Sunoco Logistics to Buy Energy Transfer

November 21 2016 - 11:40AM

Dow Jones News

Sunoco Logistics Partners L.P. will buy Energy Transfer Partners

L.P. in an all-stock deal worth about $21 billion, pushing together

two pieces of the Energy Transfer family of companies.

Energy Transfer Partners, which owns about 20% of Sunoco shares,

is one of four publicly traded partnerships in the Energy Transfer

family; the others are Energy Transfer Equity LP and Sunoco LP.

Energy Transfer is currently in the midst of building the

controversial Dakota Access Pipeline, which is facing protests from

the Standing Rock Sioux tribe and environmental activists.

Energy Transfer shareholders will receive 1.5 Sunoco shares for

each share they own, valuing their Energy Transfer shares at $39.29

according to Friday's closing prices. Energy Transfer closed at

$39.37 Friday. The companies said the price is a 10% premium over

the volume-weighted average price for the last 30 trading days.

Energy Transfer shares traded down 6.3% to $36.89 on Monday

morning, as Sunoco shares fell 7.5% to $24.24.

The deal combines Sunoco's natural gas liquids business with

Energy Transfer's natural gas gathering, processing and

transportation business. The companies expect annual cost savings

in excess of $200 million by 2019.

The two companies have worked together previously as partners in

several joint ventures. In August, they agreed to sell their $2

billion minority stake of the Bakken Pipeline Project.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 21, 2016 11:25 ET (16:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

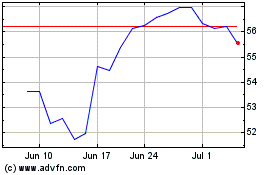

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

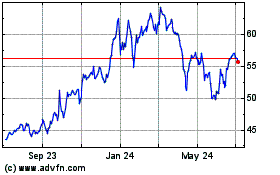

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024