As filed with the Securities and Exchange Commission on February 24, 2015

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ROYAL CARIBBEAN CRUISES LTD.

(Exact name of registrant as specified in its charter)

|

Republic of Liberia

|

|

98-0081645

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

1050 Caribbean Way, Miami, Florida 33132

(Address of principal executive offices) (Zip Code)

ROYAL CARIBBEAN CRUISES LTD.

1994 Employee Stock Purchase Plan

(Full title of the plan)

BRADLEY H. STEIN, ESQ.

Senior Vice President, General Counsel, Secretary

Royal Caribbean Cruises Ltd.

1050 Caribbean Way

Miami, Florida 33132

(Name and address of agent for service)

(305) 539-6000

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

|

Smaller reporting company o

|

CALCULATION OF REGISTRATION FEE

| |

| |

|

|

|

|

|

|

|

|

|

Title of

|

|

|

|

Proposed

|

|

Proposed

|

|

|

|

Securities to

|

|

|

|

Maximum

|

|

Maximum

|

|

|

|

be

|

|

Amount to be

|

|

Offering Price

|

|

Aggregate

|

|

Amount of

|

|

Registered

|

|

Registered (1)

|

|

Per Share (2)

|

|

Offering Price (2)

|

|

Registration Fee

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Common Stock,

par value $.01

|

|

500,000 |

|

|

|

|

|

|

|

per share

|

|

shares

|

|

U.S.$75.29

|

|

U.S.$37,645,000

|

|

US$4,374.95

|

|

|

(1) This Registration Statement registers an additional 500,000 shares of common stock, par value $.01 per share (“Common Stock”), for issuance under the Royal Caribbean Cruises Ltd. 1994 Employee Stock Purchase Plan (the “Plan”). In addition, pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended, this Registration Statement covers an indeterminate amount of additional shares of Common Stock which may be issued under the Plan as a result of any stock split, stock dividend, recapitalization or other similar transaction effected without the receipt of consideration which results in an increase in the number of outstanding shares of Common Stock.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) of the Securities Act of 1933, as amended. The price is based upon the average of the high and low prices of the Royal Caribbean Cruises Ltd. common stock as reported on the New York Stock Exchange on February 18, 2015.

EXPLANATORY NOTE

Royal Caribbean Cruises Ltd. (the “Company”) has filed this registration statement on Form S-8 (this “Registration Statement”) to register under the Securities Act of 1933, as amended (the “Act”), the offer and sale of 500,000 additional shares of its common stock, par value $0.01 per share (the “Common Stock”), under the Royal Caribbean Cruises Ltd. 1994 Employee Stock Purchase Plan (the “Plan”). The increase in shares reserved for issuance under the Plan was approved by the shareholders of the Company on May 12, 2014 and was effective as of such date.

On November 19, 1993, the Company filed a registration statement on Form S-8 (File No. 33-71956) (the “Prior Registration Statement”) to register under the Act the offer and sale of 400,000 shares of Common Stock under the Plan. This Registration Statement relates to securities of the same class as that to which the Prior Registration Statement relates, and is submitted in accordance with General Instruction E to Form S-8 regarding Registration of Additional Securities. Pursuant to Instruction E, the contents of the Prior Registration Statement are incorporated herein by reference and made part of this Registration Statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The contents of the following documents, which have previously been filed by the Company with the Securities and Exchange Commission (the “Commission”), are hereby incorporated in this Registration Statement by reference:

|

a)

|

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014;

|

|

b)

|

The Company’s Current Report on Form 8-K filed with the Commission on February 5, 2015; and

|

|

c)

|

The description of the Company’s Common Stock set forth under the caption “Description of Registrant’s Securities to be Registered” in the Company’s Registration Statement on Form 8-A filed with the Commission on April 15, 1993.

|

Each document filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, after the date hereof and prior to the filing by the Company of a post-effective amendment hereto which indicates that all shares of Common Stock being offered pursuant to this Registration Statement have been sold or which deregisters all shares of Common Stock then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such document.

Any statement contained in a document, all or a portion of which is incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 5. Interests of Named Experts and Counsel.

Certain legal matters with respect to the offering of the shares of Common Stock registered hereby have been passed upon by Bradley H. Stein, Esq., Senior Vice President, General Counsel, and Secretary of the Company.

Item 8. Exhibits.

The documents listed hereunder are filed as exhibits hereto.

|

Exhibit

|

|

|

|

Number

|

|

Description of Document

|

| |

|

|

|

4.1

|

|

1994 Employee Stock Purchase Plan, as amended

|

| |

|

|

|

4.2

|

|

Restated Articles of Incorporation of the Company, as amended (composite) (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-3, File No. 333-158161, filed with the Securities and Exchange Commission (the "Commission") on March 23, 2009)

|

| |

|

|

|

4.3

|

|

Amended and Restated By-Laws of the Company (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the Commission on September 11, 2013)

|

| |

|

|

|

5.1

|

|

Opinion of Bradley H. Stein, Esq., General Counsel to the Company

|

| |

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Certified Public Accounting Firm

|

| |

|

|

|

23.2

|

|

Consent of Bradley H. Stein, Esq. (included in Exhibit 5.1 to this Registration Statement)

|

| |

|

|

|

24.1

|

|

Power of Attorney

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Miami, State of Florida, as of the 24th day of February, 2015.

| |

|

Royal Caribbean Cruises Ltd. |

| |

|

|

|

| |

|

|

/s/ Jason T. Liberty |

| |

|

By: |

Jason T. Liberty |

| |

|

|

Chief Financial Officer |

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following persons in the capacities and as of the dates indicated:

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Richard D. Fain |

|

Chairman, Chief Executive Officer

|

|

|

|

Richard D. Fain

|

|

and Director (Principal Executive

Officer)

|

|

February 24, 2015

|

| |

|

|

|

|

| /s/ Jason T. Liberty |

|

Chief Financial Officer

|

|

|

|

Jason T. Liberty

|

|

(Principal Financial Officer)

|

|

February 24, 2015

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Henry L. Pujol |

|

Senior Vice President and Chief |

|

|

|

Henry L. Pujol

|

|

Accounting Oficer

(Principal Accounting Officer)

|

|

February 24, 2015

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Bernard W. Aronson

|

|

Director

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

John F. Brock

|

|

Director

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

William L. Kimsey

|

|

Director

|

|

|

| |

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Ann S. Moore

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

________________ |

|

Eyal Ofer

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Thomas J. Pritzker

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

William K. Reilly

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Bernt Reitan

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Vagn O. Sørensen

|

|

Director

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| * |

|

|

|

February 24, 2015 |

|

Arne Alexander Wilhelmsen

|

|

Director

|

|

|

* By:

/s/ Jason T. Liberty

Name: Jason T. Liberty

Title: Attorney-in-Fact

EXHIBIT INDEX

|

Exhibit

|

|

|

|

Number

|

|

Description of Document

|

| |

|

|

|

4.1

|

|

1994 Employee Stock Purchase Plan, as amended

|

| |

|

|

| 5.1 |

|

Opinion of Bradley H. Stein, Esq., General Counsel to the Company |

| |

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Certified Public Accounting Firm

|

| |

|

|

|

23.2

|

|

Consent of Bradley H. Stein, Esq. (included in Exhibit 5.1 to this Registration Statement)

|

| |

|

|

|

24.1

|

|

Power of Attorney

|

Exhibit 4.1

ROYAL CARIBBEAN CRUISES LTD.

1994 EMPLOYEE STOCK PURCHASE PLAN

TABLE OF CONTENTS

| |

|

Page

|

| |

|

|

|

1.

|

PURPOSE

|

1

|

| |

|

|

|

2.

|

ADMINISTRATION

|

1

|

| |

|

|

|

3.

|

ELIGIBILITY

|

2

|

| |

|

|

|

4.

|

STOCK

|

3

|

| |

|

|

|

5.

|

GRANT OF OPTION

|

3

|

| |

|

|

|

6.

|

PARTICIPATION; PAYROLL DEDUCTIONS AND LUMP SUM DEPOSITS

|

4

|

| |

|

|

|

7.

|

EXERCISE OF OPTION

|

6

|

| |

|

|

|

8.

|

EMPLOYEE'S RIGHT TO ABANDON OPTION

|

7

|

| |

|

|

|

9.

|

TERMS AND CONDITIONS OF OPTIONS

|

8

|

| |

|

|

|

10.

|

AMENDMENT OF THE PLAN

|

14

|

| |

|

|

|

11.

|

EFFECTIVE DATE OF PLAN

|

14

|

| |

|

|

|

12.

|

ABSENCE OF RIGHTS

|

15

|

| |

|

|

|

13.

|

APPLICATION OF FUNDS

|

15

|

| |

|

|

|

14.

|

MISCELLANEOUS

|

15

|

ROYAL CARIBBEAN CRUISES LTD.

1994 EMPLOYEE STOCK PURCHASE PLAN

This Employee Stock Purchase Plan (the "Plan") is intended to encourage stock ownership by all eligible employees of Royal Caribbean Cruises Ltd. (the "Company"), and of any of its "subsidiary corporations" (as defined in section 424(f) of the Internal Revenue Code of 1986, as amended (the "Code")) that are designated by the Company as participating employers, through the grant of stock options. It is intended that options issued under this Plan shall constitute options issued under an "employee stock purchase plan," within the meaning of section 423 of the Code.

The Plan shall be administered by the Company. The Company shall have the authority to establish and rescind, from time to time, such rules and regulations, not inconsistent with the provisions of the Plan, for the proper administration of the Plan and options granted thereunder, and to make such determinations and interpretations under or in connection with the Plan as it deems necessary or advisable, including the determination of which subsidiary corporations (if any) will be participating employers in the Plan. In addition, the Company may correct any defect, supply any omission and reconcile any inconsistency in this Plan or in any option granted hereunder in the manner and to the extent it shall deem desirable. All such rules, regulations, determinations and interpretations shall be binding and conclusive upon the Company and its subsidiary corporations, officers and employees (including former officers and employees) of the Company and any subsidiary corporation, and upon their respective legal representatives, beneficiaries, successors and assigns and upon all other persons claiming under or through any of them.

The Company may delegate any or all of its administrative authority under this Section 2 to one or more employees of the Company and/or to one or more third-party administrators. Any employee to whom administrative authority is delegated, in the course of exercising such authority, shall be acting in his capacity as an employee of the Company.

(a) Except as provided below in this paragraph (a) and in paragraph (b) below, each employee of the Company (or of a subsidiary corporation designated by the Company as a participating employer) who has been employed by the Company (or such subsidiary corporation) for an aggregate of at least one year shall be granted an option as of the first business day on or after January 1, April 1, July 1 or October 1 (the "Grant Date") immediately following his completion of such year of employment, and as of each succeeding Grant Date, to purchase the Company's common stock, par value $0.01 (the "Common Stock"); provided such employee shall not be granted an option on a Grant Date if (i) he is not still employed by the Company or a designated subsidiary corporation as of such Grant Date, (ii) he is excluded from participation under paragraph (b) below, or (iii) he has received his maximum options for the calendar year under Section 9(e) or 9(k). The term of each option shall be three calendar months (i.e., January 1 to March 31, April 1 to June 30; July 1 to September 30, and October 1 to December 31) (the "Option Terms"). Employment with a company or business prior to its acquisition by the Company as a subsidiary corporation shall be considered employment by the Company for the sole purpose of determining whether the one-year-of-employment requirement has been met.

(b) An employee's employment by the Company (or a subsidiary corporation) prior to his break in such employment of one year or longer shall be disregarded for purposes of determining, under subsection (a) above, whether the employee has been employed for at least

one year. In addition, an employee will not be eligible to participate in the Plan if he is customarily employed by the Company or a designated subsidiary corporation for not more than five months in any calendar year. Also, in no event may an employee be granted an option if such employee, immediately after the option is granted, owns stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company or of its "parent corporation" (as defined in section 424(e) of the Code) (if any) or of a subsidiary corporation. For purposes of determining stock ownership under this paragraph (b), the rules of section 424(d) of the Code (relating to attribution of stock ownership) shall apply, and stock which the employee may purchase under outstanding options shall be treated as stock owned by the employee. Finally, an employee will not be eligible to participate in the Plan unless he complies with the participation rules set forth in Section 6, including the requirement that he file a payroll deduction agreement or lump sum deposit agreement at the time or times specified in Section 6.

The stock subject to the options shall be shares of the Company's authorized but unissued or reacquired Common Stock. The aggregate number of shares which may be issued under options shall not exceed 1,300,000 shares of Common Stock; provided that such number shall be adjusted if required by Section 9(h)(1).

(a) Aggregate Purchase Price of Shares Purchasable Under Option. Subject to the limitation described in paragraph (c) below, each eligible employee shall be granted, as of each Grant Date, an option to purchase up to that number of whole and fractional shares of Common Stock which has an aggregate purchase price equal to $3,750.

(b) Number of Shares Purchasable Under Option. Subject to the limitation described in paragraph (c) below, the number of shares actually purchasable for an Option Term shall equal $3,750 divided by the price per share. The “price per share” shall be the greater of (i) 85% of the average of the per share “fair market value” (as determined under Section 9(b)) as of the applicable Grant Date plus the per share fair market value as of the last business day of each calendar month in the Option Term; or (ii) the lesser of (A) 85% of the per share fair market value as of the applicable Grant Date or (B) 85% of the per share fair market value as of the last business day of the Option Term (the “Exercise Date”).

(c) Limitation on Number of Shares Purchasable Under Option. Notwithstanding paragraphs (a) and (b) above, the aggregate number of whole and fractional shares purchasable under the option described in this Section 5 shall not exceed the lesser of (i) 150% of the number of shares of Common Stock determined by dividing $3,750 by 85% of the per share fair market value as of the applicable Grant Date or (ii) the limitations described in Sections 9(e) and 9(k).

|

6.

|

PARTICIPATION; PAYROLL DEDUCTIONS AND LUMP SUM DEPOSITS

|

(a) Each employee shall be notified of the terms of the Plan, of his eligibility (or future eligibility) to receive option grants under the Plan, and of his eligibility (or future eligibility) to participate in the Plan by making payroll deductions or lump sum deposits.

(b) An employee from whose compensation the Company is not prohibited by law from taking payroll deductions may elect to participate in the Plan by making payroll deductions (as a set dollar amount each pay, subject to the limits set forth in paragraph (d) below) for each Option Term in which he is eligible to participate. Payroll deduction agreements must be received by the Vice President, Human Resources (the "Plan Coordinator"), on or before the 15th calendar day of the last calendar month before the commencement of an Option Term. Payroll deductions under an employee's payroll deduction agreement shall commence as of the first

payroll period ending in the Option Term first beginning after the employee's submission of his agreement, and shall continue from Option Term to Option Term until the employee's employment terminates, subject to the employee's right to abandon his option for an Option Term under Section 8. Notwithstanding the preceding sentence, an employee may elect to begin or terminate his payroll deductions, or to increase or decrease his rate of payroll deductions, for the immediately following Option Term by mailing or delivering a new payroll deduction agreement, which must be received by the Plan Coordinator on or before the 15th calendar day of the last calendar month before the commencement of such Option Term.

(c) An employee from whose compensation the Company is prohibited by law from taking payroll deductions, or any other employee who does not elect to make payroll deductions, may participate in the Plan by making a lump sum deposit for any Option Term in which he is eligible to participate. A lump sum deposit agreement, specifying the maximum dollar amount the employee intends to contribute for the Option Term, must be received by the Plan Coordinator (or his delegate), on or before the 15th calendar day of the last calendar month before the commencement of each Option Term for which the employee wishes to make a lump sum deposit. The lump sum deposit itself, equal to the maximum dollar amount specified or any lesser amount (subject to the limits set forth in paragraph (d) below), must be received by the Plan Coordinator on or before the 15th calendar day of the last calendar month in the Option Term. An employee who makes a lump sum deposit for an Option Term before such 15th calendar day may subsequently elect to abandon his option for such Option Term under Section 8.

(d) An employee from whose compensation the Company is not prohibited by law from taking payroll deductions may elect to make either payroll deductions or a lump sum

deposit, but not both, for a particular Option Term. The total payroll deductions or lump sum deposit for any employee for an Option Term must equal at least $120. The maximum total payroll deductions or lump sum deposit for any employee for an Option Term may not exceed $3,750.

(e) Each employee who has satisfied the eligibility requirements of Section 3 but who has elected to abandon (or is deemed to have abandoned) his option in accordance with Section 8 for an Option Term, shall be granted an option in accordance with Section 5 in subsequent Option Terms, provided he continues to meet the eligibility requirements of Section 3. However, if such an employee is described in paragraph (b) above, he must submit a new payroll deduction agreement under paragraph (b) above in order to begin payroll deductions in a subsequent Option Term. If such an employee is described in paragraph (c) above, he must submit a new lump sum deposit agreement under paragraph (c) above in order to make a lump sum deposit in a subsequent Option Term.

(f) Electing payroll deductions or making a lump sum deposit in any Option Term will not constitute a contract to purchase any of the option shares.

(g) An employee who fails to participate in the Plan for an Option Term in the manner and within the time provided under this Section 6 shall be deemed to have abandoned the option granted to him for such Option Term and shall have no further rights under the Plan for that Option Term.

As of the last business day of an Option Term, unless the employee has abandoned his option in accordance with Section 8 (or is deemed to have abandoned his option under Section 6(g)), each employee will be deemed to have exercised his option for such number of shares (including fractional shares) of Common Stock as his accumulated payroll deductions or lump

sum deposit shall be sufficient to pay for, subject to the limitations of Sections 4, 5, 9(e) and 9(k).

|

8.

|

EMPLOYEE'S RIGHT TO ABANDON OPTION

|

(a) At any time during an Option Term, up to and including the 15th calendar day of the last calendar month of the Option Term, an employee may elect to abandon his option and withdraw the payroll deductions (if any) or the lump sum deposit (if any) credited to his account under the Plan by giving written notice to the Company. In order for such abandonment to be effective for the Option Term, the employee's written notice must be received by the Plan Coordinator on or before such day. All of such employee's payroll deductions or the lump sum deposit credited to his account will be refunded to him (without interest) as soon as practicable after receipt of his notice of withdrawal, and, in the case of an employee who had authorized payroll deductions, no further payroll deductions will be made from his pay as of the first pay date occurring at least 10 business days after the Plan Coordinator receives the employee's written notice, and for the remainder of that Option Term. (If the first pay date occurs fewer than 10 business days after the written notice of abandonment is received, the scheduled deduction may be taken from the employee's pay for that period, but will be refunded to the employee, along with his other accumulated deductions for the Option Term, in accordance with this paragraph (a).) The employee shall have no further option or right of any nature at any subsequent time as to any shares so abandoned.

(b) An employee's withdrawal from an Option Term will not have any effect upon his eligibility to participate in any subsequent Option Term, or any similar plan which may hereafter be adopted by the Company.

|

9.

|

TERMS AND CONDITIONS OF OPTIONS

|

Stock options granted pursuant to the Plan shall be subject to such conditions as the Company shall recommend, provided that all employees granted such options shall have the same rights and privileges (except as otherwise required by applicable law), and provided further that such options shall comply with and be subject to the terms and conditions set forth below.

(a) Employee Notification and Agreement. Employees shall be notified (i) of the requirements they must meet to be granted options under the Plan, (ii) about the terms and conditions of such options, and (iii) that any employee eligible to be granted options under the Plan may request a copy of the Plan. An employee's agreement to the terms of an option will be evidenced by his submission of a payroll deduction agreement or a lump sum deposit agreement for an Option Term.

(b) Option Price. The per share option price for an Option Term shall be determined as set forth in Section 5(b). In making such determination, during such time as the stock is listed upon an established stock exchange or exchanges, "fair market value" shall be deemed to be the mean between the highest and lowest quoted selling prices on the day the option is granted, on the day the option is exercised, or on one of the additional two business days used to calculate the average value under Section 5(b), as applicable. During such time as such stock is not listed upon an established stock exchange, the fair market value per share on such days shall be determined by the Company by a method sanctioned by the Code, or rules and regulations thereunder. The fair market value per share on any day is to be determined in accordance with Treas. Reg. §§ 1.421-7(e) and 20.2031-2. Subject to the foregoing, the Company shall have full authority and be fully protected in fixing the option price.

(c) Medium and Time of Payment. The option price shall be payable in United States dollars upon the exercise of the option and shall be payable only by accumulated payroll deductions or a lump sum deposit made in accordance with Section 6.

(d) Term of Option. No option may be exercised after the end of the Option Term in which the option was granted.

(e) Accrual Limitation. No option shall permit the right of an employee to purchase stock under all employee stock purchase plans, intended to qualify under section 423 of the Code, of the Company and its parent corporation (if any) and subsidiary corporations to accrue at a rate which exceeds $25,000 in fair market value of such stock (determined at the time options are granted) for each calendar year in which the option is outstanding at any time. (The maximum number of shares of Common Stock an employee may purchase under options under this Plan for the first Option Term in a calendar year for which the employee receives an option is determined by dividing (i) $25,000 by (ii) the per share fair market value of Common Stock on the Grant Date of such Option Term. The maximum number of shares of Common Stock the employee may purchase under options under this Plan for any succeeding Option Term in a calendar year is determined by dividing (i) $25,000 by (ii) the per share fair market value of Common Stock on the Grant Date of such Option Term, and then subtracting from the quotient the total number of shares of Common Stock purchasable by the employee under options granted in the preceding Option Term(s) of the calendar year. Such total number of shares purchasable shall be calculated as if the employee had elected for each preceding Option Term payroll deductions or a lump sum deposit equal to $3,750, and shall be subject to the 150% limit on the number of shares purchasable set forth in Section 5(c).) For purposes of this paragraph (e), (i) the right to purchase stock under an option accrues when the option (or any portion thereof) first

becomes exercisable during the calendar year; (ii) the right to purchase stock under an option accrues at the rate provided in the option but in no case may such rate exceed $25,000 of fair market value of such stock (determined at the time such option is granted) for any one calendar year; and (iii) a right to purchase stock which has accrued under one option granted pursuant to the Plan may not be carried over to any other option.

(f) Termination of Employment. An option under this Plan granted to an employee who ceases to be employed by the Company or a subsidiary corporation during an Option Term for any reason (including disability or death) after the 15th calendar day of the last calendar month of the Option Term, shall be exercised for such number of whole or fractional shares as the individual's accumulated payroll deductions or lump sum deposit shall then be sufficient to pay for in full (subject to the restrictions in Sections 4, 5, 8, 9(e) and 9(k)) as of the end of such Option Term. If such an employee ceases to be employed by the Company or a subsidiary corporation during an Option Term for any reason (including disability or death) on or before the 15th calendar day of the last calendar month of the Option Term, such individual's option shall not be exercised, and his accumulated payroll deductions or lump sum deposit shall be refunded (without interest) to him (or, in the event of his disability or death, to his or his estate's personal representative). No further grants of stock options under this Plan shall be made on behalf of an individual described in this paragraph (f) unless and until such individual again satisfies the eligibility requirements of Section 3.

Whether an authorized leave of absence for military or governmental service shall constitute termination of employment for purposes of the Plan shall be determined by the Company subject to applicable law, which determination shall be final and conclusive.

(g) Nontransferability. Neither payroll deductions or a lump sum deposit credited to an employee's account nor any rights with regard to the exercise of an option or to receive stock or a return of payroll deductions or a lump sum deposit under the Plan may be assigned, transferred, pledged, or otherwise disposed of in any way by the employee other than by will or the laws of descent and distribution. Any such attempted assignment, transfer, pledge or other disposition shall be without effect. Any option may be exercised during the employee's lifetime only by the employee.

(h) Recapitalization.

(1) Subject to any required action by the stockholders, the number of shares of Common Stock provided for in Section 4 and the number covered by each outstanding option (and the price per share thereof in each such option), shall be proportionately adjusted for any increase or decrease in the number of issued shares of Common Stock of the Company resulting from a subdivision or consolidation of shares or the payment of a stock dividend (but only on the Common Stock) or any other increase or decrease in the number of such shares affected, without receipt of consideration by the Company.

(2) Subject to any required action by the stockholders, if the Company shall be the surviving corporation in any merger or consolidation, each outstanding option shall pertain and apply to the securities to which a holder of the number of shares of Common Stock subject to the option would have been entitled. A dissolution or liquidation of the Company or a merger or consolidation in which the Company is not the surviving corporation, shall cause each outstanding option to terminate, provided that each employee granted an option under this Plan shall, in such event, have the right immediately prior to such dissolution or liquidation, or merger or consolidation in which the Company is not the surviving corporation, to exercise his option.

(3) In the event of a change in the Common Stock of the Company as presently constituted which is limited to a change of all of its authorized shares with par value into the same number of shares with a different par value or without par value, the shares resulting from any such change shall be deemed to be Common Stock within the meaning of the Plan.

(4) To the extent that the foregoing adjustments relate to stock or securities of the Company, such adjustments shall be made by the Company, whose determination in that respect shall be final, binding and conclusive, provided that each option granted pursuant to this Plan shall not be adjusted in a manner that causes the option to fail to continue to qualify as an option issued pursuant to an "employee stock purchase plan" within the meaning of section 423 of the Code.

(5) Except as hereinbefore expressly provided in this paragraph (h), an employee shall have no rights by reason of any subdivision or consolidation of shares of stock of any class or the payment of any stock dividend or any other increase or decrease in the number of shares of stock of any class or by reason of any dissolution, liquidation, merger, or consolidation or spin-off of assets or stock of another corporation, and any issue by the Company of shares of stock of any class, or securities convertible into shares of stock of any class, shall not affect, and no adjustment by reason thereof shall be made with respect to, the number or price of shares of Common Stock subject to the option.

(6) The grant of an option pursuant to the Plan shall not affect in any way the right or power of the Company to make adjustments, reclassifications, reorganizations or changes of its capital or business structure or to merge or to consolidate or to dissolve, liquidate or sell, or transfer all or any part of its business or assets.

(i) Rights as a Stockholder. An employee or a transferee of an option (as described in paragraph (f) above) shall have no rights as a stockholder with respect to any shares covered by his option until, and only to the extent that, he exercises his option under the terms of the Plan. No adjustment shall be made for dividends (ordinary or extraordinary, whether in cash, securities or other property) or distributions or other rights for which the record date is prior to the date such option is exercised, except as provided in paragraph (h) above.

(j) Investment Purpose. Each option under the Plan shall be granted on the condition that the purchase of stock thereunder shall be for investment purposes and not with a view to resale or distribution, except that in the event the stock subject to such option is registered under the Securities Act of 1933, as amended, or in the event a resale of such stock without such registration would otherwise be permissible, such condition shall be inoperative if in the opinion of counsel for the Company such condition is not required under the Securities Act of 1933 or any other applicable law, regulation or rule of any governmental agency.

(k) Adjustment in Number of Shares Exercisable. If the aggregate number of shares purchased under options granted under the Plan exceeds the aggregate number of shares of Common Stock specified in Section 4, the Company shall make a pro rata allocation of the shares available for distribution so that the limit of Section 4 is not exceeded, and the balance of payroll deductions or the lump sum deposit credited to the account of each participating employee shall be returned to him as promptly as possible.

(l) Other Provisions. The option agreements authorized under the Plan may contain such provisions as the Company shall deem advisable, provided that no such provision may in any way be in conflict with the terms of the Plan.

|

10.

|

AMENDMENT OF THE PLAN

|

(a) The Company's Board of Directors may, from time to time, with respect to any shares not subject to options, suspend, discontinue, revise or amend the Plan in any respect whatsoever except that no such revision or amendment may permit the granting of options under this Plan to persons other than employees of the Company, its parent corporation or a subsidiary corporation, or otherwise cause options issued under it to fail to meet the requirements of section 423 of the Code.

(b) In addition, if he deems it advisable, the Chief Executive Officer of the Company may approve and execute an amendment(s) to the Plan restricting the ability of an employee to make payroll deductions or a lump sum deposit in one or more Option Terms subsequent to an Option Term in which the employee has abandoned his option under Section 8, provided the amendment(s) are consistent with the requirements for employee stock purchase plans under section 423 of the Code.

(c) Notwithstanding paragraph (a) above, the Plan may not, without the approval of a majority of the votes cast at a duly held stockholders' meeting at which a quorum representing a majority of all outstanding voting stock is, either in person or by proxy, present and voting on the Plan, be amended in any manner that will change the number of shares subject to the Plan.

|

11.

|

EFFECTIVE DATE OF PLAN

|

The Plan will become effective as of November 19, 1993, subject, however, to approval of a majority of the votes cast at a duly held stockholders’ meeting at which a quorum representing a majority of all outstanding voting stock is, either in person or by proxy, present and voting on the Plan. If the Plan is not so approved, the Plan shall nevertheless be effective, but options issued under the Plan shall not constitute options issued under an “employee stock purchase plan,” within the meaning of section 423 of the Code.

The granting of an option to a person shall not entitle that person to continued employment by the Company or a subsidiary corporation or affect the terms and conditions of such employment. The Company, its parent corporation (if any) and any subsidiary corporation shall have the absolute rights, in their discretion, to terminate an employee's employment, whether or not such termination may result in a partial or total termination of his option under this Plan.

The proceeds received by the Company from the sale of Common Stock pursuant to options will be used for general corporate purposes.

(a) The provisions of the Plan shall, in accordance with its terms, be binding upon, and inure to the benefit of, all successors of each employee participating in the Plan, including, without limitation, such employee's estate and the executors, administrators or trustees thereof, heirs and legatees, and any receiver, trustee in bankruptcy or representative of creditors of such employee.

(b) Florida law shall govern all matters relating to this Plan except to the extent it is superseded by United States federal law.

15

Exhibit 5.1

February 24, 2015

The Board of Directors

Royal Caribbean Cruises Ltd.

1050 Caribbean Way

Miami, Florida 33132

Re: Royal Caribbean Cruises Ltd. Registration Statement on Form S-8

Dear Sir or Madam:

As Senior Vice President, General Counsel and Secretary of Royal Caribbean Cruises Ltd., a Liberian corporation (the “Company”), I have participated in the preparation and filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) for the registration under the Securities Act of 1933, as amended (the “Act”), of 500,000 shares of the Company's Common Stock, par value $.01 per share (the “Shares”), to be offered to participants in the Royal Caribbean Cruises Ltd. 1994 Employee Stock Purchase Plan (the “Plan”). This opinion is delivered in accordance with the requirements of Item 601(b)(5) of Regulation S-K promulgated under the Act.

In furnishing this opinion, and in my capacity as an attorney admitted to practice in the State of Florida, I have examined copies of the Registration Statement, the Articles of Incorporation and By-laws of the Company, as amended to date, the Plan, and such other papers, documents and certificates of public officials as I have deemed necessary and relevant to provide a basis for the opinions set forth below. In making such examinations, I have assumed the genuineness of all signatures and the authenticity of all documents submitted to me as originals and the conformity with the originals of all documents submitted to me as copies.

This opinion is limited to the laws of the Republic of Liberia. In rendering this opinion, I have relied solely upon the Liberian Business Corporation Act of 1976 (Title 5 of the Liberian Code of Laws Revised, effective January 3, 1977, as amended) as delivered to me by Liberian International Ship & Corporate Registry, LLC which, according to Liberian International Ship & Corporate Registry, LLC remains, to the best of their knowledge, in effect on the date hereof.

On the basis of and subject to the foregoing, I am of the opinion that, the Shares, if and when issued in accordance with the terms of the Plan and upon payment for the Shares in accordance with the Plan, will be validly issued, fully paid and nonassessable.

I hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Act or the Rules and Regulations of the Securities and Exchange Commission.

This opinion is limited to the matters stated in this letter, and no opinions may be implied or inferred beyond the matters expressly stated in this letter. The opinions expressed in this letter speak only as of its date. I do not undertake to advise you of any changes in the opinions expressed herein from matters that might hereafter arise or be brought to my attention.

Please be advised that I am a member of the Bar of the State of Florida and New York and am not licensed to practice law in any other jurisdiction.

Very truly yours,

/s/ Bradley H. Stein

Bradley H. Stein

Senior Vice President, General Counsel

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated February 23, 2015 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Royal Caribbean Cruises Ltd.'s Annual Report on Form 10-K for the year ended December 31, 2014.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Miami, Florida

February 24, 2015

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby severally constitutes and appoints Richard D. Fain, Jason T. Liberty and Bradley H. Stein, and each of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution for him or her and in his or her name, place and stead, in any and all capacities to sign in his or her name this registration statement on Form S-8 with respect to 500,000 shares of the common stock of Royal Caribbean Cruises Ltd. (the “Company”) issuable pursuant to the Company’s 1994 Employee Stock Purchase Plan Plan and any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each said attorneys-in-fact and agents or any of them or their or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

This Power of Attorney may be signed in any number of counterparts, each of which shall constitute an original and all of which, taken together, shall constitute one Power of Attorney.

EXECUTED in the capacities and on the dates indicated below:

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ Bernard W. Aronson

Bernard W. Aronson

|

|

Director

|

|

February 24, 2015

|

| |

|

|

|

|

|

/s/ John F. Brock

John F. Brock

|

|

Director

|

|

February 12, 2015

|

| |

|

|

|

|

|

/s/ William L. Kimsey

William L. Kimsey

|

|

Director

|

|

February 24, 2015

|

| |

|

|

|

|

|

/s/ Ann S. Moore

Ann S. Moore

|

|

Director

|

|

February 12, 2015

|

| |

|

|

|

|

|

______________________

Eyal Ofer

|

|

Director

|

|

_______________

|

| |

|

|

|

|

|

/s/ Thomas J. Pritzker

Thomas J. Pritzker

|

|

Director

|

|

February 24, 2015

|

| |

|

|

|

|

|

/s/ William K. Reilly

William K. Reilly

|

|

Director

|

|

February 17, 2015

|

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ Bernt Reitan

Bernt Reitan

|

|

Director

|

|

February 13, 2015

|

| |

|

|

|

|

|

/s/ Vagn O. Sørensen

Vagn O. Sørensen

|

|

Director

|

|

February 13, 2015

|

| |

|

|

|

|

|

/s/ Arne Alexander Wilhelmsen

Arne Alexander Wilhelmsen

|

|

Director

|

|

February 24, 2015

|

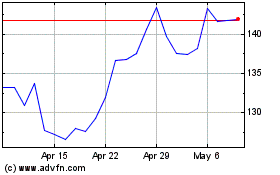

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

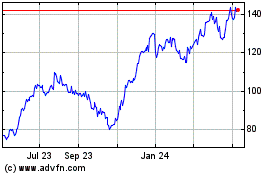

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024