SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2016

Commission File Number: 1-13368

POSCO

(Translation of registrant’s name into English)

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 135-777

(Address of principal executive office)

(Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b) : 82- .]

POSCO is furnishing under cover of Form 6-K:

Exhibit 99.1: An English-language translation of documents with respect to Performance in 2015 of POSCO

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

POSCO |

|

|

|

|

(Registrant) |

|

|

|

| Date: January 28, 2016 |

|

By |

|

/s/ Noh, Min-Yong |

|

|

(Signature)* |

| *Print the name and title under the signature of the signing officer. |

|

Name: |

|

Noh, Min-Yong |

| |

Title: |

|

Senior Vice President |

January 28, 2016 2016 Investors Forum

Figures in this presentation are based on unaudited financial statements of the company. Certain contents in this presentation are subject to change during the course of auditing process. Exhibit 99.1

2015 Operating Performance Major

Business Activities ▶ Figures in this presentation are based on unaudited financial statements of the company. Certain contents in this presentation are subject to change during the course of auditing process.

Parent Income 2015 Operating

Performance POSCO Earnings Release |January 28, 2016 Profitability improved with higher WP product sales and cost reduction, despite product price decline Net debt heavily scaled down as investment and working capital decreased and cash was

raised from restructuring Net Debt Liability to Equity 2013 2014 2015 (billion KRW) 2013 2014 2015 (thousand tons) (thousand tons, thousand KRW/ton) 36,416 37,650 37,965 Crude steel 776 727 606 Carbon steel price 2013 2014 2015 (billion KRW) 30,544

29,219 25,607 Revenue OP Margin 7.3% 8.0% 8.7% 2013 2014 2015 33,929 34,337 35,337 Product 30.9% 33.3% 38.4% 2,215 2,350 2,238 Operating Profit 1,583 1,318 1,139 Net Profit 34,293 35,078 35,589 Product Production Sales Income Free Cash Flow 687

1,238 2,921 2013 2014 2015 Operating 4,163 5,140 4,764 Investment 4,349 2,002 Cash Equivalent 28.2% 23.8% 19.3% 4,950 4,184 362 3,713 4,927 3,018 2,353 WP portion Cash Flow B/S (billion KRW)

Consolidated Income POSCO Earnings

Release |January 28, 2016 2015 Operating Performance Net profit recorded loss due to poor operating results of subsidiaries and large valuation losses Free Cash Flow turned positive and debt ratio dropped by enhancing financial soundness

Revenue Operating Profit Net Profit 2013 2014 2015 65,098 2,996 4.8% 4.9% 1,355 61,865 3,214 (billion KRW) OP Margin 557 58,192 2,410 4.1% △96 3.0% 1.2% ROE △0.2% 2013 2014 2015 2013 2014 2015 (billion KRW) 4,858 7,602 3,412 8,822 2,527

5,392 Free Cash Flow* 2013 2014 2015 △3,955 △1,576 5,856 Operating Investment 2013 2014 2015 84.3% 88.2% 78.4% 19,112 22,231 16,549 *FCF = EBITDA – Investment – Net Interest Expense – Corporate tax + Net Working Capital

(Account Receivables+Inventories-Account Payables) 7,135 5,197 8,671 Cash Flow B/S (billion KRW) Net Debt Liability to Equity Cash Equivalent (billion KRW) (billion KRW)

POSCO Earnings Release |January

28, 2016 ※ Breakdown of Consolidated Net Loss 2015 Operating Performance Recognized valuation losses of 1.6 trillion KRW on external issues, as raw material price fell and exchange rate increased ※ Profit-gained from selling equity of

POSCO E&C (3Q, Parent-basis) of 346.2 billion KRW was excluded from consolidated (as capital transaction) (in billion KRW) Operating Profit 2,410 △579 △299 Net Loss Profit-gained from restructuring Settlement Net Interest Expense

① Asset Impairment Value loss in mining assets △378 - Mt.Hope △146, Ambatovy △110, Namisa △78 Value loss from goodwill and holding stocks △252 - Thainox/Plantec goodwill △99, Holding stocks △153 Value

loss on un-used assets △236 - Tangible/Intangible Assets △199, Assets-for-sale △37 ② Forex-related losses by country (currency)* △96 △335 Corporate tax, etc +271 Brazil : △293 (42%) - BRL/USD :

(’14/E)2.66 → (’15/E)3.96 Domestic : △152 (22%) - KRW/USD : 1,099.2 → 1,172.0 China : △115 (16%) - CNY/USD : 6.20 → 6.49 * including equity-holding companies △866 △698 Forex-related

Losses② Asset Impairment① Valuation Loss without actual cash outflow India, etc △138 2014 2015 YoY Asset Impairment △597 △866 △ 269 Forex losses △48 △698 △ 650 Total △645

△1,564 △919

2015 Operating Performance Major

Business Activities ▶

Strengthen Steel Competitiveness Major

Business Activities POSCO Earnings Release |January 28, 2016 World Premium product sales volume went up by 25% through Solution-marketing Activities WP product sales volume Increase sales volume by 26% as a stretch target for 2016 Sales

Portion Solution marketing-related sales volume * X-AHSS: Extra Advanced High Strength Steel, NO: Non-Oriented magnetic steel (thousand tons) Diversified product base with new products (42 types, ‘15) Built and rationalized mills to

mass-produce WP products Plate for ice-breaking LNG carriers 3rd Generation X-AHSS* Hyper NO* for motors 1 2 3 Secured more demand for WP products through Solution-marketing activities Worked as a partner with global automakers such as

Renault-Nissan and VW, in new model development process Participated in Detroit Global Auto Show and opened Technology Exhibition towards Chinese automakers Improved welding for stronger structure (Yamal Pjt) Developed auto steel fit for

light-weight needs High Permeability electrical steel for wind power plant (Germany) ∙ Rationalization P) No.2 Steelmaking (Feb~May.’15) G) No.3 CGL (Aug~Nov. ’15) No.1 and 4 CR (’16) ∙ Finalize No.7CGL(’17) items

2014 2015 2016(f) 4 Expanded the usage of WP products (as High-purity Mn Steel) in engineering companies and internal investments - Built track record by utilizing WP product in internal investments Generated domestic/overseas demand through

partnership with global engineering companies 1,302 2,420 3,200 2014 2015 2016(f) +86% +32% 10,208 12,708 15,968 2014 2015 2016(f) 33.3 48.5% 38.4 +25% +26%

POSCO Earnings Release |January

28, 2016 Strengthen Steel Competitiveness Reinforced low-cost production by reducing fixed cost through enhancing process efficiency Plan to cut ’15~’16 consolidated fixed cost by 1.4 trillion KRW Cost Reduction Investment 2,573 2015

2016 5,149 +2,576 1,665 5,256 +3,591 2,164 1,599 Accumulated Reduction Amount Target to reduce 376.3 billion KRW (’15~’16) [POSCO] [Consolidated] [POSCO] Triggered cost reduction by taking long-term contracts on highly-priced materials

applied in FINEX and SNG facilities Extended maintenance period and recycled/localized materials with more efficient operations Increasing open competition in deals enabled cost reduction R&D expenses focused on projects with market potential

Reduced overhead cost to extent (consulting, repairment fees, etc) Cut short of both regular and committee meetings Overhead Cost Materials/ Outsourcing Saved service fee by applying self-engineering efforts in POSCO operations Reduced purchasing

cost by directly selecting suppliers through bidding based on competition Investment reduced by improving planning and reusing facilities (100 million KRW) (100 million KRW) 2015 2016 2015 2016 Major Business Activities

Speed-up Restructuring POSCO Earnings

Release |January 28, 2016 Completed 46 cases of restructuring (34 subsidiaries , 12 items of assets), B/S improvement of 2.1 trillion KRW 68 cases completed* from 4 year target, 149 Restructuring subsidiaries (Target 95 → 38 companies

complete) ` 12 19 5 ’15 ‘16 ‘17 ’14 18 Amount 1.5 0.8 0.9 1.2 Asset restructuring (Target 54 → 30 cases complete) [’15 Asset Restructuring] POSCO-E&C stake sales - Amount: 1.2 trillion KRW Sandfire stake sales

P-ICT un-used asset sales Land in Gwangyang/Pohang sold SPFC Gunsan business area sold [’15 B/S improvement] 1.6 trillion* (Amount) Total 2.1trillion KRW * Include. sales of subsidiaries [’15 List of restructuring] 34 Liquidation (19)

Disposal (11) Consolidation (4) ∙ PoNuTech ∙ P-NALT ∙ POREKA ∙POS-HiMetal ∙P-Investment ∙POS-HiAl ∙S.CMI subsidiaries ※ P-Plantec Workout process(’15.Sep) 0.5 trillion (Debt ↓) 2015 ` 201

166 144 ’15* ‘16 ‘17 ’14 228 (47) (41) (28) (22) Number of companies Restructuring 34 35 22 4 (Domestic) * 7 new companies in ‘15 * Based on Board of Directors resolution Number of Assets (Cases) * ‘14. 4

companies/18 cases, ‘15. 34 companies/12 cases (in trillion KRW) Major Business Activities

철강

본원경쟁력 강화 주요 경영활동 POSCO Earnings Release |January 28, 2016 솔루션마케팅 연계

활동으로 WP제품 판매량 25% 증가 ’16년 판매량 목표 16백만톤으로 Stretch Target 설정 * X-AHSS: Extra

Advanced High Strength Steel, NO: Non-Oriented magnetic steel Generate Results on New Growth Biz POSCO Earnings Release |January 28, 2016 Made progress on utilizing POSCO’s own technology and building SPB1 Business 22 Technology

application proposals and 13 signing process (3 MoU, 3 MoA) 1 Solution-based Platform Business 2 POSCO Innovative Steelmaking Technology 3 POSCO Lithium eXtraction Solution-based Platform Business While commercializing POSCO’s own technology,

pursued platform business based on Solutions, such as innovative operations, manufacturing and operation know-how, and engineering 5 Integrated mill projects (including PKP, Uttam, Chongqing) POIST2 CEM POS-LX3 7 on-going projects (Shougang Group

pjt bidding, etc) Built Solution-based Platform with SMS, German manufacturer, by signing License contract (‘15) - Expanded global business opportunity with or without utilizing the partnership Pursuing MoA with PKP in Iran after signing MoU

(‘15.Sep) - Both governments of S.Korea and China approved on technology sales regarding Chongqing project (‘15) - Uttam (India) : Signed MoU to relocate Pohang No.1 FINEX, and Gwangyang CEM technologies Sold Lithium extraction

technology license to Argentina company “L” FINEX 10 Negotiations on tech. application under discussion with CBSteel in Brazil Tech. sales deal underway with Brazilian steelmaker, CBSTEEL, to build 3 million tons of mill (1.5Mtpa*2

mills) in Maranhão 【SPB Case and Progress】 Peers POSCO sales tech. Engineering tech. Solution (Operation/Innovation) Tech of Peers Major Business Activities Know-how Technology

Generate Results on New Growth Biz

POSCO Earnings Release |January 28, 2016 * ENCAP : European New Car Assessment Program , IIHS : Insurance Institute for Highway Safety (Source: South Bay Environmental Services Center, http://www.sbesc.com) Started to develop and sell key

materials, in preparation for the age of electric vehicles Focused on R&D of light-weight materials Entered our electric vehicle Body-in-White part at North American International Auto Show - Reduced weight by 26.4%, by applying AHSS 65% -

Secured top rank regarding security in all parts, such as body and batteries Started to sell Hyper NO for the motor of EV Held ‘2015 Hyper NO Forum’ (Oct) Target to expand sales by customized service to global automakers (‘15. 4

→ ’20. 8 customers) * Despite NO capacity decline, due to facility rationalization (△90,000tons) , company plan to maintain Hyper NO production at best Expanded sales and development of light-weight materials, such as Mg Steel EV

Body-In-White at the Auto show 64 ‘15 ‘16 ’20(f) Hyper NO Sales Volume (thousand tons) 96 126 +48% 65* ‘17 2014 2015 2016~ Applied to roof of Renault concept car Trunk, power seat in the back of SM7 After applying to the roof

of 911 GTS RS, Porsche, reduced its weight by 10kg Seek to apply in roof, inner parts of newly commercialized models Major Business Activities

Completed commercialization base for

secondary battery materials by using POSCO’s own technology POSCO Earnings Release |January 28, 2016 * Lithium Manganese Oxide (LMO) : Excellent yield and stability. Wide usage from small batteries to Energy Storage System for

automobile Lithium Titanium Oxide (LTO) : Excellent yield under low temperature, which enables hyper speed charging Nickel Cobalt Manganese (NCM) : Anode material with improved durability and stability, which allows mass storage for EV, PHEV and ESS

PG-NCM is anode co-developed with RIST and P-ESM, produced in coprecipitation method Generate Results on New Growth Biz Pushed for global commercialization of lithium carbonate extraction technology (ChemTech) Expanded cathode production line to

respond to order increase Finished application test by running D/P (200 tons, ‘15) Plan to operate plant of 2,500 tons (‘16) Scheduled to expand the facility to 40,000 tons after 2018 Turned profit with LMO* sales increase and finished

production line for POSCO Gradient-NCM* (‘15) Start to bring up sales of LMO, LTO; win customer recognition for Nickel Cobalt Manganese Battery for EV and start sales expansion Expanded capacity due to long-term contract with customer (5,300

tons, ‘15) Start to make profit with better quality than peers, cost competitiveness and higher utilization rate (‘16) (P-ESM) Increase revenue for secondary battery materials 1,203 ‘14 ‘15 ‘16(f) ‘17(f) Anode

sales (tons) 2,302 3,163 4,116 +37% 1,248 ‘14 ‘15 ‘16(f) ’18(f) Cathode sales (tons) 1,415 6,500 12,620 +360% Major Business Activities

Build Ethical Management

Infrastructure POSCO Earnings Release |January 28, 2016 Rebuilt corporate culture by fortifying management structure based on performance and ethical conduct Strengthened performance-based management structure Implemented ethical and

market-driven corporate culture Zero tolerance rule on unethical conduct ‘One Strike Out rule’ strictly applied when misconduct occurs Strictly endowed responsibility on investment-making decisions Responsibility given on each

decision-making process ∙ Major 4 Misconduct - Bribery - Embezzlement - Sexual abuse - Data fabrication ∙ Registered in “Clean POSCO System” - Record remains on personnel, taking bribe - Certain compensation for

whistle-blowers Unethical Behavior One Strike Out Monitor Stronger transparency in transactions and outsourcing Transparent transaction system set through 100% open bid, record, and transparency - Material and outsourcing cost reduced through

expanded open bid system Real-name system ∙ Put all people in charge on the official record Principle to determine non-profitable business ∙ Strict standard to determine the business to be non-profitable - Follow strict Exit standard

Personnel measures ∙ Draw out the cause of the loss-making and take personnel measures Compensation based on performance - Top-down KPI control based on quantitative index Diversified compensation levels depending on performance by each

management level Clean POSCO Major Business Activities

Major Subsidiaries POSCO Earnings

Release |January 28, 2016 POSCO E&C Won order of 12.5 trillion, as construction market thrived - “L-City” in Busan (1.5 trillion), Philippines Masinloc power plant (0.5 trillion) Daewoo International Despite oil price drop,

profit from Myanmar gas field sustained - OP improved YoY by 45%, as production reached its peak → (’14) 261 billion KRW → (’15) 377 billion KRW Realigned with 2 Core and 3 strategic businesses - Expanded portion of steel and

3 strategic businesses and balanced the profit structure, currently heavy on the gasfield 2 Core 3 Stra-tegic · Steel : Increase high-end product sales by using overseas network - Volume : 8.6 (‘15) → 9.8 million tons (‘16)

· Auto: Building solid JV with local auto partners · IPP : Stable orders from Myanmar/Indonesia/Papua · Agriculture : Expand trading and overseas M/S · Resource: Lead to production on current mine explorations (~’18) - AD-7

drilling (1Q), A-1/A-3 drilling (‘17) Improved financial structure by stakes sales to PIF and capital increase - Cash-in: 396.5 billion, Debt/Liabilities: (’14)121 → (’15)95% * Average debt ratio of peers : approx. 180%

Improved cash flow by focusing on business activities that improves financial soundness 924 billion KRW of operating cash-in by A/R collection Cash increased by 1.1 trillion KRW through asset sales and operating cash inflow E&P 89% Steel 10%

E&P 47% Steel 22% 3 Business 16% Others 15% 2015 2018 [Operating Profit contribution] 10,013 12,506 Construction (billion KRW) Order Amount OP Margin 2014 2015 Major Business Activities

Major Subsidiaries POSCO Earnings

Release |January 28, 2016 POSCO Energy POSCO-Chemtech Expanded overseas power business and push forward domestic coal-fired plant Project (MW) Progress Samcheok coal-fired 2,100 ∙ Selected main supplier (’15.Nov) ∙ Risk

relief through landing FIs (‘16) Vietnam Mong Duong Ⅱ 1,200 ∙ Commercial production (’15.Apr) - Dividend profit 25 billion/yr Mongolia CHP-5 450 ∙ Signed PPA* contract (’15.Jul) ∙ Prepare construction for

2016 Botswana MorupuleBⅡ 300 ∙ Selected as preferred bidder (’15.Nov) *Power Purchase Agreement : Electricity contract that secures minimum profit Won refractory orders from other industries with POSCO’s know-how in

steelmaking Managed construction for power/chemical plant refractory Built profitability base in materials sector Expanded production line for cathode materials (6,500 tons, ’15. Nov) Increased supply of mid/large sized batteries for EV

(’16) Power No.1 Coal plant in Donghae/Yeosu, Mapo Resource Recovery facilities Chem Iraq’s Karbalak and Bolivia’s Ammonia plant Finalized construction of No.7~9 Incheon LNG Plants and coal-fired plant in Vietnam Maintained

profitability in power-generation sector as power capacity expanded Diversified power generation (LNG, off-gas, coal) 3,770MW 4,550MW 2014 2015 POSCO ICT Secured the source for Smart Biz growth Conducted Smart Factory biz for POSCO based on

self-developed Platform (’15.Jul~) Pursued Smart Factory projects as MPS* and distribution automatization for Chinese Steelmaker “H” (‘15.Jul~) - KEPCO’s ESS*. Doosan Heavy’s Smart Energy pjt (‘15. Jun) *

MPS : Micro Pulse System , ESS : Energy Storage System Restructured non-profit making business - Disposed non-profit making business (PoNuTech, etc) Major Business Activities

Business Plan 2015 2016(f) POSCO

Revenue (trillion KRW) 25.6 24.3 - Crude steel production (million tons) 38.0 37.2 - Product sales (〃) 35.3 35.3 Investment (trillion KRW) 2.0 2.1 Net Debt (〃) 0.4 △0.6 Consolidated Revenue (trillion KRW) 58.2 58.7 Investment

(〃) 2.5 2.8 Net Debt (〃) 16.5 14.6 POSCO Earnings Release |January 28, 2016

Appendix 1. Business Environment

– Steel Demand, Raw Materials 2. Financial Statements ▶

Domestic Steel Demand POSCO Earnings

Release |January 28, 2016 Production flat as export increase, despite the effect of consumption tax being subsided While new orders are slowing down, new construction amount will continue to increase by orders won in 2013 Public construction

staggered as SOC budget decreased Investment climbed up as housing market improved 4,521 4,525 4,556 4,563 2013 2014 2015 2016(f) 【Production】 (thousand units) 24.7 22.0 23.9 25.5 2013 2014 2015 2016(f) 【Construction】

(million GT) * Korea Automobile Manufacturers Association (Jan 2016), POSRI(Jan 2016) * Clarkson(Dec 2015), POSRI(Jan 2016) * Construction Economy Research Institute of Korea (Nov, '15), POSRI (Jan, '16) 2013 2014 2015 2016(f) 5.5% 1.0% 3.1% 2.0%

【Investment】 (yoy) Appendix#1. Business Environment Demand Outlook Shipbuilding Construction Automobile Steel Demand & Supply Outlook (in million tons) * POSRI(Jan, ‘16) 2013 2014 2015(e) 2016(f) YoY YoY

Nominal Consumption 51.8 55.5 55.5 △ 0.1% 55.8 + 0.6% Export 29.2 32.3 31.6 △ 2.2% 32.5 + 3.1% Production 69.1 74.1 73.8 △ 0.4% 75.7 + 2.5% Import 11.8 13.7 13.2 △ 3.2% 12.7 △ 4.0% Incl. Semi-Product 19.4 22.7

22.1 △ 3.0% 21.6 △ 2.1%

“Economy started to bottom out

as seen from steel price and business sentiment rebound” “Global demand to grow by 1% as emerging countries show good signs despite China’s slow-down” China : As investment dampened due to unstable economy, construction

demand will continue to slow down, however the decline will be offset by pick-up from auto industry, etc Emerging : Expected to show solid growth of 5~7% as infrastructure investments expand in regions, such as India, Southeast Asia, and MENA POSCO

Earnings Release |January 28, 2016 Steel price is showing slight rebound from early this year, as supply and demand have shortened due to capacity cuts and inventory decline - Major mills, including Baoshan and Anshan Steel, announced to

increase price in Feb~March Expectations for market recovery went up as steel PMI at the end of 2015 jumped Global Steel Demand China’s Steel Economy Steel Demand in Major Countries Appendix#1. Business Environment * CRU(Jan, ‘16), China

Federation of Logistics & Purchasing(Jan, ‘16) (million tons) * World Steel Association(Oct, ‘15), POSRI(Jan, ‘16) 2013 2014 2015(e) 2016(f) YoY YoY US 95.7 107.0 103.8 △3.0% 105.2 1.3% EU 140.9 148.0 149.8 1.3% 153.1

2.2% China 735.1 710.8 675.0 △5.0% 665.0 △1.5% India 73.7 75.9 81.5 7.3% 87.4 7.3% ASEAN 63.1 65.9 68.6 4.2% 71.9 4.8% MENA 66.4 70.1 73.3 4.6% 77.2 5.2% Global 1,529 1,540 1,500 △2.6% 1,512 0.8% 【 Steel Demand Outlook for

Major Countries 】 Steel PMI HR Price ($/ton) 【China’s Steel Price and Steel PMI】

POSCO Earnings Release

|January 28, 2016 2015.4Q 2016 Outlook Price continued to stay weak as production cuts from major mills, triggered by slow steel economy, led to actual demand fall of iron ore. The quarter average price dropped from U$55/ton (3Q) to U$47/ton

in fourth quarter As the weak steel market fails to show rebound, supply and demand imbalance is to continue as major miners continue to pour out low-priced volume in the market, resulting price to remain low around, U$40~50/ton “Fine ore

yearly average price around U$47/ton” 2015.4Q 2016 Outlook As imported coal demand plummeted as Chinese domestic coal price declined, traders competitively release their stocks in low price, and as a result, the quarter average price fell from

U$84/ton (3Q) to U$77/ton in fourth quarter Slow market will stay as China’s low demand, however, as producers are seen to reach their bottom level of cost reduction and have several mines shut-down, the price is expected to gradually rebound

“Hard Coking Coal average yearly price around U$81/ton” Raw Materials Iron Ore Coking Coal Appendix#1. Business Environment (US$/ton) *Platts 62% Fe IODEX CFR China (Quarterly Spot Average) 2014 1Q 2014 2Q 2014 3Q 2014 4Q 2015 1Q 2015 2Q

2015 3Q 2015 4Q 2016 1Q(f) (US$/ton) *Platts HCC Peak Downs Region FOB Australia (Quarterly Spot Average) 2014 1Q 2014 2Q 2014 3Q 2014 4Q 2015 1Q 2015 2Q 2015 3Q 2015 4Q 2016 1Q(f) 103 120 90 74 62 59 55 47 44 122 113 112 105 111 88 84 77 78 [Iron

Ore Price] [Coking Coal Price]

2013 2014 2015 YoY Revenue 61,865

65,098 58,192 △6,906 Gross Profit 6,860 7,283 6,534 △749 (Gross Margin) (11.1%) (11.2%) (11.2%) - Selling & Admin. Expenses 3,864 4,070 4,124 54 Operating Profit 2,996 3,214 2,410 △804 (Operating Margin) (4.8%) (4.9%) (4.1%) -

Other Operating Profit △422 △710 △893 △183 Share of Profit (loss) of Equity-accounted investees △180 △300 △506 △206 Finance Items Gains △448 △825 △830 △5 Foreign Currency

Transaction & Translation Gains (loss) 236 13 △383 △396 Net Profit 1,355 557 △96 △653 (Net Margin) (2.2%) (0.9%) (△0.2%) - Owners of the Controlling Company 1,376 626 181 △445 POSCO Earnings Release

|January 28, 2016 Summarized Statements of Income Appendix#2. Financial Statements (in billion KRW)

2013 2014 2015 YoY Current Assets

31,666 32,627 29,181 △3,446 Cash & Financial Goods* 7,135 5,197 8,686 +3,489 Account Receivable 11,493 11,786 9,596 △2,190 Inventories 9,798 10,471 8,225 △2,246 Non-Current Assets 52,789 52,625 51,228 △1,397 Other

Long-term Financial Assets** 5,263 3,600 3,205 △395 PP&E 35,760 35,241 34,523 △718 Total Assets 84,455 85,252 80,409 △4,843 Liabilities 38,633 39,961 35,339 △4,622 Current Liabilities 20,241 21,877 20,131 △1,746

Non-Current Liabilities 18,392 18,084 15,208 △2,876 (Interest-bearing Debt) 26,247 27,428 25,220 △2,208 Equity 45,822 45,291 45,070 △221 Owners of the Controlling Company 42,046 41,587 41,235 △352 Total Liabilities &

Equity 84,455 85,252 80,409 △4,843 POSCO Earnings Release |January 28, 2016 Consolidated Statements of Financial Position Appendix#2. Financial Statements (in billion KRW) * Cash & Financial Goods : Cash and cash equivalents,

Short-term financial goods, Short-term available for sale securities, Current portion of held-to-maturity securities **Including Other bonds

Consolidated Operating Results POSCO

Earnings Release |January 28, 2016 Revenue Operating Profit Net Profit 2013 2014 2015 2013 2014 2015 2013 2014 2015 Steel 48,024 49,597 44,837 2,341 2,430 1,843 1,449 857 181 Trade 25,919 31,261 27,008 196 413 374 10 181 39 E & C 10,782

10,304 9,868 464 314 147 147 13 △276 Energy 3,045 2,663 2,008 224 137 149 117 33 55 I C T 1,213 1,078 945 67 44 3 22 11 △94 Chem/ Mat’l/ Others 3,627 3,325 2,806 122 119 34 58 △35 △27 Total* 92,610 98,228 87,472 3,414

3,457 2,550 1,803 1,060 △121 (in billion KRW) Appendix#2. Financial Statements * based on simple aggregation

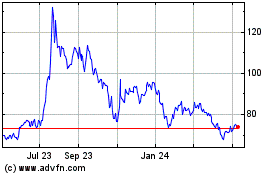

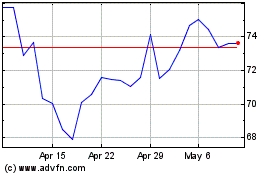

POSCO (NYSE:PKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

POSCO (NYSE:PKX)

Historical Stock Chart

From Apr 2023 to Apr 2024