UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

Date of Report (Date of Earliest Event Reported): | | February 18, 2015 |

Trinity Industries, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 1-6903 | | 75-0225040 |

(State or other jurisdiction of incorporation | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | |

2525 N. Stemmons Freeway, Dallas, Texas | | | | 75207-2401 |

(Address of principal executive offices) | | | | (Zip Code) |

|

| | |

| | |

Registrant's telephone number, including area code: | | 214-631-4420 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

The Registrant hereby furnishes the information set forth in its News Release, dated February 18, 2015, announcing operating results for the three and twelve month periods ended December 31, 2014, a copy of which is furnished as exhibit 99.1 and incorporated herein by reference. On February 19, 2015, the Registrant held a conference call and web cast with respect to its financial results for the three and twelve month periods ended December 31, 2014. The conference call scripts of Gail M. Peck, Vice President, Finance and Treasurer; Timothy R. Wallace, Chairman, Chief Executive Officer, and President; S. Theis Rice, Senior Vice President and Chief Legal Officer: William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups; D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and James E. Perry, Senior Vice President and Chief Financial Officer are furnished as exhibits 99.2, 99.3, 99.4, 99.5, 99.6, and 99.7, respectively, and incorporated herein by reference.

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 7.01 Regulation FD Disclosure.

See "Item 2.02 — Results of Operations and Financial Condition."

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(a) - (c) Not applicable.

(d) Exhibits:

Exhibit No. / Description

99.1 News Release dated February 18, 2015 with respect to the operating results for the three and twelve month periods ended December 31, 2014.

99.2 Conference call script of February 19, 2015 of Gail M. Peck, Vice President, Finance and Treasurer.

99.3 Conference call script of February 19, 2015 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President.

99.4 Conference call script of February 19, 2015 of S. Theis Rice, Senior Vice President and Chief Legal Officer.

99.5 Conference call script of February 19, 2015 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups.

99.6 Conference call script of February 19, 2015 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups.

99.7 Conference call script of February 19, 2015 of James E. Perry, Senior Vice President and Chief Financial Officer.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| Trinity Industries, Inc. |

| | |

February 19, 2015 | By: | /s/ James E. Perry |

| | Name: James E. Perry |

| | Title: Senior Vice President and Chief Financial Officer |

|

| | |

Exhibit Index |

Exhibit No. | | Description |

| | |

99.1 | | News Release dated February 18, 2015 with respect to the operating results for the three and twelve month periods ended December 31, 2014 |

99.2 | | Conference call script of February 19, 2015 of Gail M. Peck, Vice President, Finance and Treasurer |

99.3 | | Conference call script of February 19, 2015 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President. |

99.4 | | Conference call script of February 19, 2015 of S. Theis Rice, Senior Vice President and Chief Legal Officer. |

99.5 | | Conference call script of February 19, 2015 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups. |

99.6 | | Conference call script of February 19, 2015 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups. |

99.7 | | Conference call script of February 19, 2015 of James E. Perry, Senior Vice President and Chief Financial Officer. |

Exhibit 99.1

NEWS RELEASE |

| |

Investor Contact: | Media Contact: |

Jessica Greiner | Jack Todd |

Director of Investor Relations | Trinity Industries, Inc. |

Trinity Industries, Inc. | 214/589-8909 |

214/631-4420 | |

FOR IMMEDIATE RELEASE

Trinity Industries, Inc. Announces Strong Fourth Quarter and Record Full Year 2014 Results

DALLAS, Texas - February 18, 2015 - Trinity Industries, Inc. (NYSE:TRN) today announced earnings results for the fourth quarter and full year ended December 31, 2014, including the following significant highlights:

| |

• | Strong fourth quarter and record full year earnings per common diluted share of $0.86 and $4.19, respectively |

| |

• | Year-over-year fourth quarter and full year revenue growth of 32% and 41%, respectively, and earnings per common diluted share growth of 19% and 76%, respectively |

| |

• | All business segments report year-over-year revenue and operating profit growth during 2014 |

| |

• | Rail Group receives orders for 17,770 new railcars during the fourth quarter with a record value of over $2.1 billion resulting in an all-time high backlog of 61,035 units with a record value of $7.2 billion |

| |

• | Company issues earnings guidance for full year 2015 of between $4.00 and $4.40 per common diluted share |

Consolidated Results

Trinity Industries, Inc. reported net income attributable to Trinity stockholders of $138.2 million, or $0.86 per common diluted share, for the fourth quarter ended December 31, 2014. Net income for the same quarter of 2013 was $112.8 million, or $0.72 per common diluted share. Revenues for the fourth quarter of 2014 increased 32% to a record $1.7 billion compared to revenues of $1.3 billion for the same quarter of 2013.

For the year ended December 31, 2014, the Company reported record net income attributable to Trinity stockholders of $678.2 million, or $4.19 per common diluted share. In 2013, the Company reported net income of $375.5 million, or $2.38 per common diluted share. Revenues for the year ended December 31, 2014 were $6.2 billion, a 41% increase compared to revenues of $4.4 billion in 2013.

“During 2014, we utilized the strengths of our integrated business model to achieve record financial results, with all of our business segments reporting higher revenue and profit," said Timothy R. Wallace, Trinity’s Chairman, CEO and President. "Our Rail Group received a record number of orders in 2014, and its $7.2 billion order backlog provides significant production visibility. Our Leasing Group achieved record financial results in 2014 and generated strong earnings and cash flow from strategic railcar leasing transactions completed during the year. We invested over $700 million in acquisitions within our Energy Equipment Group, which added complementary product lines that provide long-term growth opportunities."

Business Group Results

In the fourth quarter of 2014, the Rail Group reported record revenues and operating profit of approximately $1.1 billion and $194.2 million, respectively, resulting in increases compared to the fourth quarter of 2013 of 25% and 23%, respectively. The increase in revenues and profit was due to higher deliveries, improved pricing, and a more favorable product mix. The Rail Group shipped 8,460 railcars and received orders for 17,770 railcars during the fourth quarter. The Rail Group backlog increased to a record $7.2 billion at December 31, 2014, representing a record 61,035 railcars, compared to a backlog of $6.1 billion as of September 30, 2014, representing 51,725 railcars.

During the fourth quarter of 2014, the Railcar Leasing and Management Services Group reported revenues of $238.0 million compared to revenues of $190.8 million during the fourth quarter of 2013. Operating profit for this Group was $96.6 million in the fourth quarter of 2014 compared to operating profit of $85.5 million in the fourth quarter of 2013. The increase in revenues and operating profit was due to higher rental rates as well as increased railcar sales from the lease fleet. Supplemental information for the Railcar Leasing and Management Services Group is provided in the following tables.

During the fourth quarter, the Company sold $114.8 million of railcars to Element Financial Corporation ("Element") under the strategic alliance announced in 2013 with $67.8 million reported as sales of railcars owned one year or less at the time of sale and $47.0 million reported in the Rail Group as external revenue. With these railcar sales, the Leasing Group has completed the sale of the first $1 billion of leased railcars to Element and anticipates fulfilling the $2 billion alliance in 2015.

The Inland Barge Group reported revenues for the fourth quarter of 2014 of $167.8 million compared to revenues of $142.9 million in the fourth quarter of 2013. Operating profit for this Group was $25.8 million in the fourth quarter of 2014 compared to $27.0 million in the fourth quarter of 2013. The increase in revenues compared to the same quarter last year was due to higher delivery volumes and product mix changes. The Inland Barge Group received orders of $130.3 million during the quarter, and as of December 31, 2014 had a backlog of $437.9 million compared to a backlog of $475.4 million as of September 30, 2014.

The Energy Equipment Group reported record revenues of $284.4 million in the fourth quarter of 2014 compared to revenues of $188.5 million in the same quarter of 2013. Revenues related to acquisitions completed in 2014 totaled $89.0 million for the fourth quarter. Operating profit for the fourth quarter of 2014 increased to $26.9 million compared to $17.2 million in the same quarter last year. The backlog for structural wind towers as of December 31, 2014 was $473.5 million compared to a backlog of $528.6 million as of September 30, 2014.

Revenues in the Construction Products Group were $116.5 million in the fourth quarter of 2014 compared to revenues of $117.5 million in the fourth quarter of 2013. The Group recorded an operating loss of $0.3 million in the fourth quarter of 2014 compared to an operating profit of $7.3 million in the fourth quarter of 2013. Revenues and operating profit decreased for the fourth quarter of 2014 compared to the same period in 2013 primarily due to lower volumes in our Highway Products business.

Cash and Liquidity

At December 31, 2014, the Company had cash, cash equivalents, and short-term marketable securities of $962.9 million. When combined with capacity under committed credit facilities, the Company had approximately $1.6 billion of available liquidity at the end of the fourth quarter.

Share Repurchase

The Company did not repurchase any shares of common stock under its share repurchase authorization during the quarter. During 2014, the Company purchased approximately $31.5 million of shares of common stock, leaving $218.5 million remaining under its current authorization through December 31, 2015.

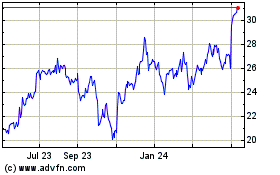

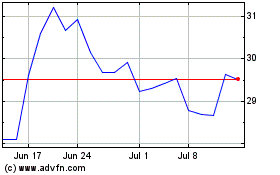

Convertible Notes

The Company’s $450 million convertible notes have a dilutive impact on the calculation of earnings per share when the average stock price for the quarter exceeds the conversion price. The average stock price for the fourth quarter was $33.50 per share compared to the conversion price in effect during the quarter of $25.22 per share, the result of which added 4.4 million additional shares to the Company’s diluted share count, reducing earnings per share by $0.03 per share. For the full year, approximately 5.6 million shares were added to the Company’s dilutive share count, reducing earnings per share by $0.16 per share. The Company’s 2015 earnings guidance, as discussed in the Earnings Outlook, assumes an annual weighted average diluted share count of 156.5 million shares, which includes 4.5 million shares from the convertible notes. The dilutive impact of the convertible notes assumes an average annual stock price of $33.75 per share and reduces full year 2015 earnings per share by approximately $0.12 per share.

Highway Products Litigation

On October 20, 2014, a jury in a federal district court returned a verdict against the Company in a False Claims Act (the “Act”) case and awarded $175 million in damages. The jury's damages award, to the extent it survives the Company's challenge in post-trial motions or on appeal, is automatically trebled under the Act to $525 million. Additionally, the district court is required to impose civil penalties for each violation of the Act (which penalties are not automatically trebled). The district court has not yet entered a final judgment or determined a civil penalty amount. The Company maintains that the allegations are without merit and intends to vigorously defend its positions in post-trial motions and on appeal. Pending entry of a final judgment and completion of the Company’s post-trial and appellate activities in this matter, the Company currently does not believe that a loss is probable, therefore no accrual has been included in the consolidated financial statements.

Earnings Outlook

For the full year of 2015, the Company anticipates earnings per common diluted share of between $4.00 and $4.40 compared to full year earnings per common diluted share of $4.19 in 2014. The Company expects the level of quarterly earnings per share in 2015 to be relatively consistent throughout the year. As a reminder, first quarter 2014 results included $0.72 per common diluted share of earnings related to sales of new and existing leased railcars to Element. As a result, we do expect first quarter 2015 earnings per common diluted share to be below last year's level.

Actual results in 2015 may differ from present expectations and could be impacted by a number of factors including, among others, fluctuations in prices of commodities that our customers produce and transport; potential costs or timing of pending tank car regulatory changes; expenses related to current and potential litigation in our Highway Products business; various labor situations in the U.S., including those causing the temporary shut-down of oil refineries as well as interruptions of imports and exports on the West Coast; the operating leverage and efficiencies that can be achieved by the Company's manufacturing businesses; the level of sales and profitability of railcars; and the impact of weather conditions on our operations and delivery schedules.

Conference Call

Trinity will hold a conference call at 11:00 a.m. Eastern on February 19, 2015 to discuss its fourth quarter and full year results. To listen to the call, please visit the Investor Relations section of the Trinity Industries website, www.trin.net. An audio replay may be accessed through the Company’s website or by dialing (402) 220-0116 until 11:59 p.m. Eastern on February 26, 2015.

Trinity Industries, Inc., headquartered in Dallas, Texas, is a diversified industrial company that owns market-leading businesses which provide products and services to the energy, transportation, chemical, and construction sectors. Trinity reports its financial results in five principal business segments: the Rail Group, the Railcar Leasing and Management Services Group, the Inland Barge Group, the Construction Products Group, and the Energy Equipment Group. For more information, visit: www.trin.net.

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements. Trinity uses the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance” and similar expressions to identify these forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in the Company's Annual Report on Form 10-K for the most recent fiscal year.

- TABLES TO FOLLOW -

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended

December 31, |

| 2014 | | 2013 |

Revenues | $ | 1,661.4 |

| | $ | 1,256.0 |

|

Operating costs: | | | |

Cost of revenues | 1,275.3 |

| | 962.7 |

|

Selling, engineering, and administrative expenses | 110.6 |

| | 80.2 |

|

(Gain)/loss on disposition of property, plant, and equipment: | | | |

Net gains on lease fleet sales | (2.1 | ) | | (10.8 | ) |

Other | 1.1 |

| | (0.5 | ) |

| 1,384.9 |

| | 1,031.6 |

|

Operating profit | 276.5 |

| | 224.4 |

|

Interest expense, net | 51.6 |

| | 45.1 |

|

Other (income) expense | (1.8 | ) | | (0.5 | ) |

Income before income taxes | 226.7 |

| | 179.8 |

|

Provision for income taxes | 80.3 |

| | 60.9 |

|

Net income from continuing operations | 146.4 |

| | 118.9 |

|

Net gain on sale of discontinued operations | — |

| | — |

|

Net income (loss) from discontinued operations | (0.1 | ) | | 0.4 |

|

Net income | 146.3 |

| | 119.3 |

|

Net income (loss) attributable to noncontrolling interest | 8.1 |

| | 6.5 |

|

Net income attributable to Trinity Industries, Inc. | $ | 138.2 |

| | $ | 112.8 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | | | |

Continuing operations | $ | 0.89 |

| | $ | 0.72 |

|

Discontinued operations | — |

| | — |

|

| $ | 0.89 |

| | $ | 0.72 |

|

Diluted | | | |

Continuing operations | $ | 0.86 |

| | $ | 0.72 |

|

Discontinued operations | — |

| | — |

|

| $ | 0.86 |

| | $ | 0.72 |

|

Weighted average number of shares outstanding: | | | |

Basic | 151.2 |

| | 151.8 |

|

Diluted | 155.7 |

| | 151.9 |

|

All share and per share information has been retroactively adjusted to reflect the 2-for-1 stock split completed during the quarter ended June 30, 2014. Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

| 2014 | | 2013 |

Revenues | $ | 6,170.0 |

| | $ | 4,365.3 |

|

Operating costs: | | | |

Cost of revenues | 4,619.8 |

| | 3,322.3 |

|

Selling, engineering, and administrative expenses | 403.6 |

| | 291.3 |

|

(Gain)/loss on disposition of property, plant, and equipment: | | | |

Net gains on lease fleet sales | (92.3 | ) | | (20.4 | ) |

Other | (12.1 | ) | | (0.8 | ) |

| 4,919.0 |

| | 3,592.4 |

|

Operating profit | 1,251.0 |

| | 772.9 |

|

Interest expense, net | 191.5 |

| | 185.2 |

|

Other (income) expense | (4.6 | ) | | (2.8 | ) |

Income before income taxes | 1,064.1 |

| | 590.5 |

|

Provision for income taxes | 354.8 |

| | 204.4 |

|

Net income from continuing operations | 709.3 |

| | 386.1 |

|

Net gain on sale of discontinued operations | — |

| | 7.1 |

|

Net income (loss) from discontinued operations | — |

| | (0.8 | ) |

Net income | 709.3 |

| | 392.4 |

|

Net income (loss) attributable to noncontrolling interest | 31.1 |

| | 16.9 |

|

Net income attributable to Trinity Industries, Inc. | $ | 678.2 |

| | $ | 375.5 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | | | |

Continuing operations | $ | 4.35 |

| | $ | 2.34 |

|

Discontinued operations | — |

| | 0.04 |

|

| $ | 4.35 |

| | $ | 2.38 |

|

Diluted | | | |

Continuing operations | $ | 4.19 |

| | $ | 2.34 |

|

Discontinued operations | — |

| | 0.04 |

|

| $ | 4.19 |

| | $ | 2.38 |

|

Weighted average number of shares outstanding: | | | |

Basic | 151.0 |

| | 152.8 |

|

Diluted | 156.7 |

| | 152.9 |

|

All share and per share information has been retroactively adjusted to reflect the 2-for-1 stock split completed during the quarter ended June 30, 2014. Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Three Months Ended

December 31, |

Revenues: | 2014 | | 2013 |

Rail Group | $ | 1,067.4 |

| | $ | 855.5 |

|

Construction Products Group | 116.5 |

| | 117.5 |

|

Inland Barge Group | 167.8 |

| | 142.9 |

|

Energy Equipment Group | 284.4 |

| | 188.5 |

|

Railcar Leasing and Management Services Group | 238.0 |

| | 190.8 |

|

All Other | 30.2 |

| | 23.6 |

|

Segment Totals before Eliminations | 1,904.3 |

| | 1,518.8 |

|

Eliminations - lease subsidiary | (145.9 | ) | | (196.0 | ) |

Eliminations - other | (97.0 | ) | | (66.8 | ) |

Consolidated Total | $ | 1,661.4 |

| | $ | 1,256.0 |

|

| | | |

| Three Months Ended

December 31, |

Operating profit (loss): | 2014 | | 2013 |

Rail Group | $ | 194.2 |

| | $ | 157.4 |

|

Construction Products Group | (0.3 | ) | | 7.3 |

|

Inland Barge Group | 25.8 |

| | 27.0 |

|

Energy Equipment Group | 26.9 |

| | 17.2 |

|

Railcar Leasing and Management Services Group | 96.6 |

| | 85.5 |

|

All Other | (14.3 | ) | | (5.7 | ) |

Segment Totals before Eliminations and Corporate Expenses | 328.9 |

| | 288.7 |

|

Corporate | (29.5 | ) | | (23.5 | ) |

Eliminations - lease subsidiary | (22.6 | ) | | (40.0 | ) |

Eliminations - other | (0.3 | ) | | (0.8 | ) |

Consolidated Total | $ | 276.5 |

| | $ | 224.4 |

|

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

Revenues: | 2014 | | 2013 |

Rail Group | $ | 3,816.8 |

| | $ | 2,867.5 |

|

Construction Products Group | 551.7 |

| | 525.0 |

|

Inland Barge Group | 638.5 |

| | 576.7 |

|

Energy Equipment Group | 992.3 |

| | 665.4 |

|

Railcar Leasing and Management Services Group | 1,118.3 |

| | 645.4 |

|

All Other | 110.4 |

| | 86.6 |

|

Segment Totals before Eliminations | 7,228.0 |

| | 5,366.6 |

|

Eliminations - lease subsidiary | (710.1 | ) | | (756.5 | ) |

Eliminations - other | (347.9 | ) | | (244.8 | ) |

Consolidated Total | $ | 6,170.0 |

| | $ | 4,365.3 |

|

| | | |

| Year Ended

December 31, |

Operating profit (loss): | 2014 | | 2013 |

Rail Group | $ | 724.1 |

| | $ | 489.7 |

|

Construction Products Group | 65.4 |

| | 52.6 |

|

Inland Barge Group | 114.4 |

| | 96.0 |

|

Energy Equipment Group | 108.1 |

| | 61.4 |

|

Railcar Leasing and Management Services Group | 516.3 |

| | 296.8 |

|

All Other | (25.6 | ) | | (13.7 | ) |

Segment Totals before Eliminations and Corporate Expenses | 1,502.7 |

| | 982.8 |

|

Corporate | (119.0 | ) | | (73.4 | ) |

Eliminations - lease subsidiary | (133.1 | ) | | (135.4 | ) |

Eliminations - other | 0.4 |

| | (1.1 | ) |

Consolidated Total | $ | 1,251.0 |

| | $ | 772.9 |

|

Trinity Industries, Inc.

Leasing Group

Condensed Results of Operations

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2014 | | 2013 | | Percent | | 2014 | | 2013 | | Percent |

| ($ in millions) | | Change | | ($ in millions) | | Change |

| | | | | | | | | | | |

Revenues: | | | | | | | | | | | |

Leasing and management | $ | 162.8 |

| | $ | 151.3 |

| | 7.6 | % | | $ | 632.0 |

| | $ | 586.9 |

| | 7.7 | % |

Sales of railcars owned one year or less at the time of sale | 75.2 |

| | 39.5 |

| | * | | 486.3 |

| | 58.5 |

| | * |

Total revenues | $ | 238.0 |

| | $ | 190.8 |

| | 24.7 |

| | $ | 1,118.3 |

| | $ | 645.4 |

| | 73.3 |

|

| | | | | | | | | | | |

Operating profit: | | | | | | | | | | | |

Leasing and management | $ | 74.1 |

| | $ | 69.1 |

| | 7.2 |

| | $ | 287.9 |

| | $ | 267.3 |

| | 7.7 |

|

Railcar sales: | | | | | | | | | | | |

Railcars owned one year or less at the time of sale | 20.4 |

| | 5.6 |

| | | | 136.1 |

| | 9.1 |

| | |

Railcars owned more than one year at the time of sale | 2.1 |

| | 10.8 |

| | | | 92.3 |

| | 20.4 |

| | |

Total operating profit | $ | 96.6 |

| | $ | 85.5 |

| | 13.0 |

| | $ | 516.3 |

| | $ | 296.8 |

| | 74.0 |

|

| | | | | | | | | | | |

Operating profit margin: | | | | | | | | | | | |

Leasing and management | 45.5 | % | | 45.7 | % | | | | 45.6 | % | | 45.5 | % | | |

Railcar sales | * | | * | | | | * | | * | | |

Total operating profit margin | 40.6 | % | | 44.8 | % | | | | 46.2 | % | | 46.0 | % | | |

| | | | | | | | | | | |

Selected expense information(1): | | | | | | | | | | | |

Depreciation | $ | 32.9 |

| | $ | 33.2 |

| | (0.9 | ) | | $ | 130.0 |

| | $ | 129.0 |

| | 0.8 |

|

Maintenance | $ | 20.1 |

| | $ | 17.7 |

| | 13.6 |

| | $ | 78.9 |

| | $ | 71.5 |

| | 10.3 |

|

Rent | $ | 13.2 |

| | $ | 13.3 |

| | (0.8 | ) | | $ | 52.9 |

| | $ | 53.3 |

| | (0.8 | ) |

Interest: | | | | | | | | | | | |

External | $ | 38.8 |

| | $ | 37.3 |

| | | | $ | 153.3 |

| | $ | 153.5 |

| | |

Intercompany | — |

| | — |

| | | | — |

| | 3.8 |

| | |

Total interest expense | $ | 38.8 |

| | $ | 37.3 |

| | 4.0 |

| | $ | 153.3 |

| | $ | 157.3 |

| | (2.5 | ) |

|

| | | | | |

| December 31,

2014 | | December 31,

2013 |

Leasing portfolio information: | | | |

Portfolio size (number of railcars) | 75,930 |

| | 75,685 |

Portfolio utilization | 99.5 | % | | 99.5 | % |

* Not meaningful

(1) Depreciation, maintenance, and rent expense are components of operating profit. Amortization of deferred profit on railcars sold from the Rail Group to the Leasing Group is included in the operating profits of the Leasing Group resulting in the recognition of depreciation expense based on the Company's original manufacturing cost of the railcars. Interest expense is not a component of operating profit and includes the effect of hedges. Intercompany interest expense is eliminated in consolidation and arises from Trinity’s previous ownership of a portion of TRIP Holdings’ Senior Secured Notes, which notes were retired in full in May 2013.

Trinity Industries, Inc.

Condensed Consolidated Balance Sheets

(in millions)

(unaudited) |

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

Cash and cash equivalents | $ | 887.9 |

| | $ | 428.5 |

|

Short-term marketable securities | 75.0 |

| | 149.7 |

|

Receivables, net of allowance | 405.3 |

| | 365.0 |

|

Income tax receivable | 58.6 |

| | 7.7 |

|

Inventories | 1,068.4 |

| | 814.7 |

|

Restricted cash | 234.7 |

| | 260.7 |

|

Net property, plant, and equipment | 4,902.9 |

| | 4,770.6 |

|

Goodwill | 773.2 |

| | 278.2 |

|

Other assets | 327.8 |

| | 238.3 |

|

| $ | 8,733.8 |

| | $ | 7,313.4 |

|

| | | |

Accounts payable | $ | 295.4 |

| | $ | 216.3 |

|

Accrued liabilities | 709.6 |

| | 567.4 |

|

Debt, net of unamortized discount of $60.0 and $74.1 | 3,553.0 |

| | 2,989.8 |

|

Deferred income | 36.4 |

| | 40.8 |

|

Deferred income taxes | 632.6 |

| | 650.7 |

|

Other liabilities | 109.4 |

| | 99.3 |

|

Stockholders' equity | 3,397.4 |

| | 2,749.1 |

|

| $ | 8,733.8 |

| | $ | 7,313.4 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited) |

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

Property, Plant, and Equipment | | | |

Corporate/Manufacturing: | | | |

Property, plant, and equipment | $ | 1,681.7 |

| | $ | 1,418.9 |

|

Accumulated depreciation | (820.7 | ) | | (748.3 | ) |

| 861.0 |

| | 670.6 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Machinery and other | 10.7 |

| | 10.3 |

|

Equipment on lease | 3,189.6 |

| | 3,509.1 |

|

Accumulated depreciation | (601.1 | ) | | (554.8 | ) |

| 2,599.2 |

| | 2,964.6 |

|

Partially-owned subsidiaries: | | | |

Equipment on lease | 2,261.2 |

| | 1,887.2 |

|

Accumulated depreciation | (261.3 | ) | | (202.1 | ) |

| 1,999.9 |

| | 1,685.1 |

|

| | | |

Net deferred profit on railcars sold to the Leasing Group | (557.2 | ) | | (549.7 | ) |

| $ | 4,902.9 |

| | $ | 4,770.6 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

Debt | | | |

Corporate - Recourse: | | | |

Revolving credit facility | $ | — |

| | $ | — |

|

Senior notes due 2024, net of unamortized discount of $0.4 and $- | 399.6 |

| | — |

|

Convertible subordinated notes, net of unamortized discount of $59.6 and $74.1 | 389.9 |

| | 375.9 |

|

Other | 0.7 |

| | 0.9 |

|

| 790.2 |

| | 376.8 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Recourse: | | | |

Capital lease obligations | 39.1 |

| | 42.2 |

|

| 39.1 |

| | 42.2 |

|

Non-recourse: | | | |

Secured railcar equipment notes | 723.3 |

| | 766.6 |

|

Warehouse facility | 120.6 |

| | 152.0 |

|

Promissory notes | 363.9 |

| | 396.1 |

|

| 1,207.8 |

| | 1,314.7 |

|

Partially-owned subsidiaries - Non-recourse: | | | |

Secured railcar equipment notes | 1,515.9 |

| | 1,256.1 |

|

| 1,515.9 |

| | 1,256.1 |

|

| $ | 3,553.0 |

| | $ | 2,989.8 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

Leasing Debt Summary | | | |

Total Recourse Debt | $ | 39.1 |

| | $ | 42.2 |

|

Total Non-Recourse Debt(1) | 2,723.7 |

| | 2,570.8 |

|

| $ | 2,762.8 |

| | $ | 2,613.0 |

|

Total Leasing Debt | | | |

Wholly-owned subsidiaries | $ | 1,246.9 |

| | $ | 1,356.9 |

|

Partially-owned subsidiaries | 1,515.9 |

| | 1,256.1 |

|

| $ | 2,762.8 |

| | $ | 2,613.0 |

|

Equipment on Lease(1) | | | |

Wholly-owned subsidiaries | $ | 2,599.2 |

| | $ | 2,964.6 |

|

Partially-owned subsidiaries | 1,999.9 |

| | 1,685.1 |

|

| $ | 4,599.1 |

| | $ | 4,649.7 |

|

Total Leasing Debt as a % of Equipment on Lease | | | |

Wholly-owned subsidiaries | 48.0 | % | | 45.8 | % |

Partially-owned subsidiaries | 75.8 | % | | 74.5 | % |

Combined | 60.1 | % | | 56.2 | % |

(1) Excludes net deferred profit on railcars sold to the Leasing Group.

Trinity Industries, Inc.

Condensed Consolidated Cash Flow Statements

(in millions)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

| 2014 | | 2013 |

Operating activities: | | | |

Net income | $ | 709.3 |

| | $ | 392.4 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Income from discontinued operations | — |

| | (6.3 | ) |

Depreciation and amortization | 244.6 |

| | 211.5 |

|

Net gains on sales of railcars owned more than one year at the time of sale | (92.3 | ) | | (20.4 | ) |

Other | 38.2 |

| | 107.9 |

|

Changes in assets and liabilities: | | | |

(Increase) decrease in receivables | (56.4 | ) | | 17.2 |

|

(Increase) decrease in inventories | (186.3 | ) | | (95.6 | ) |

Increase (decrease) in accounts payable and accrued liabilities | 142.8 |

| | 101.4 |

|

Other | 19.3 |

| | (45.9 | ) |

Net cash provided by operating activities | 819.2 |

| | 662.2 |

|

Investing activities: | | | |

Proceeds from sales of railcars owned more than one year at the time of sale | 265.8 |

| | 131.6 |

|

Proceeds from disposition of property, plant, and equipment | 23.0 |

| | 3.7 |

|

Capital expenditures - leasing, net of sold railcars owned one year or less with a net cost of $350.2 and $49.4 | (245.3 | ) | | (581.1 | ) |

Capital expenditures - manufacturing and other | (219.3 | ) | | (149.9 | ) |

(Increase) decrease in short-term marketable securities | 74.7 |

| | (149.7 | ) |

Acquisitions | (714.4 | ) | | (73.2 | ) |

Other | 0.8 |

| | 0.6 |

|

Net cash required by investing activities | (814.7 | ) | | (818.0 | ) |

Financing activities: | | | |

Payments to retire debt | (186.6 | ) | | (262.1 | ) |

Proceeds from issuance of debt | 727.3 |

| | 175.0 |

|

Shares repurchased | (36.5 | ) | | (103.2 | ) |

Dividends paid to common shareholders | (54.4 | ) | | (39.3 | ) |

Purchase of shares to satisfy employee tax on vested stock | (38.3 | ) | | (9.6 | ) |

Proceeds from sale of interests in partially-owned leasing subsidiaries | — |

| | 296.7 |

|

Repurchase of noncontrolling interest | — |

| | (84.0 | ) |

Contributions from noncontrolling interest | 49.6 |

| | 50.0 |

|

Distributions to noncontrolling interest | (28.2 | ) | | (10.0 | ) |

(Increase) decrease in restricted cash | 1.0 |

| | (12.5 | ) |

Other | 21.0 |

| | 10.3 |

|

Net cash provided by financing activities | 454.9 |

| | 11.3 |

|

Net increase (decrease) in cash and cash equivalents | 459.4 |

| | (144.5 | ) |

Cash and cash equivalents at beginning of period | 428.5 |

| | 573.0 |

|

Cash and cash equivalents at end of period | $ | 887.9 |

| | $ | 428.5 |

|

Trinity Industries, Inc.

Earnings per Share Calculation

(in millions, except per share amounts, unaudited)

Basic net income attributable to Trinity Industries, Inc. per common share is computed by dividing net income attributable to Trinity remaining after allocation to unvested restricted shares by the weighted average number of basic common shares outstanding for the period. All share and per share information has been retroactively adjusted to reflect the 2-for-1 stock split completed during the quarter ended June 30, 2014. |

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, 2014 | | Three Months Ended

December 31, 2013 |

| Income (Loss) | | Average Shares | | EPS | | Income (Loss) | | Average

Shares | | EPS |

Net income from continuing operations | $ | 146.4 |

| | | | | | $ | 118.9 |

| | | | |

Less: net income from continuing operations attributable to noncontrolling interest | 8.1 |

| | | | | | 6.5 |

| | | | |

Net income from continuing operations attributable to Trinity Industries, Inc. | 138.3 |

| | | | | | 112.4 |

| | | | |

Unvested restricted share participation | (4.4 | ) | | | | | | (3.7 | ) | | | | |

Net income from continuing operations attributable to Trinity Industries, Inc. - basic | 133.9 |

| | 151.2 |

| | $ | 0.89 |

| | 108.7 |

| | 151.8 |

| | $ | 0.72 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | 0.1 |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | 0.1 |

| | 4.4 |

| | | | — |

| | — |

| | |

Net income from continuing operations attributable to Trinity Industries, Inc. - diluted | $ | 134.0 |

| | 155.7 |

| | $ | 0.86 |

| | $ | 108.7 |

| | 151.9 |

| | $ | 0.72 |

|

| | | | | | | | | | | |

Net income (loss) from discontinued operations, net of taxes | $ | (0.1 | ) | | | | | | $ | 0.4 |

| | | | |

Unvested restricted share participation | — |

| | | | | | — |

| | | | |

Net income (loss) from discontinued operations, net of taxes - basic | (0.1 | ) | | 151.2 |

| | $ | — |

| | 0.4 |

| | 151.8 |

| | $ | — |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | 0.1 |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | — |

| | 4.4 |

| | | | — |

| | — |

| | |

Net income (loss) from discontinued operations, net of taxes - diluted | $ | (0.1 | ) | | 155.7 |

| | $ | — |

| | $ | 0.4 |

| | 151.9 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2014 | | Year Ended

December 31, 2013 |

| Income (Loss) | | Average Shares | | EPS | | Income (Loss) | | Average Shares | | EPS |

Net income from continuing operations | $ | 709.3 |

| | | | | | $ | 386.1 |

| | | | |

Less: net income from continuing operations attributable to noncontrolling interest | 31.1 |

| | | | | | 16.9 |

| | | | |

Net income from continuing operations attributable to Trinity Industries, Inc. | 678.2 |

| | | | | | 369.2 |

| | | | |

Unvested restricted share participation | (22.1 | ) | | | | | | (12.0 | ) | | | | |

Net income from continuing operations attributable to Trinity Industries, Inc. - basic | 656.1 |

| | 151.0 |

| | $ | 4.35 |

| | 357.2 |

| | 152.8 |

| | $ | 2.34 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | 0.1 |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | 0.7 |

| | 5.6 |

| | | | — |

| | — |

| | |

Net income from continuing operations attributable to Trinity Industries, Inc. - diluted | $ | 656.8 |

| | 156.7 |

| | $ | 4.19 |

| | $ | 357.2 |

| | 152.9 |

| | $ | 2.34 |

|

| | | | | | | | | | | |

Net income (loss) from discontinued operations, net of taxes | $ | — |

| | | | | | $ | 6.3 |

| | | | |

Unvested restricted share participation | — |

| | | | | | (0.2 | ) | | | | |

Net income (loss) from discontinued operations, net of taxes - basic | — |

| | 151.0 |

| | $ | — |

| | 6.1 |

| | 152.8 |

| | $ | 0.04 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | 0.1 |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | — |

| | 5.6 |

| | | | — |

| | — |

| | |

Net income (loss) from discontinued operations, net of taxes - diluted | $ | — |

| | 156.7 |

| | $ | — |

| | $ | 6.1 |

| | 152.9 |

| | $ | 0.04 |

|

Trinity Industries, Inc.

Reconciliation of EBITDA

(in millions)

(unaudited)

“EBITDA” is defined as income (loss) from continuing operations plus interest expense, income taxes, and depreciation and amortization including goodwill impairment charges. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation are, however, derived from amounts included in the historical statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA measure presented in this press release may not always be comparable to similarly titled measures by other companies due to differences in the components of the calculation.

|

| | | | | | | |

| Three Months Ended

December 31, |

| 2014 | | 2013 |

| | | |

Net income from continuing operations | $ | 146.4 |

| | $ | 118.9 |

|

Add: | | | |

Interest expense | 52.0 |

| | 45.8 |

|

Provision for income taxes | 80.3 |

| | 60.9 |

|

Depreciation and amortization expense | 73.1 |

| | 55.3 |

|

Earnings from continuing operations before interest expense, income taxes, and depreciation and amortization expense | $ | 351.8 |

| | $ | 280.9 |

|

|

| | | | | | | |

| Year Ended

December 31, |

| 2014 | | 2013 |

| | | |

Net income from continuing operations | $ | 709.3 |

| | $ | 386.1 |

|

Add: | | | |

Interest expense | 193.4 |

| | 187.3 |

|

Provision for income taxes | 354.8 |

| | 204.4 |

|

Depreciation and amortization expense | 244.6 |

| | 211.5 |

|

Earnings from continuing operations before interest expense, income taxes, and depreciation and amortization expense | $ | 1,502.1 |

| | $ | 989.3 |

|

| | | |

- END -

Exhibit 99.2

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Gail M. Peck

Vice President, Finance and Treasurer

February 19, 2015

Thank you, Jennifer. Good morning everyone. Welcome to the Trinity Industries’ fourth quarter 2014 results conference call. I'm Gail Peck, Vice President, Finance and Treasurer of Trinity. Thank you for joining us today.

This morning we are going to have two parts to our conference call remarks, which will extend the time we allocate to prepared remarks. First, we will begin with an update on the legal aspects of the ET Plus® System. We will then follow with our normal quarterly earnings conference call format.

Today’s speakers are:

•Tim Wallace our Chairman, Chief Executive Officer and President;

•Theis Rice, Senior Vice President and Chief Legal Officer;

•Bill McWhirter, Senior Vice President and Group President of the Construction Products, Energy Equipment, and Inland Barge Groups;

•Steve Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and

•James Perry, our Senior Vice President and Chief Financial Officer

Following their comments, we will then move to the Q&A session. Mary Henderson, our Vice President and Chief Accounting Officer, is also in the room with us today. I will now turn the call over to Tim Wallace.

Tim

Theis

Tim

Bill

Steve

James

Q&A Session

That concludes today's conference call. A replay of this call will be available after one o'clock eastern standard time today through midnight on February 26, 2015. The access number is (402) 220-0116. Also the replay will be available on the website located at www.trin.net. We look forward to visiting with you again on our next conference call. Thank you for joining us this morning.

Exhibit 99.3

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Timothy R. Wallace

Chairman, Chief Executive Officer, and President

February 19, 2015

Thank you, Gail and good morning everyone.

Before we provide comments about the quarter and our outlook, Theis Rice, our Senior Vice President and Chief Legal Officer, will provide an update on our Highway Products litigation matter. This is the first time that Trinity has been involved in litigation that has drawn such media attention, and we thought it would helpful for Theis to provide an update on the call this morning. We continue to believe Trinity will be ultimately be successful in our legal defense. We are confident the ET Plus System is in compliance with the controlling regulatory requirements. I’ll now turn it over to Theis.

Theis Rice Provides Update

Thank you Theis -I’ll now provide my comments pertaining to our earnings conference call.

I am very pleased with Trinity’s financial performance during 2014. In 2014, Trinity established a significantly higher earnings level. We utilized the strengths of our integrated business model to achieve this record level of financial results. We established record annual revenues, net income and EPS in 2014. Trinity’s net income increased from $375 million in 2013 to $678 million in 2014, an 80% increase. This was a major accomplishment on the part of our whole company.

I continue to be impressed with how our people drive operating leverage efficiencies to the bottom line. Our businesses are creating value by leveraging their combined expertise, competencies, and manufacturing capacity to produce quality products for a broad range of industrial markets. In addition I was impressed with the transactions we completed and the impact they had on our earnings. During the year, we also made significant progress in the business development area and I am optimistic about our growth opportunities in 2015.

Our Rail Group generated strong financial results, reporting record revenues and operating profit during the 4th quarter and full year. I remain impressed with this group’s ability to continually increase production levels through manufacturing conversions, line changeovers, and additional efficiencies. These efforts significantly enhanced the Company’s profitability. I expect this level of effort and performance will continue as we progress through 2015.

Our railcar leasing company delivered another quarter and full year of solid results. A portion of our earnings increase and cash flow contribution in 2014 was due to the level of railcar sales generated by our leasing business. Transactional activities play a key role in our leasing business model, and we expect these activities to continue.

I am pleased with our Inland Barge Group’s ability to shift production as market demand changes. During the past two years, this group has greatly enhanced its manufacturing flexibility by shifting portions of its manufacturing capacity to meet customers’ needs. This has been a major accomplishment.

The 4th quarter financial performance of our Energy Equipment Group continued to show improvement year-over-year. Our Construction Products Group was not profitable during the 4th quarter as a result of the

challenges associated with our highway products litigation, and the usual seasonal slowdown. However, their operating profit did increase 24% for the entire year.

The topside of our earnings guidance for 2015 reflects our goal of generating higher earnings in 2015 than the record level we achieved in 2014. When you consider the rapid pace of change occurring in the economy today and the fact that we established a substantially higher earnings platform in 2014, I believe we have an aggressive financial goal for 2015. In developing our earnings outlook for 2015, we took into account the positive momentum we have been experiencing within our company, as well as the uncertainties associated with the volatile price of oil and its potential impact on our businesses. It is early in the year, and we will continue to closely monitor business conditions.

Trinity’s financial and operational health remains solid. The Company has a good backlog of orders in our primary businesses which provide visibility for planning production activities during 2015. Our backlogs contain firm orders and some of these orders are associated with capital projects that are in process and long-term in nature. The diversity and size of our backlogs along with our proven ability to execute give us confidence Trinity can navigate both the tailwinds and headwinds our businesses are currently experiencing.

We are diligently working to build upon the strong earnings platform we have established. To be a premier diversified industrial company, we recognize the importance of sustainable earnings growth. Our company is driven by sustainable progress, and we are constantly striving to reach new levels of achievement.

I’ll now turn it over to Bill for his comments.

Exhibit 99.4

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of S. Theis Rice

Senior Vice President and Chief Legal Officer

February 19, 2015

Thank you Tim.

Before I begin, I would like to reiterate that it is extremely important to our Company that all of our nation’s roads are safe.

As most of you know, last October, Trinity and Trinity Highway Products received an adverse jury verdict in the False Claims Act litigation involving the ET Plus System. Trinity Highway Products manufactures and markets the ET Plus pursuant to an exclusive license agreement granted by Texas A&M University System. Our next hearing with the District Court in Marshall, Texas is scheduled for March 3rd. Trinity’s post-trial motions continue to emphasize that the allegations in the case are wholly without merit and that the damages awarded by the jury are based on insufficient evidence. While the District Court has ordered mediation, we continue to argue that judgment should be entered in Trinity’s favor and to prepare for an appeal to the 5th Circuit Court of Appeals, should that become necessary.

Following the adverse jury verdict, the Federal Highway Administration requested that we conduct eight separate crash tests pursuant to crash test criteria required in National Cooperative Highway Research Program Report 350. The FHWA noted that these tests were being conducted to evaluate, confirm and demonstrate performance of the ET Plus in compliance with Report 350 crash test criteria. Trinity submitted an ET Plus test plan, which the FHWA approved. In December and January, an independent testing agency conducted these eight crash tests. All eight test articles were randomly selected by FHWA representatives from the ET Plus inventory at the California Transportation Department, and shipped directly to the independent testing facility in San Antonio, Texas.

FHWA representatives, state highway officials, industry association representatives and media representatives attended the live tests. On February 6th the FHWA reported that the ET Plus passed the first four crash tests conducted at a 27 ¾” guardrail installation height. The 27 ¾” guardrail height accounts for the vast majority of ET Plus Systems installed on the nation’s highways. The last four tests at a 31” guardrail height were recently completed. The data on these four tests was submitted to the FHWA earlier this week for review and processing. With the 27 ¾” tests, the FHWA issued its letter expressing the ET Plus passed all four tests approximately two weeks after receiving the test report. When the 31” guardrail height test data has been fully analyzed by the FHWA, they will again report their findings. We feel confident the ET Plus is in compliance with regulatory requirements.

As Tim stated in his comments, Trinity has never been involved in an issue that has generated as much media attention as this litigation. We believe it would be helpful for our stakeholders to have a little background information on the person filing the case, Joshua Harman, and his key consultant and witness, Dr. Dean Sicking.

For many years prior to 2011, one of Mr. Harman’s companies purchased guardrail products manufactured by Trinity Highway. In 2011, Trinity Highway learned that Mr. Harman was copying the ET Plus by manufacturing, selling and installing his devices in the Commonwealth of Virginia. When the Virginia Department of Transportation requested documentation concerning his devices, he altered past Trinity Highway invoices to make it appear as though he had purchased the devices from Trinity Highway, when

he had not. The Virginia DOT required Mr. Harman remove his copies of the ET Plus from Virginia’s roadways.

Mr. Harman initiated his pursuit of a False Claims Act case against Trinity and Trinity Highway shortly after he was required to remove his products in Virginia. In conjunction with his False Claims Act lawsuit, Mr. Harman conducts numerous interviews with media representatives throughout the country. During these interviews, Mr. Harman makes a number of accusations about the performance of the ET Plus that are not supported by factual evidence or scientific data. Should Mr. Harman ultimately prevail in his litigation, he stands to receive somewhere between 20% and 30% of the monetary amount awarded upon final judgment.

Dr. Dean Sicking is a consulting expert, currently on the staff at University of Alabama-Birmingham, who was retained by Mr. Harman’s attorneys to assist in the litigation. Dr. Sicking has developed, licensed and is currently receiving royalties on end terminal products that compete directly with the ET Plus. We believe Dr. Sicking stands to gain financially by discrediting the ET Plus. Since Trinity Highway suspended shipment of the ET Plus last October, Dr. Sicking’s competing products have experienced increased demand. In the fall of 2014, a former student of Dr. Sicking’s while at the University of Nebraska-Lincoln, released a study conducted by the University of Alabama-Birmingham which was highly critical of the in-service performance of the ET Plus. Recently, this study was discredited in four independent peer reviews commissioned by the FHWA.

We expect Mr. Harman and Dr. Sicking will continue their campaign to discredit the ET Plus and Trinity Highway, ignoring facts and data that confirm the ET Plus System complies with applicable regulatory requirements. We maintain our position that Mr. Harman’s and Dr. Sicking’s allegations pertaining to the ET Plus System are without merit. We are confident the ET Plus is in compliance with applicable regulations.

In summary, the ET Plus has been successfully crash tested more times than any other product of its kind. We intend to vigorously defend our products and our long-standing reputation for ethical and honest business practices against allegations based on fiction rather than fact. We are confident the ET Plus performs within the controlling regulatory criteria when properly installed and maintained.

Today our Form 10-K will be filed. In it we address this litigation as well as other litigation involving the ET Plus System. For those of you who would like more details related to my comments today, please refer to our Form 10-K and a website created by Trinity Highway Products to address the facts pertaining to the ET Plus. This site is located at www.etplusfacts.com

I will now turn the call back over to Tim.

Exhibit 99.5

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of William A. McWhirter II,

Senior Vice President and Group President

Construction Products, Energy Equipment and Inland Barge Groups

February 19, 2015

Thank you Tim and good morning everyone.

During 2014, the Inland Barge Group reported an 11% year-over-year increase in revenues and a 19% increase in operating profit. As expected, operating margin for the fourth quarter declined year-over-year due to a change in product mix. During the fourth quarter, we received orders totaling approximately $130 million, resulting in a backlog of $438 million at the end of December.

I am pleased with our Barge Group’s ability to respond to various demand drivers and generate efficiencies within our plants. This group’s operational flexibility is a key differentiator, enabling us to enhance profitability while responding to customers’ needs. During 2013 and 2014, our team shifted between several product lines to meet those needs. This flexibility is a major accomplishment.

Inquiries for hopper barges have been steady due to strong harvests. However, orders for new 30,000 barrel tank barges have slowed as the market has absorbed a significant amount of new equipment over the last two years. Demand for 10,000 barrel tank barges that serve the chemical markets remains steady, but this represents a smaller segment of the tank barge market.

Our product mix during the first half of 2015 will be similar to the product mix during the 4th Quarter of 2014 with similar margin expectations. At this time, we expect lower margins in the back half of 2015 due to uncertainty related to demand in the tank barge market.

For the year, the Construction Products Group reported year-over-year growth in annual revenues and profit. However, the Group reported a small loss in the fourth quarter. While we expected lower results for the quarter due to normal seasonality, actual results came in below our guidance due to challenges in our highway products business related to ongoing litigation.

The current Federal Highway Bill expires in May of 2015. As a result, some state highway authorities are holding off on longer-term projects until a new highway funding bill is passed. With that being said, I continue to be pleased with the results in our aggregates business. This business has benefitted from the addition of lightweight aggregates to our product portfolio and is performing above our original expectations.

The Energy Equipment Group reported record revenue for the fourth quarter and full year. Operating profit in 2014 increased by 76%, year-over-year. Revenues increased primarily due to the acquisitions we made in 2014 coupled with higher shipments of storage containers serving the energy sector, as well as increased deliveries and improved operational performance in our wind tower business.

As part of the Company’s overall diversification efforts, Trinity acquired the assets of a number of businesses in 2014. These businesses are moving through the integration process, and we expect them to contribute positively to the bottom line in 2015.

The acquisition of Meyer Steel Structures provides Trinity a market-leading position in the North American utility steel structures market. Market leadership is a key consideration when assessing potential

acquisitions. While the current market for utility structures is very competitive, we anticipate investment in this industry over the long-term will improve as the demand fundamentals are positive.

Overall, I expect continued financial improvement from the Energy Equipment Group in 2015.

And now, I will turn the presentation over to Steve.

Exhibit 99.6

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of D. Stephen Menzies

Senior Vice President and Group President

Rail and Railcar Leasing Groups

February 19, 2015

Thank you, Bill, good morning!

I am very proud of our Rail and Leasing Groups’ record setting performance in 2014. The focused efforts of our dedicated TrinityRail team continue to enhance our efficiencies and flexibility while driving premier performance. Our business has solid momentum moving into 2015 amid healthy railcar market fundamentals. We continue to benefit from broadening railcar demand.

During 2014, the North American railcar industry experienced very strong demand, reporting a record number of industry orders for new railcars. Market demand drivers for new railcars shifted from largely “crude-by-rail” related at the start of the year, to more broad-based market drivers as the year progressed. The expansion in the downstream energy markets as well as the economic recovery in North America resulted in increased demand for a broad range of rail cars.

The industry received more tank car orders during 2014 than the previous year, despite the pause in orders for tank cars affected by pending HM 251 regulations. Many of the tank cars ordered in 2014 will transport refined petroleum products, chemicals, liquefied gases, acids, and fertilizers. Once HM 251 is finalized, we expect demand for tank cars to increase further.

The freight car market rebounded sharply in 2014 benefiting from a broadening of demand as the year progressed, with orders supporting not only the energy markets but, agricultural, automotive, construction and steel industries, as well. With over 600,000 railcars in the North American railcar fleet over 20 years old and over 440,000 railcars over 30 years old, replacement of the aging fleet is also a key factor driving freight car demand.

At the end of the year, the industry backlog stood at a record 143,000 railcars reflecting a healthy and diverse mix covering many different commodity services. During the fourth quarter, TrinityRail received orders for 17,770 new railcars. At year end, our backlog stood at 61,035 railcars with a new record value of $7.2 billion. This level of backlog provides TrinityRail with an unprecedented level of visibility to plan our production. We are pleased with the diversification of our order backlog consisting of a broad mix of tank and freight car types. Given the considerable attention paid to “crude-by-rail,” some may assume that a disproportionate share of our backlog is intended for crude oil service. In fact, the vast majority of the crude oil tank cars remaining in our backlog will be delivered in 2015 and only comprise a modest segment of our production plans. We look forward to an increase in demand for tank cars serving the crude-by-rail market once HM 251 is finalized.

Solid order inquiries thus far in the first quarter continue to reflect a broad mix of railcars. New railcar orders taken today will result in shipments well into 2016 and, for some railcar types, into 2017.

Due to our extensive backlog, comprised of a broad mix of tank and freight cars, TrinityRail continues to benefit from extended production runs that generate high levels of productivity and efficiency. During the fourth quarter, our Rail Group set another record, our 8th consecutive, for quarterly revenues and operating

profit with the delivery of 8,460 railcars. For the full year, we delivered a record 30,255 railcars. In 2015, we expect railcar deliveries in the range of 32,000 to 34,000, establishing another new record level.

We continue to make investments in our business to prepare for the new HM 251 tank car regulations which are expected from the U.S. Department of Transportation and Transport Canada on or before May 31st. TrinityRail is well positioned to meet increased demand for both new built tank cars and modifications to existing tank cars once the regulations are put in place.

During the fourth quarter, our Leasing Group reported an increase in year-over-year revenue and operating profit due to strong market fundamentals and new additions to the wholly-owned lease fleet. Rail fleet utilization remains quite high across the industry and lead times for new railcars continue to be extended. These factors, combined with stable new railcar prices, continue to drive strong lease renewal rate increases and favorable renewal terms across most railcar types. I expect that our lease fleet performance will continue to benefit in 2015 from these healthy rail market fundamentals.

Our total lease fleet portfolio now stands at 75,930 railcars after taking delivery of 1,420 railcars in the fourth quarter. At the end of the year, 28% of the railcars in our order backlog were committed to customers of our leasing business, bringing our existing lease backlog to $2.0 billion.

We continue to develop relationships with institutional investors interested in owning leased railcars and who would like Trinity to manage their investments. Our strong lease origination capabilities and large, diverse lease fleet make us an attractive partner for financial institutions who consider leased railcars to be good long term investments. With the current high level of market liquidity and interest by financial institutions, I expect transactional earnings from sales of our leased railcars to continue during 2015.

In summary, TrinityRail’s integrated business platform is well positioned and responding effectively to strong railcar demand. During 2014, our Rail Group and Leasing and Management Services Group delivered outstanding results. I expect our performance to be strong in 2015, as well. Our operating and financial flexibility continues to differentiate TrinityRail, enhancing our position as a premier provider of railcar products and services.

I will now turn it over to James for his remarks.

Exhibit 99.7

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of James E. Perry

Senior Vice President and Chief Financial Officer

February 19, 2015

Thank you, Steve and good morning everyone.

Yesterday, we announced strong results for the fourth quarter and full year 2014. For the quarter, the Company reported record revenues of $1.7 billion and EPS of $0.86, a year-over-year increase of 32% and 19% respectively. For the full year, we reported both record revenues and EPS of $6.2 billion and $4.19, respectively. These figures represent year-over-year revenue and EPS growth of 41% and 76%, respectively.

Theis provided an update with respect to the highway litigation and related matters. As a reminder, litigation costs related to the federal case are reported in Corporate and any product liability-related expenses are reported in the Construction Products Group. As it relates to the litigation, we have also previously disclosed we could be required to post an appeal bond upon the district court’s entry of a final judgment. We remain confident we will be able to obtain such a bond, if needed, on an unsecured basis..

During the fourth quarter, the company did not repurchase any shares of its common stock. We determined it was inappropriate to repurchase shares while the FHWA-requested crash testing was in process. For the full year, the Company purchased $31.5 million of its shares, leaving $218.5 million of availability under the current authorization.

We maintain a strong balance sheet with readily available liquidity of approximately $1.6 billion at the end of the fourth quarter.

I will now discuss our current outlook for 2015.

As provided in our press release yesterday, our guidance for 2015 annual EPS is $4.00 to $4.40. We expect the level of quarterly EPS to be relatively consistent throughout the year. I would like to remind you that the first quarter of 2014 included significant sales of leased railcars to Element as the alliance started. As a result, we do expect first quarter 2015 EPS to below last year’s level.

Our annual EPS guidance includes the following assumptions:

| |

• | For the year, we are assuming a tax rate of approximately 33.5%, though this rate could vary quarter-to-quarter. |

| |

• | Due to our partial ownership in TRIP and RIV 2013, we expect to deduct between $30 million and $35 million of non-controlling earnings in 2015. |

| |

• | The two class method of accounting is expected to reduce EPS by 14 cents per share in 2015, compared to calculating Trinity’s EPS directly from the face of the income statement. |

| |

• | And finally, please refer to yesterday’s press release for the dilutive impact from the convertible notes and the weighted average share count for 2015. |

Our earnings outlook for 2015 reflects the positive momentum we are experiencing. We are well positioned with the $8.1 billion of backlog in our businesses. At the same time, our businesses acknowledge some uncertainties which could impact our performance in 2015. Our customers are assessing the impacts of oil price volatility on their businesses, with some obviously experiencing negative effects while others

benefitting more positively from lower prices. We are also closely watching various labor situations in the U.S., including those causing the temporary shut-down of oil refineries, as well as interruptions of imports and exports on the West Coast.

Our guidance also includes a high level of transactional earnings due the sale of leased railcars. We are working diligently to fulfill this portion of our earnings expectations as a normal course of our business model going forward.

In 2015, as Steve mentioned, we expect our Rail Group to deliver between 32,000 and 34,000 railcars during the year. This will result in total revenues for the Rail Group of between $4.2 billion and $4.4 billion and an expected operating margin of 18% to 19%.

We expect our Leasing Group to record operating revenues for 2015 of $700 million to $725 million, with operating profit from operations of $320 million to $340 million.

Our 2015 guidance includes approximately $1 billion of sales of leased railcars to Element, which will fulfill the $2 billion strategic railcar alliance that we began in December of 2013. We expect the timing of the sales to Element to be more weighted toward the second half of the year. Our guidance assumes most of the leased railcars purchased by Element will be sold directly from the Rail Group. However, based on actual timing, a portion of these sales could ultimately be recognized as car sales in the Leasing Group.

In 2015, we anticipate the Leasing Group will report proceeds from sales of leased railcars from the lease fleet of approximately $430 million to $450 million with profit of $115 million to $130 million. This includes sales of leased railcars to third parties other than Element. Transactional earnings have been a key component of our results, and we expect these earnings to continue. We have developed strong relationships with institutional investors looking to own leased railcars, and the level of interest from this group remains high.

We expect our Construction Products Group to record 2015 revenues of $510 million to $540 million with an operating margin of 8.5% to 9.5%. The decline in our 2015 expectations for this Group, as compared to 2014, is due to ongoing impacts from our ET-Plus litigation and uncertainty around highway funding at the federal and state levels.

Our Inland Barge Group is expected to report 2015 revenues of $620 million to $650 million with an operating margin of 13% to 14%. As Bill mentioned, there is softness in the demand for tank barges, partially offsetting solid demand for hopper barges.

We expect our Energy Equipment Group to generate 2015 revenues of $1.1 billion to $1.25 billion with an operating margin of 11% to 12%. This includes a full year of operating results from the acquisition of the assets of Meyer Steel Structures.

The acquisitions we made in 2014 were primarily within the Energy Equipment Group and are expected to produce EPS in 2015 of approximately 10-15 cents. The actual operating results are higher, but amortization due to purchase price accounting of certain acquired assets reduces earnings by about 2 cents per share in 2015. We are pleased with the integration of these businesses to date and look forward to their growth potential in 2015 and in future years. Our acquisition strategy has been focused on industries and products with more stable long-term fundamentals and growth opportunities that can further diversify our portfolio of businesses. The businesses we acquired in 2014 meet these objectives and add value to our company.

Corporate expenses are expected to range from $110 million to $125 million during 2015, which includes ongoing expenses related to the highway federal litigation matter.

In 2015, we expect to eliminate between $600 million and $650 million of revenue and defer between $115 million and $130 million of operating profit due to the addition of new railcars to our lease fleet. We expect these eliminations to be more weighted toward the first-half of the year. We expect to eliminate between $375 million and $395 million of revenues from other intercompany transactions during the year.

The net result of our revenue guidance leads to an expectation of between $7.5 billion and $7.9 billion of gross revenues and $6.5 and $6.9 billion of net revenues for the year, representing net growth of between 5% and 10% as compared to 2014.

As it pertains to cash flow, we expect the annual net cash investment in new railcars in our lease fleet to be between $55 million and $70 million in 2015 after considering the expected proceeds received from leased railcar sales during the year. We may also consider the opportunistic purchase of existing leased railcars during the year.

Full-year manufacturing and corporate capital expenditures for 2015 are expected to be between $250 million and $300 million.

As we said on our last earnings call, we plan to be conservative with respect to capital allocation due to the ongoing highway litigation. We have significant cash on hand and access to capital through our committed lines of credit at both the corporate and leasing levels. Current economic uncertainty could present opportunities to make acquisitions at favorable valuations that add long-term value to the company. If we see such opportunities, we would certainly consider a transaction. As a normal course of business, we continue to visit regularly with our Board of Directors about our capital planning.