Philips Shares Rally on Earnings -- Update

January 26 2016 - 6:46AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Shares in Royal Philips NV rose 6% after the Dutch

electronics group said Tuesday its operational performance

continued to improve as it works toward the sale of its iconic

lighting business.

Philips Tuesday reported a net loss of EUR39 million ($42

million) in the three months ended Dec. 31, compared with a net

profit of EUR134 million in the same period a year earlier, largely

the result of one-time pension charges and higher taxes.

Adjusted earnings before interest and taxes, the company's

preferred measure of its operational performance, rose 13% to

EUR842 million. Total sales rose 9% to EUR7.1 billion, and by 2% on

a constant currency basis.

Analysts said the underlying results were better than expected,

and Philips shares climbed nearly 6% in Amsterdam.

The earnings report is likely to be one of the last before

Philips completes the separation of its nearly 125-years-old

lighting arm, for which it is exploring either a sale or an initial

public offering in the first six months of this year.

The sale is part of wider strategic overhaul in which Philips

seeks to concentrate on its more profitable and faster growing

healthcare-technology business, where it competes with Siemens AG

and General Electric Co.

Philips' healthcare arm recorded sales of EUR3.3 billion, up 3%

at constant currencies, lifted by strong order intake in North

America, Western Europe and China. The business signed three

multiyear deals with hospitals as it seeks to shift its focus away

from manufacturing to services.

The lighting division, meanwhile, reported sales of EUR2

billion, down 2% on a constant-currency basis, reflecting the

continued decline in sales of incandescent lightbulbs. But the unit

posted a 19% rise in adjusted operating profit, due in part due to

cost-savings and strong sales of light-emitting diode, or LED,

lamps.

"The strong result of Lighting is especially welcome in the

light of a potential sale or IPO," ING said.

Chief Executive Frans van Houten said "multiple parties" have

shown interest in the business, but declined to give further

comment.

The Wall Street Journal, citing people familiar with the matter,

reported earlier this month that U.K. industrial firm Melrose

Industries PLC is considering a bid for the unit, which could be

valued as high as EUR6 billion.

Mr. van Houten also said Philips has started the search for a

new buyer for its LED-components business, Lumileds, after a $2.8

billion deal with a Chinese investor was blocked on

national-security grounds by the powerful Committee on Foreign

Investment in the U.S.

A new deal is expected to be closed in the second half of this

year, but likely at a lower price. "The [previous] deal was very

attractive and may not be repeatable," Mr. van Houten said.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

January 26, 2016 06:31 ET (11:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

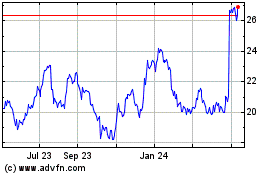

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

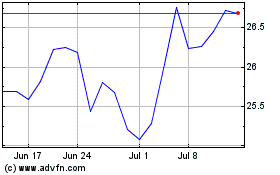

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024