By Saumya Vaishampayan And Dan Strumpf

Rattled by last week's rout, stock investors are taking comfort

in a corner of the market that remains standing: housing

stocks.

Stock markets have been pounded in the past week amid mounting

evidence that global growth is hitting the skids, and the Dow Jones

Industrial Average on Friday entered a correction, referring to a

drop of 10% from a recent peak.

Yet many investors say the recent plunge in stocks is unlikely

to turn into an outright collapse, in large part because core areas

of the U.S. economy--including the housing sector and related

industries--are still on relatively solid footing.

The $2.1 billion SPDR S&P Homebuilders Exchange-Traded Fund,

which tracks shares of companies ranging from home builders to

mattress makers, is up 9.2% in the year to date. The S&P 500

has fallen 4.3% in the same period. On Friday, the fund's shares

fell 2.3% compared with a 3.2% decline in the broader index.

"The last couple of days, the housing sector has been showing

strength when the rest of the market appears to be breaking down,"

Craig Hodges, portfolio manager of the $2 billion Hodges Small Cap

Fund, said late Thursday.

The trend marks a reversal from the last S&P 500 correction

in 2011, when housing stocks trailed the broader market for the

year.

Mr. Hodges said he has been building stakes in a handful of

home-building companies, including D.R. Horton Inc. and PulteGroup

Inc., as a bet on sustained growth in the housing market. The

stocks have gained 4.4% and 1%, respectively, in August.

Through July, investors have poured $298.3 million into the SPDR

S&P Homebuilders ETF, which is on track for its first year of

inflows since 2012, according to Morningstar.

Lawrence Kemp, portfolio manager on the $3.5 billion BlackRock

Capital Appreciation Fund, has long-standing bets on companies tied

to home repair and remodeling because he is optimistic about the

housing market. "It's important to remember that the U.S., on a

relative basis, continues to be in a strong position," he said.

"The U.S. [stock] market, after this correction, is a potential

bright spot."

The housing market's recovery from the subprime-mortgage crisis

and the Great Recession has been a bumpy one. Home buying and

construction slowed in 2013 after jobs growth hit a soft patch and

borrowing costs spiked during the so-called taper tantrum.

Lately, though, the housing sector has gained steam, and some

money managers say that could help offset the weakness in China and

other emerging markets that have roiled markets.

Despite the jump in housing shares over the past year, many

remain well below their peaks, which some money managers argue

gives them more room to run. The SPDR S&P Homebuilders ETF is

20% below its record from April 2006, according to FactSet.

In July, housing starts rose to the highest level since October

2007. Sentiment among home builders is at its highest level in

nearly a decade, according to a gauge from the National Association

of Home Builders.

This week, investors will be watching for reports on new and

pending home sales in the U.S., in addition to a second reading on

second-quarter economic growth.

A loosening of lending rules has made it easier for first-time

home buyers to get mortgages, while a continued improvement in the

labor market has made buyers more comfortable taking on debt.

"Before the crisis, you could breathe on a mirror and get a

loan," said Iman Brivanlou, head of the high-income equities group

at TCW Group. "Then the opposite happened...Now it's beginning to

ease. It's become easier to get a home mortgage."

Mr. Brivanlou has bets on M.D.C. Holdings Inc., whose

subsidiaries build homes under the Richmond American brand. That

stock has advanced 12% this year. He also holds two timber

real-estate investment trusts tied to the housing sector:

Weyerhaeuser Co. and Plum Creek Timber Co.

Some investors already are worried about stock valuations. For

example, shares of Home Depot Inc. have risen 11% in 2015 and are

trading at 22.6 times the past 12 months of earnings, higher than

the 10-year average of 18.2.

Bob Landry, portfolio manager at USAA Investment Solutions,

holds Home Depot shares and is considering whether to trim his

position.

"It's starting to look a little pricey to me," he said. "It's

had a great run here and I'm just afraid that if they stumble a

little bit, the stock could really take a pretty hard hit."

Still, bullish investors expect the pace of home buying to

quicken, especially as some prospective owners rush to purchase

ahead of any increase in short-term interest rates by the Federal

Reserve.

Alex Imas, 30 years old, is looking to buy a house in Pittsburgh

after watching the monthly rent on his one-room loft apartment in

the city's Lawrenceville neighborhood rise to $1,500.

"The renting market is not great, but the housing market has

tremendously rebounded," said Mr. Imas, an assistant professor at

Carnegie Mellon University. "It's been growing since I've been

there the last two years."

Even when the Federal Reserve begins to lift interest rates--a

move that some market watchers speculate will be delayed from a

widely anticipated date of September due to global-growth

concerns--any tightening will be gradual, analysts say. That would

leave the overall level of rates relatively low, which should

continue to support home buying.

Access Investor Kit for "D.R. Horton, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US23331A1097

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 23, 2015 19:14 ET (23:14 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

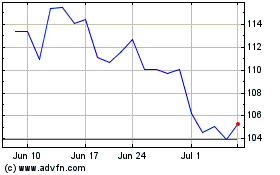

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Aug 2024 to Sep 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Sep 2023 to Sep 2024