ADR REPORT: Shares Mostly Lower As Fed Outlook Weighs

June 22 2011 - 5:26PM

Dow Jones News

International companies trading in New York closed mostly lower

Wednesday in line with the broader market, as the Federal Reserve

issued a cautious economic outlook just days before it ends its

asset-buying program.

The Bank of New York index of ADRs fell 0.9% to 138.32, with the

European index posting the largest decline amid concerns that the

European consumer environment is showing signs of extreme

stress.

The European index lost 1.2% to 128.12.

Dutch electronics company Royal Philips Electronics NV (PHG,

PHIA.AE) was one of the day's largest decliners, falling 10% to

$23.36 after warning that its profit would be hit by weak consumer

demand in Western Europe.

Meanwhile, HSBC lowered its stock-investment ratings on Lloyds

Banking Group PLC (LYG, LLOY.LN), Barclays PLC (BCS, BARC.LN) and

Royal Bank of Scotland Group PLC (RBS, RBS.LN) to neutral from

overweight. HSBC said proposed regulatory changes from the

Independent Commission on Banking could mean a hit of up to 10

billion pounds ($16.2 billion) for the three U.K. Banks. Lloyds

fell 1.3% to $2.98 while Barclays lost 3.8% to $16.28. RBS closed

2.4% lower at $12.40.

The Asian index fell 0.5% to 132.92 and the emerging markets

index slid 0.5% to 324.48.

KT Corp. (KT, 030200.SE) fell 2% to $18.16 after South Korea's

telecommunications regulator said it will bar it and SK Telecom Co.

(SKM, 017670.SE), the country's top two mobile carriers, from

participating in a spectrum auction later this month due to fair

competition concerns. SK Telecom slid 0.9% to $17.70.

But China's Hanwha SolarOne Co. (HSOL) rose 12% to $5.89 as

Collins Stewart raised its stock-investment rating on the company

to buy from neutral, saying declining wafer prices will help the

company improve its cost structure.

Collins Stewart also initiated coverage of China Sunergy Co.

(CSUN) with a buy rating, saying higher capacity of solar-cell

component polysilicon has flattened the industry's cost curve and

helped the company compete with other vendors. China Sunergy surged

20% to $2.18.

Meanwhile, E-House (China) Holdings Ltd. (EJ) rose 9.8% to $8.93

after the company said Chairman Xin Zhou plans to buy $10 million

in the company's American depositary shares over the next year.

"Despite the challenging real estate market conditions we are

experiencing now, I am confident in the strong fundamentals and

long-term prospects of the real estate industry in China," Zhou

said.

The Latin American index was the lone gainer Wednesday, ending

0.3% higher at 396.36.

Brazilian mining giant Vale SA (VALE, VALE5.BR) has given

Argentine authorities an updated investment plan for its

multi-billion dollar Rio Colorado potash mine project in an effort

to address complaints that led the government to suspend work last

week. Vale's shares edged up 8 cents to $30.74.

-By Matt Jarzemsky, Dow Jones Newswires; 212-416-2240;

matthew.jarzemsky@dowjones.com

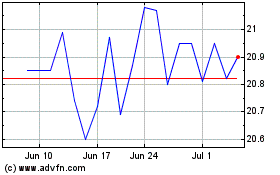

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

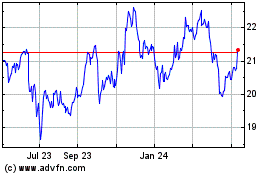

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024