Constellation Buys Charles Smith Wines, Sells Canadian Wine Business

October 17 2016 - 9:40AM

Dow Jones News

Constellation Brands Inc. said Monday it has agreed to sell its

Canadian wine business to Ontario Teachers' Pension Plan for about

$1.03 billion Canadian dollars ($784 million), underscoring

Constellation's sharpened focus on premium spirits, beer and

wine.

The news confirms a report by The Wall Street Journal on Sunday,

which said Constellation was close to a deal to sell the business

for C$1 billion.

Also on Monday, Constellation said it would buy the Charles

Smith Wines collection for about $120 million. The transaction,

expected to close in October, also highlights Constellation's pivot

to higher-quality libations.

Victor, N.Y.-based Constellation said in April it planned to

explore an initial public offering for its Canadian wine business.

But it decided to put the business up for sale after receiving

overtures from a handful of Canadian wineries and the teachers'

pension plan, The Journal reported.

Chief Executive Rob Sands said in prepared remarks Monday that

the company decided to sell the business when the opportunity

"presented itself."

Constellation is jettisoning its Canadian unit, which includes

such wine labels as Jackson-Triggs and Sumac Ridge, 10 years after

it acquired Vincor International Inc. for C$1.27 billion. But it is

keeping Vincor's international wine labels, including Australia's

Kim Crawford, that came with the 2006 purchase.

Constellation shares rose 1.5% to $172 in premarket trading. The

stock is up 25% over the past 12 months.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 17, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

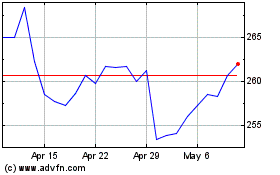

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

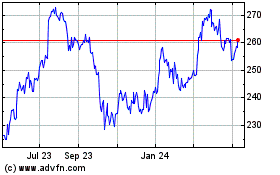

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024