Toll Brothers Says Co-Founder To Resign, Tightens Sales View

February 23 2016 - 8:40AM

Dow Jones News

Luxury home builder Toll Brothers Inc. on Tuesday said its

eponymous vice chairman Bruce Toll would retire next month from the

company he co-founded with his brother.

News of the retirement came as the home builder also reported

better-than-expected revenue for the January quarter but narrowed

its sales forecast for the year.

Robert and Bruce Toll started Toll Brothers in 1967 in

Pennsylvania. The company has focused on building more-customized

and higher-end homes than competitors, and the brothers took the

company public on July 8, 1986. Bruce Toll was the company's chief

operating officer until May 1998 and its president until November

1998.

"I am so proud of what Toll Brothers has accomplished," Bruce

Toll said.

The homes in their first community in Chester County sold for an

average of $20,000. In its latest quarterly earnings, the company

said the average price of a home delivered in its first quarter was

$873,500, up from $782,300 a year ago.

Toll said a tighter labor market and increased home complexity

has led to a lengthening in the time it takes to build a home. The

company narrowed its annual revenue guidance, saying it now expects

revenue between $4.6 billion and $5.4 billion. Previously, Toll had

projected revenue between $4.5 billion and $5.6 billion.

Analysts polled by Thomson Reuters had predicted $5.11 billion,

on average, in revenue for the year.

Shares of Toll Brothers, which have fallen 30% to $26.03 over

the past three months, were inactive in premarket trading.

For the quarter ended Jan. 31, Toll's profit fell to $73.18

million, or 40 cents a share, from $81.33 million, or 44 cents a

share, a year earlier. Analysts surveyed by Thomson Reuters were

expecting earnings of 40 cents a share.

Revenue rose 8.8% to $928.6 million, above the average analyst

estimate of $916.3 million.

Results in the first quarter were driven by growth in the

company's north and mid-Atlantic regions, both areas which the

company said have been slower to recover from the financial crisis.

In the north region, contracts increased 56% in dollars and 38% in

units compared with a year prior, boosted by New Jersey growth. The

mid-Atlantic region saw contract growth of 34%.

California was a weak spot for the quarter, with a decrease of

28% in units and flat change in dollars.

Toll's City Living division, which builds urban apartments,

increased 145% in dollars and 179% in units. While small, the

division represents a new segment for the company as the U.S.

continues to urbanize. In Southern California, one of its

developments was hobbled by a long-lasting gas leak that was

resolved Thursday.

Backlog jumped 17% during the period to 4,129 units, with

California and the West driving the growth.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 23, 2016 08:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

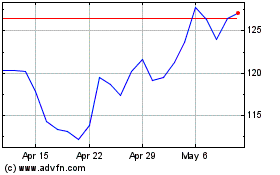

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

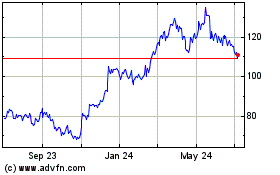

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Apr 2023 to Apr 2024