UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

SPRINT

CORPORATION

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

85207 U 10 5

(CUSIP

Number)

|

|

|

| Kenneth A. Siegel, Esq.

Morrison & Foerster LLP

Shin-Marunouchi Building, 29th Floor

5-1, Marunouchi 1-Chome

Chiyoda-ku, Tokyo, 100-6529 Japan

011-81-3-3214-6522 |

|

Robert S. Townsend, Esq.

Morrison & Foerster LLP

425 Market Street San

Francisco, CA 94105-2482 (415) 268-7000 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September 28, 2015

(Date

of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons SoftBank Group Corp. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

WC, BK (1) |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Japan |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

3,346,443,454 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

3,346,443,454 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,346,443,454 (1)(2) |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 83.19% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects (i) a reclassification exempt under Rule 16b-7 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in which Sprint Corporation (formerly known as

“Starburst II, Inc.” and referred to herein as “Sprint”) Class B Common Stock, par value $0.01 per share (“Sprint Class B Common Stock”), held by Starburst I, Inc. (“Starburst I”) was

reclassified into 3,076,525,523 shares of Sprint common stock, par value $0.01 per share (the “Sprint Common Stock”); (ii) the issuance by Sprint to Starburst I of the Sprint Warrant, dated July 10, 2013 (the

“Warrant”), which is subject to anti-dilution adjustment, as described in the Warrant; and (iii) purchases of Sprint Common Stock made in compliance with Rule 10b-18 (“Rule 10b-18”) under the Exchange Act and

pursuant to a written plan under Rule 10b5-1 under the Exchange Act (as more fully described in Item 3 of this Schedule 13D, the “Galaxy Purchases”) by Galaxy Investment Holdings, Inc. (“Galaxy”). |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, SoftBank Group Corp. (formerly known as SoftBank Corp. and referred to herein as “SoftBank”), Starburst I

and Galaxy (collectively, the “Reporting Persons”) may be deemed to be members of a “group” under Section 13(d) of the Exchange Act by virtue of SoftBank’s ownership of Starburst I and Galaxy, the Agreement and Plan

of Merger, dated as of October 15, 2012, by and among Sprint Nextel Corporation (“Sprint Nextel”), SoftBank, Starburst I, Sprint and Starburst III, Inc., as amended as of November 29, 2012, April 12, 2013 and June 10, 2013 (as

amended, the “Merger Agreement”), the Warrant, and the Galaxy Purchases. |

| (3) |

Percentage of class that may be deemed to be beneficially owned by SoftBank is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Securities and

Exchange Commission (the “Commission”) on August 7, 2015 (and including shares of Sprint Common Stock issuable upon exercise of the Warrant). |

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons Starburst I, Inc. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

3,131,105,447 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

3,131,105,447 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,131,105,447 (1)(2) |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 77.83% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects (i) a reclassification exempt under Rule 16b-7 under the Exchange Act in which Sprint Class B Common Stock held by Starburst I was reclassified into 3,076,525,523 shares of Sprint Common Stock and

(ii) the issuance of the Warrant, which is subject to anti-dilution adjustment, as described in the Warrant. |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, the Reporting Persons may be deemed to be members of a “group” under Section 13(d) of the Exchange Act by virtue

of SoftBank’s ownership of Starburst I and Galaxy, the Merger Agreement, the Warrant and the Galaxy Purchases. Starburst I expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially

owned by SoftBank and Galaxy, except to the extent of Starburst I’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Starburst I. |

| (3) |

Percentage of class is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on August 7, 2015 (and including shares of Sprint Common Stock

issuable upon exercise of the Warrant). |

|

|

|

|

|

|

|

| 1 |

|

Name of

Reporting Persons Galaxy Investment Holdings, Inc. |

| 2 |

|

Check the Appropriate Box if a Member

of a Group (a) x (b) ¨ |

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal

Proceedings Is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

215,338,007 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

215,338,007 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

215,338,007 (1)(2) |

| 12 |

|

Check Box if the Aggregate Amount in

Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount

in Row (11) 5.43% (2)(3) |

| 14 |

|

Type of Reporting Person

HC, CO |

| (1) |

Such figure reflects the Galaxy Purchases. |

| (2) |

As more fully described in the responses to Item 2 and Items 4 through 6 of this Schedule 13D, the Reporting Persons may be deemed to be members of a “group” under Section 13(d) of the Exchange Act by virtue

of SoftBank’s ownership of Starburst I and Galaxy, the Merger Agreement, the Warrant, and the Galaxy Purchases. Galaxy expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by

SoftBank and Starburst I, except to the extent of Galaxy’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Galaxy. |

| (3) |

Percentage of class is based on the outstanding Sprint Common Stock as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on August 7, 2015. |

EXPLANATORY NOTE

This Amendment No. 9 (this “Schedule 13D”) is being jointly filed on behalf of SoftBank Group Corp. (formerly known as

SoftBank Corp.), a Japanese kabushiki kaisha (“SoftBank”), Starburst I, Inc., a Delaware corporation and wholly owned subsidiary of SoftBank (“Starburst I”) and Galaxy Investment Holdings, Inc., a Delaware

corporation and wholly owned subsidiary of SoftBank (“Galaxy”, and together with SoftBank and Starburst I, the “Reporting Persons”, and each a “Reporting Person”) with respect to Sprint Corporation,

a Delaware corporation (referred to herein as “Sprint” or the “Issuer”). This Schedule 13D amends the Schedule 13D filed by SoftBank, Starburst I, Sprint and Starburst III, Inc., a Kansas corporation

(“Merger Sub”) on October 25, 2012, as amended on April 22, 2013 and June 11, 2013, as amended and restated on July 12, 2013, as amended on August 6, 2013 and August 27, 2013, as amended and restated on

September 18, 2013, and as amended on August 19, 2015 and August 28, 2015 (as amended and/or restated from time to time, the “Original 13D”), which relates to the common stock of Sprint, par value $0.01 per share (the

“Sprint Common Stock”).

In connection with the completion of the Merger, as defined in the Agreement and Plan of Merger,

dated as of October 15, 2012, by and among Sprint Nextel Corporation (“Sprint Nextel”), SoftBank, Starburst I, Sprint, and Merger Sub, as amended as of November 29, 2012, April 12, 2013 and June 10, 2013 (as

amended, the “Merger Agreement”, which is incorporated by reference from Exhibits 99.2 through 99.5 to this Schedule 13D), Merger Sub was merged into Sprint Nextel, Sprint became the parent company of Sprint Nextel, with Sprint

Nextel becoming its wholly owned subsidiary, and Sprint Nextel changed its name to “Sprint Communications, Inc.” This Schedule 13D is being filed to reflect open market purchases of Sprint Common Stock by Galaxy (i) between

August 31, 2015 and September 29, 2015 in compliance with Rule 10b-18 (“Rule 10b-18”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (such purchases, the “Rule 10b-18

Purchases”) and (ii) pursuant to a written plan under Rule 10b5-1 of the Exchange Act (the “Rule 10b5-1 Plan”) entered into by and between Galaxy and Deutsche Bank Securities Inc. on September 14, 2015, which is

attached hereto as Exhibit 99.12 and is incorporated herein by reference (such purchases, the “Rule 10b5-1 Purchases”, and together with the Rule 10b-18 Purchases, the “New Galaxy Purchases”).

Other than as set forth below, all Items in the Original 13D are unchanged. Capitalized terms used herein which are not defined herein have

the meanings given to them in the Original 13D.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

The last two paragraphs of

Item 3 of the Original 13D are hereby amended and restated to read as follows:

“Between August 1, 2013 and

September 16, 2013, and between August 10, 2015 and August 28, 2015, Galaxy purchased 167,026,064 shares of Sprint Common Stock (the “Prior Galaxy Purchases” and, together with the New Galaxy Purchases, the

“Galaxy Purchases”) in accordance with Rule 10b-18, for an aggregate purchase price of $910,444,413.88, exclusive of any fees, commissions or other expenses.

Between August 31, 2015 and September 29, 2015, Galaxy consummated the New Galaxy Purchases of 48,311,943 shares of Sprint Common

Stock in accordance with Rule 10b-18 and pursuant to the Rule 10b5-1 Plan, for an aggregate purchase price of $217,209,887, exclusive of any fees, commissions or other expenses (the shares acquired pursuant to the Galaxy Purchases are referred to

herein as the “Galaxy Shares”). The Galaxy Purchases were financed from SoftBank’s general working capital. Galaxy directly beneficially owns the Galaxy Shares.”

| Item 4. |

Purpose of Transaction. |

Item 4 of the Original 13D is hereby amended and restated

in its entirety to read as follows:

“Purpose of the Transaction

SoftBank may be deemed a beneficial owner of the Sprint Common Stock in connection with the Merger and the subsequent reclassification

described in Item 3 to this Schedule 13D, the issuance of the Warrant, and the Galaxy Purchases. The Merger is intended to make Sprint a stronger, more competitive company that will deliver significant benefits to U.S. consumers based on

SoftBank’s expertise in the deployment of next-generation wireless networks and track record of success in taking share in mature markets from larger telecommunications competitors.

Starburst I directly owns the Sprint Common Stock in connection with the Merger and the

subsequent reclassification described in Item 3 to this Schedule 13D, and may be deemed to beneficially own the shares of Sprint Common Stock issuable upon exercise of the Warrant.

Between August 1, 2013 and September 16, 2013, and between August 10, 2015 and August 28, 2015, Galaxy consummated the

Prior Galaxy Purchases of 167,026,064 shares of Sprint Common Stock in the open market in accordance with Rule 10b-18. Between August 31, 2015 and September 29, 2015, Galaxy consummated the New Galaxy Purchases of 48,311,943 shares of

Sprint Common Stock in the open market in accordance with Rule 10b-18 and pursuant to the Rule 10b5-1 Plan, or approximately 1.22% of the outstanding shares of Sprint Common Stock, based on the outstanding Sprint Common Stock as set forth in

Sprint’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (the “Commission”) on August 7, 2015. Galaxy directly beneficially owns the Galaxy Shares. SoftBank currently expects Galaxy to make

further purchases of Sprint Common Stock. However, SoftBank expects that such purchases will not increase SoftBank’s beneficial ownership in Sprint to 85% or more of the outstanding shares of Sprint Common Stock (which outstanding share count

does not include the shares of Sprint Common Stock that would be issued upon exercise of the Warrant).

Plans or Proposals

The Reporting Persons, as stockholders in Sprint, intend to review their investment in Sprint and have discussions with representatives of

Sprint and/or other stockholders of Sprint from time to time and, as a result thereof, may at any time and from time to time determine to take any available course of action and may take any steps to implement any such course of action. Such review,

discussions, actions or steps may involve one or more of the types of transactions specified in clauses (a) through (j) of Item 4 of this Schedule 13D, including purchase or sale of Sprint Common Stock, business combination or other

extraordinary corporate transactions, sales or purchases of material assets, changes in the board of directors or management of Sprint, changes to Sprint’s business or corporate structure, shared service agreements, collaborations, joint

ventures and other business arrangements between or involving SoftBank and Sprint. Any action or actions the Reporting Persons might undertake in respect of the Sprint Common Stock will be dependent upon the Reporting Persons’ review of

numerous factors, including, among other things, the price level and liquidity of the Sprint Common Stock; general market and economic conditions; ongoing evaluation of Sprint’s business, financial condition, operations, prospects and strategic

alternatives; the relative attractiveness of alternative business and investment opportunities; tax considerations; and other factors and future developments. Notwithstanding anything to the contrary herein, the Reporting Persons specifically

reserve the right to change their intentions with respect to any or all of such matters.”

| Item 5. |

Interest in Securities of the Issuer. |

Item 5(a), (b) and (c) of the

Original 13D are hereby amended and restated in their entirety to read as follows:

“(a)-(b) As of September 29, 2015, each

Reporting Person may be deemed to have beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) and shared power to vote or direct the vote of up to the number of shares of Sprint Common Stock set forth in the table below and

may be deemed to constitute a “group” under Section 13(d) of the Exchange Act as described in Item 2 of this Schedule 13D, which is incorporated herein by reference.

|

|

|

|

|

|

|

|

|

| Reporting Person |

|

Shares of Sprint

Common Stock Such

Reporting Person

May Be Deemed to

Beneficially Own |

|

|

Percent of Voting

Power of Sprint

Common Stock(1) |

|

| SoftBank Group Corp.(2) |

|

|

3,346,443,454 |

|

|

|

83.19 |

% |

| Starburst I, Inc.(3) |

|

|

3,131,105,447 |

|

|

|

77.83 |

% |

| Galaxy Investment Holdings, Inc.(4) |

|

|

215,338,007 |

|

|

|

5.43 |

% |

| (1) |

The respective percentages of beneficial ownership are based on 3,968,170,784 shares of Sprint Common Stock outstanding as set forth in Sprint’s Quarterly Report on Form 10-Q, filed with the Commission on

August 7, 2015 (and, as to SoftBank and Starburst I beneficial ownership, including shares of Sprint Common Stock issuable upon exercise of the Warrant). |

| (2) |

Consists of 3,076,525,523 shares of Sprint Common Stock held by Starburst I as a result of the Reclassification; the 54,579,924 shares of Sprint Common Stock underlying the Warrant, which may be exercised in whole or in

part, at any time until July 10, 2018; and 215,338,007 shares of Sprint Common Stock held by Galaxy. |

| (3) |

Consists of 3,076,525,523 shares of Sprint Common Stock held by Starburst I following the Reclassification and 54,579,924 shares of Sprint Common Stock issuable upon exercise of the Warrant, which may be exercised in

whole or in part, at any time until July 10, 2018. Starburst I expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Galaxy, except to the extent of Starburst

I’s direct pecuniary interest in the shares of Sprint Common Stock directly beneficially owned by Starburst I. |

| (4) |

Galaxy expressly disclaims beneficial ownership with respect to the shares of Sprint Common Stock deemed to be beneficially owned by SoftBank and Starburst I, except to the extent of Galaxy’s direct pecuniary

interest in the shares of Sprint Common Stock directly beneficially owned by Galaxy. |

(c) The information contained in Items

3 and 4 to this Schedule 13D is herein incorporated by reference. In connection with the closing of the Merger, all Sprint Nextel common stock and options to acquire Sprint Nextel common stock held by directors and executive officers of Sprint

Nextel (immediately prior to the consummation of the Merger) were exchanged for Merger Consideration (as defined in the Merger Agreement) or options to purchase Sprint Common Stock pursuant to the terms of the Merger Agreement.

The weighted average price per share, exclusive of any fees, commissions or other expenses for the Galaxy Purchases made between

August 10, 2015 and September 29, 2015 are as set forth in the following table:

|

|

|

|

|

|

|

| Purchase Date |

|

Shares Purchased |

|

Weighted Average

Price per Share |

|

Price Range for

Shares Purchased |

| August 10, 2015 |

|

7,993,500 |

|

$3.74 |

|

$3.41 - $3.87 |

| August 11, 2015 |

|

7,993,500 |

|

$3.90 |

|

$3.78 - $4.00 |

| August 12, 2015 |

|

6,886,301 |

|

$3.76 |

|

$3.60 - $3.91 |

| August 13, 2015 |

|

2,729,018 |

|

$3.98 |

|

$3.91 - $4.04 |

| August 14, 2015 |

|

5,416,720 |

|

$4.06 |

|

$3.90 - $4.20 |

| August 17, 2015 |

|

8,652,800 |

|

$4.61 |

|

$4.24 - $4.74 |

| August 18, 2015 |

|

4,531,898 |

|

$4.71 |

|

$4.63 - $4.88 |

| August 19, 2015 |

|

3,533,816 |

|

$4.83 |

|

$4.71 - $4.97 |

| August 20, 2015 |

|

6,605,100 |

|

$4.79 |

|

$4.69 - $4.92 |

| August 21, 2015 |

|

6,623,336 |

|

$4.75 |

|

$4.58 - $4.87 |

| August 24, 2015 |

|

8,071,437 |

|

$4.60 |

|

$4.38 - $4.71 |

| August 25, 2015 |

|

6,633,015 |

|

$4.76 |

|

$4.70 - $4.85 |

| August 26, 2015 |

|

7,550,000 |

|

$4.69 |

|

$4.55 - $4.84 |

| August 27, 2015 |

|

5,684,582 |

|

$4.97 |

|

$4.85 - $5.08 |

| August 28, 2015 |

|

3,561,400 |

|

$5.19 |

|

$5.07 - $5.29 |

| August 31, 2015 |

|

2,533,485 |

|

$5.21 |

|

$5.11 - $5.28 |

| September 1, 2015 |

|

3,362,500 |

|

$5.11 |

|

$4.98 - $5.22 |

| September 2, 2015 |

|

2,121,800 |

|

$5.00 |

|

$4.91 - $5.11 |

| September 15, 2015 |

|

1,874,060 |

|

$4.95 |

|

$4.82 - $4.99 |

| September 16, 2015 |

|

3,702,223 |

|

$4.71 |

|

$4.61 - $4.89 |

| September 17, 2015 |

|

1,877,789 |

|

$4.71 |

|

$4.59 - $4.81 |

| September 18, 2015 |

|

5,836,397 |

|

$4.45 |

|

$4.29 - $4.66 |

| September 21, 2015 |

|

2,841,135 |

|

$4.49 |

|

$4.39 - $4.65 |

|

|

|

|

|

|

|

| Purchase Date |

|

Shares Purchased |

|

Weighted Average

Price per Share |

|

Price Range for

Shares Purchased |

| September 22, 2015 |

|

4,656,999 |

|

$4.38 |

|

$4.24 - $4.54 |

| September 23, 2015 |

|

2,469,570 |

|

$4.43 |

|

$4.33 - $4.54 |

| September 24, 2015 |

|

2,819,064 |

|

$4.31 |

|

$4.23 - $4.40 |

| September 25, 2015 |

|

1,800,280 |

|

$4.36 |

|

$4.28 - $4.46 |

| September 28, 2015 |

|

6,184,941 |

|

$4.15 |

|

$3.99 - $4.28 |

| September 29, 2015 |

|

6,231,700 |

|

$4.01 |

|

$3.77 to $4.12 |

The Reporting Persons undertake to provide Sprint, any stockholder of Sprint, or the Staff of the Commission,

upon request, full information regarding the number of shares purchased at each separate price within the ranges set forth in this Item 5(c) to this Schedule 13D.

Except as set forth above or incorporated herein, none of (i) the Reporting Persons and, (ii) to the Reporting Persons’

knowledge, the persons set forth on Appendix A-1, A-2 or A-3 of this Schedule 13D has effected any transaction in Sprint Common Stock during the past 60 days.”

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Original 13D is hereby amended to add the following paragraph to the end thereof:

“On September 14, 2015, Galaxy entered into the 10b5-1 Plan with Deutsche Bank Securities Inc. (the “Broker”)

pursuant to which the Broker is authorized and directed to purchase, on behalf of Galaxy, shares of Sprint Common Stock, subject to satisfaction of certain conditions, including, among others, trading price. Sprint also is a signatory to the 10b5-1

Plan solely for the purpose of providing the representation and warranty set forth in Section 9 of the 10b5-1 Plan. The Broker will cease purchasing Sprint Common Stock under the 10b5-1 Plan on the earliest to occur of (i) the date and the

time trading in the Sprint Common Stock first commences on the New York Stock Exchange following Sprint’s release of financial results for the quarter ending September 30, 2015; (ii) the date that the aggregate number of shares of

Sprint Common Stock purchased by the Broker reaches the specified purchase limit; or (iii) the date Galaxy gives notice of termination pursuant to the terms of the 10b5-1 Plan. A copy of the 10b5-1 Plan is filed as Exhibit 99.12 hereto and the

foregoing description of the 10b5-1 Plan is qualified in its entirety by reference to the 10b5-1 Plan.”

| Item 7. |

Material to be Filed as Exhibits. |

Item 7 of the Original 13D is hereby amended by

adding Exhibit 99.12 as follows:

|

|

|

|

|

| “99.12 |

|

10b5-1 Purchase Plan Agreement, dated as of September 14, 2015, by and between Galaxy Investment Holdings, Inc. and Deutsche Bank Securities Inc. (pursuant to a request for confidential treatment, confidential portions of this

Exhibit have been redacted and have been filed separately with the Securities and Exchange Commission).” |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: September 30, 2015

|

|

|

| SOFTBANK GROUP CORP. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

|

|

|

| STARBURST I, INC. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

|

|

|

| GALAXY INVESTMENT HOLDINGS, INC. |

|

|

| By: |

|

/s/ Joshua O. Lubov |

| Name: |

|

Joshua O. Lubov |

| Title: |

|

Attorney-in-Fact |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Joint Filing Agreement, dated as of August 5, 2013, by and between SoftBank Group Corp., Starburst I, Inc. and Galaxy Investment Holdings, Inc. (incorporated herein by reference to Exhibit 99.1 of the Schedule 13D Amendment filed by

SoftBank Group Corp., Starburst I, Inc., and Galaxy Investment Holdings, Inc. on August 6, 2013). |

|

|

| 99.2 |

|

Agreement and Plan of Merger, dated as of October 15, 2012, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint Corporation (then known as “Starburst II, Inc.”)

and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-1 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by reference) (File No. 333-186448). |

|

|

| 99.3 |

|

First Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of November 29, 2012, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-132 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by

reference) (File No. 333-186448). |

|

|

| 99.4 |

|

Second Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of April 12, 2013, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (included as part of Annex A beginning on page Annex A-134 to the Proxy Statement-Prospectus of Sprint Corporation filed May 1, 2013 and incorporated herein by

reference) (File No. 333-186448). |

|

|

| 99.5 |

|

Third Amendment to Agreement and Plan of Merger, dated as of October 15, 2012, entered into as of June 10, 2013, by and among Sprint Nextel Corporation, SoftBank Group Corp. (f/k/a SoftBank Corp.), Starburst I, Inc., Sprint

Corporation (then known as “Starburst II, Inc.”) and Starburst III, Inc. (incorporated herein by reference to Exhibit 2.1 of Sprint Corporation’s Current Report on Form 8-K filed June 11, 2013) (File No. 333-186448). |

|

|

| 99.6 |

|

Warrant Agreement for Sprint Corporation Common Stock, dated as of July 10, 2013 (incorporated herein by reference to Exhibit 10.6 of Sprint Corporation’s Current Report on Form 8-K filed July 11, 2013) (File No.

001-04721). |

|

|

| 99.7 |

|

Amended and Restated Certificate of Incorporation of Sprint Corporation (incorporated herein by reference to Exhibit 3.1 of Sprint Corporation’s Current Report on Form 8-K filed July 11, 2013) (File No. 001-04721). |

|

|

| 99.8 |

|

Restricted Stock Unit Agreement, dated as of March 17, 2014, by and between Galaxy Investment Holdings, Inc. and Ronald D. Fisher (incorporated herein by reference to Exhibit 99.8 of the Schedule 13D Amendment filed by SoftBank

Group Corp., Starburst I, Inc., and Galaxy Investment Holdings, Inc. filed August 19, 2015). |

|

|

| 99.9 |

|

Power of Attorney, dated as of August 5, 2013, executed by Masayoshi Son (incorporated herein by reference to Exhibit 99.9 of the Schedule 13D Amendment filed by SoftBank Group Corp., Starburst I, Inc., and Galaxy Investment

Holdings, Inc. on August 6, 2013). |

|

|

| 99.10 |

|

Power of Attorney, dated as of August 5, 2013, executed by Ronald D. Fisher (incorporated herein by reference to Exhibit 99.10 of the Schedule 13D Amendment filed by SoftBank Corp., Starburst I, Inc., and Galaxy Investment Holdings,

Inc. filed August 6, 2013). |

|

|

| 99.11 |

|

Power of Attorney, dated as of August 12, 2015, executed by Ronald D. Fisher as President of Galaxy Investment Holdings, Inc. (incorporated herein by reference to Exhibit 99.11 of the Schedule 13D Amendment filed by SoftBank Group

Corp., Starburst I, Inc., and Galaxy Investment Holdings, Inc. filed August 19, 2015). |

|

|

| 99.12* |

|

10b5-1 Purchase Plan Agreement, dated as of September 14, 2015, by and between Galaxy Investment Holdings, Inc. and Deutsche Bank Securities Inc. (pursuant to a request for confidential treatment, confidential portions of this

Exhibit have been redacted and have been filed separately with the Securities and Exchange Commission). |

Exhibit 99.12

INSIDER STOCK PURCHASE PLAN

THIS INSIDER STOCK PURCHASE PLAN dated September 14, 2015 (this “Plan”) authorizes Deutsche Bank Securities Inc.

(“Broker”) to purchase shares of the outstanding common stock (“Stock”) of Sprint Corporation (the “Company”) on behalf of Galaxy Investment Holdings, Inc. (the “Purchaser”).

WITNESSETH:

WHEREAS, the

Purchaser desires to engage Broker to purchase shares of Stock in accordance with a written plan; and

WHEREAS, it is the Purchaser’s

intention that such purchases benefit from the safe harbor provided by Rule 10b-18 (“Rule 10b-18”) and the affirmative defense provided by Rule 10b5-1 (“Rule 10b5-1”) each promulgated by the Securities and Exchange Commission

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and that the Plan and the transactions contemplated hereby comply with the requirements of paragraph (c)(1) of Rule 10b5-1; and

WHEREAS, Broker is willing to purchase Stock for the Purchaser in accordance with this Plan;

NOW, THEREFORE, the Purchaser, the Company and Broker hereby agree as follows:

Section 1. Appointment. The Purchaser hereby appoints Broker to purchase shares of Stock on the Purchaser’s behalf on the terms

and conditions set forth in this Plan. Subject to such terms and conditions, Broker hereby accepts such appointment.

Section 2. Stock

Purchases. Beginning on the Commencement Date (as defined in Section 3 below), Broker shall purchase Stock for the Purchaser’s account in accordance with this Plan on each day on which the New York Stock Exchange (the “Exchange”)

is open for trading and the Stock trades regular way on the Exchange, at the then prevailing market prices; provided, however, that:

| |

(a) |

Broker shall use its best efforts to purchase shares in accordance with the conditions relating to timing, price and volume under Rule 10b-18 under the Exchange Act (each as set forth in Rule 10b-18(b)(2), (3) and (4),

respectively); |

| |

(b) |

Broker shall refer to schedule A for share and price parameters; |

In this document, “[***]”

indicates that confidential portions of this document have been redacted and filed separately with the Securities and Exchange Commission.

| |

(c) |

the total number of shares of Stock to be purchased during the term of this Plan shall not exceed [***] shares of Stock (the “Purchase Limit”). |

The number of shares referred to in clauses (b) and (c) above shall be adjusted automatically on a proportionate basis to take into account any stock split,

reverse stock split or stock dividend with respect to the Stock or any change in capitalization with respect to the Company that occurs during the term of this Plan. Broker agrees to provide the Purchaser with notice of each purchase made hereunder

via e-mail on the date of any such purchase and at such other times as the Purchaser may reasonably request.

Section 3. Term of

Plan. Broker is authorized to begin purchasing Stock in accordance with this Plan on September 15, 2015 (the “Commencement Date”) and shall cease purchasing Stock on the earliest to occur of: (a) the date and the time trading in the

Stock first commences on the Exchange following the Company’s release of financial results for the quarter ending September 30, 2015, with notice of such date and time to be provided by Purchaser to Broker via email; (b) the date that the

aggregate number of shares of Stock purchased by Broker under this Plan reaches the Purchase Limit; or (c) the date the Purchaser gives notice of termination of this Plan to Broker in accordance with Section 4 or Section 5 (such period, the

“Purchase Period”).

Section 4. Termination by the Purchaser. The Purchaser may, by notice to Broker, on any day on which

the Exchange is open for trading, terminate this Plan; provided that any such termination shall be in good faith and shall not affect any pre-termination purchases of Stock by Broker hereunder.

Section 5. Other Termination / Suspension / Cancellation by the Purchaser. If at any time during the term, a legal, contractual or

regulatory restriction that is applicable to Purchaser or Purchaser’s affiliates would prohibit any purchase pursuant to this Plan (other than any such restrictions relating to Purchaser’s possession or alleged possession of material

nonpublic information about the Company or its securities), the Purchaser agrees to give Broker notice of such restriction as soon as practicable. Such notice shall be made to XXXXXXXXXX, and shall indicate the anticipated duration of the

restriction, but shall not include any other information about the nature of the restriction or its applicability to Purchaser or otherwise communicate any material nonpublic information about the Company or its securities to Broker. The Purchaser

agrees also to use reasonable efforts to contact XXXXXXXXXX, to confirm receipt of the email notice referenced above.

Section 6.

Compliance with Rule 10b-18. Broker agrees to use its best efforts to effect all purchases hereunder in compliance with Rule 10b-18 under the Exchange Act, and to comply with all other applicable laws, rules and regulations in effecting any

purchase of Stock under this Plan and performing its obligations hereunder.

Section 6. Compliance with Rule 10b5-1(c). It is the

intent of the parties that this Plan comply with the requirements of Rule 10b5-1(c)(1) under the Exchange Act, and this Plan shall be interpreted to comply with the requirements of Rule 10b5-1(c)(1) under the Exchange Act. Without limiting the

foregoing, (a) the Purchaser acknowledges and agrees that it may not

2

attempt to exercise any subsequent influence over how, when or whether to effect purchases of Stock pursuant to the terms of this Plan nor may it enter into or alter any corresponding or hedging

transaction or position with respect to the Stock covered by this Plan; and (b) Broker agrees that no person who exercises influence, directly or indirectly, on its behalf in effecting purchases of Stock pursuant to the terms of this Plan may do so

while aware of any material non-public information relating to the Stock or the Company.

Section 8. Representations and Warranties of

Purchaser. The Purchaser represents and warrants as follows:

(a) Purchaser is not aware of any material, non-public information about

the Stock or the Company on the date hereof;

(b) Purchaser is entering into this Plan in good faith and not as part of a plan or scheme

to evade the prohibitions of Rule 10b5-1 under the Exchange Act or otherwise manipulate or support the market for the Stock;

(c) The

purchase of Stock subject to compliance by Broker with its obligations hereunder, will not contravene any provision of applicable law or any agreement or other instrument binding on the Company or any judgment, order or decree of any governmental

authority having jurisdiction over the Company.

(d) Purchaser’s execution, delivery and performance of this Plan (and any placement

of orders to repurchase shares pursuant to this Plan) are duly authorized by all necessary corporate action and do not contravene any provision of its constitutive documents, if applicable, or any law, regulation or contractual restriction binding

on it or its assets and do not give rise to any conflict of interest with the Company or its shareholders.

(e) Purchaser shall be

responsible for arranging all filings, if any, required under Sections 13(d), 13(g) and 16 of the Exchange Act as a result of the transactions contemplated hereunder, to the extent such filings are applicable to Purchaser.

(f) Purchaser hereby consents to any filings made by the Company setting forth or otherwise making publicly available the provisions of this

Plan.

(g) The Purchaser agrees not to take any action which would cause any purchase by Broker pursuant to this Plan not to comply with

Rule 10b-18 under the Exchange Act. Until this Plan is terminated, Purchaser agrees not to enter into any binding contract with respect to the purchase or sale of Stock with another broker, dealer or financial institution.

Section 9. Representation and Warranty of Company. The Company agrees not to take any action which would cause any purchase by Broker

pursuant to this Plan not to comply with Rule 10b-18 under the Exchange Act. The Company hereby represents and warrants that it will, and shall cause its affiliates and affiliated purchasers (each as defined in Rule 10b-18 of the Exchange Act) to,

whether directly or indirectly, effect all Rule 10b-18 purchases (as defined in Rule 10b-18(a)(13)) from or through Broker only on any day where Broker is purchasing Stock on behalf of Purchaser in accordance with this Plan.

3

Section 10. Indemnification and Limitation on Liability.

(a) The Purchaser agrees to indemnify and hold harmless Broker (and its directors, officers, employees and affiliates) from and against all

claims, liabilities, losses, damages and expenses (including reasonable attorneys’ fees and costs) arising out of or attributable to: (i) any material breach by Purchaser or Company of this Plan (including their respective representations and

warranties), and (ii) any violation by Purchaser or the Company of applicable laws or regulations; provided, however, that Purchaser shall have no indemnification obligations in the case of gross negligence or willful misconduct of the Broker or any

other indemnified person or the Broker’s failure to execute purchases under this Plan in accordance with Schedule A of this Plan. This indemnification shall survive the termination of this Plan.

(b) Notwithstanding any other provision herein, neither party shall be liable to the other for: (i) special, indirect, punitive, exemplary, or

consequential damages, or incidental losses or damages or any kind, including but not limited to lost profits, lost savings, or loss of use of facility or equipment, regardless of whether arising from breach of contract, warranty, tort, strict

liability or otherwise, and even if advised of the possibility of such losses or damages or if such losses or damages could have been reasonably foreseen, or (ii) any failure to perform or for any delay in performance that results from a cause or

circumstance that is beyond its reasonable control, including but not limited to failure of electronic or mechanical equipment, strikes, failure of common carrier or utility systems, severe weather, market disruptions or other causes commonly known

as “acts of God”.

(c) The Purchaser acknowledges and agrees that Broker has not provided Purchaser with any tax, accounting or

legal advice with respect to this Plan, including whether Purchaser would be entitled to any of the affirmative defenses under Rule 10b5-1.

Section 11. Market Disruptions, Restrictions, etc.

(a) The Purchaser shall notify Broker as soon as reasonably practicable if it or the Company becomes subject to any legal, regulatory or

contractual restriction that would prohibit Broker from making purchases under this Plan (it being understood the Purchaser becoming aware of material, non-public information shall not constitute such a restriction), and, in such a case, the

Purchaser and Broker shall cooperate to amend or otherwise revise this Plan to take account of such legal, regulatory or contractual restriction (provided that neither party shall be required to take any action that would be inconsistent with

the requirements of Rule 10b-5 or Rule 10b5-1(c) under the Exchange Act).

(b) The Purchaser understands that Broker may not be able to

effect a purchase due to a market disruption or a legal, regulatory or contractual restriction applicable to Broker. If any purchase cannot be executed as required by Section 2 due to a market disruption or legal, regulatory or contractual

restriction applicable to Broker, Broker agrees, subject to Section 3, to refrain from making such purchase at such time and to effect such purchase as promptly as practical after the cessation or termination of such market disruption or applicable

restriction.

4

(c) Broker agrees not to purchase Stock under this Plan after it has received notice from the

Purchaser to terminate this Plan under Section 4 or Section 5.

Section 12. Fees. The Purchaser shall pay Broker $[***] per share

of Stock purchased under this Plan.

Section 13. Entire Agreement; Amendments; Assignment. This Plan constitutes the entire

agreement of the parties with respect to the subject matter hereof and shall not be modified or amended except by a writing signed by each of the parties (provided that any such modification or amendment shall not be inconsistent with the

requirements of Rule 10b5-1(c) under the Exchange Act). In the event of any inconsistency between this Plan and the account agreement between the parties, this Plan shall govern. Neither party may assign its rights or obligations under this Plan

without the prior written consent of the other parties and any such assignment without such consent shall be void.

Section 14.

Notices. All notices hereunder must be in writing and shall be deemed to have been duly given only if delivered personally or by facsimile transmission or mailed (first class postage prepaid) to the parties at the following addresses or

facsimile numbers:

If to the Purchaser, to:

Galaxy Investment Holdings, Inc.

38 Glen Ave

Newton, MA 02465

Attention: Josh Lubov

617-928-9300 Fax: 617- 928-9302

Email: To be advised separately.

If to the

Company, to:

Sprint Corporation

6160 Sprint Parkway

Overland

Park, KS 66251

Attention: General Counsel

Phone: 913-794-1496

Email: To be

advised separately.

5

If to Broker, to:

60 Wall Street

New York, NY

10005

Attention: Nicole Massachi

Telephone: 212-250-7242

Fax:

732-935-2022

Email: To be advised separately.

with a copy to:

Deutsche Bank

Securities Inc.

60 Wall Street

New York, NY 10005

Attention:

Charles L. Nail

Telephone: 212-250-6138

Fax: 732-935-2022

Email: To be

advised separately.

All such notices shall (a) if delivered personally to the address as provided in this Section, be deemed given upon delivery, (b) if

delivered by facsimile transmission to the facsimile number as provided in this Section, be deemed given upon receipt, and (c) if delivered by mail in the manner described above to the address as provided in this Section, be deemed given upon

receipt. Any party from time to time may change its address, facsimile number or other information for the purpose of notices to that party by giving notice specifying such change to the other party hereto.

Section 15. Governing Law. This Plan shall be governed by and construed in accordance with the laws of the State of New York without

regard to any conflicts of laws principles thereof.

Section 16. Counterparts. This Plan may be executed in several counterparts,

each of which shall be regarded as an original and all of which shall constitute one and the same document.

6

IN WITNESS WHEREOF, the parties have caused this Plan to be signed by their duly authorized

representatives as of the date first above written.

|

|

|

|

|

|

|

|

|

| GALAXY INVESTMENT HOLDINGS, INC. |

|

|

|

DEUTSCHE BANK SECURITIES INC. |

|

|

|

|

|

| By: |

|

/s/ Ronald D. Fisher |

|

|

|

By: |

|

/s/ Andrew Yaeger |

| Name: |

|

Ronald D. Fisher |

|

|

|

Name: |

|

Andrew Yaeger |

| Title: |

|

President |

|

|

|

Title: |

|

Managing Director |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Nicole Massachi |

|

|

|

|

|

|

Name: |

|

Nicole Massachi |

|

|

|

|

|

|

Title: |

|

Vice President |

SPRINT CORPORATION

(signing

solely for the purpose of

providing the representation and

warranty set forth in Section 9 hereof)

|

|

|

| By: |

|

/s/ Timothy P. O’Grady |

| Name: |

|

Timothy P. O’Grady |

| Title: |

|

Vice President and Corporate Secretary |

7

Exhibit 99.12

Schedule A

Purchases of Stock

are to be made on each day during the Purchase Period, subject to the following restrictions and the terms and conditions included in the Plan:

|

|

|

| Price Range |

|

Purchases(1) based on % of composite trading

volume |

| [***] |

|

[***] |

| [***] |

|

[***] |

| [***] |

|

[***] |

| [***] |

|

[***] |

| [***] |

|

[***] |

|

|

|

| (1) |

The aggregate maximum number of shares of Stock to be purchased under the Plan may not exceed [***] shares. |

In this document, “[***]” indicates that confidential portions of this document have been redacted and filed separately with the Securities and

Exchange Commission.

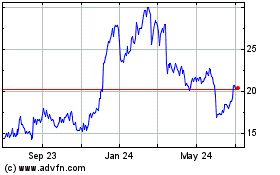

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

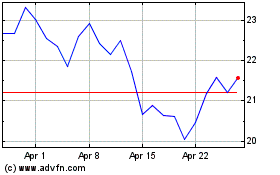

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024