Pfizer Buy of Hospira Gets Green Light

August 24 2015 - 9:00AM

Dow Jones News

Pfizer Inc. on Monday said U.S. regulators have approved its

acquisition of smaller rival Hospira Inc., pending the divestiture

of some sterile injectable drugs, putting the deal on track to

close in early September.

Pfizer said it agreed to divest itself of four U.S. sterile

injectable assets: Acetylcysteine, Clindamycin, Voriconazole and

Melphalan.

Earlier in August, Pfizer agreed to make divestitures designed

to guard against price rises and protect the research and

development of drugs to gain European approval for the deal.

The deal, announced in February, will transform New York-based

Pfizer into a leading player in the emerging market for

lower-priced versions of costly biotech drugs.

Regulators have worried that the two companies, both based in

the U.S., would together have a high market share for certain

sterile injectable drugs, which are administered with a hollow

hypodermic needle.

European regulators were also concerned that the companies might

delay or discontinue production of a copycat version of Infliximab,

a popular drug used to treat autoimmune diseases such as rheumatoid

arthritis and Crohn's disease.

To assuage those concerns, Pfizer agreed to fully divest itself

of the development, manufacturing and marketing rights of its

Infliximab biosimilar drug currently in development, though it will

retain marketing rights outside Europe. It also agreed to dispose

of certain sterile injectable drugs that raised competition

concerns in individual EU countries.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 24, 2015 08:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

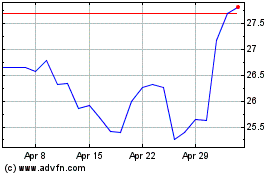

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

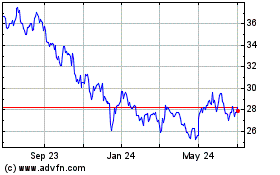

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024