By WSJ Staff

Executives around the globe headed back to work Wednesday amid

another radically changed political landscape -- the second big

shift for global businesses in recent months after the Brexit vote

-- as they weighed the ramifications of Donald Trump's surprise

election.

With Mr. Trump's victory, U.S. businesses braced for revamped

trade pacts and a potential crackdown on overseas operations,

coupled with the promise of lower taxes and higher infrastructure

spending at home. Executives in Asia and Europe said they were

hopeful their close ties with the U.S. economy would endure the

political upheaval and heated campaign rhetoric.

In an open letter Wednesday to the President-elect, a group of

CEOs including the leaders of Boeing Co., Procter & Gamble Co.

and United Technologies Corp. expressed an "urgent need to restore

faith in our vital economic and government institutions."

Mr. Trump had harsh words on the campaign trail about big

companies like Ford Motor Co. and United Technologies for moving

jobs and operations overseas. For example, Mr. Trump promised to

slap 35% tariffs on cars imported to the U.S. from Mexico.

"We are aware that there will be times when we disagree on the

specifics of important policies," the CEOs wrote in the letter

organized by the National Association of Manufacturers. "We do

believe, however, that we can be constructive -- both when we agree

and when we do not -- if we can all approach challenging situations

in good faith."

The President-elect has been critical of global trade, the North

American Free Trade Agreement and the Trans-Pacific Partnership, an

agreement to lower or eliminate tariffs between the U.S. and 11

other countries including Japan and Vietnam. He has also been

critical of China, the biggest U.S. trading partner.

"We hope President Trump is more nuanced than candidate Trump,"

said Jake Parker, vice president of China operations of the

U.S.-China Business Council.

General Motors Co.'s "scenario planning" considered ways prior

to the election to avoid tariffs Mr. Trump has threatened, Johan de

Nysschen, president of GM's luxury Cadillac brand, said at a

conference in Lisbon. "It's important to note that we produce for

the global stage not only for North America and that we are able to

divert Mexican production to serve other global markets," Mr. De

Nysschen said.

Mr. Trump's election sent waves through the U.S. healthcare

industry, providing relief to drugmakers worried about the specter

of government price limits but fanning fears for hospital operators

and some health insurers that the Medicaid expansion in President

Obama's health law could get rolled back. That provision had

brought those companies more paying customers.

Mr. Trump has vowed to repeal the Affordable Care Act, though

many analysts think it's unlikely all of the ACA's effects would be

undone. Mr. Trump also took aim at high drug prices during his

campaign, hinting at measures such as re-importation of drugs and

giving Medicare powers to negotiate drug prices to limit price

rises.

"The market wanted the certainty and clarity of a Clinton win --

it may not agree with all of her policy proposals, but it was

comfortable with gridlock," said Brian Gardner, head of Washington

research for the investment bank Keefe, Bruyette Woods.

Mr. Trump has shown himself flexible in his policy positions,

and a grim market response could prompt him and his advisers to

rethink their priorities, predicted Daniel Clifton, head of

Washington research for Strategas Research Partners. "They're going

to sell off on protectionism, but if he's killing the market on

that kind of stuff, he'll change tactics and focus on taxes" and

other domestic issues, Mr. Clifton said.

Mr. Trump has proposed overhauling U.S. corporate taxes by

reducing the corporate rate to 15% from 35%. His plan also provides

for a one-time tax rate of 10% for repatriated corporate profits,

which would help fund plans to spend $1 trillion on new

infrastructure projects.

Caterpillar Inc., the world's largest maker of heavy machinery,

said it welcomed Mr. Trump's promise to boost spending on new roads

and bridges. "We've got a lot to do at home on building our own

infrastructure in this country, and we are excited about some of

the things that [he] has said in this regard," said Kathryn Dickey

Karol, Caterpillar's vice president for global government and

corporate affairs.

Mr. Trump's campaign argues that in addition to forestalling

inversions -- acquisitions that enable companies to re-domicile

abroad -- his tax plan would accelerate U.S. economic growth. "His

view is if you lower the tax rate at the corporate level, more

money is coming back into the country," said Scott Kaplowitch, a

partner at Edelstein & Company LLP. "You would think twice

about investing overseas if the tax rate came down in the U.S."

The National Retail Federation is keeping a close eye on how Mr.

Trump might alter cross-border trade, tax policy and labor laws.

"The retail supply chain is a thoroughly global supply chain," said

David French, senior vice president of government relations at the

NRF on Wednesday. "Anything that threatens two-way trade can hurt

retail and consumers," Mr. French said.

It is unclear how the results could impact consumer sentiment

and spending in the key holiday season. "This morning there are a

lot of people who woke up very surprised," Mr. French said. "The

divisions in the country are going to be hard to heal."

Mr. Trump has said he plans to instruct the U.S. Trade

Representative to bring trade cases against the Chinese to punish

them for allegedly using unfair subsidies to help their companies.

Any friction with China could spell trouble for everyone from Apple

Inc. to Wal-Mart Stores Inc., which rely on Chinese factories to

make many of their products as well as Chinese consumers to buy

them.

MGM Resorts Chief Executive Jim Murren said in an interview

Tuesday that Mr. Trump's rhetoric on foreign countries might

alienate some key casino business interests, including China and

Japan. MGM and two of the other biggest Las Vegas-based casino

companies have built out large portions of their business in Macau,

the Chinese gambling enclave, and also depend on foreign travel to

the U.S. for significant portions of their business.

"There's no doubt that China and America disagree on many, many

topics but there's been a degree of respect," said Mr. Murren, who

is also a chair of the main casino industry trade association, the

American Gaming Association.

U.S. defense stocks rallied in early trading Wednesday as the

prospect of a short-term bump in military spending from the

incoming Trump administration outweighed concerns about a possible

hit to export sales.

Republican control of Congress is expected to pave the way for

an increase in the Pentagon's war fund to tackle conflicts in the

Middle East, though the incoming president hasn't laid out plans

for how he would fund pledges to boost the size of the Army, expand

the Navy fleet and add more combat jets.

There was also hope in the battered U.S. coal business. Robert

Murray, CEO of coal mining company Murray Energy Corp., called Mr.

Trump's election "a great day for coal miners and their families,

and for all Americans who depend on reliable, low-cost electricity,

which coal provides."

But a renaissance for coal and the high-paying unionized jobs

that mining once created in more than a dozen states may prove out

of reach, even with presidential backing. Analysts say the main

culprit for coal's decline is natural gas, which has flooded the

market since the development of hydraulic fracturing, or fracking,

undercutting coal.

(END) Dow Jones Newswires

November 09, 2016 11:53 ET (16:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

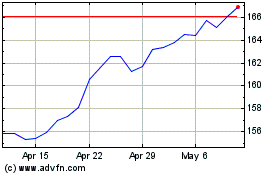

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Aug 2024 to Sep 2024

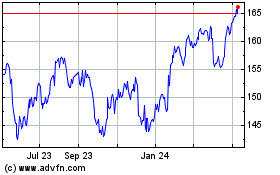

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Sep 2023 to Sep 2024