UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) May 28, 2015

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | |

Delaware | 1-10702 | 34-1531521 |

(State or Other Jurisdiction | (Commission | (IRS Employer |

of Incorporation) | File Number) | Identification No.) |

|

| |

200 Nyala Farm Road, Westport, Connecticut | 06880 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

|

|

NOT APPLICABLE |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry Into a Material Definitive Agreement.

On May 28, 2015, Terex Corporation (“Terex” or the “Company”), through certain of its subsidiaries, entered into a Loan and Security Agreement (the “Securitization Facility”) among TFS Funding I, LLC (the “Borrower”), Terex Financial Services, Inc., Institutional Secured Funding (Jersey) Limited (the “Conduit Lender”), Credit Suisse AG (Cayman Islands Branch) (the “Committed Lender”) and Credit Suisse AG (New York Branch). The Borrower is a bankruptcy remote subsidiary of the Company.

Under the Securitization Facility, the Borrower may, from time to time request the Conduit Lender to make loans to the Borrower. Such loans will be secured by and payable from collateral of the Borrower (primarily equipment loans and leases to Terex customers originated by Terex Financial Services and transferred to the Borrower). Any such loan may be made by the Conduit Lender in its sole discretion and if not made by the Conduit Lender, shall be made by the Committed Lender. The facility limit for such loans is $350,000,000. The Securitization Facility also contains customary representations, warranties and covenants.

The foregoing summary is qualified in its entirety by reference to the Securitization Facility, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015.

On May 29, 2015, Terex and certain of its subsidiaries entered into an Incremental Assumption Agreement and Amendment No. 1 (the “Amendment”) to the Credit Agreement dated as of August 13, 2014 (the “Credit Agreement”), with the lenders party thereto and Credit Suisse AG, as administrative agent and collateral agent. The principal change contained in the Amendment is the Company’s Euro denominated term loans will now bear interest at a rate of Euro Interbank Offered Rate (“EURIBOR”) plus 2.75% with a 0.75% EURIBOR floor. Previously, the Euro denominated term loans outstanding were priced at EURIBOR plus 3.25% with a 0.75% EURIBOR floor.

The foregoing summary is qualified in its entirety by reference to the Amendment, a copy of which is attached hereto and incorporated by reference herein as Exhibit 10.1 to this Current Report on Form 8-K. A copy of a press release announcing the Company’s entry into the Securitization Facility and the Amendment is included as Exhibit 99.1 to this Form 8-K.

Credit Suisse AG, or its affiliates, and certain lenders, or their affiliates, are party to other agreements with the Company and its subsidiaries, including the provision of commercial banking, investment banking, trustee and/or other financial services in the ordinary course of business of the Company and its subsidiaries.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report on Form 8-K regarding the Securitization Facility is hereby incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

|

| | |

(d) | | Exhibits |

| | |

10.1 | | Incremental Assumption Agreement and Amendment No. 1 dated as of May 29, 2015, to the Credit Agreement dated as of August 13, 2014, among Terex Corporation, the Lenders named therein and Credit Suisse AG, as Administrative Agent and Collateral Agent. |

| | |

99.1 | | Press release of Terex Corporation issued on June 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 2, 2015

|

|

TEREX CORPORATION |

|

By: /s/ Eric I Cohen |

Eric I Cohen Senior Vice President, Secretary and General Counsel |

INCREMENTAL ASSUMPTION AGREEMENT AND AMENDMENT NO. 1 dated as of May 29, 2015 (this “Agreement”), relating to the CREDIT AGREEMENT dated as of August 13, 2014 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”), among TEREX CORPORATION, a Delaware corporation (“Terex”), NEW TEREX HOLDINGS UK LIMITED, with company number 02962659, a limited company organized under the laws of England, TEREX INTERNATIONAL FINANCIAL SERVICES COMPANY, with company number 327184, a company organized under the laws of Ireland (the “European Borrower”), and TEREX AUSTRALIA PTY LTD (ACN 010 671 048), a company organized under the laws of Australia and registered in Queensland, Australia, the Lenders (as defined in Article I of the Credit Agreement), the Issuing Banks (as defined in Article I of the Credit Agreement) and CREDIT SUISSE AG, as administrative agent (in such capacity, the “Administrative Agent”) and as collateral agent (in such capacity, the “Collateral Agent”) for the Lenders.

A. Pursuant to Section 2.27 of the Credit Agreement, Terex and the European Borrower have requested that the persons set forth on Schedule I hereto (the “Incremental Euro Term Lenders”) provide Incremental Term Loans denominated in Euro (the “Incremental Euro Term Loans”; the commitments to make such loans, the “Incremental Euro Term Loan Commitments”) to the European Borrower in an aggregate principal amount equal to €199,000,000.

B. The Borrowers have requested that the Credit Agreement be amended in accordance with Section 2.27(b) of the Credit Agreement to reflect the existence and terms of this Agreement, the Incremental Euro Term Loan Commitments and the Incremental Euro Term Loans.

C. The Incremental Euro Term Lenders are willing to provide the European Borrower with the Incremental Euro Term Loans on the terms and subject to the conditions set forth herein and in the Credit Agreement.

D. Accordingly, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1. Defined Terms. Capitalized terms used and not defined herein shall have the meanings assigned to such terms in the Credit Agreement. The rules of interpretation set forth in Section 1.02 of the Credit Agreement are hereby incorporated by reference herein, mutatis mutandis. This Agreement shall be an “Incremental Assumption Agreement” for all purposes of the Credit Agreement and the other Loan Documents.

SECTION 2. Incremental Euro Term Loan Commitments. (a) On the terms and subject to the conditions set forth herein and in the Credit Agreement, each Incremental Euro Term Lender hereby agrees, severally and not jointly, to make an Incremental Euro Term Loan to the European Borrower on the Incremental Effective Date (as defined below) in an aggregate principal amount not to exceed the amount of the Incremental Euro Term Loan Commitment set forth opposite its name on Schedule I hereto. The European Borrower hereby unconditionally promises to repay the Incremental Euro Term Loans in accordance with Section 2.11 of the Credit Agreement. Amounts borrowed as Incremental Euro Term Loans and subsequently repaid may not be reborrowed.

(b) With effect from the Incremental Effective Date, unless the context shall otherwise require, (i) the Incremental Euro Term Loans shall constitute “Euro Term Loans” and “Loans” and (ii) each person that holds Incremental Euro Term Loans from time to time shall be a “Euro Term Lender” and a “Lender”, in each case, for all purposes under the Credit Agreement and the other Loan Documents.

(c) The proceeds of the Incremental Euro Term Loans shall be used solely to finance the repayment in full of the Euro Term Loans outstanding immediately prior to the Incremental Effective Date.

SECTION 3. Amendments. Effective as of the Incremental Effective Date, the Credit Agreement is hereby amended as follows:

(a) Section 1.01 of the Credit Agreement is hereby amended by adding the following definitions in proper alphabetical order:

“First Incremental Effective Date” shall mean the date on which the conditions precedent set forth in Section 5 of the Incremental Assumption Agreement and Amendment No. 1 shall have been satisfied, which date is May 29, 2015.

“Incremental Assumption Agreement and Amendment No. 1” shall mean that certain Incremental Assumption Agreement and Amendment No. 1 dated as of May 29, 2015, among the Borrowers, the lenders party thereto and Credit Suisse AG.

(b) The first sentence of the definition of the term “Applicable Percentage” set forth in Section 1.01 of the Credit Agreement is hereby amended in its entirety to read as follows:

“Applicable Percentage” shall mean, for any day (a) with respect to any Term Loan, (i) 2.75% per annum, in the case of a Eurocurrency Term Loan, or (ii) 1.75% per annum, in the case of an ABR Term Loan, and (b) with respect to any Australian Fronted Fixed Rate Loan, Australian Fronted Base Rate Loan, Eurocurrency Revolving Loan or ABR Revolving Loan, the applicable percentage set forth below under the caption “Eurocurrency Spread—Revolving

Loans” or “ABR Spread—Revolving Loans”, respectively, based upon the Consolidated Leverage Ratio as of the relevant date of determination:

(c) The definition of the term “Euro Term Loan Commitment” set forth in Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Euro Term Loan Commitment” shall have the meaning assigned to the term “Incremental Euro Term Loan Commitment” in the Incremental Assumption Agreement and Amendment No. 1.

(d) The definition of the term “Euro Term Loans” set forth in Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Euro Term Loans” shall have the meaning assigned to the term “Incremental Euro Term Loans” in the Incremental Assumption Agreement and Amendment No. 1.

(e) Section 2.11(a)(ii) of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(ii) The European Borrower shall pay to the Administrative Agent, for the account of the Euro Term Lenders, on the last Business Day of each March, June, September and December of each year (each such date being called a “Euro Term Loan Repayment Date”), commencing on the last Business Day of June 2015, a principal amount of the Euro Term Loans (as adjusted from time to time pursuant to Sections 2.12(b), 2.13(e), 2.27(d) and 9.04(l)) equal to €500,000, with the balance payable on the Term Loan Maturity Date, together in each case with accrued and unpaid interest on the principal amount to be paid to but excluding the date of such payment.

(f) The first clause of the first sentence of Section 2.12(d) of the Credit Agreement is hereby amended in its entirety to read as follows:

Notwithstanding the foregoing, in the event that, prior to the six-month anniversary of the Closing Date, in the case of U.S. Term Loans, or the First Incremental Effective Date, in the case of Euro Term Loans,

SECTION 4. Representations and Warranties. To induce the other parties hereto to enter into this Agreement, each Loan Party hereby represents and warrants to the Administrative Agent and each of the Incremental Euro Term Lenders that:

(a) This Agreement has been duly authorized, executed and delivered by it and constitutes its legal, valid and binding obligation, enforceable against each of the Loan Parties in accordance with its terms except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting

creditors’ rights generally and by general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity).

(b) At the time of and immediately after giving effect to this Agreement, the representations and warranties set forth in Article III of the Credit Agreement are true and correct in all material respects (or, in the case of any representations and warranties qualified by materiality, Material Adverse Effect or words of similar import, in all respects) on and as of the date hereof with the same effect as though made on and as of the date hereof, except to the extent such representations and warranties expressly relate to an earlier date, in which case they shall have been true and correct in all material respects (or, in the case of any representations and warranties qualified by materiality, Material Adverse Effect or words of similar import, in all respects) as of such earlier date.

(c) Each Borrower and each other Loan Party is in compliance in all material respects with all the terms and provisions set forth in each Loan Document on its part to be observed or performed, and at the time of and immediately after giving effect to this Agreement, no Event of Default or Default has occurred and is continuing.

SECTION 5. Conditions to Effectiveness. The effectiveness of this Agreement and the obligations of the Incremental Euro Term Lenders to provide the Incremental Euro Term Loans are subject to the satisfaction or waiver of the following conditions precedent (the date on which all such conditions are satisfied or waived, the “Incremental Effective Date”):

(a) the Administrative Agent shall have received counterparts of this Agreement that, when taken together, bear the signatures of each Loan Party and each Incremental Euro Term Lender;

(b) the representations and warranties set forth in Section 4 shall be true and correct, and the Administrative Agent shall have received a certificate to that effect, dated the Incremental Effective Date and signed by a President, a Vice President or a Financial Officer of Terex;

(c) Terex and the European Borrower shall have paid to the Administrative Agent and the Incremental Euro Term Lenders all fees and other amounts due and payable by them on or prior to the Incremental Effective Date and, to the extent invoiced, reimbursement or payment of all reasonable and documented out-of-pocket expenses required to be reimbursed or paid by any Loan Party under any Loan Document;

(d) the Administrative Agent shall have received (i) a certificate as to the good standing of each Loan Party as of a recent date, from the Secretary of State of the State (or comparable entity) of the state (or comparable jurisdiction) of its organization (or, if such jurisdiction does not issue such certificates, a comparable document or the results of searches of official registries demonstrating good standing or lack of insolvency proceedings against such Loan Party, as available); (ii) a certificate of the Secretary, Assistant Secretary or Director, as applicable, of each Loan Party dated the Incremental

Effective Date and certifying (A) that attached thereto is a true and complete copy of (1) the by-laws (or comparable organizational documents) and (2) the certificate or articles of incorporation (or comparable organizational documents), including all amendments thereto, certified as of a recent date by such Secretary of State (or comparable entity) (or, if no such certification is available, comparable certification or an extract of such documents filed with any official registry, as available), in each case of such Loan Party as in effect on the Incremental Effective Date and at all times since a date prior to the date of the resolutions described in clause (B) below (or, if such by-laws (or comparable documents) or certificate or articles of incorporation (or comparable documents) have not been amended or modified since any delivery thereof to the Administrative Agent on or following the Closing Date, certifying that no such amendment or modification has occurred), (B) that attached thereto is a true and complete copy of resolutions duly adopted by the Board of Directors (or comparable governing body) of such Loan Party authorizing the execution, delivery and performance of this Agreement and, in the case of the European Borrower, the borrowing hereunder, and that such resolutions have not been modified, rescinded or amended and are in full force and effect, and (C) as to the incumbency and specimen signature of each officer executing any Loan Document or any other document delivered in connection herewith on behalf of such Loan Party; and (iii) a certificate of another officer as to the incumbency and specimen signature of the Secretary or Assistant Secretary executing the certificate pursuant to clause (ii) above;

(e) on the Incremental Effective Date, immediately after giving effect to the making of the Incremental Euro Term Loans, the Senior Secured Leverage Ratio shall be less than or equal to 2.50 to 1.00, and the Administrative Agent shall have received a certificate to that effect (containing reasonably detailed calculations thereof) dated as of the Incremental Effective Date and executed by a Financial Officer of Terex;

(f) the Administrative Agent shall have received, on behalf of itself and the Lenders, executed legal opinions of (i) the General Counsel of Terex, (ii) Bryan Cave LLP, counsel to the Loan Parties, and (iii) Eversheds LLP, Irish counsel for the European Borrower, in each case, (A) dated the Incremental Effective Date, (B) addressed to the Administrative Agent and the Incremental Euro Term Lenders and (C) covering such matters as the Administrative Agent shall reasonably request, and Terex and the European Borrower hereby request such counsel to deliver such opinions; and

(g) the Administrative Agent shall have received all documentation and other information reasonably requested by it that is required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including the USA PATRIOT Act.

The Administrative Agent shall notify Terex and the Incremental Euro Term Lenders of the Incremental Effective Date, and such notice shall be conclusive and binding.

SECTION 6. Real Estate Collateral. Terex shall, and shall cause its Subsidiaries to, deliver to the Collateral Agent as soon as practicable and in any event within 60 calendar days after the Incremental Effective Date (or such later date as shall be acceptable to the Collateral Agent in its sole discretion), (i) an amendment to the Mortgage encumbering the Mortgaged Property which shall provide that such Mortgage remains in full force and effect and continues to secure the Obligations and (ii) if available in the applicable jurisdiction, a date down endorsement to the mortgagee’s title policy issued to the Administrative Agent in connection with the Mortgage in respect of the Mortgaged Property, in each case in form and substance satisfactory to the Administrative Agent.

SECTION 7. Consent and Reaffirmation. Each Borrower and each other Loan Party hereby (a) consents to this Agreement and the transactions contemplated hereby, (b) agrees that, notwithstanding the effectiveness of this Agreement, the Guarantee and Collateral Agreement, the North Atlantic Guarantee Agreement and each of the other Security Documents continue to be in full force and effect, (c) affirms and confirms its guarantee (in the case of a Guarantor) of the Obligations and the pledge of and/or grant of a security interest in its assets as Collateral pursuant to the Security Documents to secure such Obligations, all as provided in the Loan Documents, and (d) acknowledges and agrees that such guarantee, pledge and/or grant continues in full force and effect in respect of, and to secure, the Obligations under the Credit Agreement and the other Loan Documents, including the Incremental Euro Term Loans.

SECTION 8. Applicable Law. THIS AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

SECTION 9. Counterparts. This Agreement may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original but all of which when taken together shall constitute a single contract. Delivery of an executed signature page to this Agreement by facsimile or other electronic transmission shall be effective as delivery of a manually signed counterpart of this Agreement.

SECTION 10. Notices. All notices hereunder or in connection herewith shall be given in accordance with the provisions of Section 9.01 of the Credit Agreement.

SECTION 11. Headings. Section headings used herein are for convenience of reference only, are not part of this Agreement and are not to affect the construction of, or to be taken into consideration in interpreting, this Agreement.

[Remainder of this page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officers as of the day and year first above written.

|

| |

TEREX CORPORATION, |

by |

| |

| Name: Eric I Cohen |

| Title: Senior Vice President |

|

| |

NEW TEREX HOLDINGS UK LIMITED, |

by |

| |

| Name: Eric I Cohen |

| Title: Director |

|

| |

TEREX INTERNATIONAL FINANCIAL SERVICES COMPANY, |

by |

| |

| Name: |

| Title: Director |

|

| | |

TEREX AUSTRALIA PTY LTD (ACN 010 671 048),

|

by |

| |

| Name: Kevin P. Bradley |

| Title: Director |

|

by |

| |

| Name: Eric I Cohen |

| Title: Director |

|

| |

GENIE HOLDINGS, INC.

GENIE INDUSTRIES, INC.

GENIE INTERNATIONAL, INC.

TEREX SOUTH DAKOTA, INC.

TEREX WASHINGTON, INC., |

By |

| |

| Name: Eric I Cohen |

| Title: Vice President |

|

| |

TEREX USA, LLC. |

By |

| |

| Name: Eric I Cohen |

| Title: Senior Vice President |

|

| |

TEREX UTILITIES, INC. |

By |

| |

| Name: Eric I Cohen |

| Title: President |

|

| |

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH, individually and as Administrative Agent and Collateral Agent, |

|

by |

| |

| Name: |

| Title: |

|

by |

| |

| Name: |

| Title: |

|

| |

News Release

FOR IMMEDIATE RELEASE

TEREX ANNOUNCES NEW $350 MILLION SECURITIZATION FACILITY

AND RE-PRICING OF EURO TERM LOANS

WESTPORT, CT, June 1, 2015 -- Terex Corporation (NYSE: TEX) today announced that it has closed a new $350 million asset-backed securitization transaction.

The Company also announced it has completed a re-pricing of its Euro term loan that is expected to reduce its cash interest costs by approximately $1 million annually.

“We are pleased to announce the completion of our first securitization facility,” said Kevin Bradley, Terex Chief Financial Officer. “As we continue to grow and expand our Terex Financial Services (TFS) business, achieving a lower cost of funding is very important to our success. The additional liquidity afforded by this facility provides us with a new source of lower cost funds that will be deployed to help our customers secure equipment financing at competitive rates. It also strengthens our capacity to grow organically. The closing of our new securitization facility, coupled with the re-pricing of our Euro term loans, marks another milestone as we continue to improve our Company’s financial efficiency.”

The commercial paper conduit facility will finance and is secured by equipment loan and lease receivables originated by TFS in the United States and Canada. The new facility will supplement TFS’s ability to provide customer solutions for Terex equipment financing, adding to the existing underwriting, warehousing and syndication practices already in place.

Contact Information:

Tom Gelston

Vice President, Investor Relations

Phone: (203) 222-5943

Email: thomas.gelston@terex.com

About Terex

Terex Corporation is a lifting and material handling solutions company reporting in five business segments: Aerial Work Platforms, Construction, Cranes, Material Handling & Port Solutions and Materials Processing. Terex manufactures a broad range of equipment for use in various industries, including the construction, infrastructure, manufacturing, shipping, transportation, refining, energy, utility, quarrying and mining industries. Terex offers financial products and services to assist in the acquisition of Terex equipment through Terex Financial Services. Terex uses its website (www.terex.com) and its Facebook page (www.facebook.com/TerexCorporation) to make information available to its investors and the market.

# # #

Terex Corporation

200 Nyala Farm Road, Westport, Connecticut 06880

Telephone: (203) 222-7170, Fax: (203) 222-7976, www.terex.com

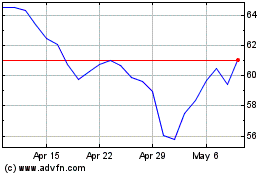

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

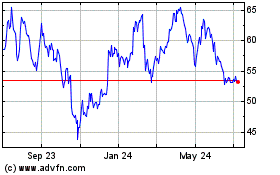

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024