UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 29, 2015

TAL INTERNATIONAL GROUP, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

| | | | |

Delaware | | 333-126317 | | 20-1796526 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

100 Manhattanville Road

Purchase, New York 10577-2135

(Address of Principal Executive Offices, including Zip Code)

Telephone: (914) 251-9000

(Registrant's Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On April 29, 2015, TAL International Group, Inc. issued a press release announcing its results of operations for the quarter ended March 31, 2015. A copy of the press release is furnished with this report as Exhibit 99.1.

The information in this Current Report on Form 8-K, including the attached exhibit, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release issued by TAL International Group, Inc. dated April 29, 2015.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| TAL International Group, Inc. |

| |

Dated: April 29, 2015 | By: | /s/ John Burns |

| | Name: | John Burns |

| | Title: | Senior Vice President and Chief Financial Officer |

3

TAL INTERNATIONAL GROUP, INC. REPORTS FIRST QUARTER 2015 RESULTS

Purchase, New York, April 29, 2015 – TAL International Group, Inc. (NYSE: TAL), one of the world’s largest lessors of intermodal freight containers and chassis, today reported results for the first quarter ended March 31, 2015.

Highlights:

| |

• | TAL reported Adjusted pre-tax income of $1.23 per fully diluted common share for the first quarter of 2015, a decrease of 12.8% from the first quarter of 2014. |

| |

• | TAL reported leasing revenues of $149.0 million for the first quarter of 2015, an increase of 2.9% from the first quarter of 2014. |

| |

• | TAL continues to achieve strong operational performance. Utilization averaged 97.9% for the first quarter of 2015, and through April 28, 2015, we have invested $344 million in new and sale-leaseback containers for delivery in 2015. |

| |

• | TAL announced a quarterly dividend of $0.72 per share payable on June 24, 2015 to shareholders of record as of June 3, 2015. |

Financial Results

The following table depicts TAL’s selected key financial information for the three months ended March 31, 2015 and 2014 (dollars in millions, except per share data):

|

| | | | | | | |

| Three Months Ended

March 31, |

| 2015 | 2014 | % Change |

Adjusted pre-tax income(1) |

| $40.5 |

|

| $47.5 |

| (14.7%) |

Adjusted pre-tax income(1) per share |

| $1.23 |

|

| $1.41 |

| (12.8%) |

Leasing revenues |

| $149.0 |

|

| $144.8 |

| 2.9% |

Adjusted EBITDA(1) |

| $138.6 |

|

| $141.0 |

| (1.7%) |

Adjusted net income(1) |

| $26.2 |

|

| $31.0 |

| (15.5%) |

Adjusted net income(1) per share |

| $0.79 |

|

| $0.92 |

| (14.1%) |

Net income |

| $25.8 |

|

| $30.0 |

| (14.0%) |

Net income per share |

| $0.78 |

|

| $0.89 |

| (12.4%) |

Note: All per share data is per fully diluted common share. |

The Company focuses on adjusted pre-tax results since it considers gains and losses on interest rate swaps and the write-off of deferred financing costs to be unrelated to operating performance and since it does not expect to pay any significant income taxes for a number of years due to the availability of accelerated tax depreciation on its existing container fleet and anticipated future equipment purchases.

Operating Performance

“TAL achieved solid results in the first quarter of 2015,” commented Brian M. Sondey, President and CEO of TAL International. “We generated $40.5 million of Adjusted pre-tax income, representing $1.23 of Adjusted pre-tax income per share. We grew our leasing revenues 2.9% from the first quarter of 2014, and we continued to generate an attractive level of returns. In the first quarter of 2015, our annualized Adjusted pre-tax return on tangible equity(1) was 15.9%.”

“Our financial performance continues to be supported by strong utilization. Our utilization averaged 97.9% in the first quarter of 2015, and finished the quarter at 97.7%. Our utilization currently stands at 97.3%. While the first quarter represents the slow season for dry containers, the global supply / demand balance for containers remains generally favorable and most forecasters expect global containerized trade growth to remain in the five percent range in 2015. Our utilization is also supported by our high quality lease portfolio. As of March 31, 2015, 75.6% of our containers on-hire were covered by long-term or finance leases, with an average remaining duration of 42 months assuming no leases are renewed.”

“While our financial performance remained solid in the first quarter, our Adjusted pre-tax income per share decreased 12.8% from the first quarter of 2014. The decrease in our earnings in the first quarter of 2015 primarily reflects ongoing pressure on leasing rates and used container sale prices. Market leasing rates have been well below the average lease rates in our portfolio for several years, and lease rates have reached new lows in 2015 due to decreases in the price of steel and new containers. Our average lease rate fell 5.4% from the first quarter of 2014 to the first quarter of 2015 on a CEU basis, excluding the impact of sale-leaseback transactions."

“The drop in new container prices has also added pressure to our used container selling prices, which were further impacted by the general appreciation of the U.S. dollar against most major foreign currencies. Average used container sale prices were down roughly 25% from the first quarter of 2014, and we recorded a $1.4 million loss on disposals in the first quarter of 2015. Most of the loss on disposals was attributable to containers purchased through sale-leaseback transactions. Sale-leaseback containers typically are purchased for prices above the net book value of like-age TAL equipment. Our sale-leaseback portfolio remains profitable despite the disposal losses due to lease revenues received under the terms of the leasebacks.”

“Our first quarter results were also negatively impacted by a large transaction combining an early lease extension with a sizable pre-committed lease for new containers. While we believe the transaction will be attractive for TAL over the long term, it had a negative impact on our first quarter results. The early lease extension reduced our first quarter revenue by roughly $0.6 million, while long-term interest rate hedging associated with the pick-up commitment contributed to the increase in our average effective interest rate in the first quarter, which added roughly $1.5 million to our interest expense. The financial impact of the deal will improve as the committed containers are picked up and placed on-hire.”

Outlook

Mr. Sondey continued, “We currently expect our operating and financial performance to improve as we move into the seasonally stronger part of the year. We expect our utilization to remain at a high level and continue to be supported by solid trade growth and a market share shift from owned to leased containers. We also have over 100,000 TEU of containers pre-committed to leases, which will help drive on-hire growth as seasonal demand ramps-up. We also expect used container selling prices to stabilize due to seasonal demand. However, we expect our average lease rates will continue to be pulled down by very low market lease rates and that aggressive competition for new deals will continue to limit the profitability of our new investments and growth. Overall, we expect our Adjusted pre-tax income to increase slightly from the first quarter of 2015 to the second, and we currently expect that our financial performance will improve from the second quarter through the rest of the year.”

Dividend

TAL’s Board of Directors has approved and declared a $0.72 per share quarterly cash dividend on its issued and outstanding common stock, payable on June 24, 2015 to shareholders of record at the close of business on June 3, 2015. Based on the information available today, we believe this distribution will qualify as a return of capital rather than a taxable dividend for U.S. tax purposes. Investors should consult with a tax adviser to determine the proper tax treatment of this distribution.

Investors’ Webcast

TAL will hold a Webcast at 9 a.m. (New York time) on Thursday, April 30, 2015 to discuss its first quarter results. An archive of the Webcast will be available one hour after the live call through Friday, June 5, 2015. To access the live Webcast or archive, please visit the Company’s website at http://www.talinternational.com.

About TAL International Group, Inc.

TAL is one of the world’s largest lessors of intermodal freight containers and chassis with 17 offices in 11 countries and approximately 230 third-party container depot facilities in 40 countries. The Company’s global operations include the acquisition, leasing, re-leasing and subsequent sale of multiple types of intermodal containers and chassis. TAL’s fleet consists of approximately 1,444,000 containers and related equipment representing approximately 2,372,000 twenty-foot equivalent units (TEUs). This places TAL among the world’s largest independent lessors of intermodal containers and chassis as measured by fleet size.

Contact

John Burns

Senior Vice President and Chief Financial Officer

Investor Relations

(914) 697-2900

Important Cautionary Information Regarding Forward-Looking Statements

Statements in this press release regarding TAL International Group, Inc.'s business that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that these statements involve risks and uncertainties, are only predictions and may differ materially from actual future events or results. For a discussion of such risks and uncertainties, see "Risk Factors" in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 19, 2015.

The Company’s views, estimates, plans and outlook as described within this document may change subsequent to the release of this statement. The Company is under no obligation to modify or update any or all of the statements it has made herein despite any subsequent changes the Company may make in its views, estimates, plans or outlook for the future.

(1) Adjusted pre-tax income, Adjusted EBITDA, Adjusted net income, and Adjusted pre-tax return on tangible equity are non-GAAP measurements we believe are useful in evaluating our operating performance. The Company’s definition and calculation of Adjusted pre-tax income, Adjusted EBITDA, Adjusted net income, and Adjusted pre-tax return on tangible equity are outlined in the attached schedules.

Please see below for a detailed reconciliation of these financial measurements.

-Financial Tables Follow-

TAL INTERNATIONAL GROUP, INC.

Consolidated Balance Sheets

(Dollars in thousands, except share data)

(Unaudited)

|

| | | | | | |

| March 31,

2015 | December 31,

2014 |

ASSETS: | |

| |

|

Leasing equipment, net of accumulated depreciation and allowances of $1,095,975 and $1,055,864 | $ | 3,822,885 |

| $ | 3,674,031 |

|

Net investment in finance leases, net of allowances of $1,056 and $1,056 | 210,200 |

| 219,872 |

|

Equipment held for sale | 58,195 |

| 59,861 |

|

Revenue earning assets | 4,091,280 |

| 3,953,764 |

|

Unrestricted cash and cash equivalents | 71,709 |

| 79,132 |

|

Restricted cash | 35,042 |

| 35,649 |

|

Accounts receivable, net of allowances of $955 and $978 | 84,368 |

| 85,681 |

|

Goodwill | 74,523 |

| 74,523 |

|

Deferred financing costs | 31,582 |

| 32,937 |

|

Other assets | 13,482 |

| 11,400 |

|

Fair value of derivative instruments | 224 |

| 1,898 |

|

Total assets | $ | 4,402,210 |

| $ | 4,274,984 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY: | |

| |

|

Equipment purchases payable | $ | 67,380 |

| $ | 88,336 |

|

Fair value of derivative instruments | 29,005 |

| 10,394 |

|

Accounts payable and other accrued expenses | 52,173 |

| 57,877 |

|

Net deferred income tax liability | 418,298 |

| 411,007 |

|

Debt | 3,180,800 |

| 3,040,842 |

|

Total liabilities | 3,747,656 |

| 3,608,456 |

|

Stockholders' equity: | |

| |

|

Preferred stock, $0.001 par value, 500,000 shares authorized, none issued | — |

| — |

|

Common stock, $0.001 par value, 100,000,000 shares authorized, 37,165,033 and 37,006,283 shares issued respectively | 37 |

| 37 |

|

Treasury stock, at cost, 3,911,843 and 3,829,928 shares | (75,310 | ) | (71,917 | ) |

Additional paid-in capital | 506,893 |

| 504,891 |

|

Accumulated earnings | 248,581 |

| 246,766 |

|

Accumulated other comprehensive (loss) | (25,647 | ) | (13,249 | ) |

Total stockholders' equity | 654,554 |

| 666,528 |

|

Total liabilities and stockholders' equity | $ | 4,402,210 |

| $ | 4,274,984 |

|

TAL INTERNATIONAL GROUP, INC.

Consolidated Statements of Income

(Dollars and shares in thousands, except earnings per share)

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31, |

| 2015 | | 2014 |

Leasing revenues: | | | |

Operating leases | $ | 144,568 |

| | $ | 139,330 |

|

Finance leases | 4,024 |

| | 4,953 |

|

Other revenues | 383 |

| | 484 |

|

Total leasing revenues | 148,975 |

| | 144,767 |

|

| | | |

Equipment trading revenues | 16,845 |

| | 12,487 |

|

Equipment trading expenses | (15,431 | ) | | (10,839 | ) |

Trading margin | 1,414 |

| | 1,648 |

|

| | | |

Net (loss) gain on sale of leasing equipment | (1,449 | ) | | 3,096 |

|

| | | |

Operating expenses: | | | |

Depreciation and amortization | 58,384 |

| | 53,803 |

|

Direct operating expenses | 8,822 |

| | 8,682 |

|

Administrative expenses | 11,982 |

| | 11,832 |

|

(Reversal) provision for doubtful accounts | (23 | ) | | 31 |

|

Total operating expenses | 79,165 |

| | 74,348 |

|

Operating income | 69,775 |

| | 75,163 |

|

Other expenses: | | | |

Interest and debt expense | 29,243 |

| | 27,619 |

|

Write-off of deferred financing costs | — |

| | 1,170 |

|

Net loss on interest rate swaps | 716 |

| | 373 |

|

Total other expenses | 29,959 |

| | 29,162 |

|

Income before income taxes | 39,816 |

| | 46,001 |

|

Income tax expense | 14,059 |

| | 15,990 |

|

Net income | $ | 25,757 |

| | $ | 30,011 |

|

Net income per common share—Basic | $ | 0.78 |

| | $ | 0.89 |

|

Net income per common share—Diluted | $ | 0.78 |

| | $ | 0.89 |

|

Cash dividends paid per common share | $ | 0.72 |

| | $ | 0.72 |

|

Weighted average number of common shares outstanding—Basic | 32,861 |

| | 33,608 |

|

Dilutive stock options and restricted stock | 149 |

| | 168 |

|

Weighted average number of common shares outstanding—Diluted | 33,010 |

| | 33,776 |

|

TAL INTERNATIONAL GROUP, INC.

Consolidated Statements of Cash Flows

(Dollars in thousands)

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31, |

| 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 25,757 |

| | $ | 30,011 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 58,384 |

| | 53,803 |

|

Amortization of deferred financing costs | 1,979 |

| | 1,922 |

|

Amortization of net loss on terminated derivative instruments designated as cash flow hedges | 687 |

| | 715 |

|

Net loss (gain) on sale of leasing equipment | 1,449 |

| | (3,096 | ) |

Net loss on interest rate swaps | 716 |

| | 373 |

|

Write-off of deferred financing costs | — |

| | 1,170 |

|

Deferred income taxes | 14,059 |

| | 15,990 |

|

Stock compensation charge | 2,002 |

| | 1,808 |

|

Changes in operating assets and liabilities: | | | |

Net equipment purchased for resale activity | (10,554 | ) | | (8,677 | ) |

Net realized gain (loss) on interest rate swaps terminated prior to their contractual maturities | — |

| | (1,670 | ) |

Other changes in operating assets and liabilities | (3,231 | ) | | (17,918 | ) |

Net cash provided by operating activities | 91,248 |

| | 74,431 |

|

Cash flows from investing activities: | | | |

Purchases of leasing equipment and investments in finance leases | (258,552 | ) | | (148,622 | ) |

Proceeds from sale of equipment, net of selling costs | 37,661 |

| | 39,461 |

|

Cash collections on finance lease receivables, net of income earned | 10,474 |

| | 12,004 |

|

Other | (74 | ) | | 25 |

|

Net cash (used in) investing activities | (210,491 | ) | | (97,132 | ) |

Cash flows from financing activities: | | | |

Purchases of treasury stock | (4,446 | ) | | — |

|

Stock options exercised and stock related activity | — |

| | (51 | ) |

Financing fees paid under debt facilities | (624 | ) | | (3,276 | ) |

Borrowings under debt facilities | 230,000 |

| | 356,017 |

|

Payments under debt facilities and capital lease obligations | (90,061 | ) | | (302,231 | ) |

Decrease (increase) in restricted cash | 607 |

| | (2,109 | ) |

Common stock dividends paid | (23,656 | ) | | (24,201 | ) |

Net cash provided by financing activities | 111,820 |

| | 24,149 |

|

Net (decrease) increase in unrestricted cash and cash equivalents | $ | (7,423 | ) | | $ | 1,448 |

|

Unrestricted cash and cash equivalents, beginning of period | 79,132 |

| | 68,875 |

|

Unrestricted cash and cash equivalents, end of period | $ | 71,709 |

| | $ | 70,323 |

|

Supplemental non-cash investing activities: | | | |

Equipment purchases payable | $ | 67,380 |

| | $ | 95,068 |

|

The following table sets forth TAL’s equipment fleet utilization(2) as of and for the quarter ended March 31, 2015:

|

| | | | |

Average and Ending Utilization for the Quarter Ended March 31, 2015 |

Average Utilization | | Ending Utilization |

97.9 | % | | 97.7 | % |

(2) Utilization is computed by dividing TAL’s total units on lease (in cost equivalent units, or "CEUs") by the total units in TAL’s fleet (in CEUs) excluding new units not yet leased and off-hire units designated for sale.

The following table provides the composition of TAL’s equipment fleet as of March 31, 2015 (in units, TEUs and CEUs):

|

| | | | | | | | | | | | |

| March 31, 2015 |

| Equipment Fleet in Units | Equipment Fleet in TEUs |

| Owned | Managed | Total | Owned | Managed | Total |

Dry | 1,244,482 |

| 15,151 |

| 1,259,633 |

| 2,019,040 |

| 26,440 |

| 2,045,480 |

|

Refrigerated | 66,048 |

| 30 |

| 66,078 |

| 125,441 |

| 48 |

| 125,489 |

|

Special | 56,797 |

| 747 |

| 57,544 |

| 103,619 |

| 1,312 |

| 104,931 |

|

Tank | 9,555 |

| — |

| 9,555 |

| 9,555 |

| — |

| 9,555 |

|

Chassis | 19,885 |

| — |

| 19,885 |

| 35,443 |

| — |

| 35,443 |

|

Equipment leasing fleet | 1,396,767 |

| 15,928 |

| 1,412,695 |

| 2,293,098 |

| 27,800 |

| 2,320,898 |

|

Equipment trading fleet | 31,264 |

| — |

| 31,264 |

| 50,865 |

| — |

| 50,865 |

|

Total | 1,428,031 |

| 15,928 |

| 1,443,959 |

| 2,343,963 |

| 27,800 |

| 2,371,763 |

|

Percentage | 98.9 | % | 1.1 | % | 100.0 | % | 98.8 | % | 1.2 | % | 100.0 | % |

|

|

| | | | | |

| March 31, 2015 | | | |

| Equipment Fleet in CEUs | | | |

| Owned | Managed | Total | | | |

Operating leases | 2,574,642 |

| 23,767 |

| 2,598,409 |

| | | |

Finance leases | 196,914 |

| 825 |

| 197,739 |

| | | |

Equipment trading fleet | 114,614 |

| — |

| 114,614 |

| | | |

Total | 2,886,170 |

| 24,592 |

| 2,910,762 |

| | | |

Percentage | 99.2 | % | 0.8 | % | 100.0 | % | | | |

| | | | | | |

Non-GAAP Financial Measures

We use the terms "EBITDA", “Adjusted EBITDA”, "Adjusted pre-tax income", "Adjusted net income", and "Adjusted pre-tax return on tangible equity" throughout this press release.

EBITDA is defined as net income before interest and debt expense, income tax expense, depreciation and amortization, and the write-off of deferred financing costs. Adjusted EBITDA is defined as EBITDA excluding gains and losses on interest rate swaps, plus principal payments on finance leases.

Adjusted pre-tax income is defined as income before income taxes as further adjusted for certain items which are described in more detail below, which management believes are not representative of our operating performance. Adjusted pre-tax income excludes gains and losses on interest rate swaps and the write-off of deferred financing costs. Adjusted net income is defined as net income further adjusted for the items discussed above, net of income tax.

Adjusted pre-tax return on tangible equity is defined as the current quarter's Annualized adjusted pre-tax income divided by the average adjusted tangible equity. Adjusted tangible equity is defined as total stockholders' equity plus net deferred income tax liability and the net fair value of derivative instruments less goodwill.

EBITDA, Adjusted EBITDA, Adjusted pre-tax income, Adjusted net income, and Adjusted pre-tax return on tangible equity are not presentations made in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Adjusted pre-tax income, Adjusted net income, and Adjusted pre-tax return on tangible equity should not be considered as alternatives to, or more meaningful than, amounts determined in accordance with U.S. GAAP, including net income, or net cash from operating activities.

We believe that EBITDA, Adjusted EBITDA, Adjusted pre-tax income, Adjusted net income, and Adjusted pre-tax return on tangible equity are useful to an investor in evaluating our operating performance because:

-- these measures are widely used by securities analysts and investors to measure a company's operating performance without regard to items such as interest and debt expense, income tax expense, depreciation and amortization, and gains and losses on interest rate swaps, which can vary substantially from company to company depending upon accounting methods and the book value of assets, capital structure and the method by which assets were acquired;

-- these measures help investors to more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure, our asset base and certain non-routine events which we do not expect to occur in the future; and

-- these measures are used by our management for various purposes, including as measures of operating performance to assist in comparing performance from period to period on a consistent basis, in presentations to our board of directors concerning our financial performance and as a basis for strategic planning and forecasting.

We have provided reconciliations of net income, the most directly comparable U.S. GAAP measure, to EBITDA and Adjusted EBITDA in the tables below for the three months ended March 31, 2015 and 2014. We have provided reconciliations of income before income taxes and net income, the most directly comparable U.S. GAAP measures, to Adjusted pre-tax income and Adjusted net income in the tables below for the three months ended March 31, 2015 and 2014.

We have also provided a reconciliation of Adjusted pre-tax return on tangible equity in the tables below for the current quarter.

|

| | | | | | |

TAL INTERNATIONAL GROUP, INC. Non-GAAP Reconciliations of EBITDA and Adjusted EBITDA

(Dollars in Thousands) |

| Three Months Ended

March 31, |

| 2015 | 2014 |

Net income | $ | 25,757 |

| $ | 30,011 |

|

Add: | | |

Depreciation and amortization | 58,384 |

| 53,803 |

|

Interest and debt expense | 29,243 |

| 27,619 |

|

Write-off of deferred financing costs | — |

| 1,170 |

|

Income tax expense | 14,059 |

| 15,990 |

|

EBITDA | 127,443 |

| 128,593 |

|

Add: | | |

Net loss on interest rate swaps | 716 |

| 373 |

|

Principal payments on finance lease | 10,474 |

| 12,004 |

|

Adjusted EBITDA | $ | 138,633 |

| $ | 140,970 |

|

| | |

TAL INTERNATIONAL GROUP, INC. Non-GAAP Reconciliations of Adjusted Pre-tax Income and Adjusted Net Income

(Dollars and Shares in Thousands, Except Per Share Data) |

| Three Months Ended

March 31, |

| 2015 | 2014 |

Income before income taxes | $ | 39,816 |

| $ | 46,001 |

|

Add: | | |

Write-off of deferred financing costs | — |

| 1,170 |

|

Net loss on interest rate swaps | 716 |

| 373 |

|

Adjusted pre-tax income | $ | 40,532 |

| $ | 47,544 |

|

Adjusted pre-tax income per fully diluted common share |

| $1.23 |

|

| $1.41 |

|

Weighted average number of common shares outstanding—Diluted | 33,010 |

| 33,776 |

|

| | |

| Three Months Ended

March 31, |

| 2015 | 2014 |

Net income | $ | 25,757 |

| $ | 30,011 |

|

Add: | | |

Write-off of deferred financing costs, net of tax(a) | — |

| 763 |

|

Net loss on interest rate swaps, net of tax(a) | 463 |

| 243 |

|

Adjusted net income(a) | $ | 26,220 |

| $ | 31,017 |

|

Adjusted net income per fully diluted common share |

| $0.79 |

|

| $0.92 |

|

Weighted average number of common shares outstanding—Diluted | 33,010 |

| 33,776 |

|

| | |

(a) The differences between Adjusted net income and reported net income in the three months ended March 31, 2015 and 2014 were due to net losses on interest rate swaps and the write-off of deferred financing costs. TAL uses interest rate swaps to synthetically fix the interest rates for most of its floating rate debt so that the duration of the fixed interest rates more closely matches the expected duration of TAL’s lease portfolio. |

|

| | | | | | |

TAL INTERNATIONAL GROUP, INC.

Non-GAAP Reconciliations of Adjusted Pre-tax Return on Tangible Equity

(Dollars in Thousands)

|

| Balance as of March 31, 2015 | Balance as of December 31, 2014 |

Total stockholders' equity | $ | 654,554 |

| $ | 666,528 |

|

Net deferred income tax liability | 418,298 |

| 411,007 |

|

Net fair value of derivative instruments liability | 28,781 |

| 8,496 |

|

Goodwill | (74,523 | ) | (74,523 | ) |

Total adjusted tangible equity | $ | 1,027,110 |

| $ | 1,011,508 |

|

Average adjusted tangible equity(a) | $ | 1,019,309 |

| |

Adjusted pre-tax income (for the current three months ended) | $ | 40,532 |

| |

Annualized adjusted pre-tax income (Adjusted pre-tax income * 4) | $ | 162,128 |

| |

Adjusted pre-tax return on tangible equity | 15.9 | % | |

| | |

(a) Calculated by taking the average of the current quarter's and the prior quarter's ending total adjusted tangible equity. |

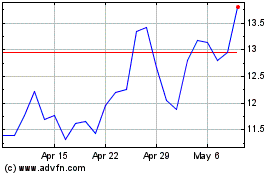

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024