Tupperware Profit Tops Expectations

April 20 2016 - 9:40AM

Dow Jones News

Tupperware Brands Corp. on Wednesday raised its outlook for the

year after posting better-than-expected earnings, though revenue

fell as the stronger dollar continued to dent results for the maker

of plastic food containers, which has a heavy overseas

presence.

For the year, Tupperware now expects earnings of $4.28 to $4.38

a share, compared with previous guidance for $3.81 to $3.91 a

share. And Tupperware now expects sales to be flat to down 2%,

compared with previous guidance for a revenue decline of 4% to

6%.

For the current quarter, the company forecast adjusted earnings

of $1.07 to $1.12 a share, below analysts' expectations for $1.13.

But sales are expected to fall 3% to 5%, less than the 7% decline

analysts projected.

"While we continued to achieve strong performances in Argentina,

Brazil, China, Tupperware Mexico and Tupperware U.S. and Canada, we

have continued to need to navigate through economic and political

headwinds," Chief Executive Rick Goings said.

He said Tupperware, which gets more than half of its sales from

outside the U.S., continues to expect some softness in

local-currency sales growth in 2016.

In the fiscal first quarter ended March 26, sales in South

America fell 10% when measured by the U.S. dollar but rose 24% in

local currency. Sales in the Asia-Pacific segment fell 9% in

dollars and 3% in local currency, as a double-digit increase in

China was offset by results in India, the Philippines and

Indonesia, its largest market.

The top line for the Tupperware North America division,

meanwhile, rose 14% in local currency and 4.7% in dollars, as sales

in Mexico rose jumped 20% in local currency and sales in the U.S.

and Canada both climbed 9% in local currency.

Overall, the company posted a profit of $43.4 million, or 86

cents a share, up from $29.5 million, or 59 cents a share, a year

earlier. Excluding the impact of foreign-currency rates, earnings

on an adjusted basis were 91 cents a share.

Revenue slipped 10% to $525.7 million.

In January, the company had given guidance for adjusted earnings

between 74 cents and 79 cents a share and sales to decrease 10% to

12%. At the time, that guidance was sharply below analyst

expectations.

Tupperware reported a total sales force of 3 million at the end

of the quarter, up 4% from a year earlier, with 2% fewer active

sellers in the quarter.

Shares of the company, which have risen 25% over the past three

months, were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 20, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

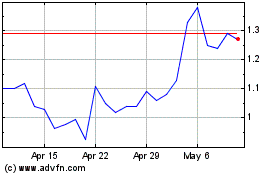

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Aug 2024 to Sep 2024

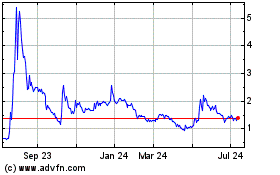

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Sep 2023 to Sep 2024