SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2015

Commission File Number: 1-13368

POSCO

(Translation of registrant’s name into English)

POSCO Center, 892 Daechi 4-dong, Kangnam-gu, Seoul, Korea, 135-777

(Address of principal executive office)

(Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

[If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b) : 82- .]

POSCO is furnishing under cover of Form 6-K:

Exhibit 99.1: An English-language translation of documents with respect to 2015 Investors Forum

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

|

|

POSCO |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: February 5, 2015 |

|

|

|

By |

|

/s/ Noh, Min-Yong |

|

|

|

|

|

|

(Signature)* |

| * Print the name and title under the signature of the signing officer. |

|

Name: |

|

Noh, Min-Yong |

|

|

|

|

Title: |

|

Senior Vice President |

|

| Exhibit 99.1

|

2015 Investor Forum

February 5, 2015

2014 Operating Performance

2014 Major Business

Activities

2015 Business Plan

Figures in this presentation are based on unaudited financial statements of the company. Certain contents in this presentation are subject to change during the course of auditing process.

2014 Operating Performance

Consolidated Income

Operating profit up, net profit down due to temporary issues

Revenue Operating Profit Net Profit

(in billion KRW)(in billion KRW)(in billion KRW)

65,098 5.7% ROE 5.7% 3.1%

63,604 OP 4.9%

61,865 Margin 4.8% 1.2%

2,386

+3,233 3,653 1,355

3,214 557

2,996 798

+218 2012 2013 2014

Temporary non-operating

losses

· Devaluation losses in investment stocks 490

2012 2013 2014 2012 2013 2014 · Contingent loss from tax dispute 372

(in billion KRW) Revenue Operating Profit Net Profit

2012 2013 2014 2012 2013 2014 2012 2013 2014

Steel 52,869 48,024 49,597 2,896 2,341 2,430 2,246 1,449 857

Trade 26,414 25,919 31,261 212 196 413 325 10 181

E & C 9,726 10,782 10,304 339 464 314 345 147 13

Energy 2,881 3,045 2,663 267 224 137 170 117 33

I C T 1,132 1,213 1,078 29 67 44 19 22 11

Chem/Mat’l/Others 3,568 3,627 3,325 166 122 119 113 58(35)

| * |

|

based on simple aggregation |

POSCO Earnings Release February 5, 2015

2014 Operating Performance

Parent Income

Operating profit rose as high-end product sales expanded

Production Sales Income

(in thousand tons)(in thousand tons, thousand KRW/ton)(in billion KRW)

883

37,986 Carbon 776 8.0%

37,650 Steel 727 OP 7.8%

Crude 36,416 Price Margin 7.3%

Steel +1,234

35,048

35,517 +785 35,078 33,929 34,337 35,665 30,544

+408 Revenue 29,219

Steel 34,293 1,325

Products 2,790 2,350

Operating 2,215 +135

Profit

2012 2013 2014 2012 2013 2014 2012 2013

2014

[WP* Product Sales Portion] (thousand tons, %) Portion 30.9 33.3 Sales Volume 9,053 10,207 =1,154

2012 2013 2014 2012 2013 2014

Carbon 36,017 34,467 35,854 Domestic 20,448 19,414 18,368

Steel

S T S 1,969 1,949 1,796 Exports 14,600

14,515 15,969

* (Gwangyang) Completion of No.4 HR mill

in July (Capacity 3,300 thousand tons/yr) Inventories 988 903 1,280 2013 2014

*World Premium: POSCO’s high-value added product

POSCO Earnings Release February 5, 2015

4

2014 Operating Performance

Consolidated Financial

Structure

Liabilities ratio went up affected by trade financing of DWI

(in billion KRW)(in billion KRW)(in billion KRW)

85,252

84,455 86.8% 88.2%

+797 45,822

79,266 84.3% 45,291

Liabilities 42,430 531

to

Equity 39,961

38,633

36,836 +1,328

2012 2013 2014 2012 2013 2014 2012 2013 2014

Borrowings of affiliates increased Equity decreased

· DWI +945, P-Energy +738 · Dividend payment 793, Loss assessment

on marketable securities 336

POSCO Earnings Release February 5, 2015

5

2014 Operating Performance

2014 Major Business

Activities

2015 Business Plan

Mid-term Management Plan

Strengthen core

competitiveness/Improve financial structure

Fortify “Develop high-end products and fortify

solution-marketing”

Steel

Competitive- “Improve profitability of overseas affiliates and

ness reinforce global businesses”

Acti-

Prioritize New “Select and focus to nurture new growth businesses”

Growth Biz.

vities

Improve

Financial “Conduct business

restructuring and non-debt financing”

Structure

Renew

Corporate “Spread Project-based Work System(PWS)”

Culture

Consolidated (trillion KRW) Consolidated

(trillion KRW)

E B I T D A Capex Debt/EBITDA

Mid-term Result Mid-term Result Mid-term Result

Target 8.5 Target Target

Result 7.3 3.8

6.2 5.6

6.5 4.2 4.4 3.0

5.4 3.0

2014 2015 2016 2014 2015 2016 2014 2015 2016

POSCO Earnings Release February 5, 2015

7

2014 Business Activities

Fortify Steel

Competitiveness

Expanded sales of high-end products through solution-marketing

Solution Marketing High value-added Products

Provided customized technology/product solutions Sales through solution-marketing

- Gained competitive advantage by providing technology

and services that satisfy diverse needs of customers,

such as light-weight and alternatives for high-cost steels

[Case studies for solution marketing]

Renault LG

Electronics

· Lower weight by applying · Cost-reduction by replacing 2013 2014

high- strength steel and Al material to PO*, used for

Mg plate refrigerators pORTION sALES vOLUME 30.9 33.3 9,053 +13% 10,207 (thousand tons, %)

Automobile Ssangyong Motor Home Samsung Electronics WP product sales portion

· Reinforced stability and Appliance · Lowered product weight by

lowered weight of Tivoli

(compact SUV) with POSCO’s developing HGI for Television

high-strength steel

UAE No.4 Nuclear Plant Mn

Steel for LNG Tank

· Cost reduction by localizing · Substitute highly priced STS

Construction highly non-corrosive STS Energy product with commercialized

High-Mn Steel for low temp.

* pickled-and-oiled steel 2013 2014

POSCO

Earnings Release February 5, 2015

8

2014 Business Activities

Fortify Steel

Competitiveness

Normalized overseas steel operations and strengthened the edge in technology

Overseas Steel Business Technology Advantage

Sales of overseas affiliates* jumped as Strengthened technology development on

new mills achieved early normalization high-end products

[Technologies developed in 2014]

WF WB

17 types (ex. HR thin foil of 20 types (ex. wire rod cable

CEM premium) for bridges)

* WF/WB® : World First / World Best [Sales volume] (thousand tons) 4,642 +54% 7,164 (thousand tons, %) Utilization rate Sales volume 65 80 599 +118% 1,305

Built base to sell self-developed technologies

2013 2014 by gaining technology leadership

*16

overseas steel affiliates with managerial rights

Indonesian mill normalized operations Type Contents

since the accident and built ground for · Acquired terms needed to earn ratification

profit-making from the Chinese government to build

integrated mill with Chongqing (Nov)

FINEX—Capacity: 3 million tons (1.5 mil × 2 plants)

· Signed MOU to relocate No.1 FINEX

demo

plant to Mesco Steel, India (Jun)

· License deal ongoing with a foreign

CEM* engineering company

2014.1H 2014.2H* Compact Endless cast-rolling Mill

POSCO Earnings Release February 5, 2015

9

2014 Business Activities

Prioritize New Growth

Businesses

Verified self-developed technologies for commercialization

Lithium Nickel Extraction Process

Verified direct-extraction technology Completed pilot test to transfer demo

for commercialization plant for PosNEP*

-

Completed construction of pilot plant in—Developed technology for PosNEP PP2 (Jun)

Argentina to test its

ability to mass-produce—Started test of adopting low-cost materials

(Dec) Proved applicability of PosNEP

technology

- Registered for patent in major countries, with Metal X, Australian miner, which has

such as the U.S. and Japan Limonite mines

- Reviewed objectively for further application

#1

Pilot #2 Pilot #3 Pilot

Plant(‘11) Plant(‘13) Plant (‘14)* POSCO Nickel Extraction Process

2 tons/yr 20 tons/yr 200 tons/yr Raw

material

Limonite(1.5%Ni)

Wet

process

Dry

Process

FeNi(18%Ni)

POSCO Earnings Release February 5,

2015

10

2014 Business Activities

Improve Financial

Structure

Enhanced financial soundness by business restructuring and disposing non-core assets

Raised non-debt financing through selling non-core assets and restructuring businesses that create low synergy with POSCO

Company Buyer Contents Progress

Restruc- POSCO-SS SeAH Besteel 52.1% (2015), 20% (2020) Signed

turing

Posfine Hahn & Company Sold 69.2%

of stakes Signed

Vietnam/Masan Lotte Dept. To pay off the balance by 2015 Signed

Dept. Store

USP Russia) Evraz Disposed 35% of stakes Finalized

Non-core

Asset SKT EB— Repaid EB with SKT ADR Finalized

Sales

POS Tower Chosun Refractory P-A&C (50%) · POSMATE (50%) Finalized

Other Unused Apartments/Shopping center of

Gilsan

Steel, etc. Finalized

Assets P-E&C, AST facilities, etc.

Collect & Collect—Collect long-term outstanding A/R (DWI) Finalized

Liquida- Long-term A/R*

tion Liquidate A/R* SMBC, etc. P-Energy, P-JAPAN, TMC Finalized

* Account Receivables

POSCO Earnings Release

February 5, 2015

11

2014 Business Activities

Renew Corporate Culture

Settled project-based working culture

Stronger Performance-oriented/ POSCO’s Own POSTIM* Model Expert Nurturing Culture

Formed organization system of PWS, Adopted system to educate the employees,

QSS+, SWP to achieve management vision named as “expertise qualification system”

designed towards engineers, staffs, etc

Provided

vision to grow as an expert,

through expansion of PCP and appointed

executives on expertise

* POSTIM : POSCO Total Innovation Methodology Managing executive Expert executive

Type Contents Leader(division) Expert (PCP,

Research)

-Focused creating actual results through IP*

PWS

Employee

projects to reach profit targets

—Promoted Quality/Stability/Safety activities Motivated employees by differentiating

QSS+ to improve work environment fit for

operating facilities bonus by outcome

—Supported to focus on one’s own task,—Widened the salary gap between employees

SWP that creates ideas based on positive work with high/low outcome

environment

* Innovation POSCO—Strengthened bonus to results, likely on PJTs

POSCO Earnings Release February 5, 2015

12

2014 Business Activities

Major Subsidiaries

Daewoo International POSCO E&C

Profit contribution from Myanmar Increased orders from overseas markets

gasfield business hiked as production—Discovered new markets such as Africa and the

reached its full capacity Middle East, as domestic and Asian construction

market remained weak

DWI Total 586 South America

Operating Profit 4,664 3,038 Asia

2013 2014 2013 2014

Explored and developed new

oilfields Major projects Amount Signed

Nigeria Coal-fired Plant 1,162 Sep

Region Mine Stakes Progress Saudi Aramco Sulfur transport facility 404 Sep

Over- Myanmar A-1/A-3 51% 3D Exploration India Uttam integrated mill 1,666 Dec

seas(mgmt rights)(Dec)

East Sea 6-1C 30% Started Ranked No.3 in construction capability

Dome- development (Oct) evaluation

stic 70%

Started drilling Portion of Myanmar gasfield DWI Total Operating Profit 16% 67% 139 347 (in billion KRW)

East

Sea 6-1S(mgmt rights)(Dec)—No.4(‘11) No.5(‘12~’13) No.3(‘14)

Comprehensive assessment

on companies based on business performance

and financial results of the year before

POSCO Earnings Release February 5, 2015

13

2014 Business Activities

Major Subsidiaries

POSCO Energy POSCO ChemTech

Diversified portfolio through entering Increased sales of cathode for secondary

coal-fired power generation by taking over battery used for IT and mobile devices

Tong Yang Power and building off-gas—Supply to domestic secondary battery makers

power plants went up

+229% 1,248

379

2013 2014

able Fulfill the demand with new

cathode

Coal- manufacturing plant

fired [Power generation 3,498 3,950 LNG offgas Renewable coal-fired]

2013 2014—Natural graphite coating line (1,200ton/yr, Feb 2015)

[New projects]

Project Capacity Progress

Coil-fired Mong Duong 1,200MW No.1 finished (Dec)

Pos-Power 2,100MW Tong Yang Power (Jun) Expanded Energy Storage System(ESS) sales

Pohang No.2 145MW Finished (Jul)

Off-gas Indonesia 200MW Finished (Apr)—ESS to LG Chem Ochang plant (1.5MW, Jul)

LNG Incheon No.7/8 840MW Finished (Oct)—ESS to Sinan solar light power (1MW, Oct)

POSCO Earnings Release February 5, 2015

14

2014 Operating Performance

2014 Major Business

Activities

2015 Business Plan

2015 Business Plan

Fortify Steel Competitiveness

Expand global sales and boost profitability through solution marketing

Sales Volume to “50 mil tons” Profitability Improvement

Expand sales volume as new facilities Raise high profit WP portion to 36%

start operating—Upgrade sales-mix through solution-marketing

(thousand tons) Projects Change and focus on 7 strategic industries

Pohang) No.3 Finex

Domestic +1,300

Gwangyang) No.4 HR

Overseas Indonesia) Integrated mill +775

India) CR +823

Reinforce solution marketing with

TSC* expansion volume +1,943

—Global TSC Network: 14) 23 ‘15) 29 Solution-mkt 1,800

based sales 1,302

2014 2015 [Global sales volume]

(million tons) Overseas productions** POSCO 46.4 50.2 11.8 +3.8 14.3 34.6 35.9

WP portion WP sales volume

Solution-mkt based sales 33.3 36.0 10,207 12,150 +1,943 1,302 1,8000

Strengthen project-based profit-making

activities

—Target to reduce 507 billion KRW by reducing

raw material and other cost

Raw materials Materials Sourcing Repair Energy cost Expenses

2014 2015 2,839 143 229 235 655 971

*TSC:

Technical Service Center,

**Including sales volume of processing centers*On a parent basis

POSCO Earnings Release February 5, 2015

16

2015 Business Plan

Fortify Steel Competitiveness

Reinforce marketing of POSCO technologies focusing on creating profits

Strategy for Technology-based Shape up Global POIST Biz. Platform

Sign JVA on building joint mill with Build and operate technology sales

Chongqing Steel process

—Grade and form package deals (221 types)

1Q) Ratification from the Chinese government—Run separate sales by type :

2Q) Korean government to sign FINEX export Strategic sales (S/A grade) and average sales (B grade)

3Q) Decide on Financing, such as inviting FIs

4Q) BOD approval, sign JVA and

pursue JV on CR

and plating [B] 95 types, as highly productive sintering operation

Subsidiaries

Make successful package sales deal of Energy Technology

FINEX/CEM E&C ICT Cooperation

Steel [Technology]

[S] 50 types including Slim

Finex tech.

[A] 76 types, as continuous HR ultrathin tech.

[B] 95 types, as highly productive sintering operation

- FINEX) Sign MOU with potential clients and Co.

proceed feasibility studies Supp-

Optimize design

by region in India and POSCO Platform liers

Vietnam search Re-

- CEM) Joint-marketing with partner company, Finance

in technology cooperation Customer Oxgen power Business

| * |

|

POIST : POSCO Innovative Steelmaking Technology Cooperation |

POSCO Earnings Release February 5, 2015

17

2015 Business Plan

Prioritize New Growth

Businesses

Commercialize fundamental materials and clean energy businesses in full swing

Fundamental Materials Clean Energy

Pursue global commercialization ofPursue global commercialization of Strategically respond on SNG business

direct lithium extraction technology considering market conditions

— Make options for Syngas production towards

technology as leverage oil price drop

- Conduct self-engineering by utilizing—Build tunnel underwater, links between Yeosu and

know-how in operating pilot plant Gwangyang, to find potential clients

Gwangyang

Secure salar Business grant

Construction

Yeosu

Gradual commercialization of nickel-

smelting

technology Strengthen competitiveness by localizing

- Set the optimal plan by reviewing the risk cell battery

production

in advance regarding size and location

—Review business profitability by securing—MCFC*: Achieve 100% localization,

stable supply of low-cost raw materials when cell plant completes (Jun, ‘15)

(Indonesia, New Caledonia, Philippines, etc)—SOFC*: Under development targeting for

first domestic commercialization

| * |

|

MCFC(Molten Carbonate Fuel Cell) |

| * |

|

SOFC (Solid Oxide Fuel Cell) |

POSCO Earnings Release February 5, 2015

18

2015 Business Plan

Improve Financial Structure

Speed up the restructuring and improve financial structure

Restructuring/CAPEX Reduction Debt/EBITDA below “38”

Speed up group restructuring Continue to improve financial structure

- Finalize strategic regroupings, such as non-core—Improve operating cash-flow through

asset disposal and share sales of subsidiaries, profit increase

which was planned to enhance corporate value—Non-debt financing, non-core asset disposal, etc

- Execute exit strategy on low-profit and

loss-making businesses [Consolidated borrowings] (trillion KRW) DEBT/EBITDA (times Liabilities to Equity (%) 4.4 3.8 27.4 26.2 88.2 81.8

Consolidated CAPEX : Down by 1.2 tr KRW

—Focus only on investments that can empower

core competitiveness

Steel) WP development, rationalization, Thailand CGL

Non-steel) Resource development, energy/source

materials, etc

2014 2015 2014 2015 2014 2015

[Consolidated]

[Parent]

POSCO Earnings Release February 5, 2015

19

2015 Business Plan

Renew Corporate Culture

Improve and spread system for efficient group management

Streamline Group Management Spread POSCO’sOwn Mgmt Infra.

Delegate middle-management companies Spread project-based working culture

—Put efforts to create results and develop

- Increase efficiency in management through groupwide C/F PJTs

improving corporate governance

Reorganize group

portfolio to 7 major businesses, Combine work Use the Apply industrial

as E&C/Energy/IT etc, to increase

group synergy Method & Innovation + same jargon + particularities

and fortify expertise by sector

Improve operating system of overseas sites Build HR base for ‘Global One POSCO’

- Operate regional infrastructures and workforces—Adopt single rank system in group and open

in a group level to boost synergy in overseas recruitments

POSCO Russia Provide opportunities to anyone regardless of backgrounds

POSCO POSCO Japan

Africa POSCO China POSCO America

POSCO South Asia

POSCO Australia Integrate education function and launch an

entity, in charge of education groupwide

| 11 |

|

Middle-management companies by region—Provide top-tier level of education |

P-China, P-Japan, P-America, P-Russia, P-Africa, P-Australia—Use retired workforces, provide consulting service

P-Thai, P-India, P-Indonesia, P-Vietnam, P-Myanmar

POSCO Earnings Release February 5, 2015

20

2015 Business Plan

Major Subsidiaries

Daewoo International POSCO Energy

Resource : Start gaining profit on Myanmar Power generation: Expand to overseas

- Continue full production (500 million ft3/day) growth markets

- Expand resource development to strategic—Venture into overseas markets, such as to

regions, such as Southeast Asia Indonesia(Sumsel-9), Mongolia(Tvan Tolgoli)

Trade: Nurture strategic businesses Fuel cell: Reduce cost and improve quality

—Finalize taking over cell technology and

-

Energy pipe, automobile parts, minerals, building the plant (Jun, 15)

provisions, power generations,

etc—Expand sales : ‘14) 13 ‘15) 23 units

POSCO E&C POSCO ChemTech

Expand plant order: Target 5.9 trillion KRW Needle cokes : Set production system(2Q, ‘15)

- Steel : Expand models for PEPCOM*, POSCO Group

— Produce needle/pitch cokes, high-end materials,

developing plants using col tar, byproduct of steel

Overseas: Win more orders from strategic

regions Group synergy for secondary battery biz.

Region Order types—Look for ways to expand overseas and create

Middle East/Africa Steel/Chemical engineering plant synergy, with cooperation of secondary battery-

S.America Energy plant as power plant related affiliates, such as POSCO, P-ICT, ESM, etc.

* Planning/Engineering/Procurement/Construction/Operating/Maintenance

POSCO Earnings Release February 5, 2015

21

2015 Business Plan

Consolidated Business Target

2014 2015(F)

Revenue(trillion KRW) 65.1 67.4

—POSCO

Revenue(“) 29.2. 29.3

Crude Steel Production (million tons) 37.7 38.4

Product Sales(“) 34.3. 35.9

Investment(trillion KRW) 5.4 4.2

—POSCO

Investment(“) 3.0 2.9

POSCO Earnings Release February 5, 2015

22

Appendix

1. Business Environment – Steel

Demand, Raw Materials

2. Financial Statements

Appendix#1. Business Environment

Global Steel

Demand

China’s Steel Economy Steel Demand in Major Countries

“Steel price to rebound “Global demand to grow by 2% as emerging as demand for restocking picks up”

countries upturned despite slowing China”

Domestic price will edge up within 1H, as distributors move to

secure inventories Export price to increase accordingly, as the refund policy for boron-containing steel has been abolished

Demand in advanced countries, such as the US, is to grow steady as demand for automotive steel increased, against the weakening demand in energy pipe due to oil price drop China is to show

low growth as its economy growth remain sluggish and construction demand stays weak

[China’s Inventories

and Steel PMI]

52.6 Steel PMI

48.3 48.6 48.4

46.4 46.0

44.2 43.6 43.3 44.1

40.7 39.9

20.9 19.4 Inventories (million tons)

15.6 16.7

14.2 13.4 13.0 12.3 11.5 10.4 9.7 9.6 10.7

‘14.1 2 3 4 5 6 7 8 9 10 11 12 ‘15.1

* Mysteel, China Federation of Logistics & Purchasing

[Steel Demand Outlook for Major Countries]

(million tons)

(million 2012 2013 2014 2015 tons) YoY YoY

US 96

96 102 6.7% 104 1.9% EU 139 140 145 3.6% 148 2.4% China 698 741 737 -0.5% 745 1.1%

India 72 74 76 3.4% 81 6.0%

SE Asia 59 63 65 2.5% 68 4.9% Global 1,475 1,531 1,551 1.3% 1,585 2.2%

* World Steel Association(Oct, 2014), POSRI

POSCO Earnings Release February 5, 2015

Appendix#1. Business Environment

Domestic Steel

Demand

Demand Outlook

Production growth to continue steady due to favorable domestic(thousand units) 4,588

4,559

sales despite slowing export 4,472 4,522

Automobile Domestic sales (thousand units): 1,383 (‘13) 1,461 (’14) 1,498 (’15) Production

Export sales (thousand units): 3,089 (‘13) 3,061 (’14) 3,090 (’15)(million GT) 31.5

Building to upturn slightly as increased orders from 2013 kicks in 24.7 21.9 23.3

Shipbuilding Building (million GT): 31.5 (’12) 24.7 (’13) 21.9 (’14) 23.3 (’15) Building

Orders (million GT): 122.(’12) 354. (’13) 225.(’14) 228. (’15) 2012 2013 2014 2015

Investment on construction to go up slightly due to SOC budget(trillion KRW)

Construction increase and recovery in orders 199 203 208

Construction 186

Orders (trillion KRW): 101.5 (’12) 91.3 (’13) 104.9 (’14) 110.0 (‘15) Investment

* POSRI(Jan, ‘15), Construction and Economy Research Institute of Korea (Nov,’14)

Steel Demand & Supply Outlook

(in

thousand tons)

2012 2013 2014 2015

YoY YoY

Nominal Consumption 54,069 51,762 55,747

+ 7.7% 56,850 + 2.0%

Export 30,485 29,191 32,173 +10.2% 33,325 + 3.6%

Production 72,052 69,146 74,368 +7.6% 76,710 + 3.1%

Import 12,502 11,807 13,552 +14.8% 13,465 0.6%

Incl. Semi-Product 20,706 19,393 22,123 +14.1% 21,100 4.6%

* POSRI(Jan, ‘15)

POSCO Earnings Release

February 5, 2015

Appendix#1. Business Environment

Raw Materials

Iron Ore Coking Coal

Monthly $average price dropped from 80/ton Despite short supply in some coals, the price stayed

(Oct) to US69/ton, as the steel industry staggered flat as continued slump in the steel industry

2014.4Q 2014.4Q

with Chinese credit crunch and

stricter dragged the demand and Australian dollar remained

environmental sanctions, under the oversupply weak

“Annual average price of Fine Ore CFR “Annual Average Price of Hard Coking Coal

within US$$US75/ton” FOB within 113/ton”

2015 2015 u y u u

Outlook fundamental improvement in steel industry, as Outlook helping to resolve the oversupply, the price is

major suppliers still continue to maintain low-cost, expected to be weak as fundamentals for recovery is

not yet seen (oil price drop, Chinese sanctions on

high production stance imported goods)

[Iron Ore Price](US$$/ton)(US[Coking Coal Price] /ton)

148

133 135

126

120 155 166

143

103 122

90 113 112 111

74 74

2013 2013 2013 2013 2014 2014 2014 2014 2015 2013 2013 2013 2013 2014 2014 2014 2014 2015

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q(f)

*Platts 62% Fe IODEX CFR China (Quarterly Spot Average)*Platts HCC Peak Downs Region FOB Australia (Quarterly Spot Average)

POSCO Earnings Release February 5, 2015

“What is Solution Marketing?”

It is

solving customers’ troubles in their perspective, through providing

“Steel Product” (hardware)

with “Application Technology” and “Commercial

Support” (Software)

Hardware

Software

Solution

=

+

+

Steel

Application

Commercial

Technology

Support

Forming

Painting

Welding

Parts

Prompt

Cheaper

Downstream Financial

Technology

Technology

Technology

Evaluation

Delivery

Logistics

Business

Support

Cost

POSCO Earnings Release February 5, 2015

Appendix#2. Financial Statements

Summarized

Statements of Income

(in billion KRW)

2012 2013 2014 YoY

Revenue 63,604 61,865 65,098

+3,233

Gross Profit 7,461 6,860 7,283 +423

(Gross Margin)(11.7%)(11.1%)(11.2%) -

Selling & Admin. Expenses 3,808 3,864 4,069 +205

Operating Profit 3,653 2,996 3,214 +218

(Operating Margin)(5.7%)(4.8%)(4.9%) -

Other Operating Profit 361 422 710 288

Share of

Profit (loss) of

Equity-accounted investees 23 180 300 120

Finance Items Gains 99 448 825 ?377

Foreign Currency Transaction

& Translation

Gains (loss) 790 236 13 223

Net Profit 2,386 1,355 557 798

(Net Margin)(3.8%)(2.2%)(0.9%) -

Owners of the Controlling

Company 2,462 1,376 626

750

POSCO Earnings Release February 5, 2015

Appendix#2. Financial Statements

Consolidated

Statements of Financial Position

(in billion KRW)

2012 2013 2014 YoY

Current Assets 31,566 31,666 32,627 +961

Cash & Financial Goods* 6,530 7,179 5,274 1,905

Account Receivable 11,038 11,493 11,786 +293

Inventories 10,585 9,798 10,471 +673

Non-Current

Assets 47,700 52,789 52,625 164

Other Long-term

Financial Assets** 4,670 5,263 3,600 1,663

PP&E 32,276 35,760 35,241 519

Total Assets

79,266 84,455 85,252 +797

Liabilities 36,836 38,633 39,961 +1,328

Current Liabilities 19,775 20,241 21,877 +1,636

Non-Current Liabilities 17,061 18,392 18,084 308

(Interest-bearing Debt) 24,921 26,247 27,428 +1,181

Equity 42,430 45,822 45,291 531

Owners of the

Controlling Company 39,454 42,046

41,587 459

Total Liabilities & Equity 79,266 84,455 85,252 +797

* Cash & Financial Goods : Cash and cash equivalents, Short-term financial goods, Short-term available for sale

securities, Current portion of held-to-maturity securities,

and Derivatives asset held for trading **Including

Other bonds

POSCO Earnings Release February 5, 2015

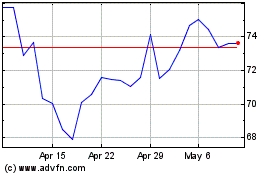

POSCO (NYSE:PKX)

Historical Stock Chart

From Aug 2024 to Sep 2024

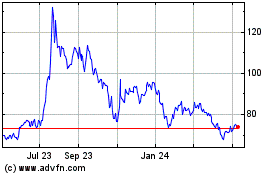

POSCO (NYSE:PKX)

Historical Stock Chart

From Sep 2023 to Sep 2024