UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 20, 2015

______________________________

(Exact name of registrant as specified in its charter)

______________________________

|

| | | | |

Delaware | | 1-15399 | | 36-4277050 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer Identification No.) |

1955 West Field Court, Lake Forest, Illinois 60045

(Address of Principal Executive Offices, including Zip Code)

(847) 482-3000

(Registrants' Telephone Number, Including Area Code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b))

¨ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

The information furnished in this Current Report on Form 8-K, including the exhibit described below, shall not be deemed “filed” hereunder for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Exchange Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On April 20, 2015, Packaging Corporation of America issued a press release announcing our first quarter 2015 financial results. The press release is furnished as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

|

| | | |

Item 9.01. Financial Statements and Exhibits. |

| (d) | Exhibits | |

| | 99.1 | First Quarter 2015 Earnings Press Release dated April 20, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | PACKAGING CORPORATION OF AMERICA |

| | | | (Registrant) |

| | | | |

| | | By: | /s/ MARK W. KOWLZAN |

| | | | Chief Executive Officer |

| | | | |

| | | By: | /s/ RICHARD B. WEST |

| | | | Senior Vice President and Chief Financial Officer |

Date: April 20, 2015

Exhibit 99.1

PACKAGING CORPORATION OF AMERICA REPORTS FIRST QUARTER 2015 RESULTS

Lake Forest, IL, April 20, 2015 – Packaging Corporation of America (NYSE: PKG) today reported first quarter net income of $91 million, or $0.92 per share compared to last year’s first quarter net income of $90 million, or $0.92 per share. Earnings included charges for special items for the Boise integration and DeRidder, Louisiana mill restructuring of $9 million, or $0.09 per share. Excluding special items, first quarter 2015 net income was $100 million, or $1.01 per share, compared to first quarter 2014 net income of $106 million, or $1.08 per share. First quarter net sales were $1.4 billion in both 2015 and 2014.

Excluding special items, the $0.07 per share reduction in first quarter 2015 earnings, compared to the first quarter of 2014, was driven by increased annual mill outage downtime and costs ($0.08), lower white papers prices and mix ($0.05), lower export containerboard prices ($0.02), and higher costs for wood ($0.04), medical ($0.04), labor and benefits ($0.04), and depreciation ($0.02). These items were partially offset by increased volume ($0.09), and lower costs for energy ($0.06), chemicals ($0.02) and purchased fiber ($0.02), and a state tax credit related to the investments at the DeRidder mill ($0.03).

Lower earnings compared to PCA guidance of $1.07 to $1.10 per share for the first quarter were a result of extreme weather conditions ($0.03), additional downtime to complete the DeRidder annual outage ($0.03), and lower prices from the retroactive price decrease by trade publications and mix changes in white papers ($0.03).

Packaging segment EBITDA in the first quarter of 2015 was $220 million, and excluding special items, was $222 million with sales of $1,099 million compared to first quarter 2014 packaging EBITDA, excluding special items, of $244 million with sales of $1,097 million. Lower profitability was the result of this year’s extended annual outage at the DeRidder mill, which did not have an annual outage in 2014, as well as higher wood, medical, labor and benefits and freight costs, and lower export containerboard prices. These items were partially offset by corrugated products volume growth and benefits from the DeRidder No. 3 machine conversion. Corrugated products shipments per workday, including both PCA and Boise plants, were up 4.4%, with one less workday compared to the first quarter of last year, and total shipments were up 2.7%.

Paper segment EBITDA in the first quarter of 2015 increased to $49 million on sales of $297 million compared to first quarter 2014 EBITDA of $40 million and net sales of $309 million. Office paper shipments were up slightly, and printing and converting and pressure sensitive paper shipments were down 5,500 tons compared to the first quarter of last year. Improved profitability was the result of operational improvements and synergy realization in the white paper mills over the past year.

Commenting on results, Mark W. Kowlzan, CEO, said “Our overall operations remained strong with steady demand and price in both domestic containerboard and corrugated products. Despite lower prices and changes in mix, we were able to improve profitability and margins in white papers. The DeRidder annual outage took about six days longer than we expected due to vendor design errors which required equipment to be modified after it was received. Extreme weather conditions also contributed to higher costs at our mills and lower shipments at our box plants.”

“Looking ahead to the second quarter,” Mr. Kowlzan added, “we expect earnings improvement driven primarily from a full quarter of operations at the DeRidder mill which will increase containerboard production and lower mill costs. We also expect seasonally higher containerboard and corrugated products shipments. Costs of annual mill outages, including amortization of repair costs, will be slightly higher than in the first quarter.

In addition, we expect higher interest and depreciation expense, a higher effective tax rate, and no additional state tax credits. Finally, we expect to incur an insurance deductible charge of $3 million, or $0.02 per share, related to a turbine drive failure on the No. 1 paper machine at the Jackson, Alabama white papers mill. Considering these items, we currently expect second quarter earnings of $1.03 per share.”

PCA is the fourth largest producer of containerboard and corrugated packaging products in the United States and the third largest producer of uncoated freesheet paper in North America. PCA operates eight mills and 94 corrugated products plants and related facilities.

CONTACT:

Barbara Sessions

Packaging Corporation of America

INVESTOR RELATIONS: (877) 454-2509

PCA’s Website: www.packagingcorp.com

Conference Call Information:

| |

WHAT: | Packaging Corporation of America’s 1st Quarter 2015 Earnings |

Conference Call

| |

WHEN: | Tuesday, April 21, 2015 |

10:00 a.m. Eastern Time

| |

CALL-IN | (855) 730-0288 (U.S. and Canada) or (832) 412-2295 (International) |

| |

NUMBER: | Dial in by 9:45 a.m. Eastern Time |

Conference Call Leader: Mr. Mark Kowlzan

| |

WEBCAST: | http://www.packagingcorp.com |

| |

REBROADCAST DATES: | April 21, 2015 1:00 p.m. Eastern Time through |

May 5, 2015 11:59 p.m. Eastern Time

| |

REBROADCAST NUMBER: | (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (International) |

Passcode: 35494228

Some of the statements in this press release are forward-looking statements. Forward-looking statements include statements about our future earnings and financial condition, our industry and our business strategy. Statements that contain words such as “ will,” “should,” “anticipate,” “believe,” “expect,” “intend,” “estimate,” “hope,” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations include the following: the impact of general economic conditions; conditions in the paper and packaging industries, including competition, product demand and product pricing; fluctuations in wood fiber and recycled fiber costs; fluctuations in purchased energy costs; the possibility of unplanned outages or interruptions at our principal facilities; and legislative or regulatory requirements, particularly concerning environmental matters, as well as those identified under Item 1A. Risk Factors in PCA’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov”.

Non-GAAP measures used in this press release are reconciled to the most comparable measure reported in accordance with GAAP in the schedules to this press release.

Packaging Corporation of America

Consolidated Earnings Results

Unaudited

(dollars in millions, except per-share data)

|

| | | | | | | | | | | | |

| Three Months Ended | |

| March 31 | | December 31, | |

| 2015 | | 2014 | | 2014 | |

Net sales | $ | 1,425.7 |

| | $ | 1,431.3 |

| | $ | 1,434.0 |

| |

Cost of sales | (1,148.7 | ) | (1) | (1,129.9 | ) | (1) | (1,137.0 | ) | (1) |

Gross profit | 277.0 |

| | 301.4 |

| | 297.0 |

| |

Selling, general, and administrative expenses | (117.3 | ) | | (116.5 | ) | | (110.4 | ) | |

Other expense, net | (2.6 | ) | (2) | (24.0 | ) | (2) | (13.4 | ) | (2) |

Income from operations | 157.1 |

| | 160.9 |

| | 173.2 |

| |

Interest expense, net | (19.2 | ) | (3) | (20.8 | ) | (3) | (23.2 | ) | |

Income before taxes | 137.9 |

| | 140.1 |

| | 150.0 |

| |

Provision for income taxes | (47.1 | ) | | (50.0 | ) | | (51.5 | ) | |

Net income | $ | 90.8 |

| | $ | 90.1 |

| | $ | 98.5 |

| |

Earnings per share: | | | | | | |

Basic | $ | 0.92 |

| | $ | 0.92 |

| | $ | 1.00 |

| |

Diluted | $ | 0.92 |

| | $ | 0.92 |

| | $ | 1.00 |

| |

Supplemental financial information: | | | | | | |

Capital spending | $ | 55.6 |

| | $ | 50.9 |

| | $ | 165.4 |

| |

Cash balance | $ | 126.4 |

| | $ | 185.7 |

| | $ | 124.9 |

| |

____________

| |

(1) | The three months ended March 31, 2015 and 2014, and the three months ended December 31, 2014, include $10.3 million, $4.0 million, and $18.0 million, respectively, of restructuring charges at our mill in DeRidder, Louisiana. The restructuring charges primarily related to accelerated depreciation and were mostly recorded in "Cost of sales". |

| |

(2) | The three months ended March 31, 2015 and 2014, and the three months ended December 31, 2014, include $3.5 million, $4.1 million, and $6.4 million, respectively, of Boise acquisition integration-related and other costs, mostly recorded in "Other expense, net". These costs primarily relate to professional fees, severance, retention, relocation, travel, and other integration-related costs. |

The three months ended March 31, 2015, also includes a $3.6 million tax credit from the State of Louisiana related to our recent capital investment and the jobs retained at the DeRidder, Louisiana, mill, which was recorded as a benefit in "Other expense, net".

The three months ended March 31, 2014, also includes $17.6 million of costs accrued for the settlement of the Kleen Products LLC v Packaging Corp. of America et al class action lawsuit. These costs are recorded in “Other expense, net”.

| |

(3) | During the three months ended March 31, 2015 and 2014, we received an interest rebate on a portion of our bank debt, reducing our interest expense $4.1 million and $0.8 million, respectively. |

Packaging Corporation of America

Segment Information

Unaudited

(dollars in millions)

|

| | | | | | | | | | | | |

| Three Months Ended | |

| March 31 | | December 31, | |

| 2015 | | 2014 | | 2014 | |

Segment sales | | | | | | |

Packaging | $ | 1,099.3 |

| | $ | 1,097.4 |

| | $ | 1,122.0 |

| |

Paper | 297.3 |

| | 309.3 |

| | 284.4 |

| |

Intersegment eliminations and other | 29.1 |

| | 24.6 |

| | 27.6 |

| |

| $ | 1,425.7 |

| | $ | 1,431.3 |

| | $ | 1,434.0 |

| |

| | | | | | |

Segment income (loss) | | | | | | |

Packaging | $ | 141.1 |

| | $ | 170.7 |

| | $ | 161.4 |

| |

Paper | 35.6 |

| | 27.7 |

| | 31.1 |

| |

Corporate and Other | (19.6 | ) | | (37.5 | ) | | (19.3 | ) | |

Income from operations | 157.1 |

| | 160.9 |

| | 173.2 |

| |

Interest expense, net | (19.2 | ) | | (20.8 | ) | | (23.2 | ) | |

Income before taxes | $ | 137.9 |

| | $ | 140.1 |

| | $ | 150.0 |

| |

| | | | | | |

Segment income (loss) excluding special items (1) | | | | | | |

Packaging | $ | 152.3 |

| | $ | 174.7 |

| | $ | 178.9 |

| |

Paper | 35.6 |

| | 28.4 |

| | 31.5 |

| |

Corporate and Other | (17.0 | ) | | (16.5 | ) | | (12.8 | ) | |

| $ | 170.9 |

| | $ | 186.6 |

| | $ | 197.6 |

| |

| | | | | | |

EBITDA (1) | | | | | | |

Packaging | $ | 219.8 |

| | $ | 240.3 |

| | $ | 238.7 |

| |

Paper | 49.3 |

| | 39.7 |

| | 44.5 |

| |

Corporate and Other | (18.6 | ) | | (35.7 | ) | | (17.8 | ) | |

| $ | 250.5 |

| | $ | 244.3 |

| | $ | 265.4 |

| |

| | | | | | |

EBITDA excluding special items (1) | | | | | | |

Packaging | $ | 222.0 |

| | $ | 244.3 |

| | $ | 249.7 |

| |

Paper | 49.3 |

| | 40.4 |

| | 44.9 |

| |

Corporate and Other | (16.0 | ) | | (14.7 | ) | | (11.3 | ) | |

| $ | 255.3 |

| | $ | 270.0 |

| | $ | 283.3 |

| |

____________

| |

(1) | Income from operations excluding special items, segment income (loss) excluding special items, earnings before interest, income taxes, and depreciation, amortization, and depletion (EBITDA), and EBITDA excluding special items are non-GAAP financial measures. We present these measures because they provide a means to evaluate the performance of our segments and our company on an ongoing basis using the same measures that are used by our management and because these measures are frequently used by investors and other interested parties in the evaluation of companies and the performance of their segments. The tables included in "Reconciliation of Non-GAAP Financial Measures" on the following pages reconcile the non-GAAP measures with the most directly comparable GAAP measures. Any analysis of non-GAAP financial measures should be done only in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

|

| | | | | | | | | | | | |

| Three Months Ended | |

| March 31 | | December 31, | |

| 2015 | | 2014 | | 2014 | |

Packaging | | | | | | |

Segment income | $ | 141.1 |

| | $ | 170.7 |

| | $ | 161.4 |

| |

DeRidder restructuring | 10.3 |

| | 4.0 |

| | 18.0 |

| |

Integration-related and other costs | 0.9 |

| | — |

| | (0.5 | ) | |

Segment income excluding special items (1) | $ | 152.3 |

| | $ | 174.7 |

| | $ | 178.9 |

| |

| | | | | | |

Paper | | | | | | |

Segment income | $ | 35.6 |

| | $ | 27.7 |

| | $ | 31.1 |

| |

Integration-related and other costs | — |

| | 0.7 |

| | 0.4 |

| |

Segment income excluding special items (1) | $ | 35.6 |

| | $ | 28.4 |

| | $ | 31.5 |

| |

| | | | | | |

Corporate and Other | | | | | | |

Segment loss | $ | (19.6 | ) | | $ | (37.5 | ) | | $ | (19.3 | ) | |

Integration-related and other costs | 2.6 |

| | 3.4 |

| | 6.5 |

| |

Class action lawsuit settlement | — |

| | 17.6 |

| | — |

| |

Segment loss excluding special items (1) | $ | (17.0 | ) | | $ | (16.5 | ) | | $ | (12.8 | ) | |

| | | | | | |

Income from operations | $ | 157.1 |

| | $ | 160.9 |

| | $ | 173.2 |

| |

| | | | | | |

Income from operations, excluding special items (1) | $ | 170.9 |

| | $ | 186.6 |

| | $ | 197.6 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

Net Income and EPS Excluding Special Items (1)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31 | | Three Months Ended | |

| 2015 | | 2014 | | December 31, 2014 | |

| Net Income | | Diluted EPS | | Net Income | | Diluted EPS | | Net Income | | Diluted EPS | |

As reported | $ | 90.8 |

| | $ | 0.92 |

| | $ | 90.1 |

| | $ | 0.92 |

| | $ | 98.5 |

| | $ | 1.00 |

| |

Special items (2): | | | | | | | | | | | | |

DeRidder restructuring | 6.6 |

| | 0.07 |

| | 2.6 |

| | 0.02 |

| | 11.7 |

| | 0.12 |

| |

Integration-related and other costs | 2.2 |

| | 0.02 |

| | 2.6 |

| | 0.03 |

| | 4.2 |

| | 0.04 |

| |

Class action lawsuit settlement | — |

| | — |

| | 11.2 |

| | 0.11 |

| | — |

| | — |

| |

Total special items | 8.8 |

| | 0.09 |

| | 16.4 |

| | 0.16 |

| | 15.9 |

| | 0.16 |

| |

Excluding special items | $ | 99.6 |

| | $ | 1.01 |

| | $ | 106.5 |

| | $ | 1.08 |

| | $ | 114.4 |

| | $ | 1.16 |

| |

____________

| |

(1) | Net income and earnings per share excluding special items are non-GAAP financial measures. The after-tax effect of special items are presented because they provide a means to evaluate the performance of our company on an ongoing basis using the same measures that are used by our management and because these measures are frequently used by investors and other interested parties in the evaluation of companies and their performance. Any analysis of non-GAAP financial measures should be done only in conjunction with results presented in accordance with GAAP. The non-GAAP measures are not intended to be substitutes for GAAP financial measures and should not be used as such. |

| |

(2) | Special items are tax-effected at a combined federal and state income tax rate in effect for the period the special items were recorded. For more information related to these items, see the footnotes to the Consolidated Earnings Results on page 1. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

EBITDA and EBITDA Excluding Special Items (1)

EBITDA represents income before interest (interest expense and interest income), income taxes, and depreciation, amortization, and depletion. The following table reconciles net income to EBITDA and EBITDA excluding special items:

|

| | | | | | | | | | | | |

| Three Months Ended | |

| March 31 | | December 31, | |

| 2015 | | 2014 | | 2014 | |

Net income | $ | 90.8 |

| | $ | 90.1 |

| | $ | 98.5 |

| |

Interest expense, net | 19.2 |

| | 20.8 |

| | 23.2 |

| |

Provision for income taxes | 47.1 |

| | 50.0 |

| | 51.5 |

| |

Depreciation, amortization, and depletion | 93.4 |

| | 83.4 |

| | 92.2 |

| |

EBITDA (1) | $ | 250.5 |

| | $ | 244.3 |

| | $ | 265.4 |

| |

Special items: | | | | | | |

DeRidder restructuring | $ | 1.3 |

| | $ | 4.0 |

| | $ | 11.5 |

| |

Integration-related and other costs | 3.5 |

| | 4.1 |

| | 6.4 |

| |

Class action lawsuit settlement | — |

| | 17.6 |

| | — |

| |

EBITDA excluding special items (1) | $ | 255.3 |

| | $ | 270.0 |

| | $ | 283.3 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited

(dollars in millions)

The following table reconciles segment income (loss) to EBITDA and EBITDA excluding special items:

|

| | | | | | | | | | | | |

| Three Months Ended | |

| March 31 | | December 31, | |

| 2015 | | 2014 | | 2014 | |

Packaging | | | | | | |

Segment income | $ | 141.1 |

| | $ | 170.7 |

| | $ | 161.4 |

| |

Depreciation, amortization, and depletion | 78.7 |

| | 69.6 |

| | 77.3 |

| |

EBITDA (1) | 219.8 |

| | 240.3 |

| | 238.7 |

| |

DeRidder restructuring | 1.3 |

| | 4.0 |

| | 11.5 |

| |

Integration-related and other costs | 0.9 |

| | — |

| | (0.5 | ) | |

EBITDA excluding special items (1) | $ | 222.0 |

| | $ | 244.3 |

| | $ | 249.7 |

| |

| | | | | | |

Paper | | | | | | |

Segment income | $ | 35.6 |

| | $ | 27.7 |

| | $ | 31.1 |

| |

Depreciation, amortization, and depletion | 13.7 |

| | 12.0 |

| | 13.4 |

| |

EBITDA (1) | 49.3 |

| | 39.7 |

| | 44.5 |

| |

Integration-related and other costs | — |

| | 0.7 |

| | 0.4 |

| |

EBITDA excluding special items (1) | $ | 49.3 |

| | $ | 40.4 |

| | $ | 44.9 |

| |

| | | | | | |

Corporate and Other | | | | | | |

Segment loss | $ | (19.6 | ) | | $ | (37.5 | ) | | $ | (19.3 | ) | |

Depreciation, amortization, and depletion | 1.0 |

| | 1.8 |

| | 1.5 |

| |

EBITDA (1) | (18.6 | ) | | (35.7 | ) | | (17.8 | ) | |

Integration-related and other costs | 2.6 |

| | 3.4 |

| | 6.5 |

| |

Class action lawsuit settlement | — |

| | 17.6 |

| | — |

| |

EBITDA excluding special items (1) | $ | (16.0 | ) | | $ | (14.7 | ) | | $ | (11.3 | ) | |

| | | | | | |

EBITDA (1) | $ | 250.5 |

| | $ | 244.3 |

| | $ | 265.4 |

| |

| | | | | | |

EBITDA excluding special items (1) | $ | 255.3 |

| | $ | 270.0 |

| | $ | 283.3 |

| |

____________

| |

(1) | See footnote (1) on page 2, for a discussion of non-GAAP financial measures. |

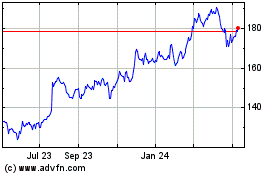

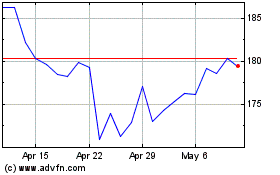

Packaging (NYSE:PKG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Packaging (NYSE:PKG)

Historical Stock Chart

From Apr 2023 to Apr 2024