CORRECT: Canada's Life Insurers Seen Posting Mixed 3Q Results

November 02 2010 - 6:38PM

Dow Jones News

Low interest rates are expected to damp third-quarter earnings

at Canada's life insurers, offsetting modest relief from rebounding

equities, analysts say.

Sun Life Financial Inc. (SLF.T, SLF) and Industrial Alliance

Insurance and Financial Services Inc. (IAG.T) report their results

Wednesday, while Manulife Financial Corp. (MFC.T, MFC) reports on

Thursday. Great-West Lifeco Inc. (GWO.T), controlled by Montreal's

Desmarais family, is scheduled to report next week.

"It's going to be a bit noisy in terms of the headline numbers,

but the operating results will be reasonable," said Craig Fehr, an

analyst at Edward Jones in St. Louis. "I don't think, by any

stretch, these companies are firing on all cylinders yet. They've

been fighting a lot of headwinds for several quarters now, but they

are managing their results somewhat effectively."

Equity markets rebounded during the third quarter, which ended

Sept. 30. The S&P 500 gained 10.7%, while the S&P/TSX

Composite Index climbed 9.5%. But, sluggish economic growth kept

interest rates on their downward trajectory, with long-term

government rates in Canada and the U.S. falling between 20 and 42

basis points.

When stock prices or bond yields decline, insurers must build up

their reserves to cover the long-term obligations on their

products, such as annuities. Unlike in the U.S., Canadian insurers

are required to mark-to-market their investments.

The earnings of the three largest life insurers--Manulife,

Great-West Lifeco and Sun Life--are sensitive to interest rate and

equity fluctuations in varying degrees. Great-West and Sun Life are

far less exposed to market fluctuations than Manulife, which not

only sold more long-term guaranteed product, it failed to hedge its

investment portfolio.

Each 1% decline in interest rates reduces earnings by C$2.7

billion, Manulife has said. The company, which embarked on a

hedging program in 2007, plans to hedge or reinsure at least 70% of

its variable annuity guaranteed value by the end of 2012, up from

51%. It didn't make any progress in hedging its book in the second

quarter, and analysts say they don't expect to see much headway in

the third quarter either.

Manulife, which owns U.S. insurer John Hancock Financial,

sideswiped investors in the second quarter when it posted a loss of

C$2.4 billion, its biggest ever, sending its stock price reeling.

The company took charges of C$3.2 billion from falling rates and

equity prices.

The life insurer forewarned in August that it will take

third-quarter charges arising from changes to its actuarial

assumptions, including increased morbidity in its long-term care

business in the U.S. and additional assumed volatility in its

variable-annuity business and modifications to its ultimate

reinvestment rate, or URR, that is the risk that future proceeds

may need to be reinvested at a lower potential interest rate.

"It's really Manulife that'll have the messy quarter," said BMO

Capital Markets analyst Tom MacKinnon.

He forecasts the company to report a loss of 89 Canadian cents a

share. That is higher than the mean estimate of 73 Canadian cents

from 11 analysts polled by Thomson Reuters. MacKinnon expects

Manulife to post a per-share operating profit of 36 Canadian cents,

which will evaporate from anticipated charges, including a 60

Canadian cent-a-share hit from its U.S. long-term care

business.

According to Thomson Reuters, Sun Life is expected to report a

profit of 61 Canadian cents a share, while per-share mean estimates

for Great-West and Industrial-Alliance are 48 Canadian cents and 73

Canadian cents, respectively.

Unlike many analysts who are cautious on the sector, Edward

Jones' Fehr has buy ratings on Manulife, Sun Life and Great-West.

For investors with a longer investment horizon, he said the stocks

are attractive buys.

"The valuations for these companies are very cheap because

they're reflecting very pessimistic expectations," he said. "The

environment isn't going to turn around for them in one to two

quarters. It's going to be a longer-term timeframe. We have to see

interest rates rise over time for these companies to start

performing well."

-By Caroline Van Hasselt, Dow Jones Newswires; 416-306-2023;

caroline.vanhasselt@dowjones.com

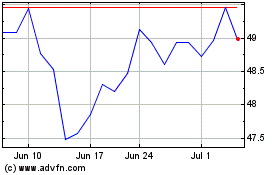

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

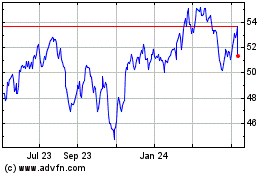

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Apr 2023 to Apr 2024