U.S. lawmakers want the Agriculture Department to weigh in on

the national security review of China National Chemical Corp.'s

planned takeover of pesticide and seed giant Syngenta AG, a move

that would add a skeptical voice to the politically sensitive $43

billion deal.

Sen. Chuck Grassley (R., Iowa) said he and a bipartisan group of

Farm Belt senators in coming days plan to seek a formal role for

the USDA, which has aired concerns over the Syngenta deal in recent

weeks.

The takeover, unveiled in February, is the largest-ever foreign

acquisition by a Chinese company. If successful, the deal would

realign the $100 billion global market for crop seeds and

pesticides as China's government is pushing to modernize its

agricultural sector, reduce reliance on imports, and compete with

longer-established Western rivals.

The national security review of the ChemChina-Syngenta deal is

being conducted by the powerful Committee on Foreign Investment in

the U.S. Syngenta, based in Switzerland, generates about

one-quarter of its sales in North America, where it is a top

pesticide seller and supplies an estimated 10% of U.S. soybean

seeds and 6% for corn.

The committee is made up of representatives from 16 U.S.

departments and agencies, including the Treasury, Homeland Security

and Defense departments, but not including the USDA. CFIUS has a

track record of scotching foreign companies' purchases of U.S.

assets they think raise national-security risks.

"I'm not saying foreign direct investment is inherently bad,"

Mr. Grassley said in an interview Wednesday. "But we ought to

ensure through [CFIUS] that we're not permitting the sale of too

much of our food industry, especially when government-controlled

entities like ChemChina are the buyers."

Mr. Grassley said he and other senators want permanent roles on

CFIUS for the USDA and the U.S. Food and Drug Administration, which

are sometimes tapped to provide their views on mergers, to evaluate

food security and safety aspects of foreign-driven deals.

"We need to consider the long-term implications of letting

foreign entities control significant market share in U.S.

agriculture, especially in consolidated markets, like the seed

market has become," he said.

U.S. farm groups and agricultural companies also have complained

that China's process for reviewing and approving agricultural

products like genetically modified seeds is out of step with other

major countries, leading to sometimes lengthy delays for high-tech

seeds and trade disruptions.

U.S. Agriculture Secretary Thomas Vilsack said in February that

the U.S. agricultural industry has grappled with "inconsistency"

and "lack of synchronization" when it comes to securing China's

approval to import new biotech crops in China, one of the world's

top buyers of agricultural commodities.

"I have a watchful eye on all of this and continue to be

extremely concerned about the way in which biotechnology and

innovation is being treated and impeded by a system in China that

often times is not based on science and appears to be based more on

politics," Mr. Vilsack said in a conference call with reporters in

February, responding to a question about the ChemChina-Syngenta

deal.

A USDA spokeswoman declined to comment further.

A spokeswoman for the Treasury Department, which chairs CFIUS,

declined to comment. Representatives for ChemChina and China's

Ministry of Agriculture didn't respond to requests for comment.

Other farm-state lawmakers have their own reservations.

"Whenever the Chinese acquire American operations, it is reason

for concern," said Rep. Jeff Fortenberry (R, Neb.) in a recent

statement to The Wall Street Journal. Rep. Adrian Smith, another

Nebraska Republican, said in a statement to the Journal that there

were "still many details" to examine. He added: "I plan to look

closely at any potential national security implications."

"China's the main holdup when we're trying to get biotech traits

approved," said Chandler Goule, a senior at the Washington-based

National Farmers Union. If a China state-owned company owns a major

biotech seed company, he said, "there's a concern they'd block

their competition."

A Syngenta spokesman declined to comment on the CFIUS

review.

Michel Demaré , Syngenta's chairman, said in February that

Syngenta doesn't expect preferential treatment by Chinese

agricultural authorities, and that the ChemChina deal could help

the Western seed industry by further opening the country to biotech

crops, which currently permits cotton, papaya, sweet peppers and

tomatoes.

"We are very convinced there is no security issue," Mr. Demaré

said.

The companies could address any U.S. security concerns and still

keep their deal, analysts say.

Terms of the deal allow ChemChina to walk away from the offer

without paying a reverse breakup fee if CFIUS or antitrust concerns

require selling businesses that generate more than $2.68 billion in

annual sales. If the U.S. lodges protests over Syngenta's U.S. seed

business, which generates about $1 billion in annual sales, the

company could sell it, according to analysts at Sanford C.

Bernstein.

Investors don't yet consider the deal a sure thing.

Syngenta shares on Wednesday climbed to 399.10 Swiss francs in

European trading and have traded well below the offer, worth 480

francs a share, since the deal's announcement. "[M]arket

unwillingness to fully price in the deal appears to center on

CFIUS," Morgan Stanley analysts wrote in a research note last

month.

ChemChina and Syngenta voluntarily initiated the CFIUS review

upon announcement of their deal. The formal review process

typically takes 75 days. The companies expect to close the deal by

the end of 2016.

As part of its review, CFIUS is expected to scrutinize

Syngenta's chemical facilities that sit close to U.S. military

sites, like one within about 10 miles of Offutt Air Force Base,

located near Omaha and the headquarters of U.S. Strategic Command,

where President George W. Bush headed following the Sept. 11, 2001,

terrorist attacks.

The group also will likely evaluate Syngenta's U.S. chemical

plants that are potential terror targets.

Chinese companies increasingly are shopping abroad for

acquisitions, putting more deals before CFIUS—which sometimes

blocks them.

Amsterdam-based Royal Philips NV in January abandoned the $2.8

billion sale of an 80% stake in its lighting components unit to a

Chinese investor after CFIUS blocked the deal on national-security

grounds. Fairchild Semiconductor International and Pericom

Semiconductor Corp., both based in San Jose, Calif., rejected

separate deal proposals from Chinese firms over concerns of a CFIUS

block.

Big China-driven agricultural deals have had fewer go-rounds

with CFIUS. China-based meat giant WH Group Ltd.'s $4.7 billion

deal in 2013 to buy Smithfield Foods Inc., the top U.S. pork

processor, at the time ranked as the biggest-ever Chinese takeover

of a U.S. company and drew some worries in U.S. farm country, but

ultimately went through.

Some saw Syngenta, and U.S. farmers benefiting from a wealthier

owner that is intent on boosting crop production around the

world.

"I don't think our folks feel threatened by more production in

China," said Bill Northey, Iowa's secretary of agriculture.

"They're still going to need more in the long term than they are

able to produce, and if market forces work there we're still going

to get a chance to export into that market."

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

March 23, 2016 13:55 ET (17:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

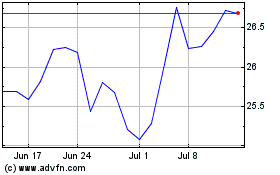

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

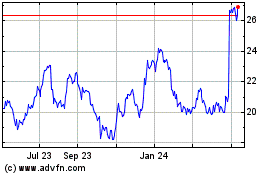

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024