UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2016

______________________________

(Exact name of registrant as specified in its charter)

______________________________

|

| | | | |

Delaware | | 1-15399 | | 36-4277050 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer Identification No.) |

1955 West Field Court, Lake Forest, Illinois 60045

(Address of Principal Executive Offices, including Zip Code)

(847) 482-3000

(Registrants' Telephone Number, Including Area Code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b))

¨ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4 (c))

The information furnished this Current Report on Form 8-K, including the exhibits described below, shall not be deemed “filed” hereunder for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Exchange Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On January 25, 2016, Packaging Corporation of America issued a press release announcing fourth quarter and full year 2015 financial results. The press release is furnished as Exhibit 99.1 and is incorporated into this Item 2.02 by reference.

|

| |

Item 7.01. | Regulation FD Disclosure. |

On January 26, 2016, Packaging Corporation of America will hold a conference call to discuss fourth quarter and full year 2015 results. Supplemental materials to PCA’s earnings release and conference call are available on PCA’s website (www.packagingcorp.com), are furnished as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

|

| | | |

Item 9.01. Financial Statements and Exhibits. |

| (d) | Exhibits | |

| | 99.1 | Fourth Quarter and Full Year 2015 Earnings Press Release dated January 25, 2016 |

| | 99.2 | Fourth Quarter and Full Year 2015 Supplemental Financial Data dated January 25, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | PACKAGING CORPORATION OF AMERICA |

| | | | (Registrant) |

| | | | |

| | | By: | /s/ MARK W. KOWLZAN |

| | | | Chairman and Chief Executive Officer |

| | | | |

| | | By: | /s/ ROBERT P. MUNDY |

| | | | Senior Vice President and Chief Financial Officer |

Date: January 25, 2016

Exhibit 99.1

PACKAGING CORPORATION OF AMERICA REPORTS RECORD FOURTH QUARTER AND FULL YEAR 2015 RESULTS

Lake Forest, IL, January 25, 2016 – Packaging Corporation of America (NYSE: PKG) today reported fourth quarter net income of $104 million, or $1.07 per share. Earnings included net charges for special items, primarily for the Boise integration, of $0.4 million. Excluding special items, fourth quarter 2015 net income was $105 million, or $1.08 per share, compared to fourth quarter 2014 net income of $114 million, or $1.16 per share. Fourth quarter net sales were $1.4 billion in both 2015 and 2014.

Full year 2015 earnings were $437 million, or $4.47 per share, compared to 2014 earnings of $393 million, or $3.99 per share. Full year earnings, excluding special items, were $443 million, or $4.53 per share, compared to 2014 earnings of $459 million, or $4.66 per share. Full year 2015 net sales were $5.74 billion compared to 2014 net sales of $5.85 billion.

Excluding special items, the $.08 per share reduction in fourth quarter 2015 earnings, compared to the fourth quarter of 2014, was driven primarily by lower white paper prices and mix ($.10), higher annual mill outage costs ($.03), lower corrugated volume ($.02), containerboard production ($.02), and export containerboard prices ($.02), and higher depreciation expense ($.02). These items were partially offset by lower costs for energy ($.05), mill repair costs ($.03), and freight ($.02) as well as lower income taxes of ($.04) per share.

Packaging segment EBITDA in the fourth quarter of 2015, excluding special items, was $252 million with sales of $1.09 billion compared to fourth quarter 2014 packaging EBITDA of $250 million with sales of $1.12 billion. Corrugated products shipments were 1% lower than last year’s record fourth quarter with the same number of workdays. Containerboard production was 903,000 tons which was a 24,000 ton decrease compared to last year’s fourth quarter as PCA ran to demand and, unlike last year’s fourth quarter, did not need to prebuild any inventory to support first quarter maintenance outages. Containerboard inventories ended the year 2,500 tons lower than the third quarter and flat compared to 2014 year-end levels. Full year 2015 packaging EBITDA, excluding special items, was $1,009 million with sales of $4.48 billion compared to full year 2014 EBITDA of $1,015 million with sales of $4.54 billion.

Paper segment EBITDA in the fourth quarter of 2015 was $28 million with sales of $273 million compared to fourth quarter 2014 paper EBITDA, excluding special items, of $45 million with sales of $284 million. Sales prices were lower and volume was essentially equal to the fourth quarter of last year. In addition, the Jackson, Alabama paper mill was down for an extended period for a planned rebuild of the recovery boiler which reduced production by 28,000 tons and increased operating costs. Full year 2015 paper EBITDA, excluding special items, was $161 million and sales were $1.14 billion compared to full year 2014 EBITDA of $186 million with sales of $1.20 billion.

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “We performed very well operationally and our earnings exceeded fourth quarter guidance despite lower than expected containerboard production and corrugated products volume. For the year, our earnings of $4.53 per share, excluding special items, were only $.13 per share below last year’s record earnings despite lower white paper prices and mix which reduced 2015 earnings by $.38 per share.”

“Looking ahead to the first quarter compared to the fourth quarter,” Mr. Kowlzan added, “labor and benefits costs will be higher with annual wage increases and other timing-related expenses, and seasonally colder weather will increase wood and energy costs. Our tax rate will also be higher in the first quarter. These items will be partially offset by slightly higher corrugated products shipments and containerboard

production, and lower scheduled mill outage costs. Finally, over the weekend Pulp and Paper Week, a trade publication, lowered its published prices for domestic linerboard and medium by $15 and $20 per ton, respectively, which will adversely affect earnings. Everything considered, we currently expect first quarter earnings of $1.00 per share.”

PCA is the fourth largest producer of containerboard and corrugated packaging products in the United States and the third largest producer of uncoated freesheet paper in North America. PCA operates eight mills and 93 corrugated products plants and related facilities.

CONTACT:

Barbara Sessions

Packaging Corporation of America

INVESTOR RELATIONS: (877) 454-2509

PCA’s Website: www.packagingcorp.com

Conference Call Information:

| |

WHAT: | Packaging Corporation of America’s 4th Quarter and Full Year 2015 Earnings Conference Call |

| |

WHEN: | Tuesday, January 26, 2016 at 10:00 a.m. Eastern Time |

| |

CALL-IN | (855) 730-0288 (U.S. and Canada) or (832) 412-2295 (International) |

| |

NUMBER: | Dial in by 9:45 a.m. Eastern Time |

Conference Call Leader: Mr. Mark Kowlzan

| |

WEBCAST: | http://www.packagingcorp.com |

| |

REBROADCAST | January 26, 2016 1:00 p.m. Eastern Time through |

| |

DATES: | February 9, 2016 11:59 p.m. Eastern Time |

| |

REBROADCAST | (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (International) |

| |

NUMBERS: | Passcode: 35494231 |

Some of the statements in this press release are forward-looking statements. Forward-looking statements include statements about our future earnings and financial condition, our industry and our business strategy. Statements that contain words such as “ will”, “should”, “anticipate”, “believe”, “expect”, “intend”, “estimate”, “hope” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations include the following: the impact of general economic conditions; conditions in the paper and packaging industries, including competition, product demand and product pricing; fluctuations in wood fiber and recycled fiber costs; fluctuations in purchased energy costs; the possibility of unplanned outages or interruptions at our principal facilities; and legislative or regulatory requirements, particularly concerning environmental matters, as well as those identified under Item 1A. Risk Factors in PCA’s Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov”.

Non-GAAP measures used in this press release are reconciled to the most comparable measure reported in accordance with GAAP in the schedules to this press release.

Packaging Corporation of America

Consolidated Earnings Results

Unaudited

(dollars in millions, except per-share data)

|

| | | | | | | | | | | | | | | | |

| Three Months Ended | | Full Year Ended | |

| December 31 | | December 31 | |

| 2015 | | 2014 | | 2015 | | 2014 | |

Net sales | $ | 1,390.9 |

| | $ | 1,434.0 |

| | $ | 5,741.7 |

| | $ | 5,852.6 |

| |

Cost of sales | (1,105.9 | ) | (1) | (1,137.0 | ) | (1) (2) | (4,533.7 | ) | (1) | (4,623.1 | ) | (1) (2) |

Gross profit | 285.0 |

| | 297.0 |

| | 1,208.0 |

| | 1,229.5 |

| |

Selling, general, and administrative expenses | (105.3 | ) | | (110.4 | ) | (2) | (451.3 | ) | | (469.5 | ) | (2) |

Other income (expense), net | (3.8 | ) | (1)(2) | (13.4 | ) | (2) | (6.7 | ) | (1)(2)(3) | (57.3 | ) | (2)(3) |

Income from operations | 175.9 |

| | 173.2 |

| | 750.0 |

| | 702.7 |

| |

Interest expense, net | (22.3 | ) | | (23.2 | ) | | (85.5 | ) | | (88.4 | ) | (3) |

Income before taxes | 153.6 |

| | 150.0 |

| | 664.5 |

| | 614.3 |

| |

Provision for income taxes | (49.3 | ) | | (51.5 | ) | | (227.7 | ) | | (221.7 | ) | |

Net income | $ | 104.3 |

| | $ | 98.5 |

| | $ | 436.8 |

| | $ | 392.6 |

| |

Earnings per share: | | | | | | | | |

Basic | $ | 1.07 |

| | $ | 1.00 |

| | $ | 4.47 |

| | $ | 3.99 |

| |

Diluted | $ | 1.07 |

| | $ | 1.00 |

| | $ | 4.47 |

| | $ | 3.99 |

| |

Supplemental financial information: | | | | | | | | |

Capital spending | $ | 96.6 |

| | $ | 165.4 |

| | $ | 314.5 |

| | $ | 420.2 |

| |

Cash balance | $ | 184.2 |

| | $ | 124.9 |

| | $ | 184.2 |

| | $ | 124.9 |

| |

____________

| |

(1) | All periods presented include amounts from restructuring activities at our mill in DeRidder, Louisiana, including costs related to the conversion of the No. 3 newsprint machine to containerboard, our exit from the newsprint business, and other improvements. The restructuring charges primarily related to accelerated depreciation and were mostly recorded in "Cost of sales". We completed the restructuring activities in first quarter 2015, but we recorded $3.5 million of income for cash received from vendor settlements during the three months ended December 31, 2015. These amounts were recorded in "Other income (expense), net". See page 3 for the amounts recorded in each period. |

| |

(2) | All periods presented include Boise acquisition integration-related and other costs, mostly recorded in "Other income (expense), net". These costs primarily relate to professional fees, severance, retention, relocation, travel, and other integration-related costs. See page 3 for the amounts recorded in each period. |

| |

(3) | In September 2015, we sold the remaining land, buildings, and equipment at our paper mill site in St. Helens, Oregon, where we ceased paper production in December 2012. We recorded a $6.7 million gain on the sale, in "Other income (expense), net". |

The twelve months ended December 31, 2015, include a $3.6 million tax credit from the State of Louisiana related to our recent capital investment and the jobs retained at the DeRidder, Louisiana, mill, which was recorded as a benefit in "Other income (expense), net".

The twelve months ended December 31, 2014, include $17.6 million of costs accrued for the settlement of the Kleen Products LLC v Packaging Corp. of America et al class action lawsuit. These costs are recorded in "Other income (expense), net".

In the twelve months ended December 31, 2014, $1.5 million of debt-refinancing costs were recorded in "Interest expense, net".

Packaging Corporation of America

Segment Information

Unaudited

(dollars in millions)

|

| | | | | | | | | | | | | | | | |

| Three Months Ended | | Full Year Ended | |

| December 31 | | December 31 | |

| 2015 | | 2014 | | 2015 | | 2014 | |

Segment sales | | | | | | | | |

Packaging | $ | 1,091.4 |

| | $ | 1,122.0 |

| | $ | 4,477.3 |

| | $ | 4,540.3 |

| |

Paper | 272.8 |

| | 284.4 |

| | 1,143.1 |

| | 1,201.4 |

| |

Corporate and other | 26.7 |

| | 27.6 |

| | 121.3 |

| | 110.9 |

| |

| $ | 1,390.9 |

| | $ | 1,434.0 |

| | $ | 5,741.7 |

| | $ | 5,852.6 |

| |

| | | | | | | | |

Segment income (loss) | | | | | | | | |

Packaging | $ | 181.0 |

| | $ | 161.4 |

| | $ | 714.9 |

| | $ | 663.2 |

| |

Paper | 13.9 |

| | 31.1 |

| | 112.5 |

| | 135.4 |

| |

Corporate and Other | (19.0 | ) | | (19.3 | ) | | (77.4 | ) | | (95.9 | ) | |

Income from operations | 175.9 |

| | 173.2 |

| | 750.0 |

| | 702.7 |

| |

Interest expense, net | (22.3 | ) | | (23.2 | ) | | (85.5 | ) | | (88.4 | ) | |

Income before taxes | $ | 153.6 |

| | $ | 150.0 |

| | $ | 664.5 |

| | $ | 614.3 |

| |

| | | | | | | | |

Segment income (loss) excluding special items (1) | | | | | | | | |

Packaging | $ | 179.0 |

| | $ | 178.9 |

| | $ | 721.0 |

| | $ | 733.9 |

| |

Paper | 13.9 |

| | 31.5 |

| | 105.8 |

| | 135.4 |

| |

Corporate and Other | (16.7 | ) | | (12.8 | ) | | (68.1 | ) | | (64.8 | ) | |

| $ | 176.2 |

| | $ | 197.6 |

| | $ | 758.7 |

| | $ | 804.5 |

| |

| | | | | | | | |

EBITDA (1) | | | | | | | | |

Packaging | $ | 254.1 |

| | $ | 238.7 |

| | $ | 1,012.2 |

| | $ | 986.2 |

| |

Paper | 28.2 |

| | 44.5 |

| | 167.4 |

| | 186.0 |

| |

Corporate and Other | (17.8 | ) | | (17.8 | ) | | (73.1 | ) | | (88.5 | ) | |

| $ | 264.5 |

| | $ | 265.4 |

| | $ | 1,106.5 |

| | $ | 1,083.7 |

| |

| | | | | | | | |

EBITDA excluding special items (1) | | | | | | | | |

Packaging | $ | 252.1 |

| | $ | 249.7 |

| | $ | 1,009.3 |

| | $ | 1,015.0 |

| |

Paper | 28.2 |

| | 44.9 |

| | 160.7 |

| | 186.0 |

| |

Corporate and Other | (15.5 | ) | | (11.3 | ) | | (63.8 | ) | | (57.4 | ) | |

| $ | 264.8 |

| | $ | 283.3 |

| | $ | 1,106.2 |

| | $ | 1,143.6 |

| |

____________

| |

(1) | Income from operations excluding special items, segment income (loss) excluding special items, earnings before interest, income taxes, and depreciation, amortization, and depletion (EBITDA), and EBITDA excluding special items are non-GAAP financial measures. We present these measures because they provide a means to evaluate the performance of our segments and our company on an ongoing basis using the same measures that are used by our management and because these measures are frequently used by investors and other interested parties in the evaluation of companies and the performance of their segments. The tables included in "Reconciliation of Non-GAAP Financial Measures" on the following pages reconcile the non-GAAP measures with the most directly comparable GAAP measures. Any analysis of non-GAAP financial measures should be done only in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

|

| | | | | | | | | | | | | | | | |

| Three Months Ended | | Full Year Ended | |

| December 31 | | December 31 | |

| 2015 | | 2014 | | 2015 | | 2014 | |

Packaging | | | | | | | | |

Segment income | $ | 181.0 |

| | $ | 161.4 |

| | $ | 714.9 |

| | $ | 663.2 |

| |

DeRidder restructuring | (3.5 | ) | | 18.0 |

| | 2.0 |

| | 65.8 |

| |

Integration-related and other costs | 1.5 |

| | (0.5 | ) | | 4.1 |

| | 4.9 |

| |

Segment income excluding special items (1) | $ | 179.0 |

| | $ | 178.9 |

| | $ | 721.0 |

| | $ | 733.9 |

| |

| | | | | | | | |

Paper | | | | | | | | |

Segment income | $ | 13.9 |

| | $ | 31.1 |

| | $ | 112.5 |

| | $ | 135.4 |

| |

Integration-related and other costs | — |

| | 0.4 |

| | — |

| | — |

| |

Sale of St. Helens paper mill site | — |

| | — |

| | (6.7 | ) | | — |

| |

Segment income excluding special items (1) | $ | 13.9 |

| | $ | 31.5 |

| | $ | 105.8 |

| | $ | 135.4 |

| |

| | | | | | | | |

Corporate and Other | | | | | | | | |

Segment loss | $ | (19.0 | ) | | $ | (19.3 | ) | | $ | (77.4 | ) | | $ | (95.9 | ) | |

Integration-related and other costs | 2.3 |

| | 6.5 |

| | 9.3 |

| | 13.5 |

| |

Class action lawsuit settlement | — |

| | — |

| | — |

| | 17.6 |

| |

Segment loss excluding special items (1) | $ | (16.7 | ) | | $ | (12.8 | ) | | $ | (68.1 | ) | | $ | (64.8 | ) | |

| | | | | | | | |

Income from operations | $ | 175.9 |

| | $ | 173.2 |

| | $ | 750.0 |

| | $ | 702.7 |

| |

| | | | | | | | |

Income from operations, excluding special items(1) | $ | 176.2 |

| | $ | 197.6 |

| | $ | 758.7 |

| | $ | 804.5 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

Net Income and EPS Excluding Special Items (1)

|

| | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | |

| 2015 | | 2014 | |

| Net Income | | Diluted EPS | | Net Income | | Diluted EPS | |

As reported | $ | 104.3 |

| | $ | 1.07 |

| | $ | 98.5 |

| | $ | 1.00 |

| |

Special items(2): | | | | | | | | |

DeRidder restructuring | (2.2 | ) | | (0.02 | ) | | 11.7 |

| | 0.12 |

| |

Integration-related and other costs | 2.6 |

| | 0.03 |

| | 4.2 |

| | 0.04 |

| |

Total special items | 0.4 |

| | 0.01 |

| | 15.9 |

| | 0.16 |

| |

Excluding special items | $ | 104.7 |

| | $ | 1.08 |

| | $ | 114.4 |

| | $ | 1.16 |

| |

|

| | | | | | | | | | | | | | | | |

| Full Year Ended December 31 | |

| 2015 | | 2014 | |

| Net Income | | Diluted EPS | | Net Income | | Diluted EPS | |

As reported | $ | 436.8 |

| | $ | 4.47 |

| | $ | 392.6 |

| | $ | 3.99 |

| |

Special items (2): | | | | | | | | |

DeRidder restructuring | 1.3 |

| | 0.01 |

| | 42.1 |

| | 0.43 |

| |

Integration-related and other costs | 8.9 |

| | 0.10 |

| | 12.7 |

| | 0.13 |

| |

Sale of St. Helens paper mill site | (4.4 | ) | | (0.05 | ) | | — |

| | — |

| |

Class action lawsuit settlement | — |

| | — |

| | 11.2 |

| | 0.11 |

| |

Total special items | 5.8 |

| | 0.06 |

| | 66.0 |

| | 0.67 |

| |

Excluding special items | $ | 442.6 |

| | $ | 4.53 |

| | $ | 458.6 |

| | $ | 4.66 |

| |

____________

| |

(1) | Net income and earnings per share excluding special items are non-GAAP financial measures. The after-tax effect of special items are presented because they provide a means to evaluate the performance of our company on an ongoing basis using the same measures that are used by our management and because these measures are frequently used by investors and other interested parties in the evaluation of companies and their performance. Any analysis of non-GAAP financial measures should be done only in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. |

| |

(2) | Special items are tax-effected at a combined federal and state income tax rate in effect for the period the special items were recorded. For more information related to these items, see the footnotes to the Consolidated Earnings Results on page 1. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

EBITDA and EBITDA Excluding Special Items (1)

EBITDA represents income before interest (interest expense and interest income), income taxes, and depreciation, amortization, and depletion. The following table reconciles net income to EBITDA and EBITDA excluding special items:

|

| | | | | | | | | | | | | | | | |

| Three Months Ended | | Full Year Ended | |

| December 31 | | December 31 | |

| 2015 | | 2014 | | 2015 | | 2014 | |

Net income | $ | 104.3 |

| | $ | 98.5 |

| | $ | 436.8 |

| | $ | 392.6 |

| |

Interest expense, net | 22.3 |

| | 23.2 |

| | 85.5 |

| | 88.4 |

| |

Provision for income taxes | 49.3 |

| | 51.5 |

| | 227.7 |

| | 221.7 |

| |

Depreciation, amortization, and depletion | 88.6 |

| | 92.2 |

| | 356.5 |

| | 381.0 |

| |

EBITDA (1) | $ | 264.5 |

| | $ | 265.4 |

| | $ | 1,106.5 |

| | $ | 1,083.7 |

| |

Special items: | | | | | | | | |

DeRidder restructuring | (3.5 | ) | | 11.5 |

| | (7.0 | ) | | 23.9 |

| |

Integration-related and other costs | 3.8 |

| | 6.4 |

| | 13.4 |

| | 18.4 |

| |

Sale of St. Helens paper mill site | — |

| | — |

| | (6.7 | ) | | — |

| |

Class action lawsuit settlement | — |

| | — |

| | — |

| | 17.6 |

| |

EBITDA excluding special items (1) | $ | 264.8 |

| | $ | 283.3 |

| | $ | 1,106.2 |

| | $ | 1,143.6 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

The following table reconciles segment income (loss) to EBITDA and EBITDA excluding special items:

|

| | | | | | | | | | | | | | | | |

| Three Months Ended | | Full Year Ended | |

| December 31 | | December 31 | |

| 2015 | | 2014 | | 2015 | | 2014 | |

Packaging | | | | | | | | |

Segment income | $ | 181.0 |

| | $ | 161.4 |

| | $ | 714.9 |

| | $ | 663.2 |

| |

Depreciation, amortization, and depletion | 73.1 |

| | 77.3 |

| | 297.3 |

| | 323.0 |

| |

EBITDA (1) | 254.1 |

| | 238.7 |

| | 1,012.2 |

| | 986.2 |

| |

DeRidder restructuring | (3.5 | ) | | 11.5 |

| | (7.0 | ) | | 23.9 |

| |

Integration-related and other costs | 1.5 |

| | (0.5 | ) | | 4.1 |

| | 4.9 |

| |

EBITDA excluding special items (1) | $ | 252.1 |

| | $ | 249.7 |

| | $ | 1,009.3 |

| | $ | 1,015.0 |

| |

| | | | | | | | |

Paper | | | | | | | | |

Segment income | $ | 13.9 |

| | $ | 31.1 |

| | $ | 112.5 |

| | $ | 135.4 |

| |

Depreciation, amortization, and depletion | 14.3 |

| | 13.4 |

| | 54.9 |

| | 50.6 |

| |

EBITDA (1) | 28.2 |

| | 44.5 |

| | 167.4 |

| | 186.0 |

| |

Sale of St. Helens paper mill site | — |

| | — |

| | (6.7 | ) | | — |

| |

Integration-related and other costs | — |

| | 0.4 |

| | — |

| | — |

| |

EBITDA excluding special items (1) | $ | 28.2 |

| | $ | 44.9 |

| | $ | 160.7 |

| | $ | 186.0 |

| |

| | | | | | | | |

Corporate and Other | | | | | | | | |

Segment loss | $ | (19.0 | ) | | $ | (19.3 | ) | | $ | (77.4 | ) | | $ | (95.9 | ) | |

Depreciation, amortization, and depletion | 1.2 |

| | 1.5 |

| | 4.3 |

| | 7.4 |

| |

EBITDA (1) | (17.8 | ) | | (17.8 | ) | | (73.1 | ) | | (88.5 | ) | |

Integration-related and other costs | 2.3 |

| | 6.5 |

| | 9.3 |

| | 13.5 |

| |

Class action lawsuit settlement | — |

| | — |

| | — |

| | 17.6 |

| |

EBITDA excluding special items (1) | $ | (15.5 | ) | | $ | (11.3 | ) | | $ | (63.8 | ) | | $ | (57.4 | ) | |

| | | | | | | | |

EBITDA (1) | $ | 264.5 |

| | $ | 265.4 |

| | $ | 1,106.5 |

| | $ | 1,083.7 |

| |

| | | | | | | | |

EBITDA excluding special items (1) | $ | 264.8 |

| | $ | 283.3 |

| | $ | 1,106.2 |

| | $ | 1,143.6 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

Fourth Quarter 2015 Supplementary Financial Data January 25, 2016

Certain statements in this supplementary data are forward-looking statements. Forward-looking statements include statements about our future financial condition, our industry and our business strategy. Statements that contain words such as “anticipate”, “believe”, “expect”, “intend”, “estimate”, “hope” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations are those identified under the caption “Risk Factors” in PCA’s Form 10K filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov”. We undertake no obligation to publically update any forward-looking statements, whether as a result of new information, future events, or otherwise. Packaging Corporation of America Certain non-U.S. GAAP financial information is presented on these slides. A reconciliation of those numbers to U.S. GAAP financial measures is included in the schedules attached to our press release. Non-GAAP Financial Measures 2

Fourth Quarter 2014 $1.16 White Paper Prices / Mix (.10) Mill Outage Costs (.03) Corrugated Volume (.02) Containerboard Production (.02) Export Containerboard Prices (.02) Depreciation Expense (.02) Energy Costs .05 Repair Costs .03 Freight .02 Tax Rate .04 Other (.01) Fourth Quarter 2015 $ 1.08 EPS Change – Q4 2015 vs. Q4 2014 (Excluding Special Items) 3

4 Cash Provided by Operations (1) $ 221 $ 763 Less Capital Expenditures (97) (315) Free Cash Flow $ 124 $ 448 Other Cash Uses Common Stock Dividends $ (54) $ (201) Share Repurchases (57) (155) Debt Payments (17) (48) $ (128) $ (404) December 31, 2015 Ending Cash $ 184 Supplemental Cash Data ($ Millions) (1) Net of federal and state tax cash payments of $75 million and $238 million. Q4 2015 FY 2015

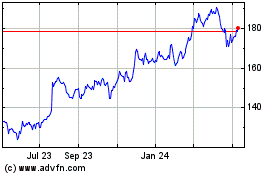

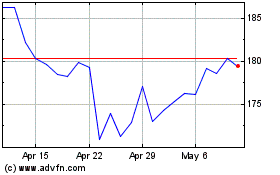

Packaging (NYSE:PKG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Packaging (NYSE:PKG)

Historical Stock Chart

From Apr 2023 to Apr 2024