Utility Company PPL Reaffirms Guidance After Surprise Brexit Vote

June 24 2016 - 9:08AM

Dow Jones News

By Austen Hufford

PPL Corp. reaffirmed its earnings guidance but warned that a

long-term decline in the British pound could require the utility

company to "reassess" its profit growth rate in response to

Britain's surprise vote to leave the European Union.

The Allentown, Pa.-based PPL has substantial operations in the

U.K., serving almost eight million customers through its four

utilities there. In its most recent quarter, more than 60% of PPL's

earnings were tied to its U.K. operations.

Shares of PPL fell 4.2% to $37.78 in premarket trading, amid a

broader market selloff.

PPL said the Brexit decision wasn't expected to significantly

affect its U.K. operations, thanks in part to the company's

hedging. The company said it had largely protected itself from

fluctuations in the pound through 2017, being 93% hedged for the

remainder of this year, 89% hedged for 2017 and 41% hedged for

2018.

Like many companies with operations across countries, currency

fluctuations can disrupt results. The British pound took the

referendum especially hard, falling by nearly 8% in recent Friday

trading.

In a statement, PPL said a "long-term" reduction in the relative

value of the pound compared with the dollar would cause the company

to "reassess our earnings growth rate."

The company also said the final impact of the referendum was

uncertain as potential currency fluctuations could be offset by

increases to the U.K. inflation and interest rates.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 24, 2016 08:53 ET (12:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

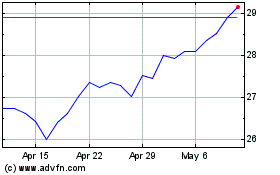

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

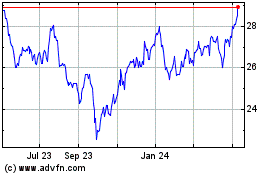

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024