Boston Beer's Seasonal Strategy Has Historical Roots

January 26 2012 - 9:11AM

Dow Jones News

Boston Beer Co. (SAM) is springing into the new year with a new

seasonal offering, as the craft brewer continues to experiment with

new flavors, a strategy that has historical roots.

The brewer of Sam Adams beer is rolling out its newest spring

ale, named Alpine Spring, which will be available through April.

The medium-bodied, golden-colored lager incorporates fruit flavors

such as tangerine, orange, peach and apricot and retails at a

suggested $7.99 for a six pack.

Boston Beer Chairman and founder Jim Koch told Dow Jones

Newswires the new brew invokes the change of the season, describing

the beer as "the first day of spring" and an awakening of the

palate.

The launch of a new seasonal ale comes as Boston Beer's Noble

Pils brew, which is being replaced by Alpine Spring, becomes a

year-round offering. Noble Pils had been Boston Beer's seasonal

offering for two years, succeeding White Ale, which is also sold

all year.

Boston Beer often explores new flavors during the spring season,

as the company's Octoberfest, Summer Ale and Winter Lager are more

closely identified with the other three seasons of the year.

Koch said beers traditionally have had a seasonal aspect, noting

many major brewing nations including the Germany, the U.K. and the

U.S. are located in regions with four distinct seasons.

"There is a rhythm to the seasons and there should be a rhythm

to the beers," said Koch about the appeal of Alpine Spring and the

other seasonal brands. He made the comments at a New York City

event.

He said Boston Beer also aims to create new flavors and tastes

to appeal to the core craft aficionado. Koch said interest in craft

brews has ramped up in recent years, attributing the demand to a

cultural shift, a trend that goes beyond the performance of the

U.S. economy. Last year, Boston Beer brewed and released

commercially over 50 different beers, though the availability of

those ales greatly varies.

Koch added that it was possible Alpine Spring could become a

year-round beer like Noble Pils, depending on the ale's

popularity.

William Capital Group analyst Marc Riddick, who has tasted the

beer and gave it a positive review, said Boston Beer's experimental

and innovative history contrasts with some of the traditional

brewers. The larger players court customers by demanding loyalty in

advertisement campaigns touting established brands, while craft

drinkers are more likely to seek out a variety of beers, though

they may remain loyal to one brewer.

For Alpine Spring, Riddick said the citrus notes could be more

popular with women than other beers. Overall, he said seasonal

beers are popular across all demographics.

Craft industry players like Boston Beer make up a sliver of the

roughly $100 billion U.S. beer business, though demand in the

higher-price segment is growing rapidly seasonal blends and other

innovative flavors appeal to more consumers. Competition in the

space has intensified, as big brewers aggressively push their craft

brands.

Analysts say Boston Beer, the flagship player in the craft

category, has a successful multitier research and development,

marketing and testing strategy that often begins with experimental,

limited-edition beers. The flavors discovered in early development

can later be used to make a seasonal brew and if well received,

become an all-year offering.

"They are very judicious in how they go about bringing these

brands to the market for the full year," said Auriga analyst Gary

Albanese.

Albanese said Boston Beer utilizes a different strategy than

other brewers when launching new ales, as the company often

launches new flavors nationally for a limited amount of time.

Competitors often launch a product in a test market and try to

gauge if consumers like it, Albanese added.

"It's a different strategy but the impact is still the same: do

people like it, are they buying it and when it goes away, do people

keep asking for it," said Albanese.

As craft's popularity surges, Boston Beer is forced to compete

with smaller players as well as behemoths like Molson Coors Brewing

Co. (TAP) and Anheuser-Busch InBev NV (BUD, ABI.BT) to win more

shelf space at retail stores and on premise. William Capital's

Riddick said Boston Beer last year bolstered its sales force so the

brews can be more available to consumers, and he said some

retailers like Wal-Mart Stores Inc. (WMT) were taking notice by

indicating they would provide more shelf space for craft.

Boston Beer's shares closed Wednesday up 0.3% at $100.01.

-By John Kell, Dow Jones Newswires; 212-416-2480;

john.kell@dowjones.com

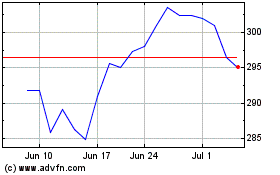

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Aug 2024 to Sep 2024

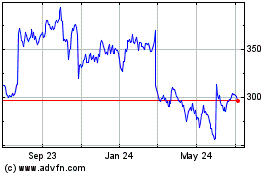

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Sep 2023 to Sep 2024