Sysco Names Nelson Peltz, Josh Frank of Trian to Board -- Update

August 20 2015 - 7:17PM

Dow Jones News

By Annie Gasparro and David Benoit

Sysco Corp. agreed to add Nelson Peltz and Josh Frank of Trian

Fund Management LP to its board less than a week after the

investment fund disclosed a 7% stake in the food distributor, an

unusually fast agreement that reflects activist investors' growing

clout with public companies.

Sysco, which delivers food and supplies to restaurants and

hospitals, faces pressure to bolster profit margins and hone a new

strategy in the wake of its failed attempt to acquire rival US

Foods Inc.

The move to expand Sysco's board to 12 members comes after

Trian--led by Mr. Peltz, its chief executive and co-founder--said

last week that Sysco hadn't lived up to its potential and should

run itself more efficiently. Trian, which became Sysco's largest

shareholder through its investment, also said Sysco should better

align management's compensation with the company's performance.

"We have engaged in constructive dialogue with Nelson and Josh

and look forward to benefiting from their insights and

contributions," Sysco's nonexecutive chairman, Jackie Ward, said in

a statement Thursday.

The accord marks one of the more rapid examples of activists

gaining board seats without a public battle, a sign of their

increasing influence among companies and other shareholders. Last

year, activists gained board seats at a record 107 companies, 91 of

them through pacts negotiated with the companies, according to data

provider FactSet. This year has gotten off to an even faster start,

with activists gaining seats at 86 companies in the first half

alone.

Trian long has exercised its muscle as among the most successful

activist firms in securing board seats. The roughly $12 billion New

York fund believes gaining those seats is the best way it can help

companies it invests in.

"Sysco is a leader in its business, and we believe it is

undervalued and has tremendous long-term potential," Mr. Peltz said

Thursday.

Houston-based Sysco, the largest U.S. food distributor by sales,

had touted its planned $3.5 billion acquisition of US Foods as a

way to cut costs and run a larger, more efficient operation. The

merger was in the works for about 18 months before Sysco dropped it

in June after a federal judge issued a preliminary injunction to

block the deal on antitrust grounds.

Sysco's operating profit margin has declined for the past

several years, as local, specialty distributors and wholesale

stores, such as Restaurant Depot, attract smaller restaurant

customers, which are typically more profitable for Sysco than

national chains. Meanwhile, sluggish U.S. restaurant sales overall

have pinched Sysco's revenues.

Trian's partners are no strangers to the food industry, a

specialty of the 73-year-old Mr. Peltz. Trian's first investment,

in 2005, was in Wendy's Co., where Mr. Peltz remains chairman. He

also serves on the board of snacks giant Mondelez International

Inc.

Mr. Frank, a younger partner at the firm at 36, has been

involved in many of Trian's consumer-goods investments.

Sysco has scheduled an investor conference for Sept. 15, when it

plans to discuss its plans for cost-cutting, smaller acquisitions,

and improving its technology and product assortment. Chief

Executive Bill DeLaney reiterated on Thursday that the company

plans to repurchase $3 billion more of its shares over the next two

years. Over the past three years, the company has cut $750 million

in annual costs, he has said.

Josh Beckerman contributed to this article.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 20, 2015 19:02 ET (23:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

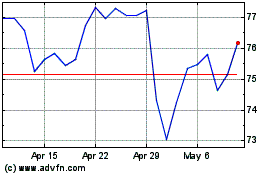

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

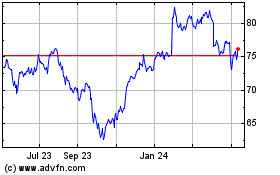

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024