting of

Shareholders and ending on the fifth anniversary of the date of the publication

in the Mémorial of the deed recording the minutes of such meeting;

b. the

renewal of the authorization to the Board of Directors, or any delegate(s) duly

appointed by the Board of Directors, for a period starting on the date of the

Extraordinary General Meeting of Shareholders and ending on the fifth

anniversary of the date of the publication in the Mémorial of the deed recording

the minutes of such meeting, from time to time to issue shares within the

limits of the authorized share capital against contributions in cash,

contributions in kind or by way of incorporation of available reserves at such

times and on such terms and conditions, including the issue price, as the Board

of Directors or its delegate(s) may in its or their discretion resolve;

c. the

renewal of the authorization to the Board of Directors, for a period starting

on the date of the Extraordinary General Meeting of Shareholders and ending on

the fifth anniversary of the date of the publication in the Mémorial of the

deed recording the minutes of such meeting, to waive, suppress or limit any

pre-emptive subscription rights of shareholders provided for by law to the

extent it deems such waiver, suppression or limitation

advisable for any issue or issues of shares within the authorized share

capital; waiver of any pre-emptive subscription rights provided for by law and

related procedures;

d. the

decision that for as long as (but only for as long as) the shares of the

Company are listed on a regulated market, any issuance of shares for cash

within the limits of the authorized share capital shall be subject by provision

of the Company’s articles of association to the pre-emptive subscription rights

of the then existing shareholders, except in the following cases (in which

cases no pre-emptive rights shall apply):

i. any issuance of shares for, within, in

conjunction with or related to, an initial public offering of the shares of the

Company on one or more regulated markets (in one or more instances); and

ii. any issuance of shares against a

contribution other than in cash; and

iii. any issuance of shares upon conversion of

convertible bonds or other instruments convertible into shares of the Company;

provided, however, that the pre-emptive subscription rights of the then

existing shareholders shall apply by provision of the Company’s articles of

association in connection with any issuance of convertible bonds or other

instruments convertible into shares of the Company for cash; and

iv. any issuance of shares (including by way

of free shares or at discount), up to an amount of 1.5% of the issued share

capital of the Company, to directors, officers, agents, employees of the

Company, its direct or indirect subsidiaries, or its Affiliates (as such term

is defined in the Company’s articles of association) (collectively, the

“Beneficiaries”), including without limitation the direct issue of shares or

upon the exercise of options, rights convertible into shares, or similar

instruments convertible or exchangeable into shares issued for the purpose of

compensation or incentive of the Beneficiaries or in relation thereto (which

the Board of Directors shall be authorized to issue upon such terms and

conditions as it deems fit).

e. the

acknowledgement and approval of the report of the Board of Directors in

relation with the authorized share capital and the proposed authorizations to

the Board of Directors with respect to any issuance of shares within the

authorized share capital while suppressing any pre-emptive subscription rights

of existing shareholders under law and related waiver; and

f. the

amendment of article 5 of the articles of association of the Company to reflect

the resolutions on this item of the agenda.

The Meeting

resolved:

To renew the

validity period of the Company’s authorized share capital for a period starting

on the date of this Meeting and ending on the fifth anniversary of the date of

the publication in the Mémorial of the deed recording the minutes of this

Meeting.

To renew the

authorization to the Board of Directors, or any delegate(s) duly appointed by

the Board of Directors, for a period starting on the date of this Meeting and

ending on the fifth anniversary of the date of the publication in the Mémorial

of the deed recording the minutes of this Meeting, from time to time, to issue

shares within the limits of the authorized share capital against contributions

in cash, contributions in kind or by way of incorporation of available reserves

at such times and on such terms and

conditions, including the issue price, as the Board of Directors or its delegate(s) may in its or their discretion resolve.

To renew the authorization to the Board of Directors, for a period starting on the date of this Meeting and ending on the fifth anniversary of the date of the publication in the Mémorial of the deed recording the minutes of this Meeting, to waive, suppress or limit any pre-emptive subscription rights of shareholders provided for by law to the extent it deems such waiver, suppression or limitation advisable for any issue or issues of shares within the authorized share capital and further resolved to waive any preemptive subscription rights provided for by law and related procedures.

That for so long as (but only for so long as) the shares of the Company are listed on a regulated market, any issuance of shares for cash, within the limits of the authorized share capital, shall be subject by provision of the Company’s articles of association to the pre-emptive subscription rights of the then existing shareholders, except in the following cases (in which cases no pre-emptive rights shall apply):

i. any issuance of shares for, within, in conjunction with or related to, an initial public offering of the shares of the Company on one or more regulated markets (in one or more instances); and

ii. any issuance of shares against a contribution other than in cash; and

iii. any issuance of shares upon conversion of convertible bonds or other instruments convertible into shares of the Company; provided, however, that the pre-emptive subscription rights of the then existing shareholders shall apply by provision of the Company’s articles of association in connection with any issuance of convertible bonds or other instruments convertible into shares of the Company for cash; and

iv. any issuance of shares (including by way of free shares or at discount), up to an amount of 1.5% of the issued share capital of the Company, to directors, officers, agents, employees of the Company, its direct or indirect subsidiaries, or its Affiliates (as such term is defined in the Company’s articles of association) (collectively, the “Beneficiaries), including without limitation the direct issue of shares or upon the exercise of options, rights convertible into shares, or similar instruments convertible or exchangeable into shares issued for the purpose of compensation or incentive of the Beneficiaries or in relation thereto (which the Board of Directors shall be authorized to issue upon such terms and conditions as it deems fit).

To acknowledge and approve the report of the Board of Directors dated 18 February 2015, in relation with the authorized share capital and the proposed authorizations to the Board of Directors with respect to any issuance of shares within the authorized share capital while suppressing any pre-emptive subscription rights of existing shareholders under law and related waiver. Such report of the Board of Directors shall remain annexed to the present deed to be registered therewith.

To approve the amendment of article 5 of the Company’s articles of association to reflect the resolutions on the agenda, so that articles 5.2. (i), 5.2. (ii) and 5.2. (iii) of the articles of association of the Company shall read as follows:

”5.2. (i) The Company’s authorized share capital shall be three billion five hundred million US dollars (USD 3,500,000,000), including the issued share capital, represented by three billion five hundred million (3,500,000,000) shares with a par value of one U.S. dollar per share. The Company’s authorized share

capital (and any

authorization granted to the Board of Directors in relation thereto) shall be

valid from 6 May 2015 until the fifth anniversary of the date of publication of

the deed of the extraordinary General Shareholders’ Meeting held on 6 May 2015

in the Mémorial.

(ii) The Board of Directors, or any delegate(s) duly appointed by

the Board of Directors, may from time to time, for a period starting on the

Extraordinary General Meeting of Shareholders held on 6 May 2015 and ending on

the fifth anniversary of the date of the publication in the Mémorial of the

deed recording the minutes of such meeting, issue shares within the limits of

the authorized share capital against contributions in cash, contributions in

kind or by way of incorporation of available reserves at such times and on such

terms and conditions, including the issue price, as the Board of Directors or

its delegate(s) may in its or their discretion resolve.

The General Shareholders’ Meeting has authorised the Board of

Directors, for a period starting on the date of the Extraordinary General

Meeting of Shareholders held on 6 May 2015 and ending on the fifth anniversary

of the date of the publication in the Mémorial of the deed recording the

minutes of such meeting, to waive, suppress or limit any pre-emptive

subscription rights of shareholders provided for by law to the extent it deems

such waiver, suppression or limitation advisable for any issue or issues of

shares within the authorized share capital, and has waived any pre-emptive

subscription rights provided for by law and related procedures;

(iii) For as long as (but only for as long as) the shares of the

Company are listed on a regulated market, any issuance of shares for cash

within the limits of the authorized share capital shall be subject by provision

of these articles of association to the pre-emptive subscription rights of the

then existing shareholders, except in the following cases (in which cases no

pre-emptive rights shall apply):

(a) any issuance of shares for, within, in conjunction with or

related to, an initial public offering of the shares of the Company on one or

more regulated markets (in one or more instances); and

(b) any issuance of shares against a contribution other than in

cash; and

(c) any issuance of shares upon conversion of convertible bonds or

other instruments convertible into shares of the Company; provided, however,

that the pre-emptive subscription rights of the then existing shareholders

shall apply by provision of the Company’s articles of association in connection

with any issuance of convertible bonds or other instruments convertible into

shares of the Company for cash; and

(d) any issuance of shares (including by way of free

shares or at discount), up to an amount of 1.5% of the issued share capital of

the Company, to directors, officers, agents, employees of the Company, its

direct or indirect subsidiaries, or its Affiliates (collectively, the

“Beneficiaries”), including without limitation the direct issue of shares or

upon the exercise of options, rights convertible into shares, or similar

instruments convertible or exchangeable into shares issued for the purpose of

compensation or incentive of the Beneficiaries or in relation thereto (which

the Board of Directors shall be authorized to issue upon such terms and

conditions as it deems fit).”

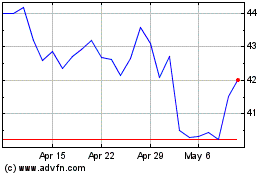

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

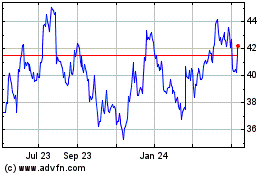

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024