UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 20, 2015

Sysco Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-06544 |

|

74-1648137 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1390 Enclave Parkway, Houston, TX 77077-2099

(Address of principal executive office) (zip code)

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN

OFFICERS.

(d) On August 20, 2015, the Board of Directors (the “Board”) of Sysco Corporation (the “Company”)

increased the size of the Board from ten to twelve directors and elected Nelson Peltz and Joshua D. Frank to fill the resulting vacancies, effective August 21, 2015, pursuant to arrangements in which Mr. Peltz and Mr. Frank will also

be nominated by the Company for election to the Board at the Company’s 2015 annual meeting of stockholders and Trian Fund Management, L.P. (“Trian”) has entered into customary confidentiality arrangements with respect to the

Company’s information. Mr. Peltz is a founding partner and the Chief Executive Officer of Trian and Mr. Frank is a Trian partner.

Mr. Peltz has been appointed to the Corporate Governance and Nominating Committee of the Board, and Mr. Frank has been appointed to

the Compensation Committee and the Finance Committee of the Board. Each of Mr. Peltz and Mr. Frank will receive customary compensation from the Company for serving as a non-employee director, in accordance with the Company’s director

compensation program as described in the Company’s proxy statement for its 2014 annual meeting of stockholders, filed with the Securities and Exchange Commission on October 8, 2014.

There are no transactions between Mr. Peltz or Mr. Frank and the Company that would be reportable under Item 404(a) of

Regulation S-K.

Press Release

The

press release issued by the Company and Trian on August 20, 2015 relating to the election of Mr. Peltz and Mr. Frank to the Board is filed herewith as Exhibit 99.1, and is incorporated herein by reference.

(e) On August 20, 2015, the Compensation Committee (the “Committee”) of the Board approved incentive opportunities for certain

officers of the Company under the Fiscal 2016 Management Incentive Program (the “2016 MIP”) and the Fiscal 2016-2018 Cash Performance Unit Program (the “2016-2018 CPU Program”), which programs were established pursuant to the

Company’s 2013 Long-Term Incentive Plan.

Certain officers of the Company are eligible to receive cash payments under the 2016 MIP

and the 2016-2018 CPU Program, including the following named executive officers:

| |

• |

|

William J. DeLaney – President and Chief Executive Officer; |

| |

• |

|

Thomas L. Bené - Executive Vice President and Chief Commercial Officer; and |

| |

• |

|

Wayne R. Shurts - Executive Vice President and Chief Technology Officer. |

2016 Management Incentive Program

With respect to each participant in the 2016 MIP, the Committee established a target opportunity for fiscal 2016, which is expressed as a

percentage of each participant’s fiscal 2016 annual base salary. The target opportunity under the 2016 MIP for each eligible named executive officer is as follows: Mr. DeLaney (150%), Mr. Bené (125%) and Mr. Shurts

(100%).

Annual incentive payments earned under the 2016 MIP will be based 75% on the financial performance of the Company and 25% on the

individual participant’s performance with respect to his or her own strategic bonus objectives (“SBOs”). The financial metrics related to Company performance are based on (i) operating income for fiscal 2016 as compared to

projected, target operating income for the year, and (ii) sales growth and gross profit dollar growth for fiscal 2016 over the prior fiscal year, as compared to projected, target year over year growth. The financial metrics related to Company

performance may be adjusted for certain extraordinary or non-recurring items. Each individual participant’s annual incentive payment will be calculated as follows:

| |

• |

|

(Participant’s Bonus Target Amount) x (Operating Income Bonus Percentage) x 50% |

| |

• |

|

(Participant’s Bonus Target Amount) x (Sales Growth and Gross Profit Dollar Growth Percentage) x 25% |

| |

• |

|

(Participant’s Bonus Target Amount) x (SBO Bonus Percentage) x 25% |

Each of the above

components for the annual incentive payment will be calculated and awarded independently. Each metric based on the Company’s financial performance has a possible payout between 0% and 200%, depending on the Company’s actual performance

relative to established targets, and the individual SBO portion of the annual incentive payment has a possible payout of between 0% and 150%, depending on actual performance relative to established targets. Consequently, in the aggregate, the

maximum incentive opportunity under the 2016 MIP would be 187.5% of an individual’s target opportunity. If performance with respect to any component does not meet the threshold level, a participant will not receive any payment with respect to

that component.

2016-2018 Cash Performance Unit Program

The 2016-2018 CPU Program provides the opportunity for participants to earn cash incentive payments based on pre-established performance

criteria over a performance period of three years. The Committee has established performance criteria for the 2016-2018 CPU Program based on Return on Invested Capital (“ROIC”), which is then adjusted up or down by up to 20% based on the

Company’s Total Shareholder Return (“TSR”) relative to TSR for companies comprising the S&P 500 Index over the three-year performance period. Company goals for ROIC are set for each fiscal year within the three-year performance

period, with the average of the results for each year being used to determine the total ROIC payout, prior to modification based on the Company’s TSR for the entire three-year performance period. Target ROIC for each of the fiscal years during

the performance period will be established by the Committee within the first 90 days of each respective fiscal year, and calculations may be adjusted for certain extraordinary or non-recurring items.

Each cash performance unit (“CPU”) granted to participants as part of the 2016-2018 CPU

Program has a par value of $1.00, but the ultimate value for each CPU will be determined at the end of the three-year performance period, with the payout amount for each CPU being a multiple of (i) a performance factor based on the

Company’s average ROIC performance relative to target ROIC for each fiscal year, and (ii) up to a 20% adjustment based on the Company’s relative TSR for the three-year period. The ROIC performance factor could range from 0% to 150%

based on the Company’s performance relative to target ROIC during each fiscal year. The Committee expects to grant awards of CPUs under the 2016-2018 CPU Program in November 2015.

Sysco’s Incentive Payment Clawback Policy

All payments received by participants under the 2016 MIP and the 2016-2018 CPU Program are subject to the Company’s incentive payment

clawback policy that allows the Company to recoup payments in the event of a restatement of financial results (other than a restatement due to a change in accounting policy), within 36 months of the payment of a bonus under the program, if the

Committee or the Company determines that the bonus paid to the participant would have been lower had it been calculated based on such restated results.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Joint Press Release dated August 20, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Sysco Corporation |

|

|

|

|

| Date: August 25, 2015 |

|

|

|

By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

|

Russell T. Libby Executive Vice

President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Joint Press Release dated August 20, 2015 |

Exhibit 99.1

SYSCO ELECTS NELSON PELTZ AND JOSH FRANK OF TRIAN PARTNERS

TO BOARD OF DIRECTORS

HOUSTON, Aug. 20, 2015 – Sysco Corporation (NYSE: SYY) today announced that it has added Nelson Peltz, chief executive officer and

a founding partner of Trian Fund Management L.P., and Josh Frank, a Trian partner, to its Board of Directors, effective Aug. 21, 2015. With the election of Peltz and Frank, the Sysco Board of Directors expands to 12 members, 10 of whom are

independent. Peltz and Frank will be included in the company’s slate of nominees for election to the Board at the 2015 Annual Meeting of Shareholders.

“We are firmly committed to enhancing value for all Sysco shareholders and always welcome constructive input toward driving long-term

shareholder value,” said Jackie Ward, non-executive chairman of Sysco’s Board of Directors. “Nelson and Josh will bring our Board an informed perspective based on their significant experience in the food products industry. We have

engaged in constructive dialogue with Nelson and Josh and look forward to benefiting from their insights and contributions.”

Bill

DeLaney, Sysco president and chief executive officer, commented, “As evidenced by our recent full-year and fourth quarter results, Sysco is well positioned to continue building on its momentum to enhance long-term shareholder value. We respect

Trian’s experience and value the perspective they will bring as we continue to focus on supporting the success of our customers, profitably growing our business and improving our return on invested capital. As we previously announced, we plan

to repurchase an incremental $3 billion in Sysco shares over the next two years and we will continue to further evaluate opportunities to optimize our capital structure, while improving productivity across our business. We look forward to providing

additional details regarding our strategic initiatives during our Investor Day on Sept. 15, 2015.”

Peltz said, “Sysco is a leader in its business, and we believe it is undervalued and has

tremendous long-term potential. As Sysco’s largest shareholder with an approximate 7.1 percent ownership position, we welcome the opportunity to work constructively with the Board and management.”

Frank added, “We are excited to begin working with Sysco’s leadership to design and execute initiatives to drive shareholder value

creation over time.”

Peltz will join the Corporate Governance and Nominating Committee and Frank will join the Compensation and

Finance Committees of Sysco’s Board.

Nelson Peltz

Nelson Peltz, 73, is a Founding Partner and has served as Chief Executive Officer of Trian Fund Management, L.P. since its formation in 2005. Mr. Peltz

has served as a director of The Wendy’s Company, the second-largest quick-service hamburger company in North America, since 1993, and non-executive Chairman since 2007. Mr. Peltz has served as a director of Mondelēz International,

Inc., a global snacking company, since January 2014, and as a director of The Madison Square Garden Company, a sports, entertainment and media company, since December 2014. He served on the board of directors of Ingersoll-Rand plc, a global

diversified industrial company, from 2012 to June 2014. From 2006 until June 2013, Mr. Peltz served as a director of H.J. Heinz Company. From 2009 until December 2014, Mr. Peltz served as a director of Legg Mason, Inc. and served as Chair

of its Nominating and Corporate Governance Committee from 2013 until December 2014.

Mr. Peltz began his business career in the 1960s when he joined

A. Peltz and Sons (APS Food Systems, Inc.), a frozen food distributor servicing the New York metropolitan area with approximately $2 million in revenue. In the 1970s, together with his Trian co-Founding Partner, Peter May, Mr. Peltz expanded

APS both organically and through M&A. The company was merged with Flagstaff Corporation resulting in the formation of the largest foodservice distributor in the northeast United States with revenues of approximately $140 million by 1978, when it

was sold to a private investor group.

Josh Frank

Josh Frank, 36, is a Partner and has been a member of the Trian investment team since Trian’s formation in 2005. Mr. Frank has played a leading role

in many of Trian’s investments in the consumer sector, as well as numerous investments across other industries. Mr. Frank was previously an Associate, Corporate Development, of Triarc Companies, Inc. Prior to joining Triarc in 2003,

Mr. Frank worked at Credit Suisse First Boston from 2001 to 2003, where he spent time in both the mergers & acquisitions and healthcare investment banking groups. Mr. Frank graduated cum laude from Yale University with a B.A. in

Economics.

About Sysco

Sysco is the global

leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home. Its family of products also includes equipment and

supplies for the foodservice and hospitality industries. The company operates 196 distribution facilities serving approximately 425,000 customers. For

2

Fiscal Year 2015 that ended June 27, 2015, the company generated sales of more than $48 billion. For more information, visit www.sysco.com or connect with Sysco on Facebook at

www.facebook.com/SyscoCorporation or Twitter at https://twitter.com/Sysco. Important news regarding Sysco is available at www.sysco.com/investors. You can follow us at www.twitter.com/SyscoStock and download the

Sysco IR App, available on the iTunes App Store and the Google Play Market. Investors are encouraged to read our news releases and filings with the Securities and Exchange Commission. It is possible that the information we disclose

through any of these channels of distribution could be deemed to be material information.

About Trian Fund Management, L.P.

Founded in 2005 by Nelson Peltz, Peter May and Ed Garden, Trian seeks to invest in high quality but undervalued and under-performing public companies and to

work constructively with the management and boards of those companies to significantly enhance shareholder value for all shareholders through a combination of improved operational execution, strategic redirection, more efficient capital allocation

and increased focus.

Trian Media and Investor Relations Contact

Anne Tarbell

Head of Communications

T: (212) 451-3030

###

Forward-Looking Statements

Statements made in

this press release that look forward in time or that express beliefs, expectations or hopes are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the

current views at the time such statements are made and are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These statements include our plans and

expectations related to and the benefits and expected timing of our goals and initiatives to increase profitability, manage expenses and grow our business, and our outlook and expectations for fiscal 2016. The success of our initiatives and

expectations regarding our operating performance are subject to the general risks associated with our business, including the risks of interruption of supplies due to lack of long-term contracts, severe weather, crop conditions, work

stoppages, intense competition, technology disruptions, dependence on large regional and national customers, inflation risks, the impact of fuel prices, adverse publicity, and labor issues. Risks and uncertainties also include risks impacting

the economy generally, including the risks that the current general economic conditions will deteriorate, or consumer confidence in the economy may not improve and decreases in consumer spending, particularly on food-away-from-home, may

not reverse. Market conditions may not improve. If sales from our locally managed customers do not grow at the same rate as sales from regional and national customers, our gross margins may decline. Our ability to meet our long-term strategic

objectives to grow the profitability of our business depends largely on the success of our various business initiatives. There are various risks related to these efforts, including the risk that these efforts may not provide the expected benefits in

our anticipated time frame, if at all, and may prove costlier than expected; the risk that the actual costs of any initiatives may be greater or less than currently expected; and the risk of adverse effects to our business, results of operations and

liquidity if past and future undertakings, and the associated changes to our business, do not prove to be cost effective or do not result in the cost savings and other benefits at the levels that we anticipate. Our plans related

3

to and the timing of any initiatives are subject to change at any time based on management’s subjective evaluation of our overall business needs. If we are unable to realize the anticipated

benefits from our cost cutting efforts, we could become cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease. Capital expenditures may vary from those projected based on changes in business plans and

other factors, including risks related to the implementation of various initiatives, the timing and successful completions of acquisitions, construction schedules and the possibility that other cash requirements could result in delays or

cancellations of capital spending. Periods of high inflation, either overall or in certain product categories, can have a negative impact on us and our customers, as high food costs can reduce consumer spending in the food-away-from-home market, and

may negatively impact our sales, gross profit, operating income and earnings. Expanding into international markets presents unique challenges and risks, including compliance with local laws, regulations and customs and the impact of local political

and economic conditions, and such expansion efforts may not be successful. Any business that we acquire may not perform as expected, and we may not realize the anticipated benefits of our acquisitions. Expectations regarding the accounting treatment

of any acquisitions may change based on management’s subjective evaluation. Expectations regarding tax rates are subject to various factors beyond management’s control. For a discussion of additional factors impacting Sysco’s

business, see the Company’s Annual Report on Form 10-K for the year ended June 28, 2014, as filed with the Securities and Exchange Commission, and the Company’s subsequent filings with the SEC, including the Company’s

Annual Report on Form 10-K that will be filed for the year ended June 27, 2015. Sysco does not undertake to update its forward-looking statements.

4

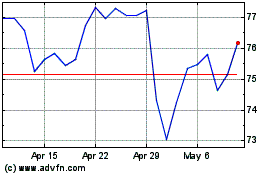

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

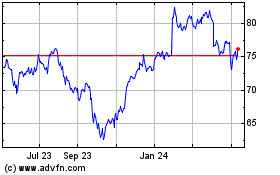

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024