UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) September 8, 2015

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | |

Delaware | 1-10702 | 34-1531521 |

(State or Other Jurisdiction | (Commission | (IRS Employer |

of Incorporation) | File Number) | Identification No.) |

|

| |

200 Nyala Farm Road, Westport, Connecticut | 06880 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

|

|

NOT APPLICABLE |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry Into a Material Definitive Agreement.

As previously reported, on August 27, 2015, Terex Corporation (“Terex” or the “Company”) announced it was conducting a consent solicitation in connection with the previously announced merger (the “Merger”) of Terex with Konecranes Plc, a Finnish public company limited by shares (“Konecranes”). As a result of Terex’s receipt of the requisite consents (the “Consents”) with respect to such consent solicitation from holders of its 6.00% Senior Notes due 2021 (the “2021 Notes”) and 6.50% Senior Notes due 2020 (the “2020 Notes” and together with the 2021 Notes, the “Notes”) to certain proposed amendments to the indentures governing the Notes, on September 8, 2015, Terex and certain subsidiaries of the Company entered into the following supplemental indentures (collectively, the “Supplemental Indentures”):

| |

• | Supplemental Indenture to the Third Supplemental Indenture dated as of March 27, 2012 to the Senior Debt Indenture dated as of July 20, 2007, with HSBC Bank USA, National Association (“HSBC”) as trustee relating to the 2020 Notes; and |

| |

• | Supplemental Indenture to the Fourth Supplemental Indenture dated as of November 26, 2012 to the Senior Debt Indenture dated as of July 20, 2007, with HSBC as trustee relating to the 2021 Notes. |

The following are the principal changes to the indentures governing the Notes that were implemented pursuant to the Supplemental Indentures:

| |

• | the definition of “Change of Control” was amended so that the Merger does not constitute a “Change of Control” under the Supplemental Indentures and to permit Konecranes to insert one or more holding companies below or above Konecranes without triggering a “Change of Control” if such holding companies do not affect Terex’s ultimate beneficial ownership. |

| |

• | the reporting covenant was amended to permit Konecranes or another holding company that guarantees the Notes, instead of Terex (following the consummation of the Merger), to furnish the information required under each indenture and to provide that, if Konecranes or such other holding company qualifies as a foreign private issuer, then the reporting covenant will be satisfied if Konecranes or such other holding company furnishes, among other things, the information, documents and other reports applicable to foreign private issuers (provided that Konecranes or such other holding company will be required to provide quarterly reports). |

The terms of the Supplemental Indentures will not become operative unless and until the remaining conditions to the consent solicitation have been satisfied or waived, including but not limited to consummation of the Merger.

The foregoing summary is qualified in its entirety by reference to the Supplemental Indentures, copies of which are filed herewith as Exhibits 4.1 and 4.2 and are incorporated herein by reference.

HSBC and its affiliates maintain relationships in the ordinary course of business with the Company and its subsidiaries, including the provision of commercial banking, investment banking, trustee and/or other financial services.

Item 3.03. Material Modification to Rights of Security Holders

The information contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01. Other Events.

As a result of the receipt of the Consents, on September 8, 2015, the Company and Konecranes notified Credit Suisse Securities (USA) LLC and Credit Suisse AG (collectively, “Credit Suisse”) that it terminated the commitments of the lenders in the amount of $1.15 billion with respect to the bridge facility under the commitment letter from Credit Suisse dated August 10, 2015 (and the joinder letters from the other lenders with respect thereto) pursuant to the terms thereof.

A copy of a press release announcing the receipt of the Consents is included as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

4.1 Supplemental Indenture, dated as of September 8, 2015, to the Third Supplemental Indenture dated as of March 27, 2012 to the Senior Debt Indenture dated as of July 20, 2007, with HSBC Bank USA, National Association as Trustee relating to the 6.5% Senior Notes due 2020.

4.2 Supplemental Indenture, dated as of September 8, 2015, to the Fourth Supplemental Indenture dated as of November 26, 2012 to the Senior Debt Indenture dated as of July 20, 2007, with HSBC Bank USA, National Association as Trustee relating to the 6% Senior Subordinated Notes due 2021.

99.1 Press Release of Terex Corporation issued on September 8, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 14, 2015

|

| |

| TEREX CORPORATION |

|

|

| By: /s/ Eric I Cohen |

| Eric I Cohen |

| Senior Vice President, |

| Secretary and General Counsel |

TEREX CORPORATION,

as Issuer,

THE SUBSIDIARY GUARANTORS (as defined herein)

and

HSBC BANK USA, NATIONAL ASSOCIATION,

as Trustee

SUPPLEMENTAL INDENTURE

Dated as of September 8, 2015

to THIRD SUPPLEMENTAL INDENTURE

Dated as of March 27, 2012

to SENIOR DEBT INDENTURE

Dated as of July 20, 2007

6.50% Senior Notes due 2020

THIS SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of September 8, 2015, between Terex Corporation, a Delaware corporation (the “Company”), HSBC Bank USA, National Association, as trustee (the “Trustee”) and the subsidiary guarantors named herein (the “Subsidiary Guarantors”). Capitalized terms used herein but not otherwise defined herein shall have the meanings ascribed to such terms in the Indenture (as defined below).

WITNESSETH

WHEREAS, the Company executed and delivered to the Trustee an indenture (the “Base Indenture”), by and between the Company and the Trustee, dated as of July 20, 2007;

WHEREAS, the Company and the guarantors named therein executed and delivered to the Trustee a supplemental indenture (the “Third Supplemental Indenture” and together with the Base Indenture, the “Indenture”), by and between the Company, the Trustee and such guarantors, dated as of March 27, 2012, pursuant to which the Company’s 6.50% Senior Notes due 2020 (the “Notes”) were issued;

WHEREAS, the Company has entered into a Business Combination Agreement and Plan of Merger, dated as of August 10, 2015, among the Company, Konecranes Plc, a Finnish public company limited by shares (“Konecranes”), Konecranes, Inc., a Texas corporation and an indirect wholly owned subsidiary of Konecranes, Konecranes Acquisition Company LLC, a Delaware limited liability company and a wholly owned subsidiary of Konecranes, Inc., as amended from time to time (the “Merger Agreement”);

WHEREAS, the Company has solicited (the “Consent Solicitation”) the Holders, upon the terms and subject to the conditions set forth in the Notice of Consent Solicitation dated August 27, 2015 (the “Notice”) and the accompanying Consent Form (the “Consent Form” and, together with the Notice and the other documents related to the Consent Solicitation, the “Consent Documents”), to direct the Trustee to execute and deliver amendments to the Indenture as set forth in Article I hereof (the “Amendments”);

WHEREAS, Section 902 of the Indenture provides that, subject to certain exceptions inapplicable hereto, the Indenture may be amended or supplemented with the consent of the Holders of more than 50% in aggregate principal amount of the Notes then outstanding;

WHEREAS, in connection with the Consent Solicitation, Holders that have validly delivered and have not validly withdrawn consent to the Amendments and the execution of this Supplemental Indenture on a timely basis (the “Consenting Holders”) are entitled to receive a consent fee with respect to the Notes in respect of which they have validly consented, payable only if all conditions to the Consent Solicitation set forth in the Consent Documents, including, without limitation, the consummation of the transactions contemplated by the Merger Agreement, are satisfied or waived by the Company (the “Consent Fee”);

WHEREAS, Consenting Holders constitute Holders of more than 50% in aggregate principal amount of the Notes now outstanding and direct the Trustee to execute and deliver this Supplemental Indenture in its capacity as Trustee; and

WHEREAS, the execution and delivery of this Supplemental Indenture have been duly authorized by the Company and all conditions and requirements necessary to make this instrument a valid and binding agreement have been duly performed and complied with.

NOW, THEREFORE, in consideration of the above premises, and for the purpose of memorializing the Amendments consented to by the Holders, each party agrees, for the benefit of the others and for the equal and ratable benefit of the Holders of the Notes, as follows:

ARTICLE I

AMENDMENT OF INDENTURE

Section 101 Amendment to Definitions. Section 101 of the Indenture is hereby amended as follows:

(a) The following definitions are hereby inserted alphabetically into Section 101 of the Indenture:

“IFRS” means International Financial Reporting Standards promulgated from time to time by the International Accounting Standards Board (or any successor board or agency).

“Merger” means the merger pursuant to which Konecranes Acquisition Company LLC, a Delaware limited liability company and direct wholly-owned Subsidiary of Konecranes, Inc., a Texas corporation and indirect wholly-owned Subsidiary of Parent, will be merged with and into the Company and following which the Company will be a direct wholly owned Subsidiary of Konecranes Inc. and an indirect wholly-owned Subsidiary of Parent.

“Parent” means Konecranes Plc, a Finnish public company limited by shares, and any successor thereto.

“Permitted Holders” means as of any date of determination following consummation of the Merger, Parent, and any of its wholly-owned Subsidiaries.

(b) The definition of “Change of Control” is hereby amended and restated in its entirety as follows:

“Change of Control” means the occurrence of any of the following:

(1) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act) other than any Permitted Holder, is or becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a Person shall be deemed to have beneficial ownership of all shares that such Person has the right to acquire, whether such right is exercisable immediately or only after the passage of time),

directly or indirectly, of more than 50% of the total voting power of the Voting Stock of the Company, whether as a result of issuance of securities of the Company, any merger, consolidation, liquidation or dissolution of the Company, any direct or indirect transfer of securities or otherwise;

(2) (A) another corporation merges into the Company or the Company consolidates with or merges into any other corporation, or

(B) the Company conveys, transfers or leases all or substantially all of its assets (computed on a consolidated basis) to any person or group in one transaction or a series of transactions other than any conveyance, transfer or lease between the Company and a Restricted Subsidiary of the Company,

in the case of each of clause (2)(A) and (B), in one transaction or a series of related transactions with the effect that either (x) immediately after such transaction any person or entity or group (as so defined) of persons or entities, other than any Permitted Holder, shall have become the beneficial owner of securities of the surviving corporation of such merger or consolidation representing a majority of the combined voting power of the outstanding securities of the surviving corporation ordinarily having the right to vote in the election of directors or (y) the securities of the Company that are outstanding immediately prior to such transaction and which represent 100% of the combined voting power of the securities of the Company ordinarily having the right to vote in the election of directors are changed into or exchanged for cash, securities or property, unless pursuant to such transaction such securities are changed into or exchanged for, in addition to any other consideration, securities of the surviving corporation that represent immediately after such transaction, at least a majority of the combined voting power of the securities of the surviving corporation ordinarily having the right to vote in the election of directors; or

(3) during any period of two consecutive years, individuals who at the beginning of such period constituted the Board of Directors (together with any new directors whose election by such Board of Directors or whose nomination for election by the shareholders of the Company was approved by a vote of the majority of the directors of the Company then still in office who were either directors at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the Board of Directors then in office. Notwithstanding the foregoing, upon consummation of the Merger, references in this clause (3) to “the beginning of such period” shall refer to the date immediately following the consummation of the Merger, until expiry of the two year anniversary of the Merger.

Notwithstanding the foregoing clauses (1) and (2) above, a transaction will not be deemed to involve a Change of Control if (i) the Company becomes a direct or indirect Subsidiary of a person, and (ii) the direct or indirect holders of the common shares of such person immediately following the transaction are substantially the same as the direct or indirect holders of the Company’s common shares, or other voting shares into which

the Company’s common shares are reclassified, consolidated, exchanged or changed immediately prior to that transaction.

Section 102 Amendment to SEC Reports. Section 1023 of the Indenture is hereby amended and restated in its entirety as follows:

Notwithstanding that the Company may not be subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, the Company shall file to the extent permitted with the SEC and provide within 15 days to the Trustee and the Holders with such annual reports and such information, documents and other reports as are specified in Sections 13 and 15(d) of the Exchange Act and applicable to a U.S. corporation subject to such Sections, such information, documents and other reports to be so filed and provided at the times specified for the filing of such information, documents and reports under such Sections 13 and 15(d) of the Exchange Act. If the SEC will not accept such filings for any reasons, the Company shall post the specified reports on its public website within the time periods that would apply if the Company were required to file those reports with the SEC. Delivery of such information, documents and other reports to the Trustee is for informational purposes only, and the Trustee’s receipt of such shall not constitute constructive notice of any information contained therein or determinable from information contained therein, including the Company’s compliance with any of its covenants hereunder (as to which the Trustee is entitled to conclusively rely exclusively on an Officers’ Certificate). Notwithstanding the foregoing, following the consummation of the Merger and if and for so long as the 2020 Notes are fully and unconditionally guaranteed by Parent or any other direct or indirect parent company of Parent, the Company is permitted to elect to satisfy its obligations under this Section by delivering the corresponding reports, information and documents of Parent or such other entity within the timeframes set forth under this Section, provided, that to the extent Parent or such other entity qualifies as a foreign private issuer as defined in Rule 405 of the Securities Act, the phrase “U.S. corporation”, solely as used in this paragraph, shall be deemed to be replaced with “foreign private issuer” for all purposes; provided further, however, that if Parent or such other entity so qualifies as a foreign private issuer, it shall file on Form 6-K (or any successor form) within 60 days after the end of each of the first three fiscal quarters of each fiscal year, quarterly reports containing the following information: (i) an unaudited condensed consolidated balance sheet as of the end of such period and unaudited condensed statements of income and cash flows for such periods, and the comparable prior year periods, each under IFRS, together with condensed footnote disclosure; and (ii) an operating and financial review of the financial statements, including a discussion of the results of operations, financial condition, and liquidity and capital resources, and a discussion of material commitments and contingencies and changes in critical accounting policies.

ARTICLE II

MISCELLANEOUS PROVISIONS

Section 201 Effect of Supplemental Indenture.

From and after the Amendment Operative Time (as defined below), the Indenture shall be amended and supplemented in accordance herewith. Each reference in the Indenture to “this Indenture,” “hereunder,” “hereof,” or “herein” shall mean and be a reference to the Indenture as amended and supplemented by this Supplemental Indenture unless the context otherwise requires. The Indenture as amended and supplemented by this Supplemental Indenture shall be read, taken and construed as one and the same instrument, and every Holder of the Notes heretofore or hereafter authenticated and delivered under the Indenture as supplemented by this Supplemental Indenture shall be bound thereby.

Section 202 Effectiveness.

This Supplemental Indenture shall become effective and binding on the Company, the Subsidiary Guarantors, the Trustee and every Holder of the Notes heretofore or hereafter authenticated and delivered under the Indenture, upon the execution and delivery by the parties to this Supplemental Indenture; provided, however, that the Amendments shall become operative only upon the later of the (a) payment of the Consent Fee to the Consenting Holders in accordance with the terms and conditions of the Consent Solicitation and (b) consummation of the transactions contemplated by the Merger Agreement (the “Amendment Operative Time”), as notified to the Trustee in writing by the Company.

Section 203 Indenture Remains in Full Force and Effect.

Except as supplemented and amended hereby, all provisions in the Indenture shall remain in full force and effect.

Section 204 Confirmation of Indenture.

The Indenture, as supplemented and amended by this Supplemental Indenture, is in all respects confirmed and ratified.

Section 205 Conflict with Trust Indenture Act.

If any provision of this Supplemental Indenture limits, qualifies or conflicts with another provision hereof or of the Indenture which is required to be included in this Supplemental Indenture or the Indenture by any of the provisions of the Trust Indenture Act of 1939, such required provision shall control.

Section 206 Severability.

In case any one or more of the provisions in this Supplemental Indenture shall be held invalid, illegal or unenforceable, in any respect for any reason, the validity, legality and enforceability of any such provision in every other respect and of the remaining provisions shall not in any way be affected or impaired thereby, it being intended that all of the provisions hereof shall be enforceable to the full extent permitted by law.

Section 207 Successors.

All agreements of the Company and each Subsidiary Guarantor in this Supplemental Indenture shall bind its respective successors. All agreements of the Trustee in this Supplemental Indenture shall bind its successors.

Section 208 Certain Duties and Responsibilities of the Trustee.

In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating to the conduct or affecting the liability of or affording protection to the Trustee, whether or not elsewhere herein so provided. The Trustee, for itself and its successor or successors, accepts the terms of the Indenture as amended by this Supplemental Indenture, and agrees to perform the same, but only upon the terms and provisions defining and limiting the liabilities and responsibilities of the Trustee, which terms and provisions shall in like manner define and limit its liabilities and responsibilities in the performance of the trust created by the Indenture. The Trustee makes no representations as to the validity or sufficiency of this Supplemental Indenture other than as to the validity of its execution and delivery by the Trustee.

Section 209 Governing Law.

This Supplemental Indenture will be governed by and construed in accordance with the laws of the State of New York.

Section 210 Duplicate Originals.

All parties may sign any number of copies of this Supplemental Indenture. Each signed copy or counterpart shall be an original, but all of them together shall represent the same agreement.

Section 211 Effect of Headings.

The Section headings herein are for convenience only and shall not affect the construction hereof.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed, as of the date first set forth above.

|

| | |

| THE ISSUER: |

| | |

| TEREX CORPORATION |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Senior Vice President |

| | |

| SUBSIDIARY GUARANTORS: |

| | |

| CMI TEREX CORPORATION FANTUZZI NOELL USA, INC. GENIE HOLDINGS, INC. GENIE INDUSTRIES, INC. GENIE INTERNATIONAL, INC. POWERSCREEN HOLDINGS USA INC. POWERSCREEN NORTH AMERICA INC. TEREX ADVANCE MIXER, INC. TEREX AERIALS, INC. TEREX FINANCIAL SERVICES, INC. TEREX SOUTH DAKOTA, INC. TEREX WASHINGTON, INC. |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| POWERSCREEN INTERNATIONAL LLC |

| | |

| By: | Powerscreen North America, Inc., its managing member |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| | |

|

| | |

| POWERSCREEN USA LLC |

| | |

| By: | Powerscreen Holdings USA, Inc., its managing member |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| TEREX USA, LLC |

| |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Senior Vice President |

| | |

| TEREX UTILITIES, INC. |

| |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: President |

| | |

| | |

| | |

| | |

|

| | |

| THE TRUSTEE: |

| |

| HSBC BANK USA, NATIONAL ASSOCIATION, as Trustee |

| |

| | |

| By: | /s/ Annette Kos-Culkin |

| | Name: Annette Kos-Culkin |

| | Title: Vice President |

TEREX CORPORATION,

as Issuer,

THE SUBSIDIARY GUARANTORS (as defined herein)

and

HSBC BANK USA, NATIONAL ASSOCIATION,

as Trustee

SUPPLEMENTAL INDENTURE

Dated as of September 8, 2015

to FOURTH SUPPLEMENTAL INDENTURE

Dated as of November 26, 2012

to SENIOR DEBT INDENTURE

Dated as of July 20, 2007

6.00% Senior Notes due 2021

THIS SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of September 8, 2015, between Terex Corporation, a Delaware corporation (the “Company”), HSBC Bank USA, National Association, as trustee (the “Trustee”) and the subsidiary guarantors named herein (the “Subsidiary Guarantors”). Capitalized terms used herein but not otherwise defined herein shall have the meanings ascribed to such terms in the Indenture (as defined below).

WITNESSETH

WHEREAS, the Company executed and delivered to the Trustee an indenture (the “Base Indenture”), by and between the Company and the Trustee, dated as of July 20, 2007;

WHEREAS, the Company and the guarantors named therein executed and delivered to the Trustee a supplemental indenture (the “Fourth Supplemental Indenture” and together with the Base Indenture, the “Indenture”), by and between the Company, the Trustee and such guarantors, dated as of November 26, 2012, pursuant to which the Company’s 6.00% Senior Notes due 2021 (the “Notes”) were issued;

WHEREAS, the Company has entered into a Business Combination Agreement and Plan of Merger, dated as of August 10, 2015, among the Company, Konecranes Plc, a Finnish public company limited by shares (“Konecranes”), Konecranes, Inc., a Texas corporation and an indirect wholly owned subsidiary of Konecranes, Konecranes Acquisition Company LLC, a Delaware limited liability company and a wholly owned subsidiary of Konecranes, Inc., as amended from time to time (the “Merger Agreement”);

WHEREAS, the Company has solicited (the “Consent Solicitation”) the Holders, upon the terms and subject to the conditions set forth in the Notice of Consent Solicitation dated August 27, 2015 (the “Notice”) and the accompanying Consent Form (the “Consent Form” and, together with the Notice and the other documents related to the Consent Solicitation, the “Consent Documents”), to direct the Trustee to execute and deliver amendments to the Indenture as set forth in Article I hereof (the “Amendments”);

WHEREAS, Section 902 of the Indenture provides that, subject to certain exceptions inapplicable hereto, the Indenture may be amended or supplemented with the consent of the Holders of more than 50% in aggregate principal amount of the Notes then outstanding;

WHEREAS, in connection with the Consent Solicitation, Holders that have validly delivered and have not validly withdrawn consent to the Amendments and the execution of this Supplemental Indenture on a timely basis (the “Consenting Holders”) are entitled to receive a consent fee with respect to the Notes in respect of which they have validly consented, payable only if all conditions to the Consent Solicitation set forth in the Consent Documents, including, without limitation, the consummation of the transactions contemplated by the Merger Agreement, are satisfied or waived by the Company (the “Consent Fee”);

WHEREAS, Consenting Holders constitute Holders of more than 50% in aggregate principal amount of the Notes now outstanding and direct the Trustee to execute and deliver this Supplemental Indenture in its capacity as Trustee; and

WHEREAS, the execution and delivery of this Supplemental Indenture have been duly authorized by the Company and all conditions and requirements necessary to make this instrument a valid and binding agreement have been duly performed and complied with.

NOW, THEREFORE, in consideration of the above premises, and for the purpose of memorializing the Amendments consented to by the Holders, each party agrees, for the benefit of the others and for the equal and ratable benefit of the Holders of the Notes, as follows:

ARTICLE I

AMENDMENT OF INDENTURE

Section 101 Amendment to Definitions. Section 101 of the Indenture is hereby amended as follows:

(a) The following definitions are hereby inserted alphabetically into Section 101 of the Indenture:

“IFRS” means International Financial Reporting Standards promulgated from time to time by the International Accounting Standards Board (or any successor board or agency).

“Merger” means the merger pursuant to which Konecranes Acquisition Company LLC, a Delaware limited liability company and direct wholly-owned Subsidiary of Konecranes, Inc., a Texas corporation and indirect wholly-owned Subsidiary of Parent, will be merged with and into the Company and following which the Company will be a direct wholly owned Subsidiary of Konecranes Inc. and an indirect wholly-owned Subsidiary of Parent.

“Parent” means Konecranes Plc, a Finnish public company limited by shares, and any successor thereto.

“Permitted Holders” means as of any date of determination following consummation of the Merger, Parent, and any of its wholly-owned Subsidiaries.

(b) The definition of “Change of Control” is hereby amended and restated in its entirety as follows:

“Change of Control” means the occurrence of any of the following:

(1) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act) other than any Permitted Holder, is or becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a Person shall be deemed to have beneficial ownership of all shares that such Person has the right to acquire, whether such right is exercisable immediately or only after the passage of time),

directly or indirectly, of more than 50% of the total voting power of the Voting Stock of the Company, whether as a result of issuance of securities of the Company, any merger, consolidation, liquidation or dissolution of the Company, any direct or indirect transfer of securities or otherwise;

(2) (A) another corporation merges into the Company or the Company consolidates with or merges into any other corporation, or

(B) the Company conveys, transfers or leases all or substantially all of its assets (computed on a consolidated basis) to any person or group in one transaction or a series of transactions other than any conveyance, transfer or lease between the Company and a Restricted Subsidiary of the Company,

in the case of each of clause (2)(A) and (B), in one transaction or a series of related transactions with the effect that either (x) immediately after such transaction any person or entity or group (as so defined) of persons or entities, other than any Permitted Holder, shall have become the beneficial owner of securities of the surviving corporation of such merger or consolidation representing a majority of the combined voting power of the outstanding securities of the surviving corporation ordinarily having the right to vote in the election of directors or (y) the securities of the Company that are outstanding immediately prior to such transaction and which represent 100% of the combined voting power of the securities of the Company ordinarily having the right to vote in the election of directors are changed into or exchanged for cash, securities or property, unless pursuant to such transaction such securities are changed into or exchanged for, in addition to any other consideration, securities of the surviving corporation that represent immediately after such transaction, at least a majority of the combined voting power of the securities of the surviving corporation ordinarily having the right to vote in the election of directors; or

(3) during any period of two consecutive years, individuals who at the beginning of such period constituted the Board of Directors (together with any new directors whose election by such Board of Directors or whose nomination for election by the shareholders of the Company was approved by a vote of the majority of the directors of the Company then still in office who were either directors at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the Board of Directors then in office. Notwithstanding the foregoing, upon consummation of the Merger, references in this clause (3) to “the beginning of such period” shall refer to the date immediately following the consummation of the Merger, until expiry of the two year anniversary of the Merger.

Notwithstanding the foregoing clauses (1) and (2) above, a transaction will not be deemed to involve a Change of Control if (i) the Company becomes a direct or indirect Subsidiary of a person, and (ii) the direct or indirect holders of the common shares of such person immediately following the transaction are substantially the same as the direct or indirect holders of the Company’s common shares, or other voting shares into which

the Company’s common shares are reclassified, consolidated, exchanged or changed immediately prior to that transaction.

Section 102 Amendment to SEC Reports. Section 1035 of the Indenture is hereby amended and restated in its entirety as follows:

Notwithstanding that the Company may not be subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, the Company shall file to the extent permitted with the SEC and provide within 15 days to the Trustee and the Holders with such annual reports and such information, documents and other reports as are specified in Sections 13 and 15(d) of the Exchange Act and applicable to a U.S. corporation subject to such Sections, such information, documents and other reports to be so filed and provided at the times specified for the filing of such information, documents and reports under such Sections 13 and 15(d) of the Exchange Act. If the SEC will not accept such filings for any reasons, the Company shall post the specified reports on its public website within the time periods that would apply if the Company were required to file those reports with the SEC. Delivery of such information, documents and other reports to the Trustee is for informational purposes only, and the Trustee’s receipt of such shall not constitute constructive notice of any information contained therein or determinable from information contained therein, including the Company’s compliance with any of its covenants hereunder (as to which the Trustee is entitled to conclusively rely exclusively on an Officers’ Certificate). Notwithstanding the foregoing, following the consummation of the Merger and if and for so long as the 2021 Notes are fully and unconditionally guaranteed by Parent or any other direct or indirect parent company of Parent, the Company is permitted to elect to satisfy its obligations under this Section by delivering the corresponding reports, information and documents of Parent or such other entity within the timeframes set forth under this Section, provided, that to the extent Parent or such other entity qualifies as a foreign private issuer as defined in Rule 405 of the Securities Act, the phrase “U.S. corporation”, solely as used in this paragraph, shall be deemed to be replaced with “foreign private issuer” for all purposes; provided further, however, that if Parent or such other entity so qualifies as a foreign private issuer, it shall file on Form 6-K (or any successor form) within 60 days after the end of each of the first three fiscal quarters of each fiscal year, quarterly reports containing the following information: (i) an unaudited condensed consolidated balance sheet as of the end of such period and unaudited condensed statements of income and cash flows for such periods, and the comparable prior year periods, each under IFRS, together with condensed footnote disclosure; and (ii) an operating and financial review of the financial statements, including a discussion of the results of operations, financial condition, and liquidity and capital resources, and a discussion of material commitments and contingencies and changes in critical accounting policies.

ARTICLE II

MISCELLANEOUS PROVISIONS

Section 201 Effect of Supplemental Indenture.

From and after the Amendment Operative Time (as defined below), the Indenture shall be amended and supplemented in accordance herewith. Each reference in the Indenture to “this Indenture,” “hereunder,” “hereof,” or “herein” shall mean and be a reference to the Indenture as amended and supplemented by this Supplemental Indenture unless the context otherwise requires. The Indenture as amended and supplemented by this Supplemental Indenture shall be read, taken and construed as one and the same instrument, and every Holder of the Notes heretofore or hereafter authenticated and delivered under the Indenture as supplemented by this Supplemental Indenture shall be bound thereby.

Section 202 Effectiveness.

This Supplemental Indenture shall become effective and binding on the Company, the Subsidiary Guarantors, the Trustee and every Holder of the Notes heretofore or hereafter authenticated and delivered under the Indenture, upon the execution and delivery by the parties to this Supplemental Indenture; provided, however, that the Amendments shall become operative only upon the later of the (a) payment of the Consent Fee to the Consenting Holders in accordance with the terms and conditions of the Consent Solicitation and (b) consummation of the transactions contemplated by the Merger Agreement (the “Amendment Operative Time”), as notified to the Trustee in writing by the Company.

Section 203 Indenture Remains in Full Force and Effect.

Except as supplemented and amended hereby, all provisions in the Indenture shall remain in full force and effect.

Section 204 Confirmation of Indenture.

The Indenture, as supplemented and amended by this Supplemental Indenture, is in all respects confirmed and ratified.

Section 205 Conflict with Trust Indenture Act.

If any provision of this Supplemental Indenture limits, qualifies or conflicts with another provision hereof or of the Indenture which is required to be included in this Supplemental Indenture or the Indenture by any of the provisions of the Trust Indenture Act of 1939, such required provision shall control.

Section 206 Severability.

In case any one or more of the provisions in this Supplemental Indenture shall be held invalid, illegal or unenforceable, in any respect for any reason, the validity, legality and enforceability of any such provision in every other respect and of the remaining provisions shall not in any way be affected or impaired thereby, it being intended that all of the provisions hereof shall be enforceable to the full extent permitted by law.

Section 207 Successors.

All agreements of the Company and each Subsidiary Guarantor in this Supplemental Indenture shall bind its respective successors. All agreements of the Trustee in this Supplemental Indenture shall bind its successors.

Section 208 Certain Duties and Responsibilities of the Trustee.

In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture relating to the conduct or affecting the liability of or affording protection to the Trustee, whether or not elsewhere herein so provided. The Trustee, for itself and its successor or successors, accepts the terms of the Indenture as amended by this Supplemental Indenture, and agrees to perform the same, but only upon the terms and provisions defining and limiting the liabilities and responsibilities of the Trustee, which terms and provisions shall in like manner define and limit its liabilities and responsibilities in the performance of the trust created by the Indenture. The Trustee makes no representations as to the validity or sufficiency of this Supplemental Indenture other than as to the validity of its execution and delivery by the Trustee.

Section 209 Governing Law.

This Supplemental Indenture will be governed by and construed in accordance with the laws of the State of New York.

Section 210 Duplicate Originals.

All parties may sign any number of copies of this Supplemental Indenture. Each signed copy or counterpart shall be an original, but all of them together shall represent the same agreement.

Section 211 Effect of Headings.

The Section headings herein are for convenience only and shall not affect the construction hereof.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed, as of the date first set forth above.

|

| | |

| THE ISSUER: |

| | |

| TEREX CORPORATION |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Senior Vice President |

| | |

| SUBSIDIARY GUARANTORS: |

| | |

| CMI TEREX CORPORATION FANTUZZI NOELL USA, INC. GENIE HOLDINGS, INC. GENIE INDUSTRIES, INC. GENIE INTERNATIONAL, INC. POWERSCREEN HOLDINGS USA INC. POWERSCREEN NORTH AMERICA INC. TEREX ADVANCE MIXER, INC. TEREX AERIALS, INC. TEREX FINANCIAL SERVICES, INC. TEREX SOUTH DAKOTA, INC. TEREX WASHINGTON, INC. |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| POWERSCREEN INTERNATIONAL LLC |

| | |

| By: | Powerscreen North America, Inc., its managing member |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| | |

|

| | |

| POWERSCREEN USA LLC |

| | |

| By: | Powerscreen Holdings USA, Inc., its managing member |

| | |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Vice President |

| | |

| TEREX USA, LLC |

| |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: Senior Vice President |

| | |

| TEREX UTILITIES, INC. |

| |

| | |

| By: | /s/ Eric I Cohen |

| | Name: Eric I Cohen |

| | Title: President |

| | |

| | |

| | |

| | |

|

| | |

| THE TRUSTEE: |

| |

| HSBC BANK USA, NATIONAL ASSOCIATION, as Trustee |

| |

| | |

| By: | /s/ Annette Kos-Culkin |

| | Name: Annette Kos-Culkin |

| | Title: Vice President |

News Release

FOR IMMEDIATE RELEASE

TEREX CORPORATION ANNOUNCES RECEIPT OF REQUISITE CONSENTS FOR

CONSENT SOLICITATION

WESTPORT, CT, September 8, 2015 -- Terex Corporation (NYSE: TEX) ("Terex") announced today that it has received the requisite consents with respect to its previously announced consent solicitation from holders of its 6.00% Senior Notes due 2021 (the “2021 Notes”) and 6.50% Senior Notes due 2020 (the “2020 Notes” and together with the 2021 Notes, the “Notes”) to certain proposed amendments to the indentures governing the Notes. The consent solicitation was conducted in connection with the previously announced merger (the “Merger”) of Terex with Konecranes Plc, a Finnish public company limited by shares (“Konecranes”).

The consent solicitation expired at 5:00 p.m., New York City time, on September 4, 2015 (the “Expiration Time”). As of the Expiration Time, Terex had received the requisite consents needed to approve the proposed amendments to the indentures governing the Notes. These consents cannot be revoked.

Having received the requisite consents for each series of Notes, Terex intends to promptly execute supplemental indentures covering the proposed amendments to the indentures, as described in greater detail in the Consent Solicitation Notice (the “Notice”) previously provided to holders of Notes. The terms of the supplemental indentures will not become operative unless and until the remaining conditions to the consent solicitation have been satisfied or waived.

In the event that each of the conditions to the consent solicitation described in the Notice is satisfied or waived, including but not limited to consummation of the Merger, Terex will pay to each holder of record of Notes as of 5:00 p.m., New York City time, on August 26, 2015, who delivered a valid consent prior to the Expiration Time, a cash fee of $17.50 for each $1,000 principal amount of 2021 Notes and $10.00 for each $1,000 principal amount of 2020 Notes consented to by such holder. Holders of Notes of any series who did not submit consents prior to the Expiration Time will not receive a consent fee, even if the proposed amendments become operative with respect to such series of Notes. Subject to applicable law, the consent solicitation with respect to either series of Notes may be abandoned or terminated for any reason at any time, including after the Expiration Time and prior to the applicable proposed amendments becoming operative, in which case the consents received with respect to such series of Notes will be voided and no consent fee will be paid to any holders with respect to such consents.

Consummation of the Merger is expected to occur in the first half of 2016, subject to satisfaction of closing conditions including approval by Terex’s stockholders and Konecranes’ shareholders.

Terex engaged Credit Suisse Securities (USA) LLC to act as Solicitation Agent and Global Bondholder Services Corporation to act as Information and Tabulation Agent for the consent solicitation. Questions regarding the consent solicitation may be directed to Credit Suisse Securities (USA) LLC at (800) 820-1653 (toll-free) or (212) 538-2147 (collect). Requests for documents relating to the consent solicitation may be directed to Global Bondholder Services Corporation at (866) 470-3800 (toll-free), (212) 430-3774 (banks and brokers), (212) 430-3775/3779 (facsimile) and (212) 430-3774 (confirmation).

This press release is for informational purposes only and the consent solicitation was only made pursuant to the terms of the Notice and the related Consent Form. The consent solicitation was not made to, and consents were not solicited from, holders of Notes in any jurisdiction in which it is unlawful to make such consent solicitation or grant such consent. None of Terex, the Trustee, the Solicitation Agent or the Information and Tabulation Agent made any recommendation as to whether or not holders should deliver consents.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Forward-Looking Statements

This press release may contain forward-looking information and statements regarding Terex and the consent solicitation. Any statements included in this press release that address activities, events or developments that will or may occur in the future are forward looking, and include among others, statements regarding: (i) the proposed amendments, (ii) the expected payment of a consent fee, and (iii) the consummation of the Merger. Actual results may differ materially due to a variety of factors including: changed market conditions, the conditions for completing the Merger, the participation of and level of participation by the holders of Notes in the consent solicitation and other factors listed in the Notice under “Statement Regarding Forward-Looking Statements.” Except as required by law, Terex undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change. Do not place undue reliance on forward-looking information.

About Terex

Terex Corporation is a lifting and material handling solutions company reporting in five business segments: Aerial Work Platforms, Construction, Cranes, Material Handling & Port Solutions and Materials Processing. Terex manufactures a broad range of equipment for use in various industries, including the construction, infrastructure, manufacturing, shipping, transportation, refining, energy, utility, quarrying and mining industries. Terex offers financial products and services to assist in the acquisition of Terex equipment through Terex Financial Services. Terex uses its website (www.terex.com) and its Facebook page (www.facebook.com/TerexCorporation) to make information available to investors and the market.

Contact Information:

Tom Gelston

Vice President, Investor Relations

Phone: (203) 222-5943

Email: thomas.gelston@terex.com

# # #

Terex Corporation

200 Nyala Farm Road, Westport, Connecticut 06880

Telephone: (203) 222-7170, Fax: (203) 222-7976, www.terex.com

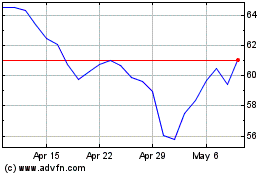

Terex (NYSE:TEX)

Historical Stock Chart

From Aug 2024 to Sep 2024

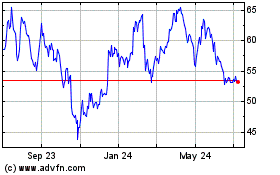

Terex (NYSE:TEX)

Historical Stock Chart

From Sep 2023 to Sep 2024