Pearson to Slash Jobs, Warns on Profit -- 3rd Update

January 21 2016 - 8:43AM

Dow Jones News

By Simon Zekaria

LONDON-- Pearson PLC on Thursday said it is launching fresh

cost-savings worth half a billion dollars and plans to ax 10% of

its workforce world-wide after cutting its earnings guidance.

The London-based company, which makes most of its revenue from

educational services in the U.S., announced it is cutting 4,000

jobs and said it had underestimated the impact of trading pressures

across its key markets.

The educational products specialist plans to simplify its

structure by merging businesses and focus on fewer, bigger

opportunities.

Pearson has raised $2.5 billion from disposals over the last

three years, including its flagship publishing asset, the Financial

Times newspaper, to fund its growth across global education, which

includes textbooks in Western markets, digital learning programs

and English-language schools.

In August last year, Pearson sold its 50% non-controlling stake

in the publisher of the Economist magazine for $731 million. The

disposal followed its sale of the FT Group, which includes the

Financial Times newspaper, to Nikkei Inc. of Japan for $1.32

billion.

But Pearson Thursday said rapid growth in employment and

increasing regulation in the U.S. has resulted in higher-education

enrollments falling approximately 10% to about 19 million in 2015

from a peak of around 21 million in 2010.

It also said certain enrollments in the U.K. have fallen and

purchases of textbooks in South Africa had dropped

significantly.

"In combination, these factors have reduced Pearson's operating

profit by approximately GBP230 million from its peak. We

overestimated how quickly those markets would return to sustainable

levels of revenues and profits from their peak," the company

said.

It also warned that profit would be lower next year as it

absorbs the costs of its reorganization, which are forecast to hit

GBP320 million ($451 million) in 2016.

However the company said this restructuring will yield savings

of approximately GBP350 million, including approximately GBP250

million this year, and Chief Executive John Fallon said Pearson has

"solid grounds" to expect a boost in the medium term.

Pearson expects to report adjusted operating profit of GBP720

million for 2015 and believes this figure will reach GBP800 million

in 2018, based on a recovery of its business in the U.K. and

U.S.

"We are moving quickly to implement this restructuring and are

planning to complete the majority of it by the half-year, and all

of it by the end of the year," Pearson said in a statement.

"Our competitive performance during the last three years has

been strong, but the cyclical and policy related challenges in our

biggest markets have been more pronounced and persisted for longer

than anticipated," said Mr. Fallon.

"We are today announcing decisive plans to further integrate the

business and reduce the cost base, rationalize our product

development and focus on fewer, bigger opportunities."

Pearson's shares jumped 15% as investors reacted favorably to

the company's update, with analysts saying the measures taken

reflect the group's outlook.

"We are broadly encouraged that Pearson has decided to redouble

its efforts to meet external and internal challenges," said Shore

Capital's Roddy Davidson.

Pearson has booked hundreds of millions of dollars in cost

savings in recent years to counter a slowdown in mature educational

markets and boost its push into emerging economies, such as Brazil

and China, where there is greater demand for learning services.

It intends to propose an unchanged final dividend of 34 pence a

share, giving a total dividend for 2015 of 52 pence a share, up 2%

year-over-year on 2014.

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing,

business-news and education divisions.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

January 21, 2016 08:28 ET (13:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

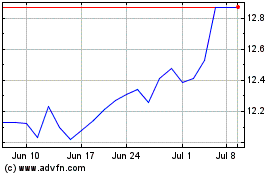

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

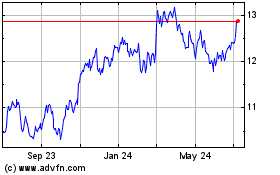

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024