Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 16 2015 - 6:07AM

Edgar (US Regulatory)

ISSUER FREE WRITING PROSPECTUS

Filed pursuant to Rule 433

Relating

to Preliminary Prospectus Supplement dated July 15, 2015

Registration Statement No. 333-203965

July 15, 2015

SUNOCO LP

PRICING TERM SHEET

JULY 15, 2015

This free

writing prospectus is being filed pursuant to Rule 433 of the Securities Act of 1933, as amended, and relates to the preliminary prospectus supplement filed by Sunoco LP (the “Partnership”) with the Securities and Exchange Commission on

July 15, 2015 and their Registration Statement (File No. 333-203965). This issuer free writing prospectus sets forth the final pricing information related to the underwritten public offering of the Partnership’s common units

representing limited partner interests. The information in this free writing prospectus updates and supersedes the information in the preliminary prospectus supplement to the extent that it is inconsistent therewith. All capitalized terms not

otherwise defined in this free writing prospectus shall have the meanings given in the preliminary prospectus supplement.

| Offering Size: |

5,500,000 common units representing limited partner interests |

| Option to purchase additional common units: |

Up to 825,000 additional common units |

| Price to public: |

$40.10 per common unit |

| Proceeds to SUN (after expenses)1: |

$212,933,500 |

| Trade date: |

July 15, 2015 |

| Settlement date: |

July 21, 2015 |

| Stabilization Transactions: |

We have been advised by the Joint Book-Running Managers that, prior to purchasing the common units being offered pursuant to the preliminary prospectus supplement, on July 15, 2015, Morgan Stanley & Co. LLC purchased, on behalf of the

syndicate, 43,344 common units at an average price of $40.10 per common unit in stabilizing transactions. |

| Joint Book-Running Managers: |

Morgan Stanley & Co. LLC |

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

UBS Securities LLC

Wells Fargo Securities, LLC

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) Inc.

Deutsche Bank Securities Inc.

Goldman, Sachs & Co.

Jefferies LLC

J.P. Morgan

Securities LLC

Raymond James & Associates, Inc.

RBC Capital Markets, LLC

Robert W. Baird & Co. Incorporated

| 1 |

After deducting underwriting discounts and commissions and estimated offering expenses payable by us and assumes option to purchase additional common units is not exercised. |

Sunoco LP previously filed a registration statement on Form S-3 (Registration No. 333-203965) with the

Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates, which registration statement became effective on May 7, 2015. Before you invest, you should read the prospectus supplement to the

prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about Sunoco LP and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at

www.sec.gov.

A copy of the preliminary prospectus supplement and prospectus relating to the offering may be obtained from the offices of:

|

|

|

|

|

| Morgan Stanley

Attn: Prospectus Department

180 Varick Street, 2nd Floor

New York, NY 10014 |

|

BofA Merrill Lynch 222 Broadway,

New York, NY 10038 Attn: Prospectus Department

Email: dg.prospectus_requests@baml.com |

|

UBS Investment Bank

Attn: Prospectus Department

1285 Avenue of the Americas New York, NY 10019

(888) 827-7275 |

|

|

|

| Wells Fargo Securities

Attn: Equity Syndicate Dept.

375 Park Avenue

New York, New York 10152

Phone: (800) 326-5897

cmclientsupport@wellsfargo.com |

|

Citigroup c/o Broadridge Financial Solutions

1155 Long Island Avenue Edgewood, New York 11717

Phone: (800) 831-9146 prospectus@citi.com |

|

Credit Suisse

Attn: Prospectus Department One

Madison Avenue New York, NY 10010 Email:

newyork.prospectus@credit-suisse.com Telephone: (800) 221-1037 |

|

|

|

| Deutsche Bank Securities

Attn: Prospectus Group

60 Wall Street

New York, NY 10005-2836

Telephone: (800) 503-4611

Email: prospectus.cpdg@db.com |

|

Goldman, Sachs & Co. Prospectus

Department 200 West Street New York, NY 10282

Telephone: 1-866-471-2526 Email:

prospectus-ny@ny.email.gs.com |

|

Jefferies

Attn: Equity Syndicate Prospectus Department

520 Madison Avenue, 2nd Floor New York, NY, 10022

Telephone: 877-547-6340

Email: Prospectus_Department@Jefferies.com |

|

|

|

| J.P. Morgan

Attn: Broadridge Financial Solutions

1155 Long Island Avenue

Edgewood, New York 11717

Phone: (866) 803-9204

Robert W. Baird & Co. Incorporated

Attention: Syndicate Department

777 E. Wisconsin Avenue

Milwaukee, WI 53202

Telephone: 800-792-2473

Email: syndicate@rwbaird.com |

|

Raymond James 880 Carillon Parkway

St. Petersburg, Florida 33716 (800) 248-8863

prospectus@raymondjames.com |

|

RBC Capital Markets

ATTN: Equity Syndicate

Three World Financial Center 200 Vesey St., 8th Floor

New York, NY 10281 Phone: (877) 822-4089

Email: equityprospectus@rbccm.com |

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded.

Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

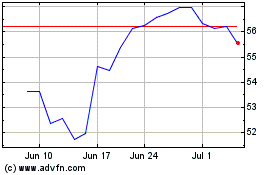

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

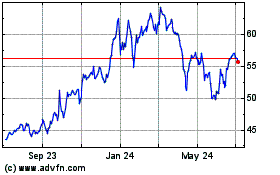

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024