Ocwen to Pay $30 Million to Resolve Disclosure Suits

June 23 2016 - 1:10PM

Dow Jones News

Ocwen Financial Corp. shares climbed Thursday after the company

said it agreed to pay $30 million to resolve lawsuits that claimed

it didn't properly include disclosures for loans it was

servicing.

The stock rose 10%, or 16 cents, to $1.73. It is still down 84%

over the past 12 months.

The lawsuits, which were brought by Michael Fisher and the U.S.

Justice Department, alleged that Ocwen didn't make required

disclosures in connection with the Home Affordable Modification

Program, a government program introduced after the housing crisis

to help struggling homeowners avoid foreclosure.

Under the preliminary settlement, Ocwen will pay $15 million to

the U.S. and $15 million to Mr. Fisher, for attorneys' fees and

costs.

Ocwen hasn't admitted liability or wrongdoing, and the

settlement hasn't received final approval.

The Justice Department didn't immediately return a request for

comment.

"Right now I wouldn't want to make any more comments until that

process is concluded," Samuel Boyd, a lawyer for Mr. Fisher, said.

"There is no final settlement until the Department of Justice

concludes its process."

In the wake of regulatory problems, the West Palm Beach, Fla.,

company has pared down its mortgage-servicing rights and shifted

its focus to mortgages not owned by government agencies, selling

off assets and reducing its workforce in recent years.

Earlier this year, Ocwen paid $2 million to settle with the

Securities and Exchange Commission over charges that it used flawed

methodology to value mortgages and lacked proper accounting

controls.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 23, 2016 12:55 ET (16:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

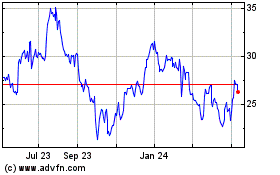

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024