Energy Transfer and Williams Cos. to Merge in $32.6 Billion Deal

September 28 2015 - 8:30AM

Dow Jones News

Williams Cos. agreed to be acquired by an Energy Transfer Equity

LP affiliate in a deal that values Williams at roughly $32.6

billion, expected to create one of the biggest energy companies in

the world.

Under the deal, Williams holders would receive roughly $43.50

per share held, or 1.8716 shares of ETE affiliate Energy Transfer

Corp. per Williams share held. If Williams holders chose to receive

more than an aggregate of $6.05 billion cash, the deal would be

subject to proration.

Including debt and other liabilities, the deal is valued at

about $37.7 billion.

If all of Williams' stockholders elect to receive all cash or

all stock, then each share of Williams common stock would receive

$8 a share in cash and 1.5274 ETC common shares.

Williams holders also would be eligible to a one-time special

dividend of 10 cents per share held.

The deal was approved by both companies' boards.

Energy Transfer, a Dallas-based pipeline company, had been

pursuing Williams for six months before Williams spurned its

unsolicited offer, valued at $48 billion or $53.1 billion including

debt and other liabilities, in June. Williams said at the time that

the offer significantly undervalued the company, setting the stage

for a potential bidding contest.

Williams Chairman Frank T. MacInnis on Monday said that after an

evaluation of the company's alternatives, the board concluded the

deal with Energy Transfer is in the best interest of the company's

stakeholders.

Shares of energy companies have been slammed of late amid a drop

in oil prices, with Williams and Energy Transfer shares both

declining more than 25% in the past three months. A downturn in

commodities prices has had stronger companies across the

industry—including exploration and drilling companies—eyeing rivals

as potential acquisition targets.

Geographically, a deal with Williams gives Energy Transfer an

expanded geographic footprint. Williams has significant fuel-moving

capabilities in the northeastern U.S., while most of Energy

Transfer's pipelines are located across the south and Midwest.

Williams and Energy Transfer already have a contentious history.

In 2011, Energy Transfer agreed to buy pipeline operator Southern

Union Co. for $4.2 billion when Williams swooped in and offered

$4.9 billion. Ultimately, Energy Transfer paid $5.7 billion to win

the deal.

Williams also terminated its deal to acquire pipeline affiliate

Williams Partners LP, which will remain a publicly traded master

limited partnership.

Energy Transfer Equity is a master limited partnership that owns

the general partner and 100% of the incentive distribution rights

of Energy Transfer Partners LP and Sunoco LP.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 08:15 ET (12:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

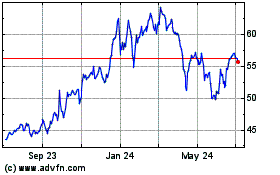

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

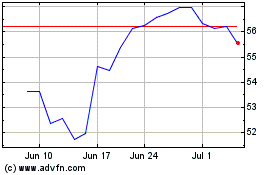

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024