Report of Foreign Issuer (6-k)

November 25 2016 - 8:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2016

Commission File Number: 333-04906

SK Telecom

Co., Ltd.

(Translation of registrant’s name into English)

Euljiro 65, Jung-gu

Seoul 04539, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7):

Cash Consideration for Shares of SK Communications Co., Ltd.

On November 24, 2016, the board of directors of SK Telecom Co., Ltd. (“SK Telecom”) resolved to approve the payment of cash

consideration in lieu of the issuance of shares of SK Telecom in a comprehensive exchange of shares of SK Communications Co., Ltd. (“SK Communications”) (the “Transaction”). Upon the consummation of the Transaction, SK

Communications will become a wholly-owned subsidiary of SK Telecom.

1. Form of the Transaction: Small-scale share swap

2. Information about SK Communications

|

|

a.

|

Representative Director: Sang Soon Park

|

|

|

b.

|

Main Business: Portal services and other Internet information services

|

|

|

c.

|

Relationship with SK Telecom: SK Communications is a subsidiary of SK Telecom.

|

|

|

d.

|

Number of issued shares: 43,427,530 shares

|

|

|

e.

|

Financial Information (on a separate basis as of and for the year ended December 31, 2015)

|

|

|

•

|

|

Total Assets: Won 152.5 billion

|

|

|

•

|

|

Total Liabilities: Won 35.0 billion

|

|

|

•

|

|

Total Equity: Won 117.5 billion

|

|

|

•

|

|

Share Capital: Won 21.7 billion

|

3. Share Exchange Ratio

The share exchange ratio for the Transaction has been determined to be 1:0.0125970. On the share exchange date, the common shares of SK Communications not

already owned by SK Telecom will be transferred to SK Telecom and the holders of such common shares will be given cash consideration of Won 2,814 per common share of SK Communications (in lieu of common shares newly issued by SK Telecom) in

accordance with Article 360-3(3)4 of the Korean Commercial Code (the “KCC”).

4. Determination of the Transaction Ratio

As both SK Telecom and SK Communications are listed corporations, the share exchange ratio was determined based on the reference share prices calculated

pursuant to Article 165-4 of the Financial Investment Services and Capital Markets Act of Korea (“FSCMA”) and Articles 176-5(1) and 176-6(2) of the Enforcement Decree of the FSCMA.

2

The reference share price for each of SK Telecom and SK Communications is the arithmetic mean of (i) the

weighted average of the share prices for the most recent one-month period from the calculation date, (ii) the weighted average of the share prices for the most recent one-week period from the calculation date and (iii) the closing share

price on the calculation date. The calculation date is November 23, 2016, which is the date prior to the earlier of (a) the date of the board resolution regarding the Transaction (November 24, 2016) and (b) the date of the share

exchange agreement (the “Share Exchange Agreement”) for the Transaction (November 25, 2016).

In addition, while Article 176-5(1)1 of the

Enforcement Decree of the FSCMA allows for the share reference price to be decreased or increased by up to 30% (or 10% in the case of mergers between affiliated companies), SK Telecom did not apply this rule in determining the share exchange ratio.

|

|

|

|

|

|

|

|

|

Item

|

|

Amount (Won)

|

|

|

Calculation Period

|

|

(i) Weighted average of the share prices for the most recent

one-month

period

|

|

|

222,595

|

|

|

October 24, 2016 – November 23, 2016

|

|

(ii) Weighted average of the share prices for the most recent

one-week

period

|

|

|

221,562

|

|

|

November 17, 2016 – November 23, 2016

|

|

(iii) Closing share price on the calculation date

|

|

|

226,000

|

|

|

November 23, 2016

|

|

Arithmetic mean [((i) + (ii) + (iii)) / 3]

|

|

|

223,386

|

|

|

—

|

|

Reference share price

|

|

|

223,386

|

|

|

—

|

|

|

|

|

|

|

|

|

|

Item

|

|

Amount (Won)

|

|

|

Calculation Period

|

|

(i) Weighted average of the share prices for the most recent

one-month

period

|

|

|

2,821

|

|

|

October 24, 2016 – November 23, 2016

|

|

(ii) Weighted average of the share prices for the most recent

one-week

period

|

|

|

2,870

|

|

|

November 17, 2016 – November 23, 2016

|

|

(iii) Closing share price on the calculation date

|

|

|

2,750

|

|

|

November 23, 2016

|

|

Arithmetic mean [((i) + (ii) + (iii)) / 3]

|

|

|

2,750

|

|

|

—

|

|

Reference share price

|

|

|

2,814

|

|

|

—

|

Pursuant to the method set forth above, the share exchange ratio for the Transaction is 1 (SK Telecom): 0.0125970 (SK

Communications). On the share exchange date, the holders of common shares of SK Communications (other than SK Telecom) will be given cash consideration of Won 2,814 per common share of SK Communications (in lieu of common shares newly issued by

SK Telecom) in accordance with Article 360-3(3)4 of the KCC.

5. Matters Relating to the External Appraisal

3

As both SK Telecom and SK Communications are listed corporations, the share exchange ratio was determined based

on the reference share prices calculated pursuant to Article 165-4 of the FSCMA and Articles 176-5 and 176-6 of the Enforcement Decree of the FSCMA. Therefore, pursuant to

Article 176-6(3)

of

the Enforcement Decree of FSCMA, an external appraisal with respect to the calculation of the reference share prices is not required.

6. Purpose of the

Transaction: SK Telecom intends to acquire all of the shares of SK Communications that it does not already own through the Transaction, following which SK Communications will become its wholly-owned subsidiary, in order to enhance corporate value by

improving management efficiency and maximizing synergies in the platform business.

7. Impact and Effect of the Transaction

|

|

a.

|

Impact and Effect on SK Telecom’s Share Ownership and Management: Upon the completion of the Transaction, (i) there will be no change in the share ownership interest of SK Telecom’s existing shareholders

or the corporate governance structure and management of SK Telecom, (ii) SK Telecom and SK Communications will remain as existing corporate entities, (iii) SK Communications will become a wholly-owned subsidiary of SK Telecom, (iv) SK

Telecom will remain a listed corporation on the Korea Exchange, (v) SK Communications will be delisted from the Korea Exchange and (vi) pursuant to the Share Exchange Agreement, the directors and members of the Audit Committee of SK

Telecom appointed before the Transaction shall retain their original terms of appointment despite Article 360-13 of the KCC, and there will be no executive officers newly appointed due to the Transaction.

|

|

|

b.

|

Impact and Effect on SK Telecom’s Financial Position and Business: Through the Transaction, it is expected that management efficiency will be improved through the more efficient use of resources of both companies

and therefore, the Transaction will have a positive effect on the financial position of both companies. In order to create a sustainable foundation for growth, SK Telecom aims to transform into a next-generation platform service provider. As part of

this goal, SK Telecom expects that with SK Communications as a wholly-owned subsidiary, it will be able to utilize the platform service management capabilities of SK Communications and maximize synergies in the platform business.

|

8. Timeline of the Transaction

|

|

|

|

|

Event

|

|

Date(s)

(1)

|

|

|

|

|

Date of the Share Exchange Agreement

|

|

November 25, 2016

|

|

|

|

|

Record date

|

|

December 9, 2016

|

|

|

|

|

Closure of the shareholder register

|

|

December 10, 2016 to December 16, 2016

|

|

|

|

|

Dissent filing period

|

|

December 9, 2016 to December 23, 2016

|

|

|

|

|

Board of directors’ meeting to approve the Share Exchange Agreement

(2)

|

|

January 4, 2017

|

|

|

|

|

Closing date of the Transaction

|

|

February 7, 2017

|

|

(1)

|

The dates listed herein are subject to change due to consents or approvals from relevant institutions or due to further agreements among the parties.

|

4

|

(2)

|

As the Transaction will proceed in accordance with the procedures for a small-scale share swap pursuant to Article 360-10 of the KCC, a meeting of the board of directors will be held to approve the Share Exchange

Agreement in lieu of a general meeting of shareholders held in accordance with Article 360-3(1) of the KCC.

|

9. Appraisal Rights

Shareholders of SK Telecom dissenting from the Transaction are not granted any appraisal rights as the Transaction will proceed in accordance with the

procedures for a small-scale share swap set forth in

Article 360-10

of the KCC.

10. Board of Directors’

Meeting: The Transaction was approved at a meeting of the board of directors of SK Telecom on November 24, 2016 with all four outside directors attending.

11. Back-door Listing: Not applicable.

12. Put-back Option:

Not applicable.

13. Other Matters to be Considered

|

|

a.

|

Pursuant to Article 360-10(5) of the KCC, if shareholders that collectively hold 20% or more of the total number of issued and outstanding shares of SK Telecom object to the Transaction, SK Telecom may not proceed with

the Transaction as a small-scale share swap and instead proceed with the Transaction as a general share exchange.

|

|

|

b.

|

The Share Exchange Agreement would lose effectiveness retroactively if the Share Exchange Agreement is not approved by the board of directors of SK Telecom or the shareholders of SK Communications.

|

|

|

c.

|

The Share Exchange Agreement may be amended or terminated in accordance with the following terms.

|

|

|

(1)

|

Following the execution of the Share Exchange Agreement and prior to the share exchange date, in the event any matter related to the terms of the Share Exchange Agreement is in breach of applicable laws and/or

accounting standards, SK Telecom and SK Communications may amend the Share Exchange Agreement by written agreement to comply with such applicable laws and/or accounting standards.

|

|

|

(2)

|

Following the execution of the Share Exchange Agreement and prior to the share exchange date, in the event any of the following occurs, SK Telecom and SK Communications may by mutual written agreement terminate or amend

the Share Exchange Agreement:

|

|

|

(i)

|

a natural disaster or other material change to the assets and operation of SK Telecom or SK Communications;

|

5

|

|

(ii)

|

failure to obtain approvals necessary for the Transaction from the government or related agencies or any breach of applicable law due to the Transaction which cannot be cured; or

|

|

|

(iii)

|

other causes which make it impossible to maintain the Share Exchange Agreement, including the unfairness of the share exchange ratio.

|

|

|

(3)

|

Following the execution of the Share Exchange Agreement, if shareholders that collectively hold 20% or more of the total number of issued and outstanding shares of SK Telecom object to the Transaction (for which the

approval of the general meeting of shareholders is substituted by the approval of the board of directors), SK Telecom may terminate the Share Exchange Agreement by notifying SK Communications in writing within 30 days after the end of the dissent

filing period.

|

|

|

(4)

|

SK Telecom and SK Communications may enter into separate agreements for matters requiring agreement in connection with the Transaction and such separate agreements shall be deemed part of the Share Exchange Agreement.

|

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

SK T

ELECOM

C

O

., L

TD

.

|

|

(

Registrant

)

|

|

|

|

|

By:

|

|

/s/ Sunghyung Lee

|

|

(

Signature

)

|

|

Name:

|

|

Sunghyung Lee

|

|

Title:

|

|

Senior Vice President

|

Date: November 25, 2016

7

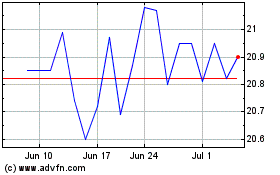

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

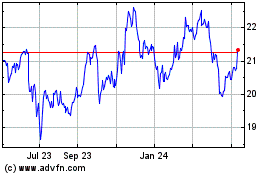

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024