Revenues Grow 10.3% in the Quarter – 7.9% in

the First Six Months of 2015

PAR Technology Corporation (NYSE:PAR) today announced results

for the second quarter ended June 30, 2015.

Summary of Fiscal 2015 Second Quarter and Year-to-Date

Financial Results

- Revenue increased 10.3% to $63.3

million in the second quarter of fiscal 2015, compared to $57.4

million in the same period in 2014.

- Non-GAAP net income in the second

quarter of fiscal 2015 was $0.6 million, or $0.04 per diluted

share, compared to a non-GAAP net loss of $0.3 million, or $0.02

loss per share, in the same period in 2014.

- GAAP net income in the second quarter

of fiscal 2015 was $0.1 million, or $0.01 per diluted share,

compared to a GAAP net loss of $0.5 million, or $0.03 loss per

share, in the same period in 2014.

- Revenue increased 7.9% to $122.9

million in the first six months of fiscal 2015, compared to $113.9

million in the same period in 2014.

- Non-GAAP net income in the first six

months of fiscal 2015 was $0.6 million, or $0.04 per diluted share,

compared to a non-GAAP net loss of $1.0 million or $0.06 loss per

share, in the same period in 2014.

- GAAP net loss in the first six months

of fiscal 2015 was $0.3 million or $0.02 loss per share, compared

to a GAAP net loss of $1.5 million, or $0.10 loss per share, in the

same period in 2014.

Commenting on the second quarter results, Ronald J. Casciano,

Chief Executive Officer & President, stated, “We are pleased

with the quarterly performance and the progress being made in both

of our business segments as they delivered revenue and income

growth in the quarter. We are seeing strong interest in our new

hospitality technology products, specifically our Brink POS™

software, and are encouraged by the recent new customer wins in

this segment. Our Government segment also had a strong second

quarter and delivered double digit revenue growth and improved

profits for the quarter when compared to the same period in 2015.

Going forward we fully expect to build upon our recent progress by

focusing on alignment, innovation and execution to compete and

succeed in the markets we serve.”

The Company previously stated its intention to make strategic

and operational improvements involving its hospitality segment,

primarily in its international operations to focus on global

delivery of its software solutions. This restructuring realigns

sales and support functions with US-based operations, increases

efficiencies and reduces operating costs. In connection with this

restructuring, the Company’s GAAP results include a one-time

pre-tax charge in the second quarter of $416,000.

A reconciliation and description of non-GAAP financial measures

to their comparable GAAP financial measures are included in the

tables following this news release.

Certain Company information in this release or statements made

by its spokespersons from time to time may contain forward-looking

statements. Any statements in this document that do and not

describe historical facts are forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Investors are cautioned that all forward-looking statements involve

risks and uncertainties, including without limitation, delays in

new product introduction, risks in technology development and

commercialization, risks in product development and market

acceptance of and demand for the Company’s products, risks of

downturns in economic conditions generally, and in the quick

service sector of the restaurant market specifically, risks of

intellectual property rights associated with competition and

competitive pricing pressures, risks associated with foreign sales

and high customer concentration, and other risks detailed in the

Company’s filings with the Securities and Exchange Commission.

About PAR Technology Corporation

PAR Technology Corporation's stock is traded on the New York

Stock Exchange under the symbol PAR. PAR’s Hospitality segment has

been a leading provider of restaurant and retail technology for

more than 30 years. PAR offers technology solutions for the full

spectrum of restaurant operations, from large chain and independent

table service restaurants to international quick service chains.

PAR’s Hospitality business also provides hotel management systems

with a complete suite of powerful tools for guest management,

recreation management, and timeshare/condo management. In addition,

PAR offers the spa industry a leading management application

specifically designed to support the unique needs of the resort spa

and day spa markets, a rapidly growing hospitality segment.

Products from PAR also can be found in retailers, cinemas, cruise

lines, stadiums and food service companies. PAR’s Government

Business is a leader in providing computer-based system design,

engineering and technical services to the Department of Defense and

various federal agencies. Visit www.partech.com for more

information.

There will be a conference call at 4:45 p.m. (Eastern) on August

6, 2015, during which the Company’s management will discuss the

financial results for the second quarter of 2015. To participate in

the call, please call 866-868-9502, approximately 10 minutes

in advance. No passcode is required to participate in the live call

or to listen to the replay version. Individual & Institutional

Investors will have the opportunity to listen to the conference

call/event over the internet by visiting PAR’s website at

www.partech.com. Alternatively, listeners may access an archived

version of the presentation call through August 13, 2015 by dialing

855-859-2056.

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED BALANCE SHEETS(in thousands,

except share amounts)(Unaudited)

June 30, December 31,

Assets

2015 2014 Current assets: Cash and cash equivalents $ 5,136 $

10,167 Accounts receivable-net 34,467 31,445 Inventories-net 24,936

25,922 Deferred income taxes 5,583 4,512 Other current assets

4,352 4,597 Total current assets

74,474 76,643 Property, plant and equipment - net 6,353 6,135

Deferred income taxes 10,948 11,357 Goodwill 17,167 17,167

Intangible assets - net 22,863 22,952 Other assets 3,676

3,043

Total Assets

$ 135,481 $ 137,297

Liabilities and Shareholders’

Equity

Current liabilities: Current portion of long-term debt $ 3,176 $

3,173 Borrowings under line of credit 3,276 5,000 Accounts payable

15,422 19,676 Accrued salaries and benefits 6,376 6,429 Accrued

expenses 6,150 6,578 Customer deposits 4,078 2,345 Deferred service

revenue 16,175 12,695 Income taxes payable 373

475 Total current liabilities 55,026 56,371 Long-term

debt 2,528 2,566 Other long-term liabilities 8,765

8,847 Total liabilities 66,319

67,784 Commitments and contingencies

Shareholders’ Equity: Preferred stock, $.02 par value, 1,000,000

shares authorized - -

Common stock, $.02 par value, 29,000,000

shares authorized; 17,250,209 and 17,274,708 sharesissued;

15,542,100 and 15,566,599 outstanding

345 346 Capital in excess of par value 45,066 44,854 Retained

earnings 31,181 31,465 Accumulated other comprehensive loss (1,594

) (1,316 ) Treasury stock, at cost, 1,708,109 shares (5,836

) (5,836 ) Total shareholders’ equity 69,162

69,513

Total Liabilities and

Shareholders’ Equity $ 135,481 $ 137,297

PAR TECHNOLOGY

CORPORATIONCONSOLIDATED STATEMENTS OF OPERATIONS(in

thousands, except per share amounts)(Unaudited)

For the threemonths endedJune 30,

For the threemonths endedJune 30,

For the sixmonths endedJune 30,

For the sixmonths endedJune 30,

2015 2014 2015 2014 Net

revenues: Product $ 25,802 $ 22,953 $ 47,488 $ 41,545 Service

15,929 14,920 30,031 29,170 Contract 21,561

19,529 45,397 43,228

63,292 57,402 122,916

113,943 Costs of sales: Product 18,172 15,815 33,013 28,718

Service 10,404 10,831 19,724 20,384 Contract 20,189

18,495 42,663 40,567

48,765 45,141 95,400

89,669 Gross margin 14,527

12,261 27,516 24,274 Operating

expenses: Selling, general and administrative 9,253 9,513 18,317

18,776 Research and development 4,420 3,761 8,765 7,625 Acquisition

amortization 249 - 498

- 13,922 13,274

27,580 26,401 Operating income (loss): 605

(1,013 ) (64 ) (2,127 ) Other (expense) income, net (10 ) 406 (239

) 328 Interest expense (85 ) (25 ) (171 )

(42 ) Income (loss) before (provision for) benefit from

income taxes 510 (632 ) (474 ) (1,841 ) (Provision for) benefit

from income taxes (409 ) 113 190

333 Net income (loss) $ 101 $ (519 ) $ (284 )

$ (1,508 ) Earnings (loss) per Share: Basic $ 0.01 $ (0.03 )

$ (0.02 ) $ (0.10 ) Diluted $ 0.01 $ (0.03 ) $ (0.02 ) $ (0.10 )

Weighted average shares outstanding Basic 15,584

15,612 15,541 15,473

Diluted 15,671 15,612

15,541 15,473

PAR TECHNOLOGY

CORPORATIONRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

RESULTS(in thousands, except per share data)(Unaudited)

For the three months ended June 30, 2015 For the

three months ended June 30, 2014

Reportedbasis (GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Reported basis(GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Net revenues $ 63,292 - 63,292 $ 57,402 - 57,402 Costs of

sales 48,765 85 48,680

45,141 - 45,141 Gross

Margin 14,527 85 14,612 12,261 - 12,261 Operating Expenses

Selling, general and administrative 9,253 346 8,907 9,513 278 9,235

Research and development 4,420 13 4,407 3,761 - 3,761 Acquisition

amortization 249 249 -

- - Total operating expenses

13,922 608 13,314 13,274 278 12,996 Operating income (loss) 605 693

1,298 (1,013 ) 278 (735 ) Other (expense) income, net (10 ) - (10 )

406 - 406 Interest expense (85 ) 25 (60

) (25 ) - (25 ) Income (loss) before

(provision for) benefit from income taxes 510 718 1,228 (632 ) 278

(354 ) (Provision for) benefit from income taxes (409 )

(266 ) (675 ) 113 (95 )

18 Net income (loss) $ 101 $ 452 $ 553

$ (519 ) $ 183 $ (336 ) Earnings (loss) per diluted share $

0.01 $ 0.04 $ (0.03 ) $ (0.02 )

The Company reports its financial results in accordance with

GAAP, which refers financial information presented in accordance

with generally accepted accounting principles in the United States.

However, non-GAAP adjusted financial measures, as defined in the

reconciliation table above, are provided herein because management

uses such measures in evaluating the results of the operations of

the Company and believes this information provides investors better

insight into underlying business trends and performance. Non-GAAP

financial measures should be viewed in addition to, and not as an

alternative for, the Company's reported results prepared in

accordance with GAAP.

During the second quarter of 2015, the Company recorded

severance and other related charges of $416,000, of which $85,000

is included in cost of sales, $13,000 is included in research and

development and $318,000 is included in selling, general and

administrative. Also included within selling, general and

administrative is equity based compensation charges of $28,000.

Lastly, related to the acquisition of Brink, the Company recognized

amortization of acquired intangible assets of $249,000 and accreted

interest of $25,000. During the second quarter of 2014, the Company

recorded a charge of $278,000 for equity based compensation

expense. The aforementioned charges, along with an associated

adjustment to the Company’s provision for income taxes have been

excluded in the Company’s non-GAAP measures because they are

considered non-recurring in nature and/or are quantitatively and

qualitatively different from the Company’s core operations during

any particular period.

PAR TECHNOLOGY

CORPORATIONRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

RESULTS(in thousands, except per share data)(Unaudited)

For the six months ended June 30, 2015 For the

six months ended June 30, 2014

Reportedbasis (GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Reported basis(GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Net revenues $ 122,916 - $ 122,916 $ 113,943 - $ 113,943

Costs of sales 95,400 151 95,249

89,669 - 89,669

Gross Margin 27,516 151 27,667 24,274 - 24,274 Operating

Expenses

Selling, general and administrative

18,317 706 17,611 18,776 802 17,974 Research and development 8,765

13 8,752 7,625 7,625 Acquisition amortization 498

498 - - -

Total operating expenses 27,580 1,217 26,363 26,401 802

25,599 Operating income (loss) (64 ) 1,368 1,304 (2,127 ) 802

(1,325 ) Other (expense) income, net (239 ) - (239 ) 328 - 328

Interest expense (171 ) 51 (120 )

(42 ) - (42 ) Income (loss) before

(provision for) benefit from income taxes (474 ) 1,419 945 (1,841 )

802 (1,039 ) (Provision for) benefit from income taxes 190

(525 ) (335 ) 333 (273 )

60 Net income (loss) $ (284 ) $ 894 $ 610

$ (1,508 ) $ 529 $ (979 ) Earnings (loss) per diluted

share $ (0.02 ) $ 0.04 $ (0.10 ) $ (0.06 )

During the six months ended June 30, 2015, the Company recorded

severance and other related charges of $597,000, of which $151,000

is included in cost of sales, $13,000 is included in research and

development and $433,000 is included in selling, general and

administrative. Also included within selling, general and

administrative is equity based compensation charges of $273,000.

Lastly, related to the acquisition of Brink, the Company recognized

amortization of acquired intangible assets of $498,000 and accreted

interest of $51,000. During the six months ended June 30, 2014, the

Company recorded a charge of $802,000 for equity based compensation

expense. The aforementioned charges, along with an associated

adjustment to the Company’s provision for income taxes have been

excluded in the Company’s non-GAAP measures because they are

considered non-recurring in nature and/or are quantitatively and

qualitatively different from the Company’s core operations during

any particular period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150806006314/en/

PAR Technology CorporationChristopher R. Byrnes, 315-738-0600

ext. 6226cbyrnes@partech.comwww.partech.com

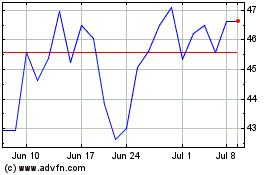

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

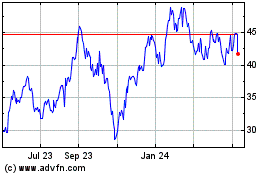

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024