(A free translation of the original in Portuguese)

TIM Participações S.A. and

TIM Participações S.A. and

subsidiaries

Financial Statements as at

December 31, 2015

and Independent Auditors’ Report

TIM PARTICIPAÇÕES S.A.

FINANCIAL STATEMENTS

December 31, 2015 and 2014

Contents

| |

Independent auditors’ report on the financial statements

| 1

|

| |

Audited financial statements

| |

Balance sheet

| 3

|

Statement of income

| 5

|

Statement of comprehensive income

| 6

|

Statement of changes in shareholders’ equity

| 7

|

Statement of cash flows

| 9

|

Statement of value added

| 11

|

Management report

| 12

|

Notes to the financial statements

| 41

|

Fiscal Council Opinion

| 106

|

Statutory Audit Committee Annual Report

| 107

|

Directors statement on financial statements

| 111

|

Directors statement on independent auditors’ report

| 112

|

(A free translation of the original in Portuguese)

(Free translation of the original report in Portuguese, issued on financial statements prepared in accordance with Brazilian and international financial reporting standards)

Independent auditor's report

To the Board of Directors and Shareholders

TIM Participações S.A.

We have audited the accompanying individual and consolidated financial statements of TIM Participações S.A. ("Parent Company") and of TIM Participações S.A. and its subsidiaries ("Consolidated"), which comprise the balance sheet as at 31st. December 2015 and the statements of income, of comprehensive income, of changes in equity and of cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information,.

Management's responsibility for the financial statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting practices adopted in Brazil and with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and for such internal controls as management determines as necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Brazilian and International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error.

In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

(A free translation of the original in Portuguese)

(Free translation of the original report in Portuguese, issued on financial statements prepared in accordance with Brazilian and international financial reporting standards)

Independent auditor's report (continued)

To the Board of Directors and Shareholders

TIM Participações S.A.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of TIM Participações S.A. and TIM Participações S.A. and its subsidiaries as at 31st. December 2015, and their financial performance and their cash flows for the year then ended, in accordance with accounting practices adopted in Brazil and International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

Other matters

Supplementary information - statements of value added

We also have audited the parent company and consolidated statements of value added for the year ended 31st. December 2015, which are the responsibility of the Company's management. The presentation of these statements is required by the Brazilian corporate legislation for listed companies, but they are considered supplementary information for IFRS. These statements were subject to the same audit procedures described above and, in our opinion, are fairly presented, in all material respects, in relation to the financial statements taken as a whole.

Prior year balances

The individual and consolidated financial statements of TIM Participações S.A. for the year ended 31st. December 2014 were examined by other independent auditors, who issued an unqualified opinion dated 12th. February 2015.

Rio de Janeiro, 4th. February 2016.

Ricardo Julio Rodil

Accountant – CRC-1SP111444/O-1

Baker Tilly Brasil Auditores Independentes S/S

CRC-2SP016754/O-1

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

BALANCE SHEET

(in thousands of Reais)

| | | | | | | | | |

| | | Parent Company

| | Consolidated

|

| Notes

| | 2015

| | 2014

| | 2015

| | 2014

|

Assets

| | | | | | | | | |

Current assets

| | | | | | | | | |

Cash and cash equivalents

| 4

| | 24,763

| | 43,455

| | 6,100,403

| | 5,232,992

|

Securities

| 5

| | -

| | -

| | 599,414

| | -

|

Trade accounts receivable

| 6

| | 329

| | 329

| | 2,858,089

| | 3,537,417

|

Inventories

| 7

| | -

| | -

| | 141,720

| | 264,033

|

Dividends receivable

| | | 469,013

| | 385,835

| | -

| | -

|

Indirect taxes and contributions recoverable

| 8

| | -

| | -

| | 922,593

| | 1,285,143

|

Direct taxes and contributions recoverable

| 9

| | 21,911

| | 20,648

| | 324,780

| | 357,482

|

Prepaid expenses

| 11

| | 15

| | -

| | 210,056

| | 266,264

|

Derivative transactions

| 40

| | -

| | -

| | 608,915

| | 47,541

|

Leasing

| 16

| | -

| | -

| | 1,969

| | 1,525

|

Other assets

| | | 26,720

| | 12,743

| | 265,334

| | 182,018

|

| | | 542,751

| | 463,010

| | 12,033,273

| | 11,174,415

|

Noncurrent assets

| | | | | | | | | |

Long-term receivables

| | | | | | | | | |

Securities

| 5

| | -

| | 98

| | -

| | 41,149

|

Trade accounts receivable

| 6

| | -

| | -

| | 24,861

| | 29,886

|

Indirect taxes and contributions recoverable

| 8

| | -

| | -

| | 817,676

| | 574,490

|

Direct taxes and contributions recoverable

| 9

| | -

| | -

| | 24,758

| | 23,346

|

Deferred income tax and social contribution

|

10

| | -

| | -

| |

14,526

| |

537,097

|

Judicial deposits

| 12

| | 73,825

| | 65,631

| | 1,106,041

| | 986,017

|

Prepaid expenses

| 11

| | 57

| | -

| | 55,234

| | 70,587

|

Derivative transactions

| 40

| | -

| | -

| | 490,659

| | 463,157

|

Leasing

| 16

| | -

| | | | 197,966

| | 193,511

|

Other assets

| | | -

| | -

| | 12,117

| | 11,926

|

| | | 73,882

| | 65,729

| | 2,743,838

| | 2,931,166

|

| | | | | | | | | |

Investments

| 13

| | 16,731,543

| | 15,101,231

| | -

| | -

|

Property, plant and equipment

| 14

| | -

| | -

| | 10,667,348

| | 8,914,929

|

Intangible assets

| 15

| | 157,556

| | 157,556

| | 9,959,193

| | 9,322,634

|

| | | 16,962,981

| | 15,324,516

| | 23,370,379

| | 21,168,729

|

Total assets

| | |

17,505,732

| |

15,787,526

| |

35,403,652

| |

32,343,144

|

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

BALANCE SHEET

(in thousands of Reais)

| | | | | | | | | |

| | | Parent Company

| | Consolidated

|

| Notes

| | 2015

| | 2014

| | 2015

| | 2014

|

Liabilities

| | | | | | | | | |

Current liabilities

| | | | | | | | | |

Suppliers

| 17

| | 4,071

| | 1,218

| | 3,784,945

| | 5,402,204

|

Borrowings and financing

| 19

| | -

| | -

| | 2,326,186

| | 1,281,554

|

Leasing

| 16

| | -

| | -

| | 38,592

| | 3,642

|

Derivative transactions

| 40

| | -

| | -

| | 109,512

| | 67,044

|

Labor obligations

| | | 1,723

| | 2,119

| | 199,373

| | 208,629

|

Indirect taxes and contributions payable

| 20

| | 317

| | 225

| | 501,768

| | 645,896

|

Direct taxes and contributions payable

| 21

| | 46

| | 14

| | 213,880

| | 162,311

|

Dividends payable

| 25

| | 524,779

| | 421,002

| | 524,779

| | 421,002

|

Authorizations payable

| 18

| | -

| | -

| | 467,687

| | 493,169

|

Deferred revenues

| 22

| | -

| | -

| | 484,392

| | 427,862

|

Other liabilities

| | | 7,587

| | 7,547

| | 7,292

| | 9,943

|

| | | 538,523

| | 432,125

| | 8,658,406

| | 9,123,256

|

Noncurrent liabilities

| | | | | | | | | |

Borrowings and financing

| 19

| | -

| | -

| | 5,600,250

| | 5,472,865

|

Leasing

| 16

| | -

| | -

| | 1,579,914

| | 326,027

|

Indirect taxes, fees and contributions payable

|

20

| |

-

| |

-

| |

103

| |

94

|

Direct taxes, fees and contributions payable

| 21

| | -

| | -

| | 243,151

| | 229,027

|

Deferred income tax and social contribution

| 10

| | -

| | -

| | 120,730

| | 129,206

|

Provision for legal and administrative proceedings

| 23

| | 4,403

| | 3,603

| | 415,611

| | 406,509

|

Pension plan and other post-employment benefits

| | | -

| | -

| | 1,275

| | 645

|

Asset retirement obligation

| 24

| | -

| | -

| | 31,609

| | 286,275

|

Authorizations payable

| 18

| | -

| | -

| | 690,285

| | 879,012

|

Deferred revenues

| 22

| | -

| | -

| | 1,098,689

| | 137,585

|

Other liabilities

| | | 29,762

| | 29,764

| | 30,585

| | 30,609

|

| | | 34,165

| | 33,367

| | 9,812,202

| | 7,897,854

|

| | | | | | | | | |

Total liabilities

| | | 572,688

| | 465,492

| | 18,470,608

| | 17,021,110

|

| | | | | | | | | |

Shareholders’ equity

| 25

| | | | | | | | |

Capital stock

| | | 9,866,298

| | 9,866,298

| | 9,866,298

| | 9,866,298

|

Treasury shares

| | | (3,369)

| | (3,369)

| | (3,369)

| | (3,369)

|

Capital reserves

| | | 1,442,097

| | 1,344,470

| | 1,442,097

| | 1,344,470

|

Carrying value adjustments

| | | 1,887

| | 2,303

| | 1,887

| | 2,303

|

Revenue reserves

| | | 5,626,131

| | 4,112,332

| | 5,626,131

| | 4,112,332

|

Total shareholders’ equity

| | | 6,933,044

| | 15,322,034

| | 16,933,044

| | 15,322,034

|

| | | | | | | | | |

Total liabilities and shareholders’ equity

| | | 17,505,732

| | 15,787,526

| | 35,403,652

| | 32,343,144

|

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

STATEMENT OF INCOME

Years ended December 31

(in thousands of Reais, unless otherwise indicated)

| | | | | | | | | | | |

| | | Parent Company

| | Consolidated

|

| Notes

| | 2015

| | | 2014

| | 2015

| | 2014

|

| | | | | | | | | | |

Net revenues

| 27

| | -

| | | -

| | 17,138,851

| | 19,498,165

|

| | | | | | | | | | |

Cost of services provided and goods sold

| 28

| | -

| | | -

| | (8,306,857)

| | (10,083,920)

|

Gross profit

| | | -

| | | -

| | 8,831,994

| | 9,414,245

|

| | | | | | | | | | |

Operating revenues (expenses):

| | | | | | | | | | |

Selling expenses

| 29

| | -

| | | -

| | (4,826,895)

| | (5,022,972)

|

General and administrative expenses

| 30

| | (29,058)

| | | (23,877)

| | (1,195,277)

| | (1,130,754)

|

Income from equity accounting

| 13

| | 2,095,890

| | | 1,579,188

| | -

| | -

|

Other incomes (expenses), net

| 31

| | (964)

| | | (736)

| | 434,395

| | (774,830)

|

| | | 2,065,868

| | | 1,554,575

| | (5,587,777)

| | (6,928,556)

|

| | | | | | | | | | |

Operating income

| | | 2,065,868

| | | 1,554,575

| | 3,244,217

| | 2,485,689

|

| | | | | | | | | | |

Financial incomes (expenses):

| | | | | | | | | | |

Financial incomes

| 32

| | 7,090

| | | 3,146

| | 848,737

| | 702,417

|

Financial expenses

| 33

| | (1,448)

| | | (11,308)

| | (1,115,524)

| | (997,294)

|

Exchange variations, net

| 34

| | (365)

| | | 6

| | 2,409

| | 2,105

|

| | | 5,277

| | | (8,156)

| | (264,378)

| | (292,772)

|

| | | | | | | | | | |

Income before income tax and social contribution

| | |

2,071,145

| | |

1,546,419

| |

2,979,839

| |

2,192,917

|

| | | | | | | | | | |

Income tax and social contribution

| 35

| | -

| | | -

| | (908,694)

| | (646,498)

|

| | | | | | | | | | |

Net income for the year

| | | 2,071,145

| | | 1,546,419

| | 2,071,145

| | 1,546,419

|

| | | | | | | | | | |

Earnings per share attributable to Company shareholders (in R$ per share)

| | | | | | | | | | |

| | | | | | | | | | |

Basic earnings per share

| 36

| | 0.8558

| | | 0.6396

| | | | |

| | | | | | | | | | |

Diluted earnings per share

| 36

| | 0.8557

| | | 0.6393

| | | | |

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

STATEMENT OF COMPREHENSIVE INCOME

Years ended December 31

(in thousands of Reais)

| | | | | | | | |

| | Parent Company

| | Consolidated

|

| |

2015

| |

2014

| |

2015

| |

2014

|

| | | | | | | | |

Profit for the year

| | 2,071,145

| | 1,546,419

| | 2,071,145

| | 1,546,419

|

| | | | | | | | |

Other components of comprehensive income

Item that will not be reclassified to income:

| | | | | | | | |

Pension plan and other post-employment benefits, net of taxes

| | (416)

| | 290

| | (416)

| | 290

|

| | | | | | | | |

Total comprehensive income for the year

| | 2,070,729

| | 1,546,709

| | 2,070,729

| | 1,546,709

|

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(in thousands of Reais)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Revenue reserves

|

| | | | | | | | | |

| |

Capital

stock

|

Capital

reserves

|

Legal

reserve

|

Reserve for expansion

| Additional dividend

proposed

|

Treasury shares

|

Carrying value adjustments

|

Accumulated earnings

| |

Total

|

Balances as at December 31, 2013

| |

9,839,770

| |

1,217,640

| |

438,634

| |

2,614,230

| |

485,722

| |

(3,369)

| |

2,013

| |

-

| |

14,594,640

|

Total comprehensive income for the year

| | | | | | | | | |

| | | | | | | | |

Profit for the year

| | -

| | -

| | -

| | -

| | -

| | -

| | -

| | 1,546,419

| | 1,546,419

|

Effect of amount of post employment benefits posted directly to subsidiaries shareholders’ equity

| | -

| | -

| | | | | | | | | |

290

| | -

| |

290

|

Total comprehensive income for the year

| |

-

| |

-

| |

-

| |

-

| |

-

| |

-

| |

290

| |

1,546,419

| |

1,546,709

|

| | | | | | | | | | | | | | | | | | |

Total of shareholders' contributions and distributions to shareholders

| | | | | | | | | | | | | | | | | | |

Stock options

(note 26)

| | -

| | 5,687

| | -

| | -

| | -

| | -

| | -

| | -

| | 5,687

|

Capital Increase

| | 26,528

| | | | -

| | -

| | -

| | -

| | -

| | -

| | 26,528

|

| | | | | | | | | | | | | | | | | | |

Allocation of profit for the year:

| | | | | | | | | | | | | | | | | | |

Legal reserve (note 25)

| | -

| | -

| | 77,322

| | -

| | -

| | -

| | -

| | (77,322)

| | -

|

Proposed dividends (note 25)

| | -

| | -

| | -

| | -

| | -

| | -

| | | | (367,274)

| | (367,274)

|

Constitution of tax benefit reserve (note 25)

| | -

| | 121,143

| | -

| | -

| |

-

| | -

| | -

| | (121,143)

| | -

|

Constitution of reserve for expansion (note 25)

| | -

| | -

| | -

| | 980,680

| |

-

| | -

| | -

| | (980,680)

| | -

|

Distribution of supplementary dividends 2013

| | -

| | -

| | -

| | -

| |

(485,722)

| | -

| | -

| | -

| | (485,722)

|

Dividends posted directly to shareholders’ equity

| | -

| | -

| | -

| | 1,466

| | -

| | -

| | -

| | -

| | 1,466

|

| | | | | | | | | | | | | | | | | | |

Total of shareholders' contributions and distributions to shareholders

| |

26,528

| |

126,830

| |

77,322

| |

982,146

| |

(485,722)

| |

-

| |

-

| |

(1,546,419)

| |

(819,315)

|

Balances as at December 31, 2014

| | 9,866,298

|

| 1,344,470

| |

515,956

| |

3,596,376

| |

-

| | (3,369)

| |

2,303

| |

-

| |

15,322,034

|

| | | | | | | | | | | | | | | | | | |

Total comprehensive income for the year

| | | | | | | | | |

| | | | | | | | |

Profit for the year

| | -

| | -

| | -

| | -

| | -

| | -

| | | | 2,071,145

| | 2,071,145

|

Effect of amount of post employment benefits posted directly to subsidiaries shareholders’ equity

| | -

| | -

| | -

| | -

| | -

| | -

| | (416)

| | -

| | (416)

|

Total comprehensive income for the year

| | -

| | -

| | -

| | -

| | -

| | -

| | (416)

| | 2,071,145

| | 2,070,729

|

| | | | | | | | | | | | | | | | | | |

Total of shareholders' contributions and distributions to shareholders

| | | | | | | | | | | | | | | | | | |

Stock options (note 26)

| | -

| | 4,504

| | -

| | -

| | -

| | -

| | -

| | -

| | 4,504

|

Allocation of profit for the year:

| | | | | | | | | | | | | | | | | | |

Legal reserve (note 25)

| | -

| | -

| | 103,557

| | -

| | -

| | -

| | -

| | (103,557)

| | -

|

Proposed dividends (note 25)

| | -

| | -

| | -

| | -

| | -

| | -

| | | | (468,616)

| | (468,616)

|

Constitution of tax benefit reserve (note 25)

| | -

| | 93,123

| | -

| | -

| | -

| | -

| | -

| | (93,123)

| | -

|

Constitution of reserve expansion (note 25)

| | -

| | -

| | -

| | 1,405,849

| | -

| | -

| | -

| | (1,405,849)

| | -

|

Dividends posted directly to shareholders’ equity

| | -

| | -

| | -

| | 4,393

| | -

| | -

| | -

| | -

| | 4,393

|

| | | | | | | | | | | | | | | | | | |

Total of shareholders' contributions and distributions to shareholders

| | -

| | 97,627

| | 103,557

| | 1,410,242

| | -

| | -

| | -

| | (2,071,145)

| | (459,719)

|

Balances as at December 31, 2015

| |

9,866,298

| |

1,442,097

| |

619,513

| |

5,006,618

| |

-

| |

(3,369)

| |

1,887

| |

-

| |

16,933,044

|

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

STATEMENT OF CASH FLOWS

Years ended December 31

(in thousands of Reais)

| | | | | | | | | |

| | | | | Parent Company

| | | | |

| Notes

| | 2015

| | 2014

| | 2015

| | 2014

|

Operating activities

| | | | | | | | | |

Income before income tax and social contribution

| | | 2,071,145

| | 1,546,419

| | 2,979,839

| | 2,192,917

|

Adjustments to reconcile income with cash from operating activities:

| | | | | | | | | |

Depreciation and amortization

| | | -

| | -

| | 3,361,971

| | 3,052,579

|

Income from equity accounting

| 13

| | (2,095,890)

| | (1,579,188)

| | -

| | -

|

Gain on sale of property, plant and equipment (leaseback)

| 1b e 31

| | -

| | -

| | (1,210,980)

| | -

|

Residual value of property, plant and equipment and intangible assets written off

| | | -

| | -

| | 11,704

| | 15,659

|

Interests on asset retirement obligations

| 24

| | -

| | -

| | 3,961

| | 7,915

|

Constitution of provision for legal and administrative proceedings

| 23

| | 2,384

| | 694

| | 359,973

| | 264,338

|

Monetary adjustment of deposits and administrative and judicial proceedings

| | |

(411)

| |

(511)

| |

28,857

| |

(6,211)

|

Monetary adjustment of dividends

| | | -

| | 10,957

| | -

| | 10,957

|

Interest, monetary and exchange variations of borrowings and other financial adjustments

| | |

-

| |

-

| |

757,960

| |

747,989

|

Leasing interest payable

| 33

| | -

| | -

| | 145,274

| | 43,904

|

Leasing interest receivable

| 32

| | -

| | -

| | (24,045)

| | (32,085)

|

Allowance for doubtful accounts

| 29

| | -

| | -

| | 230,357

| | 248,576

|

Call options

| 26

| | 654

| | 870

| | 4,504

| | 5,687

|

| | | (22,118)

| | (20,759)

| | 6,649,375

| | 6,552,225

|

Decrease (increase) in operating assets

| | | | | | | | | |

Trade accounts receivable

| | | | | -

| | 535,736

| | (204,173)

|

Taxes and contributions recoverable

| | | (1,263)

| | 4,470

| | 156,845

| | (375,939)

|

Inventories

| | | -

| | -

| | 122,313

| | 32,796

|

Prepaid expenses

| | | -

| | -

| | 71,561

| | (33,591)

|

Dividends received

| | | 385,835

| | 871,796

| | -

| | -

|

Judicial deposits

| | | (6,979)

| | (14,559)

| | (70,491)

| | (232,952)

|

Other assets

| | | (14,046)

| | (2,481)

| | (75,181)

| | (33,233)

|

Increase (decrease) in operating liabilities

| | | | | | | | | |

Labor obligations

| | | (396)

| | 1,333

| | (9,256)

| | 38,074

|

Suppliers

| | | 2,853

| | (569)

| | (1,804,175)

| | 12,623

|

Taxes, fees and contributions payable

| | | 124

| | (5,043)

| | (493,936)

| | (225,866)

|

Authorizations payable

| | | -

| | -

| | (247,806)

| | 1,294,640

|

Payment of legal and administrative proceedings

| 23

| | (2,388)

| | (172)

| | (429,261)

| | (256,497)

|

Other liabilities

| | | 35

| | 35

| | (127,518)

| | (127,043)

|

Net cash from operating activities

| | | 341,657

| | 834,051

| | 4,278,206

| | 6,441,064

|

| | | | | | | | | |

Investment activities

| | | | | | | | | |

Financial assets stated at fair value through profit or loss

| | | 98

| | (9)

| | (558,264)

| | (12,468)

|

Cash received on sale of property, plant and equipment

| 1.b

| | -

| | -

| | 2,498,421

| | -

|

Additions to property, plant and equipment and intangible assets

| | | -

| | -

| | (4,764,239)

| | (6,829,436)

|

Asset retirement obligations

| | | -

| | -

| | -

| | (21,453)

|

Net cash from (used in) investment activities

| | |

98

| |

(9)

| | (2,824,082)

| |

(6,863,357)

|

| | | | | | | | | |

Financing activities

| | | | | | | | | |

Increase in capital stock – share issue

| | | -

| | 26,199

| | -

| | 26,199

|

New borrowings

| | | -

| | -

| | 1,262,351

| | 2,302,691

|

Repayment of borrowings

| | | -

| | -

| | (1,711,497)

| | (984,342)

|

Payment of financial leasing

| | | -

| | -

| | (82,092)

| | (17,586)

|

Reimbursement to shareholders – combination of TIM Fiber S.A. shares

| | | -

| | -

| | (22)

| | (46)

|

Derivative transactions

| | | -

| | -

| | 304,994

| | (123,375)

|

Dividends paid

| | | (360,447)

| | (835,898)

| | (360,447)

| | (835,898)

|

Net cash from (used in) financing activities

| | |

(360,447)

| |

(809,699)

| |

(586,713)

| |

367,643

|

| | | | | | | | | |

Increase (decrease) in cash and cash equivalents

| | | (18,692)

| | 24,343

| | 867,411

| | (54,650)

|

| | | | | | | | | |

Cash and cash equivalents at the beginning of the year

| | | 43,455

| | 19,112

| | 5,232,992

| | 5,287,642

|

Cash and cash equivalents at the end of the year

| | | 24,763

| | 43,455

| | 6,100,403

| | 5,232,992

|

Disclosures on supplementary information on non-monetary and other transactions are shown on note 43.

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

STATEMENT OF VALUE ADDED

Years ended December 31

(in thousands of Reais)

| | | | | | | |

| Parent Company

| | Consolidated

|

| 2015

| | 2014

| | 2015

| | 2014

|

Revenues

| | | | | | | |

Gross operating revenue

| -

| | -

| | 25,767,812

| | 29,004,503

|

Allowance for doubtful accounts

| -

| | -

| | (230,357)

| | (248,576)

|

Discounts granted, returns and others

| -

| | -

| | (2,380,926)

| | (2,782,896)

|

| -

| | -

| | 23,156,529

| | 25,973,031

|

Inputs acquired from third parties

| | | | | | | |

Cost of services provided and goods sold

| -

| | -

| | (5,167,254)

| | (7,232,375)

|

Material, energy, third party services and others

| (16,444)

| | (11,952)

| | (2,358,921)

| | (3,674,485)

|

| (16,444)

| | (11,952)

| | (7,526,175)

| | (10,906,860)

|

| | | | | | | |

Retentions

| | | | | | | |

Depreciation and amortization

| -

| | -

| | (3,361,971)

| | (3,052,579)

|

| | | | | | | |

Net value added created

| (16,444)

| | (11,952)

| | 12,268,383

| | 12,013,592

|

| | | | | | | |

Value added received by transfer

| | | | | | | |

Income from equity accounting

| 2,095,890

| | 1,579,188

| | -

| | -

|

Financial incomes

| 7,122

| | 3,265

| | 1,996,752

| | 1,003,425

|

| 2,103,012

| | 1,582,453

| | 1,996,752

| | 1,003,425

|

Total value added for distribution

| 2,086,568

| | 1,570,501

| | 14,265,135

| | 13,017,017

|

| | | | | | | |

Distribution of value added

| | | | | | | |

Personnel and charges

| | | | | | | |

Direct compensation

| 9,203

| | 8,699

| | 595,117

| | 562,053

|

Benefits

| 1,124

| | 1,045

| | 180,995

| | 154,606

|

F.G.T.S

| 202

| | 179

| | 57,339

| | 52,627

|

Others

| 685

| | 22

| | 16,911

| | 13,303

|

| 11,214

| | 9,945

| | 850,362

| | 782,589

|

Taxes, charges and contributions

| | | | | | | |

Federal

| 2,193

| | 2,515

| | 3,205,224

| | 3,310,755

|

State

| -

| | 1

| | 5,219,157

| | 5,519,228

|

Municipal

| 14

| | 15

| | 16,743

| | 13,934

|

| 2,207

| | 2,531

| | 8,441,124

| | 8,843,917

|

Remuneration of third party capital

| | | | | | | |

Interest

| 1,797

| | 11,393

| | 2,257,714

| | 1,289,139

|

Rentals

| 205

| | 213

| | 644,790

| | 554,953

|

| 2,002

| | 11,606

| | 2,902,504

| | 1,844,092

|

Remuneration of shareholders’ equity

| | | | | | | |

Dividends

| 468,616

| | 367,274

| | 468,616

| | 367,274

|

Retained earnings

| 1,602,529

| | 1,179,145

| | 1,602,529

| | 1,179,145

|

| 2,071,145

| | 1,546,419

| | 2,071,145

| | 1,546,419

|

The accompanying notes are an integral part of these financial statements.

(A free translation of the original in Portuguese)

TIM PARTICIPAÇÕES S.A.

Publicly-held Company

Corporate Taxpayer's ID (CNPJ/MF): 02.558.115/0001-21

Corporate Registry (NIRE): 33 300 276 963

MANAGEMENT REPORT

COMMENTS ON THE FINANCIAL STATEMENTS FOR THE YEAR ENDED ON DECEMBER 31, 2015

Dear Shareholders,

The management of TIM Participações S.A. (“TIM Participações”, “The Company” or “TIM”) submits to you the Management Report and the Consolidated Financial Statements of the Company, with the independent auditors’ report for the fiscal year ended on December 31, 2015.

The consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS) as defined by the IASB.

The operating and financial information of 2015 below, unless stated otherwise, is presented in Brazilian Reais (R$), based on consolidated figures and pursuant to Brazilian corporate law.

Profile

TIM Participações is a publicly traded company which shares are listed on the São Paulo Stock Exchange (Bovespa) and which ADRs (American Depositary Receipts) are listed on the New York Stock Exchange (NYSE). In late 2015, the Company was informed that it will be part, for the eighth consecutive year, of the select group of companies that make up the ISE (Corporate Sustainability Index) portfolio. Moreover, it is the only telecommunications company to participate in the Novo Mercado, the highest level of corporate governance of BM&FBOVESPA, in addition of having implemented the Audit Committee under the Company’s Bylaws, achieving further progress in its Corporate Governance.

TIM Participações is controlled by TIM Brasil Serviços e Participações S.A., a subsidiary of the Telecom Italia group. Through the sharing of experiences and the adoption of a best practices policy, the Company shares experiences with its parent and builds synergies benefiting all of its customers. Through our subsidiaries, TIM Celular S.A. and Intelig, we operate in the mobile phone market, in fixed telephony, in long-distance and data transmission markets, throughout the Brazilian territory. TIM is also a reference in the offering of ultra-broadband services through TIM Fiber, and our area of operation for TIM Fiber incompasses the metropolitan areas of Rio de Janeiro and São Paulo states.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

1. Message from Management

The year of 2015 was marked by significant challenges, both for the country, with a progressively deteriorating macroeconomic environment throughout the year and impacts to growth, FX rate and inflation, and for the sector and company, which saw the total mobile user base decline for the first time after years of continued growth, with the acceleration of the substitution of voice by data usage and messaging applications, leading to the beginning of a strong decline in the use of multiple SIM cards and the reduction of the so called “community effect” on prepaid users.

Facing this “perfect storm” scenario, we maintained our focus on the execution of our strategic plan and its mid/long-term goals, in particular with an intense infrastructure investment, but also acted rapidly to reposition our portfolio in face of the sector’s structural changes, and at the same time intensified further our efficiency actions, which helped protect our financial results and expand our operating margin even in a year of reduction in revenues and, slightly less so, in EBITDA.

The Year of Infrastructure

In spite of the short-term challenges, we maintained our vision about the strategic importance of developing a robust infrastructure for data growth, centered in particular on the 4G technology, which allows for better quality of service and more efficient network costs. And with this vision we got to the mark of R$4.7 billion invested during last year, not only achieving, but surpassing our infrastructure growth objectives during 2015, even amidst a scenario of significant FX depreciation of the local currency. These investments allowed us to reach, by year-end, the milestone of 411 cities covered with 4G, or 59% of the country’s urban population, achieving the undisputed leadership in 4G coverage in Brazil, both by number of cities served and % of population covered. In addition to this, we have added yet another 500 cities to our 3G coverage, and reached the mark of over 70.000 km of own optical fiber, which will continue to allow the fast growth of our high capacity data infrastructure – key for a successful competitive positioning now and in the future.

Agile Repositioning of Portfolio and Offers

With the rapid change in the profile of telecom services consumption by Brazilian users, TIM maintained its tradition as the most innovative operator in the country, and was the first to reposition its complete portfolio for all customer segments – Prepaid, Control and Postpaid, effectively eliminating the different rates for calls to users in our own network and to users of other operators in all of our new plans, increasing the convenience of our voice and data bundles in all segments. We thus established first mover advantage at the beginning of a new industry cycle, represented by the reduction of the multiple SIM cards per user and corresponding concentration of spending in a single preferred SIM card. This bold movement will help us protect and increase the value of our prepaid customer base, where we remain leaders, as well as keep growing our base of postpaid customers, who start to have at TIM more complete voice and data offers for fair prices, providing an incentive to usage growth with its understanding and adoption.

Although still preliminary, the first results of our new offers are very encouraging from the standpoint of attractiveness to new clients and generation of new gross additions, average ARPU increase and consistency with the planned margin profiles, and helped turn the results of Mobile Number Portability balances against all other operators to become positive starting from the launch month of the new portfolio, in all customer segments.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

Intensity of Efficiency Actions Compensating the Short-Term Challenges in Financial Results

Throughout 2015, the short-term pressures coming from the voice, SMS and interconnection revenue reduction made total service revenues to decline 5.8% YoY. Nevertheless, excluding the interconnection revenues (which continued on a regulatory reduction path with a new MTR reduction in 2015), we could maintain the so called customer generated or “outgoing” revenues stable, based on the significant growth of data revenues, which had an YoY growth of around 40%, with positive results both in terms of data ARPU and data user base. It is also worth highlighting the larger reduction in total net revenues was a result of the direct impact of our change in handset strategy, reducing their overall sales volumes (without any significant impact to operating margin) to focus on value customers.

Notwithstanding the reduction on mobile service revenues, the intensification of our efficiency actions announced by the second quarter last year allowed for a limited impact to the EBITDA generated by the company, which declined by 2.6% YoY even with a much larger revenue decline. Based on our efficiency plan, very good results were achieved in the containment of operating expenses in virtually all areas of the company, elevating our operating EBITDA margin to 31.5% in 2015, an all-time high annual result thus far and a sector benchmark in Brazil. It is important to emphasize the continued solidity of our balance sheet, which presents a Net Debt / EBITDA ratio of only 0,3x, one of the lowest in the industry, allowing for significant financial flexibility. Also worth mentioning that the 2015 reported results, when augmented by the proceeds of our tower sale process, present numbers that are significantly more positive than the organic results highlighted above.

Conclusion and Perspectives

In conclusion, despite all of the challenges faced during 2015, the company was able to demonstrate its commitment with a mid/long-term positioning and structural actions, while at the same time reacting very rapidly to the main market transition challenges and subsequent need to protect its financial results in a scenario of short-term pressures to its revenues.

For 2016, we will emphasize the focus on three main pillars, with the maintenance of infrastructure investments and 4G leadership, development and positive results of our new portfolio and offers announced late 2015 and continuation of the intensity of efficiency actions that allow us to keep expanding our operating margin. We expect those three pillars, when combined with the growing usage of data services and the evolution of our positioning in quality/offers/user experience, will allow us to finish 2016 in an upward trajectory of continuous result improvements.

Very shortly, we will announce our 2016-2018 industrial plan details and I am confident that, once again, TIM’s outstanding team of professionals will keep making a difference in face of all of the upcoming challenges.

Rodrigo Abreu

CEO

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

2. Economic and Industry Overview

2.1. Economic Environment

The macroeconomic scenario was quite difficult in 2015, in which political instability, GDP contraction, inflation pick-up, the lowering of credit notes and the cooling of the world economy worsened the situation in Brazil. The increasing interest rate policy in the United States, the slowdown of the Chinese and European economies and the decreasing prices of oil and other commodities have led the country to an estimate Gross Domestic Product (GDP) contraction of –3.7%, according to the latest 2015 Central Bank Consensus Report, and an increase in the unemployment rate to 9.0% in the year, according to the last research PNAD Contínua, released by Brazilian Institute of Geography and Estatistics (IBGE) in october.

The official inflation ended the year at 10.67%, out of the ceiling limit of the target, 6.5%, although Brazilian Central Bank (BACEN) implemented successive increases in the basic interest rate (SELIC) that, in 2015, went from 11.75% to 14.25% at the end of the year. The expectation for the end of 2016, according to the latest 2015 Central Bank Consensus Report is that the SELIC may reach up to 15.25%.

Regarding the exchange rate issue, Brazil continues to try to curb the appreciation of the US dollar, which rose 47% against Brazilian Real in 2015, even with the BACEN keeping the sale of currency in the market with swap contracts. On the other hand, despite the decrease of 14% in exports, the slowdown of the Brazilian economy contributed to a further decrese in imports, resulting on a trade balance with an accumulated surplus of US$19.7 billion.

2.2. Particularities of the sector

Mobile telephony in Brazil is characterized by being a private sector where prices and tariffs are regulated by the market. ANATEL acts as the agency that regulates all sectors of telecommunications in Brazil, with the mission to “promote the development of the country's telecommunications to give it a modern and efficient telecommunications infrastructure, able to offer society appropriate services, diversified and at fair prices, throughout the national territory.”

In the competitive environment, the Brazilian mobile telephony sector presents as one of the most competitive in the world, being one of the few to have four major competitors with a national presence and a market share from 18% to 29%. The strong competitive movement in the market implies greater pressure on margins due to commercial expenses related to advertising, commissions and benefits.

The need for intensive capital is also a major feature of the telecommunications industry. To support the increase in network traffic over the years and the advent of new technologies, high levels of investment are necessary to ensure the scale and quality of services provided.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

3. TIM Services

3.1. Our Business

A strong brand associated with innovation. TIM has a strong brand and a reputation for innovation, having pioneered several product launches in Brazil, our innovative plans and offerings have helped to position the company as a service provider able to set a new standard in the market. Among these plans, we introduced the concept of charging per call (rather than per minute), equalizing the tariffs for local and long distance calls within our network.

In 2015, with the pressure of the macroeconomic scenario, the achievement of a near saturation level for voice lines in the country and the accelerated substitution of voice by messaging and data, we confirm our prediction of the beginning of a significant consolidation in the number of multiple prepaid SIM cards, resulting in an important reduction in the so called “community effect” (club effect, with on-net calls costing a fraction of off-net calls and retaining users based on the total size of the customer base, or “community”), and a corresponding overall reduction in the number of total users due to the reduction of the prepaid base, as a result, overall market reduced to 257.8 million lines versus 280.7 million lines in 2014.

3.2. Our Strategy

With our stated strategy of focus on data, the growth of our gross data revenues continued unabated even by the macro crisis and achieved again a double digit growth, 17% year over year.

This performance was certainly helped by the maintenance of our long term focus on investing in infrastructure, which again delivered substantial results in 2015 as detailed further below and also by the strategy of moving up the value of our customer base, which presented an improvement in mix between postpaid and prepaid customers, with the former growing at double digits and reaching a mix of 21% at the end of the year compared to 17% a year prior.

We keep focusing on the strategic importance of developing a robust data infrastructure for data growth, focusing particularly on 4G technology, which provides better quality of service and increased efficiency in network costs. Our volume of investments allowed us to achieve at the end of the year, the milestone of 411 cities covered or 59% of the urban population of the country, thus reaching the absolute leadership position in 4G coverage in Brazil, either in number of cities, whether in percentage of the population covered. In addition, we have added yet nearly 300 new cities with 3G coverage, and reach the more than 70,000 kilometers of its own fiber brand, which will follow allowing the accelerated growth of our high-capacity data infrastructure - essential to the competitive position now and in the future.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

4. Human Resources

TIM has as one of its strategic pillars “People and Organization,” so that the focus on people, the development of their capabilities and skills initiatives are vectors of encouragement and renewal of the sense of pride and belonging of employees. Our goal is to stimulate creativity and encourage people to break the barriers of everyday life and go beyond their limits. All this with a focus on the client, to bring unlimited communication, access to technology and full mobility throughout the TIM customers.

The company manages its human resources by aligning the expectations of the people, the needs of the business and the market conditions. In a motivating and challenging work environment, TIM offers space and opportunities for its team to expand its horizons, develop and enhance the achievements of the company.

4.1. People

The TIM Group closed the year 2015 with 13,062 employees throughout Brazil. These workforce, with their stories and their knowledge, represent the intellectual capital of the company and act as a key element to the development of the business.

Approximately 48% of people have a college education or are attending college and 7% of the workforce has a post-graduate degree. The numbers and achievements show that employees make up a diverse and highly qualified staff to meet the challenges of the company. TIM's workforce is complemented by 278 trainees and 402 apprentices.

4.2. Development and Training

Employees have access to innovative tools and well-structured ways to evolve within the company and build a successful career. In line with the organizational values of the company, they trace the career from their own professional experiences and knowledge acquired with the company's investment. On this regard, TIM invested more than R$13 million in training and development of its employees during 2015.

To guide the careers of its employees, TIM maps and monitor individual performance to guide the activities with more assertiveness. In addition to encouraging and providing real opportunities for growth, the company recognizes the dedication and the high performance of its professionals, with reference to the Performance Management.

Throughout 2015, 1,211 employees were awarded merit actions and internal opportunities, reaching 21% of the eligible population, with an average salary increase of 20.8%

The attraction and the development of high potential professionals are priorities for TIM. Through the Programa Talentos Sem Fronteiras, TIM seeks to identify and attract the best young professionals in the job market, preparing them to put into practice new ideas and take strategic positions in the company in a short time.

In order to attract the best students of the market and train our future professionals, the Programa Estágio Sem Fronteiras brings to TIM youths with energy, determination, initiative, team sense and, especially, interest in challenges. In 2015, over 59,930 students from across the country enrolled in the program.

On the internal communication channel, the corporate identity campaign sought to align the same goal to all employees, highlighting the importance of the work of each one to the achievements of the company, focusing on the company's purpose/mission “Connect and take care of every customer, so everyone can do more” and the values of Commitment, Agility, Client Care, Innovation and Transparency.

4.3. Long Term Incentive Plan

The Long Term Incentive Plan aims at granting stock options or subscription of shares issued by TIM Participações to officers and employees of the Company and its subsidiaries, thus seeking to promote the expansion, the achievement and the success of the Company’s social objectives as well as align the interests of shareholders, directors and employees of the Company.

The plan consist on granting the right to buy company stock for a predetermined price during an specified period. The options are subject to vesting (a period of time where the options cannot be exercised) and performance conditions (that can adjust positively or negatively the option price). As long as the employees are able to add value to the stock price, they can profit with the exercise of their options.

The granting of stock options or subscription of shares has been held annually for 3 years, and the exercise of the purchase option or subscription of shares will be carried out gradually, up to 33% in the first year, up to 66% in the second year and 100% in the third year, counted from each of the three grants. The term of the options is 6 years.

As approved by the Company's General Meeting, the administration of the Plan rests with the Board of Directors, subject to the Company's Bylaws. Currently, there are two prevailing Long Term Incentive Plans in the company, referring to the 2011-2013 and 2014-2016 cycles.

The exercise of 2011-2013 Plan options is conditioned upon the achievement of specific performance targets, while the exercise of options of the 2014-2016 Plan does not have this condition. The Strike Price is calculated by applying an adjust, increasing or decreasing, over the Share Base Price as a result of share performance, considering the criteria defined in each Plan.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

4.3.1. 2011-2013 Cycle

For this Plan, the results of 3 vestings of the 2011 and 2012 grants 2011 and the 1st and 2nd vestings of the 2013 have already been determined:

| | | | |

Plan

| Granted Options

| Exercised Options

| Expired Options

| Not Exercised Options

|

| | | | |

2011 - 2013 Plan

| 8.567.765

| -3.399.832

| -3.122.045

| 2.045.888

|

1st Grant

| 2,833,595

| -1,532,132

| -1,301,463

| 0

|

2nd Grant

| 2,661,752

| -896,479

| -1,251,369

| 513,904

|

3rd Grant

| 3,072,418

| -971,221

| -569,213

| 1,531,984

|

4.3.2. 2014-2016 Cycle

| | | | |

Plan

| Granted Options

| Exercised Options

| Expired Options

| Not Exercised Options

|

| | | | |

2014 - 2016 Plan

| 5,042,915

| 0

| -382.124

| 4.660.791

|

1st Grant

| 1,687,686

| 0

| -382,124

| 1,305,562

|

2nd Grant

| 3,355,229

| 0

| 0

| 3,355,229

|

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

5. Network

The investments of the Company prioritized projects for (i) the expansion of its fiber optic network (ii) the optimization of the use of the network, with adjustments to improve the signal quality in the current coverage areas and (iii) the mapping of the main causes of interruptions and failures of the network, as well as the necessary measures to prevent these events, ensuring call and data connection quality, for greater user access capability.

As a provider of an essential service to the socioeconomic development of the country, we strongly believe that this is contributing to the country's infrastructure development, promoting universal access to telecommunications services. The Company reaffirms its investment commitment for the year 2016 and with the incessant search for more and better services, striving to meet all the needs of all its clients.

5.1. National Coverage

TIM Brasil today has a broad national reach, covering approximately 95% of the Brazilian urban population, with a presence in over 3,400 cities. TIM also has extensive data coverage throughout the country, using the most advanced 3G and 4G technologies available, respectively, for 82% and 54% of the urban population.

Of the total investments in 2015, R$2.7 billion was invested only in network and information technology, in order to expand coverage and capacity, with the growth of voice and data traffic.

TIM will continue investing to provide a high performance mobile broadband, primarily through the Mobile BroadBand program (MBB). This program enables the network to transmit data services with high quality through the capacitation of 3G with HSPA+, enabling the achievement of up to 21Mbps per carrier, in addition to enabling the Dual Carrier (DC) feature, totaling up to 42Mbps per antenna. The MBB also includes activation sites with LTE (4G), enhanced backhaul antennas through the expansion of Fiber to The Site (FTTS) network, microwave radios and use of new content management model (Cache infrastructure), reducing latency services and improving the customer experience.

The year of 2015 ends with the delivery of major infrastructure projects for the benefit of the users. Improvements in data transmission allow a differentiated navigation performance for mobile broadband users through websites linked to optical fiber and high-capacity microwaves, the upgrade of the radio access and implementation of new features in the network core.

In 2015, TIM increased by 108% the volume of eNodeB equipment installation and also increased by 32% the amount of sites connected by optical fiber and microwave, enabling an increase in data transmission capacity.

It’s important to highlight that, in the beginning of 2016, TIM achieved the leadership on 4G coverage, with 411 cities and more than 100 million inhabitants that now can count on 4th generation mobile internet. In 2016, TIM will accelerate this expansion rhythm.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

![[tsuitr4q15002.gif]](http://www.sec.gov/Archives/edgar/data/1066116/000129618216000070/tsuitr4q15002.gif)

2G Coverage (95% of urban pop.)

3G Coverage (82% of urban pop.)

4G Coverage (54% of urban pop.)

The Company maintained the internal program started in 2009 to monitor the network quality, based on sample measurements on the roads of the major metropolitan areas of the country. The program monitors the network performance of TIM and also of the other mobile operators, and is used to make fine adjustments and provide improved network quality.

5.2. Client Service and Quality

Until November/15 (last data available), TIM excelled positively in the number of customer complaints in Procons, integrated into SINDEC system (Integrated National Information System), being the operator with the lowest number of complaints in the consolidated national result with 50% fewer complaints than the second least claimed.

Regarding Anatel’s network quality requirements, TIM kept its solid performance meeting all Agency’s target at the end of 2015. From April to October/15 (last data available), the Company has met all Anatel’s targets for both Voice and Data services (3G/4G) in every single state. This achievement is a result of strong commitment with quality and our goal to accelerate infrastructure development, specially to support data expansion and deliver a better usage experience.

5.3. International Coverage (Roaming)

Abroad, TIM continues to expand the availability of international roaming services, there are already more than 474 networks available in more than 212 destinations on six continents (including Antarctica) for the use of Voice and 153 destinations with data coverage. In addition, the company is also a leader in coverage for prepaid customers making the service available to 54 destinations. In order to provide even more convenience to the user of the service, clients traveling abroad also have coverage aboard sea cruises and aircraft, including some domestic flights (partnership of TIM, OnAir and TAM).

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

6. Operational Performancee

6.1. Overview of the Brazilian Market

2015 was marked by a significant acceleration in the consolidation process of multiple SIM cards, driven by macroeconomic pressures, high penetration of mobile service and fast substitution of voice by data usage, resulting in an important reduction in the community effect and a overall reduction in the number of total users, due to the reduction of the prepaid base. All players presented negative net adds in the prepaid segment. This movement was intensified in the last quarters, as perceived in Anatel’s numbers, leading to the first year with overall customer base reduction.

6.2. TIM’s Performance

TIM’s subscriber base reached 66.2 million lines in the end of 2015, down 12.5% when compared to the same period of last year.

In 3G technology, total customer base reached 37.5 million users, flat against 2014, following an increasing penetration of 4G devices. 4G base reached 7.1 million users by the end of 2015, comparing with 2.5 million users by the end of 2014, and a support evidence that the Company’s approach on 4G is paying off.

Overall smartphone penetration reached 68% of the customer base, an outstanding growth compared to 49% in the end of 2014, proving the success of the strategy of equip its customers in order to stimulate data services penetration among its users. Unique data users reached 31.8 million lines or 48% of total base by the end of 2015.

TIM’s net additions totaled -9.5 million lines in 2015 (vs. +2.3 million in 2014), as a result of lower gross additions of 34 million lines and down 12.5% vs. 2014 and much higher disconnections of 43.7 million lines in the period and up 18.6% YoY. Consequently churn rate in 2015 came at 59.1% and up from 49.6% in the same period of last year.

Postpaid customer base reached 13.6 million users at the end of the year, +8.6% yearly growth. During the year, TIM added 1.1 million users in the postpaid segment (vs. 223 thousand net adds in the same period of last year).

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

7. Financial Performance

7.1. Operating Revenues

The 2015 year brought notable impacts on all business fronts after major changes in usage patterns (voice to data shift), tough macroeconomic conditions and still the impact of mobile-termination rate cut.

Gross revenues breakdown and other highlights are presented as follows:

Usage and monthly fee gross revenues ended 2015 down 11% YoY, impacted by a continuing migration from voice towards data usage. Minutes of Use (MOU) came in at 119 minutes in 2015 (-12% YoY). However, on a sequential basis in 4Q15, MOU showed a slight rebound to 120 versus 119 in 3Q15, thanks to the new offer launch and its off-net allowance.

Value Added Services (VAS) gross revenues rose 17% YoY in 2015 as innovative revenues increased its relevance in the business. Although short-message business reduced again and continues to impact total Value-Added-Service line, Innovative revenues rose 35% YoY. All together, VAS revenues came to 38% of mobile net service revenues and represented a positive impact for the company's margin.

Long distance gross revenues was strongly exposed to the switch from voice to data usage in 2015. Such process is speeding up the commoditization of LD and impacted its performance during the year. The new offers lauched in november, which included off-net calls within Brazil at the same price of on-net calls, may reduce the pace of this process.

Interconnection gross revenues dropped by 40% YoY in 2015 due to a combination of the sharp cut on MTR price and the change in the dynamic of overall voice traffic. SMS messaging reduction was also an impact in this line. In all, interconnection revenues declined by over R$1Bln in 2015, being one of the main causes for mobile service revenues to reduce in the period.

Other Mobile Revenues increased by 12.5% YoY in 2015, mainly driven by the growth of revenues related to infrastructure sharing, and partially offset by the decline in tower leasing revenues as a consequence of the sale-leaseback transaction.

Fixed business gross revenues had a solid rebound in 2015 and rose more than 11% YoY after consecutive losses in past years. The segment had its better quarter of the year in 4Q15, proving how attractive the ultra-broadband business is and the rewards of a successful restructuring phase of TIM’s corporate portfolio.

A tougher macroeconomic environment affected the whole retail segment in Brazil and together with the FX appreciation were the major barriers to handset sales in 2015. Product revenues were down by 41% in the period. In 4Q15 we saw an even further deterioration as the company is also making adjustments to its handset strategy as the smartphone penetration reaches ~70%.

In all, product unit sale has reduced by 61% YoY in 2015 to 4.7 million units while average price has increased by 50% YoY in the same period.

Total Net Revenues were down by 12.1% in 2015 while Net Services Revenues were down by 5.8%. In Net Revenues is important to highlight that "Business Generated" stood flat in 2015, even with the faster transition from voice to data and the macroeconomic headwinds. This indicator, that best represents the fundamentals and the core business of TIM, was mostly supported by data revenues growth.

Innovative Mobile Net Revenues (VAS revenues excluding SMS revenues) rose 35% in 2015 driven by the company strategy to switch clients to 4G technology and the increase of smartphone penetration that stimulated data usage. BOU (bytes of use) rose ~30% in comparison to 2014 while smartphone penetration reached 66.7% of the customer base versus 49.5% in at the same period of 2014.

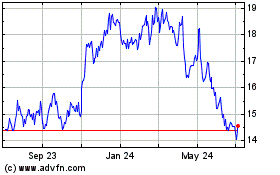

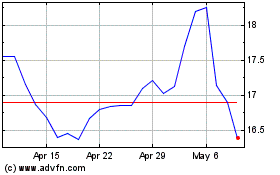

ARPU (average revenue per user) reached R$17 in 2015, down 5.6% YoY, largely impacted by MTR cut and the reduction in voice usage. As for ARPU from VAS, it posted a significant increase of ~18% YoY in 2015. It was responsible for sustaining innovative revenues growth during the year.

As a consequence of consecutive MTR cuts combined with migration from voice to data, the MTR incidence on net service revenues have been decreasing significantly every quarter, reaching its lowest level in at the end of 2015 at 8.0%.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

7.2. Operating Costs and Expenses

The breakdown of costs and expenses in 2015 is as follows:

Personnel expenses rose 8.4% YoY in 2015 as result of the stabilization of our headcount, which has been increasing over the last years due to network expansion and insourcing program together with owned stores increase. In 2015, our workforce increased by 1.6% YoY reaching 13,062 people (+5.7% YoY vs. 2014).

Selling & Marketing expenses decreased by 6.1% YoY in 2015 due to (i) significant decrease in advertising, despite the lauch of a new portifolio in November; (ii) robust reduction in commissioning expenses and; (iii) important decrease in FISTEL taxes (-16%YoY) as a result of strong disconnection in low ARPU prepaid users.

Network & Interconnection costs were down 11.4% YoY in 2015, heavely impacted by the reductions in (i) MTR prices, (ii) voice/SMS off-net traffic and (ii) leased lines costs but partially compensated by higher electricity costs (+44% YoY) and sites land rental expenses as a consequence of network coverage acceleration.

General & Administrative expenses (G&A) anual decrease of 8.8% was mainly driven by the Efficiency Plan started in the 2Q15.

Cost of Goods Sold sharply decreased by 44.4% versus the same period last year, due to a reduction of 61% in the number of handsets sold. A tougher macroeconomic environment which affected the whole retail segment and a strong FX appreciation were the main drivers for this performance. In 4Q15, this trend accelerated even further causing Cost of Goods Sold to decrease by 85.2% YoY.

Bad Debt expenses decreased by 7.3% YoY in 2015 due to a better performance in the fixed segment, following the business turnaround. As a percentage of gross revenues, Bad Debt reached 0.89% in 2015, virtually stable when compared to 2014 (0.86%) despite a even more challenging macroeconomic environment.

Other operational expenses remained stable in 2015 when compared to last year, while in 4Q15 it was up by 4.0% YoY mainly due to higher costs on contingencies.

Subscriber Acquisition Costs (where SAC = subsidy + commissioning + total advertising expenses) came at R$30.5 per gross add in 2015, an increase of 11.3% YoY due to a greater focus on high value customers acquisition. The SAC/ARPU ratio (indicating the payback per customer) reached 1.9x in 2015 and flat when compared to 2014, despite the 8.6% YoY increase in postpaid customers.

7.3. From EBITDA to Net Income

EBITDA

Recurring EBITDA (ex-towers sale) dropped 2.6% in 2015, mainly due to: (i) a tougher macroeconomic environment, (ii) MTR cut impact and (iii) voice services migration to data.

Following a similar trajectory as revenues exposure, MTR incidence on recurring EBITDA has been falling significantly during the year, reaching its lowest levels at ~10% in 4Q15.

Reported EBITDA yearly increase is mainly due to the three tranches of towers sale occurred in 2nd, 3rd and 4th quarters with a total net effect of R$1,211 million (please refer to dedicated session below for further details). In 4Q15, the 3rd tranch did not offset the declining trend mentioned above.

D&A / EBIT

In 2015, Depreciation and Amortization increased by 10% YoY, due to higher network equipment acquisition following our Capex deployment intensification. TIM’s 4G coverage reached the leadership position in terms of urban population (59% vs. 36% in 2014) and in terms of cities covered (411 vs. 45 in 2014). Also, total kilometers of fiber has surpassed the 70,000 mark.

As a consequence, EBIT declined in 2015, following the increase in depreciation and amortization explained above.

Net Financial Result

In 2015, Net financial result improved versus 2014, mainly due to a better financial income performance, with higher investment yield that more than offset the financial cost increase. Lease back from towers sale also impacted the financial expenses in the period.

Income and Social Contribution Taxes

In 2015, Recurring Income and Social Contribution decreased when compared to the same period of last year, mainly due to a reduction in the tax base. Effective tax rate reached 30.3% in 2015, a small increase compared to 29.5% in 2014.

Net Income

In 2015, Recurring Net Income decreased by 20% compared to the same period of last year. EPS (Earnings per Share) reached R$0.51 in 2015 (vs. R$0.64 in 2014), driven by EBIT performance. Reported Net Income in 2015 increase was largerly impacted by the towers sale, thus Reported EPS (Earnings per Share) reached R$0.86 in 2015 compared to R$0.64 in 2014.

7.4. CAPEX

In 2015, Recurring Capex amounted to R$4,658 million, an increase of 18.6% when compared to Recurring Capex of 2014, following our Industrial Plan’s capex increase. This capex intensity, which stood near 27% of total net revenues, has been crucial for the Company to improve infrastructure and quality of services. In 2015, it is already possible to see encouraging results from the Capex cycle, with for example our leadership position in 4G coverage, fiber roll-out, spectrum refarming, etc.

It’s worth highlighting that more than 92% of the total Capex was dedicated to infrastructure, mainly related to 3G and 4G technologies.

7.5. Debt, cash and free cash flow

Gross Debt reached R$8,432 million by the end of 2015, including the leasing recognition in a total value of R$1,245 million following the leaseback of the towers sold (3 tranches) and it compares to R$6,507 million in 2014. Excluding the towers sales effect, gross debt would have increased by almost 10%.

Company's debt is concentrated in long-term contracts (78% of the total) composed mainly by financing from BNDES (Brazilian Economic and Social Development Bank) and EIB (European Investment Bank), as well as borrowings from other top local and international financial institutions.

Approximately 35% of total debt is denominated in foreign currency (USD), and it is 100% hedged in local currency. In 2015, average cost of debt was 11.73% compared to 9.70% in 2014. Nevertheless, the increase in cost of debt was more than offset by a higher cash yield.

Cash, Cash equivalents and securities totaled R$6,700 million by the end of 2015, an increase vs. R$5,233 in 2014. Average cash yield reached 13.50% in 2015 compared to 10,88% in 2014.

The proceeds from the towers sale increased cash position in R$2,498 million and other moviments that affect cash and cash equivalents in 2015 are demonstrated as follow:

The Company has an investment fund in foreign exchange of R$599.4 million in order to follow the variations of the US Dollar, basically formed by highly liquid public securities. The investment is intended to reduce foreign exchange risk on payments made to suppliers in foreign currency.

Net Debt/EBITDA ratio reached 0.3x in 2015 compared to 0.2x in 2014. Due to the above mentioned payments, net debt increased to R$1,733 million by the end of 2015, up from R$1,274 million in 2014.

Recurring Operating Free Cash Flow came at R$141 million in 2015, (vs. -R$45 million in 2014), despite being adversely impacted by an increase in capex of about +R$730 million from 2014. Fourth quarter contributed to reverse OFCF into positive, Recurring Operating Free Cash Flow totaled R$920 million, vs. -R$320 million in 4Q14.

Recurring Net Cash Flow in 2015 totaled -R$1,235 million compared to -R$1,695 million in the same period of last year.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

7.6. Towers Sales Impacts

In 4Q15, TIM concluded the third closing under the Tower Sale agreement signed in November 2014 with American Tower do Brasil (ATC), that comprised overall sale of 6,481 towers for ~R$3 billion cash.

·

First closing: On April 29, 2015, TIM transferred 4,176 towers to ATC and received ~R$1.9 billion.

·

Second closing: On September 30, 2015 TIM transferred 1,125 towers to ATC and received ~R$517 million.

·

Third closing: On December 16, 2015 TIM transferred 182 towers to ATC and received ~R$84 million.

The Master lease agreement (MLA) defines the leaseback of the transferred towers for a 20 years period. According to IAS17, this transaction should be registered as (1) sale and (2) leaseback and following its requirements, the leaseback registered as financial leasing.

The Financial Statements impacts conciliation and the related notes for further details concerning all three closings can be found on Note nº 1.b of Financial Statements.

TIM PARTICIPAÇÕES S.A. and

TIM PARTICIPAÇÕES S.A. AND SUBSIDIARIES

MANAGEMENT REPORT

(A free translation of the original in Portuguese)

8. Corporate Social Responsibility

Our Social and Environmental Responsibility policies guide the company's actions and initiatives and are based on the principles of the UN Global Pact, a voluntary agreement of which TIM is a signatory since 2008. Through this agreement, companies worldwide are committed to ensure compliance with the ten principles relating to human rights, working conditions, environment and anti-corruption.