UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 1, 2016

Sysco Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-06544 |

|

74-1648137 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1390 Enclave Parkway, Houston, TX 77077-2099

(Address of principal executive office) (zip code)

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 2 – FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition.

On February 1, 2016, Sysco Corporation (“Sysco”) issued a press release announcing its results of operations and financial

condition for its second quarter of fiscal year 2016, which ended on December 26, 2015. Sysco hereby incorporates by reference herein the information set forth in its press release dated February 1, 2016 (the “Press Release”), a

copy of which is attached hereto as Exhibit 99.1.

Except for the historical information contained in this report, the statements

made by Sysco are forward looking statements that involve risks and uncertainties. All such statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Sysco’s future financial performance could

differ significantly from the expectations of management and from results expressed or implied in the Press Release. Forward-looking statements in the Press Release are subject to certain risks and uncertainties described in the Press Release. For

further information on other risk factors, please refer to the “Risk Factors” contained in Sysco’s Annual Report on Form 10-K for the fiscal year ended June 27, 2015, as filed with the Securities and Exchange Commission.

The Press Release contains certain non-GAAP financial measures that are adjusted to exclude certain items to provide an important perspective

with respect to our results and meaningful supplemental information to both management and investors that removes these items which are difficult to predict and are often unanticipated, and which, as a result, are difficult to include in

analysts’ financial models and our investors’ expectations with any degree of specificity. The non-GAAP measures presented in the Press Release and the most directly comparable financial measures calculated and presented in accordance with

GAAP include the following:

| |

• |

|

For the second quarter of fiscal 2016, operating income increased 37.1% to $433 million and adjusted operating income increased 10.2% to $437 million; diluted EPS increased 77.8% to $0.48 and adjusted diluted EPS

increased $0.07 to $0.48. |

| |

• |

|

For the first half of fiscal 2016, operating income increased 18.6% to $926 million and adjusted operating income increased 4.2% to $943 million; diluted EPS increased 21% to $0.88 and adjusted diluted EPS increased

$0.07 to $1.00. |

The Press Release includes other non-GAAP financial measures that are presented with the directly

comparable financial measures calculated and presented in accordance with GAAP. The adjusted non-GAAP financial measures presented here and in the Press Release should be analyzed in conjunction with, and not as a substitute for, the comparable GAAP

measures.

The information in this Item 2.02 is being furnished, not filed, pursuant to Item 2.02 of Form 8-K. Accordingly, the

information in Item 2.02 of this report, including the Press Release attached hereto as Exhibit 99.1, will not be incorporated by reference into any registration statement filed by Sysco under the Securities Act of 1933, as amended, unless

specifically identified therein as being incorporated therein by reference.

- 2 -

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated February 1, 2016 |

- 3 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Sysco Corporation |

|

|

|

|

| Date: February 1, 2016 |

|

|

|

By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

|

Russell T. Libby |

|

|

|

|

|

|

Executive Vice President, Administration and Corporate Secretary |

- 4 -

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated February 1, 2016 |

- 5 -

Exhibit 99.1

SYSCO REPORTS STRONG LOCAL CASE AND OPERATING INCOME GROWTH

AND DELIVERS DILUTED EPS OF $0.48

Continued gross margin expansion and solid expense management

mitigates deflation and currency translation pressure

HOUSTON, February 1, 2016 — Sysco Corporation (NYSE: SYY) today announced financial results for its 13-week second fiscal quarter ended

December 26, 2015.¹

Second Quarter Fiscal 2016 Highlights²

| |

• |

|

Sales increased 0.6% to $12.2 billion; |

| |

• |

|

Gross profit increased 3.4% to $2.2 billion; gross margin increased 50 basis points to 17.75%; |

| |

• |

|

Adjusted operating income increased 10.2% to $437 million; and |

| |

• |

|

Adjusted Earnings Per Share (EPS), including a one-time $0.03 benefit from resolving certain tax contingencies, increased $0.07 to $0.48. |

First Half Fiscal 2016 Highlights²

| |

• |

|

Sales increased 0.8% to $24.7 billion; |

| |

• |

|

Gross profit increased 2.8% to $4.4 billion; gross margin increased 36 basis points to 17.78%; |

| |

• |

|

Adjusted operating income increased 4.2% to $943 million; and |

| |

• |

|

Adjusted Earnings Per Share (EPS), including a one-time $0.03 benefit from resolving certain tax contingencies, increased $0.07 to $1.00. |

“I am very pleased with our second quarter results,” said Bill DeLaney, Sysco chief executive officer. “We achieved strong local case growth,

while managing gross margins well and also containing operating expense growth. Through the first six-months of the year, we are on-track to achieve our financial objectives for the first year of our three-year plan.”

| ¹ |

Financial comparisons presented in this release are compared to the same period in the prior year. Earnings Per Share (EPS) and Adjusted EPS are shown on a diluted basis unless otherwise specified. Adjusted financial

results exclude certain items, which primarily include restructuring and merger-related costs. A reconciliation of non-GAAP measures is included in this release. |

| ² |

On a GAAP basis, operating income was $433 million for the second quarter, an increase of 37.1% from the prior year, and $926 million for the first half, an increase of 18.6% from the prior year. Diluted EPS was

$0.48 for the second quarter, an increase of 77.8% from the prior year, and $0.88 for the first half, an increase of 21% from the prior year. |

Second Quarter Fiscal 2016 Summary

Sales for the second quarter were $12.2 billion, an increase of 0.6% compared to the same period last year. Overall food cost deflation was 1.2% (1.9% in U.S.

Broadline), as measured by the estimated change in Sysco’s product costs, with deflation in the meat, poultry, dairy and seafood categories partially offset by modest inflation in other categories. In addition, sales from acquisitions completed

within the last 12 months increased sales by 0.4%, and the impact of changes in foreign exchange rates decreased sales by 1.7%. Case volume for the Company’s U.S. Broadline operations grew 3.9% during the quarter. Local case growth within U.S.

Broadline operations grew 3.0%. Gross profit was $2.2 billion, an increase of 3.4% compared to the same period last year. Gross margin increased 50 basis points to 17.75%.

Non-GAAP Operating Income, Net Earnings and EPS

Adjusted

operating expenses increased $31 million, or 1.8%, compared to the same period last year, due mainly to higher case volume-related expenses and planned business technology investments. Adjusted operating income was $437 million, an increase of $41

million, or 10.2%, compared to the same period last year. Interest expense was $47 million, an increase of $22 million compared to the same period last year, reflecting the increased debt used primarily to fund the Company’s accelerated share

repurchase program. Adjusted net earnings, which include a $21 million or $0.03 per share tax benefit related to the favorable resolution of certain tax contingencies, were $275 million, an increase of $31 million, or 12.6%, compared to the same

period last year. Adjusted diluted EPS was $0.48, which was 17.1% higher compared to the same period last year.

GAAP Operating Income, Net Earnings

and EPS

Operating expenses decreased $45 million, or 2.6%, compared to the same period last year, due mainly to a lower merger-related expenses,

partially offset by higher case volume-related expenses and planned business technology investments. Operating income was $433 million, an increase of $117 million, or 37.1%, compared to the same period last year. Interest expense was $47 million, a

decrease of $30 million compared to the same period last year. Net earnings were $272 million, an increase of $114 million, or 72.4%, compared to the same period last year. Diluted EPS was $0.48, which was 77.8% higher compared to the same period

last year.

First Half Fiscal 2016 Summary

Sales for the first half of fiscal 2016 were $24.7 billion, an increase of 0.8% compared to the same period last year. Overall food cost deflation was 0.7%

(1.5% in U.S. Broadline), as measured by the estimated change in Sysco’s product costs, with deflation in the meat, poultry, dairy and seafood categories partially offset by modest inflation in other categories. In addition, sales from

acquisitions completed within the last 12 months increased sales by 0.4%, and the impact of changes in foreign exchange rates decreased sales by 1.8%. Case volume for the company’s U.S. Broadline operations grew 3.6% during the first half.

Local case growth within U.S. Broadline operations grew 2.5%. Gross profit was $4.4 billion, an increase of 2.8% compared to the same period last year. Gross margin increased 36 basis points to 17.78%.

2

Non-GAAP Operating Income, Net Earnings and EPS

Adjusted operating expenses increased $83 million, or 2.5%, compared to the same period last year, due mainly to higher case volume-related expenses, planned

business technology investments and incentive accruals. Adjusted operating income was $943 million, an increase of $38 million, or 4.2%, compared to the same period last year. Adjusted interest expense was $79 million, an increase of $27 million

compared to the same period last year, reflecting the increased debt used primarily to fund the Company’s accelerated share repurchase program. Adjusted net earnings were $587 million, an increase of $33 million, or 6.1%, compared to the same

period last year. Adjusted diluted EPS was $1.00, which was 7.5% higher compared to the same period last year.

GAAP Operating Income, Net Earnings and

EPS

Operating expenses decreased $24 million, or 0.7%, compared to the same period last year, due mainly to lower merger-related expenses, partially

offset partially offset by higher case volume-related expenses, planned business technology investments and incentive accruals. Operating income was $926 million, an increase of $145 million, or 18.6%, compared to the same period last year. Interest

expense was $174 million, an increase of $66 million compared to the same period last year. Net earnings were $517 million, an increase of $80 million, or 18.3%, compared to the same period last year. Diluted EPS was $0.88, which was 20.5% higher

compared to the same period last year.

Capital Spending and Cash Flow

Capital expenditures, net of proceeds from sales of plant and equipment, totaled $237 million for the first half of fiscal 2016. Cash flow from operations was

$469 million for the first half of fiscal 2016, which was $16 million higher compared to the same period last year. Free cash flow was $231 million, which was $75 million higher compared to the same period last year.

Conference Call & Webcast

Sysco’s

second quarter fiscal 2016 earnings conference call will be held on Monday, February 1, 2016, at 10:00 a.m. Eastern. A live webcast of the call, a copy of this press release and a slide presentation will be available online at

investors.sysco.com.

For purposes of public disclosure, Sysco plans to use the investor relations portion of its website as a primary channel for

publishing key information to its investors, some of which may contain material and previously non-public information. As a result, a live webcast of the call, a copy of this press release and a slide presentation, will be available online at

investors.sysco.com. We encourage investors to consult that section of our website, or our investor relations app, regularly for important information about us.

3

|

|

|

|

|

|

|

|

|

| |

|

13-Week Period Ended |

|

26-Week Period Ended |

| |

|

December 26, 2015 |

|

Change |

|

December 26, 2015 |

|

Change |

| Financial Comparison |

|

|

|

|

|

|

|

|

| Sales: |

|

$12.2 billion |

|

0.6% |

|

$24.7 billion |

|

0.8% |

| Real Growth (non-gaap)³ |

|

3.0% |

|

130bps |

|

2.9% |

|

130bps |

| Food Cost Inflation |

|

-1.2% |

|

-720bps |

|

-0.7% |

|

-610bps |

| Acquisitions |

|

0.4% |

|

-40bps |

|

0.4% |

|

-30bps |

| Impact of Foreign Exchange Rate Translation |

|

-1.7% |

|

-80bps |

|

-1.8% |

|

-110bps |

| Gross Profit: |

|

$2.2 billion |

|

3.4% |

|

$4.4 billion |

|

2.8% |

| Gross Margin |

|

17.75% |

|

+50bps |

|

17.78% |

|

+36bps |

| Non-GAAP³: |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

$1.7 billion |

|

1.8% |

|

$3.5 billion |

|

2.5% |

| Operating Income |

|

$437 million |

|

10.2% |

|

$943 million |

|

4.2% |

| Operating Margin |

|

3.59% |

|

31bps |

|

3.82% |

|

13bps |

| Net Income |

|

$275 million |

|

12.6% |

|

$587 million |

|

6.1% |

| Diluted Earnings Per Share |

|

$0.48 |

|

17.1% |

|

$1.00 |

|

7.5% |

| GAAP: |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

$1.7 billion |

|

-2.6% |

|

$3.5 billion |

|

-0.7% |

| Certain Items |

|

$4 million |

|

-94.7% |

|

$17 million |

|

-86.1% |

| Operating Income |

|

$433 million |

|

37.1% |

|

$926 million |

|

18.6% |

| Operating Margin |

|

3.56% |

|

+95bps |

|

3.75% |

|

+57bps |

| Net Earnings |

|

$272 million |

|

72.4% |

|

$517 million |

|

18.3% |

| Diluted Earnings Per Share |

|

$0.48 |

|

77.8% |

|

$0.88 |

|

20.5% |

| Dividends Paid Per Share |

|

$0.31 |

|

3.3% |

|

$0.61 |

|

3.4% |

| Business Highlights |

|

|

|

|

|

|

|

|

| Total Sales: |

|

$12.2 billion |

|

0.6% |

|

$24.7 billion |

|

0.8% |

| Broadline |

|

$9.6 billion |

|

0.6% |

|

$19.6 billion |

|

0.6% |

| SYGMA |

|

$1.5 billion |

|

-3.4% |

|

$3.0 billion |

|

-4.8% |

| Other |

|

$1.4 billion |

|

10.9% |

|

$2.8 billion |

|

10.1% |

| Intersegment |

|

($407) million |

|

24.4% |

|

($685) million |

|

5.9% |

| Case Growth: |

|

|

|

|

|

|

|

|

| Total Broadline |

|

3.4% |

|

30bps |

|

3.4% |

|

50bps |

| Local |

|

2.9% |

|

110bps |

|

2.8% |

|

100bps |

| U.S. Broadline |

|

3.9% |

|

40 bps |

|

3.6% |

|

60 bps |

| Local |

|

3.0% |

|

150 bps |

|

2.5% |

|

100 bps |

| Sysco Brand Sales: |

|

|

|

|

|

|

|

|

| U.S. Broadline |

|

36.52% |

|

-19bps |

|

36.80% |

|

-2bps |

| Local |

|

43.55% |

|

43bps |

|

43.66% |

|

57bps |

Note:

| ³ |

A reconciliation of non-GAAP measures is included in this release. |

Individual components in the table above

may not sum to the totals due to rounding.

About Sysco

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments

and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. The company operates 194 distribution facilities serving approximately 425,000

customers. For fiscal year 2015 that ended June 27, 2015, the company generated sales of more than $48 billion. For more information, visit www.sysco.com or connect with Sysco on Facebook at www.facebook.com/SyscoCorporation or

Twitter at https://twitter.com/Sysco. For important news regarding Sysco, visit the Investor Relations section of the company’s Internet home page at investors.sysco.com, follow

4

us at www.twitter.com/SyscoStock and download the new Sysco IR App, available on the iTunes App Store and the Google Play Market. In addition, investors should also continue

to review our press releases and filings with the Securities and Exchange Commission. It is possible that the information we disclose through any of these channels of distribution could be deemed to be material information.

5

Forward-Looking Statements

Statements made in this press release or in our earnings call for the second quarter of fiscal 2016 that look forward in time or that express management’s

beliefs, expectations or hopes are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the views of management at the time such statements are made and are

subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These statements include our plans and expectations related to our three-year financial objectives,

including targets for adjusted operating income and adjusted ROIC, and the key levers for realizing these goals, expectations regarding revenue management, expense management and our digital e-commerce strategy, expectations regarding food cost

deflation and currency translation, expectations regarding restructuring charges, expectations regarding tax rates, and expectations regarding capital expenditures. The success of our plans and expectations regarding our operating performance,

including expectations regarding our three-year financial objectives, are subject to the general risks associated with our business, including the risks of interruption of supplies due to lack of long-term contracts, severe weather, crop conditions,

work stoppages, intense competition, technology disruptions, dependence on large regional and national customers, inflation risks, the impact of fuel prices, adverse publicity, and labor issues. Risks and uncertainties also include risks impacting

the economy generally, including the risks that the current general economic conditions will deteriorate, or consumer confidence in the economy or consumer spending, particularly on food-away-from-home, may decline. Market conditions may not

improve. If sales from our locally managed customers do not grow at the same rate as sales from regional and national customers, our gross margins may decline. Our ability to meet our long-term strategic objectives depends largely on the success of

our various business initiatives, including efforts related to revenue management, expense management, our digital e-commerce strategy and any efforts related to restructuring. There are various risks related to these efforts, including the risk

that these efforts may not provide the expected benefits in our anticipated time frame, if at all, and may prove costlier than expected; the risk that the actual costs of any initiatives may be greater or less than currently expected; and the risk

of adverse effects to our business, results of operations and liquidity if past and future undertakings, and the associated changes to our business, do not prove to be cost effective or do not result in the cost savings and other benefits at the

levels that we anticipate. Our plans related to and the timing of any initiatives are subject to change at any time based on management’s subjective evaluation of our overall business needs. If we are unable to realize the anticipated benefits

from our efforts, we could become cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease. Capital expenditures may vary based on changes in business plans and other factors, including risks related to the

implementation of various initiatives, the timing and successful completion of acquisitions, construction schedules and the possibility that other cash requirements could result in delays or cancellations of capital spending. Periods of high

inflation, either overall or in certain product categories, can have a negative impact on us and our customers, as high food costs can reduce consumer spending in the food-away-from-home market, and may negatively impact our sales, gross profit,

operating income and earnings, and periods of deflation can be difficult to manage effectively. Fluctuations in inflation and deflation, as well as fluctuations in the value of foreign currencies, are beyond our control and subject to broader market

forces. Expanding into international markets presents unique challenges and risks, including compliance with local laws, regulations and customs and the impact of local political and economic conditions, and such expansion efforts may not be

successful. Any business that we acquire may not perform as expected, and we may not realize the anticipated benefits of our acquisitions. Expectations regarding the accounting treatment of any acquisitions may change based on management’s

subjective evaluation. Expectations regarding share repurchases are subject to various factors beyond management’s

6

control, including fluctuations in the stock market, and decisions regarding share repurchases are subject to change based on management’s subjective evaluation of the Company’s needs.

Expectations regarding tax rates are also subject to various factors beyond management’s control. For a discussion of additional factors impacting Sysco’s business, see the Company’s Annual Report on Form 10-K for the year ended

June 27, 2015, as filed with the Securities and Exchange Commission, and the Company’s subsequent filings with the SEC. Sysco does not undertake to update its forward-looking statements.

7

Sysco Corporation and its Consolidated Subsidiaries

CONSOLIDATED RESULTS OF OPERATIONS (Unaudited)

(In Thousands, Except for Share and Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

13-Week Period Ended |

|

|

26-Week Period Ended |

|

| |

|

Dec. 26, 2015 |

|

|

Dec. 27, 2014 |

|

|

Dec. 26, 2015 |

|

|

Dec. 27, 2014 |

|

| Sales |

|

$ |

12,153,626 |

|

|

$ |

12,087,074 |

|

|

$ |

24,716,237 |

|

|

$ |

24,532,155 |

|

| Cost of sales |

|

|

9,996,812 |

|

|

|

10,001,937 |

|

|

|

20,321,428 |

|

|

|

20,258,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

2,156,814 |

|

|

|

2,085,137 |

|

|

|

4,394,809 |

|

|

|

4,273,854 |

|

| Operating expenses |

|

|

1,724,231 |

|

|

|

1,769,691 |

|

|

|

3,468,752 |

|

|

|

3,492,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

432,583 |

|

|

|

315,446 |

|

|

|

926,057 |

|

|

|

781,059 |

|

| Interest expense |

|

|

47,235 |

|

|

|

77,042 |

|

|

|

174,142 |

|

|

|

107,976 |

|

| Other expense (income), net |

|

|

(7,764 |

) |

|

|

2,207 |

|

|

|

(23,004 |

) |

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

393,112 |

|

|

|

236,197 |

|

|

|

774,919 |

|

|

|

673,064 |

|

| Income taxes |

|

|

120,713 |

|

|

|

78,218 |

|

|

|

258,100 |

|

|

|

236,272 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

272,399 |

|

|

$ |

157,979 |

|

|

$ |

516,819 |

|

|

$ |

436,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.48 |

|

|

$ |

0.27 |

|

|

$ |

0.89 |

|

|

$ |

0.74 |

|

| Diluted earnings per share |

|

|

0.48 |

|

|

|

0.27 |

|

|

|

0.88 |

|

|

|

0.73 |

|

| Average shares outstanding |

|

|

566,881,538 |

|

|

|

590,723,351 |

|

|

|

581,790,230 |

|

|

|

589,499,802 |

|

| Diluted shares outstanding |

|

|

571,452,124 |

|

|

|

595,911,680 |

|

|

|

586,121,013 |

|

|

|

594,610,315 |

|

| Dividends declared per common share |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

$ |

0.61 |

|

|

$ |

0.59 |

|

- more -

8

Sysco Corporation and its Consolidated Subsidiaries

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In

Thousands, Except for Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec. 26, 2015 |

|

|

June 27, 2015 |

|

|

Dec. 27, 2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

595,602 |

|

|

$ |

5,130,044 |

|

|

$ |

4,907,677 |

|

| Accounts and notes receivable, less allowances of $57,631, $41,720 and $68,427 |

|

|

3,353,453 |

|

|

|

3,353,381 |

|

|

|

3,529,997 |

|

| Inventories |

|

|

2,736,382 |

|

|

|

2,691,823 |

|

|

|

2,791,813 |

|

| Deferred income taxes |

|

|

— |

|

|

|

135,254 |

|

|

|

140,456 |

|

| Prepaid expenses and other current assets |

|

|

83,263 |

|

|

|

93,039 |

|

|

|

76,682 |

|

| Prepaid income taxes |

|

|

10,326 |

|

|

|

90,763 |

|

|

|

10,279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,779,026 |

|

|

|

11,494,304 |

|

|

|

11,456,904 |

|

| Plant and equipment at cost, less depreciation |

|

|

3,936,612 |

|

|

|

3,982,143 |

|

|

|

4,002,932 |

|

| Other assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

1,977,921 |

|

|

|

1,959,817 |

|

|

|

1,966,547 |

|

| Intangibles, less amortization |

|

|

163,089 |

|

|

|

154,809 |

|

|

|

168,446 |

|

| Restricted cash |

|

|

— |

|

|

|

168,274 |

|

|

|

165,465 |

|

| Other assets |

|

|

232,820 |

|

|

|

229,934 |

|

|

|

169,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other assets |

|

|

2,373,830 |

|

|

|

2,512,834 |

|

|

|

2,469,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

13,089,468 |

|

|

$ |

17,989,281 |

|

|

$ |

17,929,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Notes payable |

|

$ |

83,037 |

|

|

$ |

70,751 |

|

|

$ |

76,876 |

|

| Accounts payable |

|

|

2,710,469 |

|

|

|

2,881,953 |

|

|

|

2,797,947 |

|

| Accrued expenses |

|

|

1,071,632 |

|

|

|

1,467,610 |

|

|

|

1,100,239 |

|

| Current maturities of long-term debt |

|

|

7,076 |

|

|

|

4,979,301 |

|

|

|

310,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

3,872,214 |

|

|

|

9,399,615 |

|

|

|

4,285,953 |

|

| Other liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

4,265,857 |

|

|

|

2,271,825 |

|

|

|

7,208,252 |

|

| Deferred income taxes |

|

|

111,822 |

|

|

|

81,591 |

|

|

|

117,353 |

|

| Other long-term liabilities |

|

|

852,655 |

|

|

|

934,722 |

|

|

|

940,349 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other liabilities |

|

|

5,230,334 |

|

|

|

3,288,138 |

|

|

|

8,265,954 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

| Noncontrolling interest |

|

|

45,493 |

|

|

|

41,304 |

|

|

|

34,942 |

|

| Shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock, par value $1 per share, Authorized 1,500,000 shares, issued none |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Common stock, par value $1 per share, Authorized 2,000,000,000 shares, issued 765,174,900 shares |

|

|

765,175 |

|

|

|

765,175 |

|

|

|

765,175 |

|

| Paid-in capital |

|

|

1,022,816 |

|

|

|

1,213,999 |

|

|

|

1,181,918 |

|

| Retained earnings |

|

|

8,922,498 |

|

|

|

8,751,985 |

|

|

|

8,858,831 |

|

| Accumulated other comprehensive loss |

|

|

(1,045,177 |

) |

|

|

(923,197 |

) |

|

|

(828,656 |

) |

| Treasury stock at cost, 198,552,842, 170,857,231 and 174,109,675 shares |

|

|

(5,723,885 |

) |

|

|

(4,547,738 |

) |

|

|

(4,634,308 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

3,941,427 |

|

|

|

5,260,224 |

|

|

|

5,342,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

13,089,468 |

|

|

$ |

17,989,281 |

|

|

$ |

17,929,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- more -

9

Sysco Corporation and its Consolidated Subsidiaries

CONSOLIDATED CASH FLOWS (Unaudited)

(In Thousands)

|

|

|

|

|

|

|

|

|

| |

|

26-Week Period Ended |

|

| |

|

Dec. 26, 2015 |

|

|

Dec. 27, 2014 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

516,819 |

|

|

$ |

436,792 |

|

| Adjustments to reconcile net earnings to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Share-based compensation expense |

|

|

44,045 |

|

|

|

44,460 |

|

| Depreciation and amortization |

|

|

281,400 |

|

|

|

274,655 |

|

| Amortization of debt issuance and other debt-related costs |

|

|

13,637 |

|

|

|

20,144 |

|

| Loss on extinguishment of debt |

|

|

86,460 |

|

|

|

— |

|

| Deferred income taxes |

|

|

153,423 |

|

|

|

6,804 |

|

| Provision for losses on receivables |

|

|

10,093 |

|

|

|

9,414 |

|

| Other non-cash items |

|

|

(15,468 |

) |

|

|

(2,359 |

) |

| Additional changes in certain assets and liabilities, net of effect of businesses acquired: |

|

|

|

|

|

|

|

|

| (Increase) in receivables |

|

|

(50,853 |

) |

|

|

(181,877 |

) |

| (Increase) in inventories |

|

|

(69,370 |

) |

|

|

(214,111 |

) |

| Decrease in prepaid expenses and other current assets |

|

|

9,812 |

|

|

|

6,537 |

|

| (Decrease) in accounts payable |

|

|

(140,499 |

) |

|

|

(7,450 |

) |

| (Decrease) increase in accrued expenses |

|

|

(388,667 |

) |

|

|

78,438 |

|

| Increase in accrued income taxes |

|

|

92,638 |

|

|

|

40,220 |

|

| (Increase) decrease in other assets |

|

|

(9,556 |

) |

|

|

16,072 |

|

| (Decrease) in other long-term liabilities |

|

|

(52,942 |

) |

|

|

(67,438 |

) |

| Excess tax benefits from share-based compensation arrangements |

|

|

(12,091 |

) |

|

|

(7,863 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

468,881 |

|

|

|

452,438 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Additions to plant and equipment |

|

|

(248,233 |

) |

|

|

(298,068 |

) |

| Proceeds from sales of plant and equipment |

|

|

10,827 |

|

|

|

2,130 |

|

| Acquisition of businesses, net of cash acquired |

|

|

(98,154 |

) |

|

|

(29,177 |

) |

| Decrease (increase) in restricted cash |

|

|

168,274 |

|

|

|

(20,053 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

|

|

(167,286 |

) |

|

|

(345,168 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Bank and commercial paper borrowings (repayments), net |

|

|

— |

|

|

|

(129,999 |

) |

| Other debt borrowings |

|

|

2,012,353 |

|

|

|

5,008,502 |

|

| Other debt repayments |

|

|

(19,155 |

) |

|

|

(21,618 |

) |

| Redemption of senior notes |

|

|

(5,050,000 |

) |

|

|

— |

|

| Debt issuance costs |

|

|

(20,881 |

) |

|

|

(30,980 |

) |

| Cash paid for settlement of cash flow hedge |

|

|

(6,134 |

) |

|

|

(188,840 |

) |

| Cash received from the termination of interest rate swap agreements |

|

|

14,496 |

|

|

|

— |

|

| Proceeds from stock option exercises |

|

|

131,969 |

|

|

|

122,492 |

|

| Accelerated share and treasury stock purchases |

|

|

(1,521,638 |

) |

|

|

— |

|

| Dividends paid |

|

|

(348,436 |

) |

|

|

(340,654 |

) |

| Excess tax benefits from share-based compensation arrangements |

|

|

12,091 |

|

|

|

7,863 |

|

|

|

|

|

|

|

|

|

|

| Net cash (used for) provided by financing activities |

|

|

(4,795,335 |

) |

|

|

4,426,766 |

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rates on cash |

|

|

(40,702 |

) |

|

|

(39,405 |

) |

|

|

|

|

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(4,534,442 |

) |

|

|

4,494,631 |

|

| Cash and cash equivalents at beginning of period |

|

|

5,130,044 |

|

|

|

413,046 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

595,602 |

|

|

$ |

4,907,677 |

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

106,600 |

|

|

$ |

73,756 |

|

| Income taxes |

|

|

33,156 |

|

|

|

189,538 |

|

- more -

10

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Impact of Certain

Items

(In Thousands, Except for Share and Per Share Data)

Sysco’s results of operations are impacted by certain items which include restructuring costs (consisting of severance charges, facility closure charges

and professional fees incurred related to our three-year financial objectives), merger and integration planning, and termination costs in connection with the merger that had been proposed with US Foods, Inc. (US Foods), and US Foods related

financing costs. These fiscal 2016 and fiscal 2015 items are collectively referred to as “Certain Items”. Management believes that adjusting its operating expenses, operating income, operating margin as a percentage of sales, interest

expense, net earnings and diluted earnings per share to remove these Certain Items provides an important perspective with respect to our results and provides meaningful supplemental information to both management and investors that removes these

items which are difficult to predict and are often unanticipated, and which, as a result are difficult to include in analyst’s financial models and our investors’ expectations with any degree of specificity. Sysco believes the adjusted

totals facilitate comparison on a year-over-year basis.

The company uses these non-GAAP measures when evaluating its financial results as well as for

internal planning and forecasting purposes. These financial measures should not be used as a substitute for GAAP measures in assessing the company’s results of operations for the periods presented. An analysis of any non-GAAP financial measure

should be used in conjunction with results presented in accordance with GAAP. As a result, in the tables that follow, each period presented is adjusted to remove the Certain Items noted above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

13-Week

Period Ended

Dec. 26, 2015 |

|

|

13-Week

Period Ended

Dec. 27, 2014 |

|

|

13-Week

Period Change

in Dollars |

|

|

13-Week

Period

% Change |

|

| Sales |

|

$ |

12,153,626 |

|

|

$ |

12,087,074 |

|

|

$ |

66,552 |

|

|

|

0.6 |

% |

| Operating expenses (GAAP) |

|

$ |

1,724,231 |

|

|

$ |

1,769,691 |

|

|

$ |

(45,460 |

) |

|

|

-2.6 |

% |

| Impact of restructuring cost |

|

|

(4,281 |

) |

|

|

(2,790 |

) |

|

|

(1,491 |

) |

|

|

53.4 |

|

| Impact of US Foods merger and integration planning costs |

|

|

— |

|

|

|

(78,019 |

) |

|

|

78,019 |

|

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses adjusted for certain items (Non-GAAP) |

|

$ |

1,719,950 |

|

|

$ |

1,688,882 |

|

|

$ |

31,068 |

|

|

|

1.8 |

% |

| Operating income (GAAP) |

|

$ |

432,583 |

|

|

$ |

315,446 |

|

|

$ |

117,137 |

|

|

|

37.1 |

% |

| Impact of restructuring cost |

|

|

4,281 |

|

|

|

2,790 |

|

|

|

1,491 |

|

|

|

53.4 |

|

| Impact of US Foods merger and integration planning costs |

|

|

— |

|

|

|

78,019 |

|

|

|

(78,019 |

) |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income adjusted for certain items (Non-GAAP) |

|

$ |

436,864 |

|

|

$ |

396,255 |

|

|

$ |

40,609 |

|

|

|

10.2 |

% |

| Operating margin (GAAP) |

|

|

3.56 |

% |

|

|

2.61 |

% |

|

|

0.95 |

% |

|

|

36.4 |

% |

| Operating margin (Non-GAAP) |

|

|

3.59 |

% |

|

|

3.28 |

% |

|

|

0.32 |

% |

|

|

9.6 |

% |

| Interest expense (GAAP) |

|

$ |

47,235 |

|

|

$ |

77,042 |

|

|

$ |

(29,807 |

) |

|

|

-38.7 |

% |

| Impact of US Foods financing costs |

|

|

— |

|

|

|

(52,057 |

) |

|

|

52,057 |

|

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted interest expense (Non-GAAP) |

|

$ |

47,235 |

|

|

$ |

24,985 |

|

|

$ |

22,250 |

|

|

|

89.1 |

% |

| Net earnings (GAAP) (1) |

|

$ |

272,399 |

|

|

$ |

157,979 |

|

|

$ |

114,420 |

|

|

|

72.4 |

% |

| Impact of restructuring cost (net of tax) |

|

|

2,966 |

|

|

|

1,819 |

|

|

|

1,147 |

|

|

|

63.1 |

|

| Impact of US Foods merger and integration planning costs (net of tax) |

|

|

— |

|

|

|

50,876 |

|

|

|

(50,876 |

) |

|

|

NM |

|

| Impact of US Foods Financing Costs (net of tax) |

|

|

— |

|

|

|

33,946 |

|

|

|

(33,946 |

) |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings adjusted for certain items (Non-GAAP) (1) |

|

$ |

275,365 |

|

|

$ |

244,620 |

|

|

$ |

30,745 |

|

|

|

12.6 |

% |

| Diluted earnings per share (GAAP) (1) |

|

$ |

0.48 |

|

|

$ |

0.27 |

|

|

$ |

0.21 |

|

|

|

77.8 |

% |

| Impact of restructuring cost |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

NM |

|

| Impact of US Foods merger and integration planning costs |

|

|

— |

|

|

|

0.09 |

|

|

|

(0.09 |

) |

|

|

NM |

|

| Impact of US Foods Financing Costs |

|

|

— |

|

|

|

0.06 |

|

|

|

(0.06 |

) |

|

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS adjusted for certain items (Non-GAAP) (1) (2) |

|

$ |

0.48 |

|

|

$ |

0.41 |

|

|

$ |

0.07 |

|

|

|

17.1 |

% |

| Diluted shares outstanding |

|

|

571,452,124 |

|

|

|

595,911,680 |

|

|

|

|

|

|

|

|

|

| (1) |

The net earnings and diluted earnings per share impacts are shown net of tax. The tax impact of adjustments for Certain Items was $1,315 and $46,224 for the 13-week periods ended December 26, 2015 and

December 27, 2014, respectively. Amounts are calculated by multiplying the pretax impact of each Certain Item by the statutory rates in effect for each jurisdiction. |

| (2) |

Individual components of diluted earnings per share may not add to the total presented due to rounding. Total diluted earnings per share is calculated using adjusted net earnings for certain items divided by diluted

shares outstanding. |

NM represents that the percentage change is not meaningful

- more -

11

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Impact of Certain

Items

(In Thousands, Except for Share and Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

26-Week

Period Ended

Dec. 26, 2015 |

|

|

26-Week

Period Ended

Dec. 27, 2014 |

|

|

26-Week

Period Change

in Dollars |

|

|

26-Week

Period

% Change |

|

| Sales |

|

$ |

24,716,237 |

|

|

$ |

24,532,155 |

|

|

$ |

184,082 |

|

|

|

0.8 |

% |

| Operating expenses (GAAP) |

|

$ |

3,468,752 |

|

|

$ |

3,492,795 |

|

|

$ |

(24,043 |

) |

|

|

-0.7 |

% |

| Impact of restructuring cost |

|

|

(7,470 |

) |

|

|

(5,745 |

) |

|

|

(1,725 |

) |

|

|

30.0 |

|

| Impact of US Foods merger and integration planning costs |

|

|

(9,816 |

) |

|

|

(118,499 |

) |

|

|

108,683 |

|

|

|

-91.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses adjusted for certain items (Non-GAAP) |

|

$ |

3,451,466 |

|

|

$ |

3,368,551 |

|

|

$ |

82,915 |

|

|

|

2.5 |

% |

| Operating income (GAAP) |

|

$ |

926,057 |

|

|

$ |

781,059 |

|

|

$ |

144,998 |

|

|

|

18.6 |

% |

| Impact of restructuring cost |

|

|

7,470 |

|

|

|

5,745 |

|

|

|

1,725 |

|

|

|

30.0 |

|

| Impact of US Foods merger and integration planning costs |

|

|

9,816 |

|

|

|

118,499 |

|

|

|

(108,683 |

) |

|

|

-91.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income adjusted for certain items (Non-GAAP) |

|

$ |

943,343 |

|

|

$ |

905,303 |

|

|

$ |

38,040 |

|

|

|

4.2 |

% |

| Operating margin (GAAP) |

|

|

3.75 |

% |

|

|

3.18 |

% |

|

|

0.56 |

% |

|

|

17.7 |

% |

| Operating margin (Non-GAAP) |

|

|

3.82 |

% |

|

|

3.69 |

% |

|

|

0.13 |

% |

|

|

3.4 |

% |

| Interest expense (GAAP) |

|

$ |

174,142 |

|

|

$ |

107,976 |

|

|

$ |

66,166 |

|

|

|

61.3 |

% |

| Impact of US Foods financing costs |

|

|

(94,835 |

) |

|

|

(55,761 |

) |

|

|

(39,074 |

) |

|

|

70.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted interest expense (Non-GAAP) |

|

$ |

79,307 |

|

|

$ |

52,215 |

|

|

$ |

27,092 |

|

|

|

51.9 |

% |

| Net earnings (GAAP) (1) |

|

$ |

516,819 |

|

|

$ |

436,792 |

|

|

$ |

80,027 |

|

|

|

18.3 |

% |

| Impact of restructuring cost (net of tax) |

|

|

4,683 |

|

|

|

3,729 |

|

|

|

954 |

|

|

|

25.6 |

|

| Impact of US Foods merger and integration planning costs (net of tax) |

|

|

6,154 |

|

|

|

76,901 |

|

|

|

(70,747 |

) |

|

|

-92.0 |

|

| Impact of US Foods Financing Costs (net of tax) |

|

|

59,452 |

|

|

|

36,187 |

|

|

|

23,265 |

|

|

|

64.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings adjusted for certain items (Non-GAAP) (1) |

|

$ |

587,108 |

|

|

$ |

553,609 |

|

|

$ |

33,499 |

|

|

|

6.1 |

% |

| Diluted earnings per share (GAAP) (1) |

|

$ |

0.88 |

|

|

$ |

0.73 |

|

|

$ |

0.15 |

|

|

|

20.5 |

% |

| Impact of restructuring cost |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

NM |

|

| Impact of US Foods merger and integration planning costs |

|

|

0.01 |

|

|

|

0.13 |

|

|

|

(0.12 |

) |

|

|

-92.3 |

|

| Impact of US Foods Financing Costs |

|

|

0.10 |

|

|

|

0.06 |

|

|

|

0.04 |

|

|

|

66.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS adjusted for certain items (Non-GAAP) (1) (2) |

|

$ |

1.00 |

|

|

$ |

0.93 |

|

|

$ |

0.07 |

|

|

|

7.5 |

% |

| Diluted shares outstanding |

|

|

586,121,013 |

|

|

|

594,610,315 |

|

|

|

|

|

|

|

|

|

| (1) |

The net earnings and diluted earnings per share impacts are shown net of tax. The tax impact of adjustments for Certain Items was $41,832 and $63,189 for the 26-week periods ended December 26, 2015 and

December 27, 2014, respectively. Amounts are calculated by multiplying the pretax impact of each Certain Item by the statutory rates in effect for each jurisdiction. |

| (2) |

Individual components of diluted earnings per share may not add to the total presented due to rounding. Total diluted earnings per share is calculated using adjusted net earnings for certain items divided by diluted

shares outstanding. |

NM represents that the percentage change is not meaningful

- more -

12

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Free Cash Flow

(In Thousands)

Free cash flow represents net cash

provided from operating activities less purchases of plant and equipment and includes proceeds from sales of plant and equipment. Sysco considers free cash flow to be a liquidity measure that provides useful information to management and investors

about the amount of cash generated by the business after the purchases and sales of buildings, fleet, equipment and technology, which may potentially be used to pay for, among other things, strategic uses of cash including dividend payments, share

repurchases and acquisitions. However, free cash flow may not be available for discretionary expenditures, as it may be necessary that we use it to make mandatory debt service or other payments. Free cash flow should not be used as a substitute for

the most comparable GAAP measure in assessing the company’s liquidity for the periods presented. An analysis of any non-GAAP financial measure should be used in conjunction with results presented in accordance with GAAP. In the table that

follows, free cash flow for each period presented are reconciled to net cash provided by operating activities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

26-Week

Period Ended

Dec 26, 2015 |

|

|

26-Week

Period Ended

Dec 27, 2014 |

|

|

26-Week

Period Change

in Dollars |

|

|

26-Week

Period

% Change |

|

| Net cash provided by operating activities (GAAP) |

|

$ |

468,881 |

|

|

$ |

452,438 |

|

|

$ |

16,443 |

|

|

|

3.6 |

% |

| Additions to plant and equipment |

|

|

(248,233 |

) |

|

|

(298,068 |

) |

|

|

49,835 |

|

|

|

16.7 |

|

| Proceeds from sales of plant and equipment |

|

|

10,827 |

|

|

|

2,130 |

|

|

|

8,697 |

|

|

|

408.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow (Non-GAAP) |

|

$ |

231,475 |

|

|

$ |

156,500 |

|

|

$ |

74,975 |

|

|

|

47.9 |

% |

- more -

13

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Real Growth

Real growth represents our sales growth after removing the impact of food cost inflation / deflation, sales from acquisitions that occurred within

the last 12 months and the impact of foreign exchange rate translation. Sysco considers real growth to be a performance measure that provides useful information to management and investors about the amount of sales growth organically generated. Real

growth is a commonly used metric within the food-away-from-home industry. The company uses these non-GAAP measures when evaluating its financial results, as well as for internal planning and forecasting purposes. These financial measures should not

be used as a substitute for GAAP measures in assessing the company’s sales growth for the periods presented. An analysis of any non-GAAP financial measure should be used in conjunction with results presented in accordance with GAAP. As a

result, in the tables that follow, each period presented is adjusted to remove the components of real growth noted above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

13-Week

Period Ended

Dec 26, 2015 |

|

|

13-Week

Period Ended

Dec 27, 2014 |

|

|

26-Week

Period Ended

Dec 26, 2015 |

|

|

26-Week

Period Ended

Dec 27, 2014 |

|

| Sales Growth (GAAP) |

|

|

0.6 |

% |

|

|

7.6 |

% |

|

|

0.8 |

% |

|

|

6.9 |

% |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Food cost inflation (deflation) |

|

|

-1.2 |

|

|

|

6.0 |

|

|

|

-0.7 |

|

|

|

5.4 |

|

| Acquisitions |

|

|

0.4 |

|

|

|

0.1 |

|

|

|

0.4 |

|

|

|

0.7 |

|

| Impact of foreign exchange rate translation |

|

|

-1.7 |

|

|

|

-0.9 |

|

|

|

-1.8 |

|

|

|

-0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Real Growth (Non-GAAP) (1) |

|

|

3.0 |

% |

|

|

1.7 |

% |

|

|

2.9 |

% |

|

|

1.6 |

% |

| (1) |

Individual components of real growth may not add to the total presented due to rounding. |

14

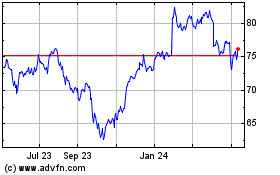

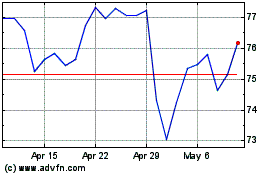

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024