UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15 (d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 15, 2015

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Florida |

|

1-13219 |

|

65-0039856 |

| |

|

|

|

|

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| |

|

|

|

|

1000

Abernathy Road NE, Suite 210

Atlanta,

Georgia 30328

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation

FD Disclosure. |

Beginning

on September 15, 2015, Ocwen Financial Corporation (“Ocwen”) will be using the materials attached hereto as Exhibit

99.1 in connection with a series of meetings with current and potential investors. The materials attached hereto as Exhibit 99.1

are incorporated herein by reference.

The

information contained under Item 7.01 in this Current Report, including Exhibit 99.1, is being furnished and, as a result, such

information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

Special

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section

21E of the Exchange Act. These forward-looking statements may be identified by a reference to a future period or by the use of

forward-looking terminology, and include pro forma financial information presented solely for illustrative purposes. Forward-looking

statements by their nature address matters that are, to different degrees, uncertain. Our business has been undergoing substantial

change which has magnified such uncertainties. Readers should bear these factors in mind when considering such statements

and should not place undue reliance on such statements. Forward-looking statements involve a number of assumptions, risks and

uncertainties that could cause actual results to differ materially. In the past, actual results have differed from those suggested

by forward looking statements and this may happen again. Important factors that could cause actual results to differ materially

from those suggested by the forward-looking statements include, but are not limited to, the following: our servicer and credit

ratings as well as other actions from various rating agencies, including the impact of recent downgrades of our servicer and credit

ratings; adverse effects on our business as a result of recent regulatory settlements; reactions to the announcement of such settlements

by key counterparties; increased regulatory scrutiny and media attention, due to rumors or otherwise; uncertainty related to claims,

litigation and investigations brought by government agencies and private parties regarding our servicing, foreclosure, modification

and other practices; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; our ability

to effectively manage our regulatory and contractual compliance obligations; our ability to execute on our strategy to reduce

the size of our Agency servicing portfolio; the adequacy of our financial resources, including our sources of liquidity and ability

to sell, fund and recover advances, repay borrowings and comply with debt covenants; volatility in our stock price; the characteristics

of our servicing portfolio, including prepayment speeds along with delinquency and advance rates; our ability to contain and reduce

our operating costs, including our ability to successfully execute on our cost improvement initiative; our ability to successfully

modify delinquent loans, manage foreclosures and sell foreclosed properties; uncertainty related to legislation, regulations,

regulatory agency actions, government programs and policies, industry initiatives and evolving best servicing practices; as well

as other risks detailed in Ocwen’s reports and filings with the SEC, including its annual report on Form 10-K for the year

ended December 31, 2014 (filed with the SEC on May 11, 2015) and its quarterly report on Form 10-Q for the quarter ended June

30, 2015 (filed with the SEC on July 31, 2015). Anyone wishing to understand Ocwen’s business should review its SEC filings.

Ocwen’s forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under

the U.S. federal securities laws, we undertake no obligation to update or revise forward-looking statements whether as a result

of new information, future events or otherwise. Ocwen may post information

that is important to investors on its website.

| Item 9.01 | Financial

Statements and Exhibits. |

(d) Exhibits

| Exhibit |

| |

| Number |

| Description |

| |

| |

| 99.1 |

| Investor Presentation dated September, 2015. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned, hereunto duly authorized.

| |

OCWEN

FINANCIAL CORPORATION

(Registrant) |

| |

|

|

| Date: September

15, 2015 |

By: |

/s/

Michael R. Bourque, Jr. |

| |

|

Michael R.

Bourque, Jr. |

| |

|

Chief Financial

Officer |

| |

|

(On

behalf of the Registrant and as its principal financial officer)

|

Exhibit 99.1

Investor Presentation

September, 2015

Ocwen Financial Corporation? 1

©2015 Ocwen Financial Corporation. All rights reserved.

FORWARD-LOOKING STATEMENTS:

Our presentation contains certain forward-looking statements as defined under the federal securities laws. These forward-looking statements may be identified by a reference to a future period or by the use of forward-looking terminology, and include pro forma financial information presented solely for illustrative purposes. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Our business has been undergoing substantial change which has magnified such uncertainties. Readers should bear these factors in mind when considering such statements and should not place undue reliance on such statements. Forward-looking statements involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially. In the past, actual results have differed from those suggested by forward looking statements and this may happen again. Important factors that could cause actual results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the following: our servicer and credit ratings as well as other actions from various rating agencies, including the impact of recent downgrades of our servicer and credit ratings; adverse effects on our business as a result of recent regulatory settlements; reactions to the announcement of such settlements by key counterparties; increased regulatory scrutiny and media attention, due to rumors or otherwise; uncertainty related to claims, litigation and investigations brought by government agencies and private parties regarding our servicing, foreclosure, modification and other practices; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; our ability to effectively manage our regulatory and contractual compliance obligations; our ability to execute on our strategy to reduce the size of our Agency servicing portfolio; the adequacy of our financial resources, including our sources of liquidity and ability to sell, fund and recover advances, repay borrowings and comply with debt covenants; volatility in our stock price; the characteristics of our servicing portfolio, including prepayment speeds along with delinquency and advance rates; our ability to contain and reduce our operating costs, including our ability to successfully execute on our cost improvement initiative; our ability to successfully modify delinquent loans, manage foreclosures and sell foreclosed properties; uncertainty related to legislation, regulations, regulatory agency actions, government programs and policies, industry initiatives and evolving best servicing practices; as well as other risks detailed in Ocwen s reports and filings with the SEC, including its annual report on Form 10-K for the year ended December 31, 2014 (filed with the SEC on May 11, 2015) and its quarterly report on Form 10-Q for the quarter ended June 30, 2015 (filed with the SEC on July 31, 2015). Anyone wishing to understand Ocwen s business should review its SEC filings. Ocwen s forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under the U.S. federal securities laws, we undertake no obligation to update or revise forward-looking statements whether as a result of new information, future events or otherwise. Information contained in this presentation that reflects assumptions as to facts or circumstances may or may not reflect current or future facts or circumstances and may simplify certain variable or otherwise complex outcomes for purposes of presenting such information. Such information is presented solely for illustrative purposes and readers should not place undue reliance on information reflecting such assumptions. Ocwen may post information that is important to investors on its website.

Ocwen Financial Corporation? 2

Strategic Update

Company executing on key objectives:

Announced Agency MSR sales on track to close as expected before end of 2015(a)

Reducing Corporate Debt/Equity ratio as previously indicated to an anticipated pro forma ratio of ~0.8x as of June 30, 2015 by year end

Executing detailed cost improvement plans

Continue intense focus on helping homeowners and improving the borrower experience

Completed 554,500+ modifications since 2009(b); Most HAMP modifications in industry(c)

CFPB complaints down 27%(d), the largest improvement of any servicer for the second consecutive report

Bank-like Risk and Compliance management systems taking hold

Building future growth engines:

Mortgage Originations technology platform for speed, cost advantages; retail focus

Small Balance Commercial Lending piloting two new products we expect to someday securitize

a) Asset sales are subject to final contract terms, certain consents and closing conditions. While some asset sales have been announced and are under contract, some have yet to be finalized and are still subject to contract negotiations and certain closing conditions, including GSE and FHFA approvals. b) As of 6/30/2015 c) Source: First Quarter 2015 Making Home Affordable Program Performance Report by U.S. Department of the Treasury; includes acquired loans d) Source: August 2015 CFPB Monthly Complaint Report, Vol. 2; Represents complaint volume from March to May, 2015; The percent reduction is compared to the same period in 2014. In the July 2015 CFPB Monthly Complaint Report,

Vol. 1, Ocwen s compliant volume was down 29%, the most of any servicer.

Ocwen Financial Corporation? 3

Second Half 2015 Update

The Company is in the process of refinancing the $1.8B private label OMART servicing advance facility with a $1.65B servicing advance facility comprised of $1.35B of variable funding notes and $300 million of 1-year term notes

As previously indicated, the second half will be challenging from an income perspective following revisions to the assumptions underlying the Company s expectations regarding its financial performance in light of operational and other developments, including lower revenue expectations and higher expected operating, interest and tax expense, the Company now anticipates a loss for 2015. The Company has initiated a comprehensive cost improvement plan which it is executing on. (See page 8 for more details on the cost improvement initiative.)

Ocwen continues to invest in compliance and improving the customer experience

National Mortgage Settlement monitor completed investigation of Ocwen s Internal Review Group and concluded past challenges have been "sufficiently addressed"

In addition to mandatory prepayments associated with sales of MSRs, the Company expects to make a voluntary prepayment of its senior secured term loan of $150 million this week and may make further voluntary prepayments later this year

The Company has terminated the FiServ servicing system contract and expects to recognize a $(10) million charge in Q3 15. This termination will result in cost savings of $18 million in 2016

Two securities class actions lawsuits against Ocwen dismissed without prejudice on 9/4/15

Ocwen Financial Corporation? 4

Agency MSR Transactions Update

($ in millions)

Closed by Closed in Q3

Q2f15 as of Sep 10 In process(b) Comments UPB of sold MSRs

($ in billions)

Performing 63 - 21 Non Performing 3 2 2

Total 66 2 23 Proceeds(a)

Performing 414 97 230 Excludes $333 recovery Non Performing (55) (18) (65) of Corporate cash from

Total 165 advances 358 79 Gain

Performing 102 (2) 64 $4 higher gain vs. 7/31 Non Performing (45) (18) (20) presentation

Total 57 (20) 44

Expect all transactions to close in FY 2015 as communicated previously

Exploring potential to sell additional Agency MSRs

(a) Proceeds net of deal expenses, compensatory fee payments, collateral payments and tax expenses 5 Ocwen Financial Corporation? (b) Asset sales are subject to final contract terms, certain consents and closing conditions. While some asset sales have been announced and are under contract, some have yet to be finalized and are still subject to contract negotiations and certain closing conditions, including GSE and FHFA approvals. As such, proceed / gain amounts are still subject to change

Corporate Leverage, Liquidity and Financing Update

($ in millions)

Pro Forma SSTL Liquidity and Financing Update

Average Cash + Available Liquidity(c) of $487 in the third quarter 2015(d)

OMART private label servicing advance facility refinancing is in process and we are targeting execution in September

$1.35B in variable funding notes; $300 in S&P rated 1-year term note

Successfully refinanced $200 Homeward forward originations warehouse line in August

Successfully refinanced $100 Liberty reverse originations warehouse line in August

Extended $100 OLS forward originations warehouse line maturity to late-September to enable refinance with same lender

1.2x 0.8x 1.7x Corporate Pro Forma Corporate Debt/Equity(a) Corporate Debt/Equity(a) Debt/Equity(a)(b)

Leverage reduction expected before end of 2015

Consistent with previous communications

(a) Corporate Debt = Senior Secured Term Loan + Unsecured bonds + OASIS notes

(b) Pro forma Corporate Debt includes adjustments from the MSR Sale Proceeds and the anticipated SSTL pay down as well as additional SSTL payments. Pro forma Equity includes adjustments for the anticipated income from announced asset sales (c) Due to high liquidity levels, Ocwen is currently foregoing borrowings on a few warehouse and advance facilities and funding a portion of loans and advances with cash. These assets are pledged to our debt facilities as collateral, and we can re-borrow on the facilities with short notice. Available Liquidity represents this available borrowing capacity. (d) July 1, 2015 thru September 9, 2015

Note: 6 Ocwen Financial Corporation? Asset sales are subject to final contract terms, certain consents and closing conditions. While some asset sales have been announced and are under contract, some have yet to be finalized and are still subject to contract negotiations and certain closing conditions, including GSE and FHFA approvals. As such, proceed / gain amounts are still subject to change. For Pro-forma Debt/Equity ratio, the impact of taxes on Equity has been ignored. Anticipated SSTL repayment is dependent on net sale proceeds.

Credit ratings are not a recommendation to buy, sell or hold any security and are subject to change

Debt Facilities Overview (balances as of 9/11/15)

($ in millions)

Debt Facility Available Weighted Average Weighted Average

Balance Cap Credit Advance Rate Interest Rate Maturity Comments

Advance Facilities

OMART $ 1,262 $ 1,800.0 $ 28 79.3% 1L + 2.0% 10/15/2015 Expected to refinance in September OFAF 225 $ 450.0 61 87.7% 1 L + 2.4% 6/10/2016 VFN: 2016 maturity; Term Notes: 2015 maturity OSART III 51 $ 93.8 19 76.9% CoF + 3.6% 12/22/2015 Expected to refinance in Q4 EBO (Counterparty 1) 47 47 - 79.0% 1L + 4.5% N/A N/A

EBO (Counterparty 2) 18 18 - 87.0% 1L + 5.5% N/A N/A

Subtotal - Advance Facilities 1,603 2,410 108

Warehouse Lines

OLS - Lender 1 32 150 93 100.0% WAC 4/30/2016 2016 maturity

OLS - Lender 2 38 100 66 85.8% 1L + 2.00% to 3.45% 9/29/2015 In process of extending another year HRI - Lender 3 167 200 59 94.5% 1L + 2.00% 8/23/2016 2016 maturity HRI - Lender 4 49 100 9 100.0% WAC 4/30/2016 2016 maturity Liberty - Lender 5 49 100 - 99.0% 1L + 2.75% 5/27/2016 2016 maturity

Subtotal - Warehouse Lines 336 650 227

Corporate Debt

OASIS 101 101 N/A N/A N/A 2/28/2028

SSTL 860 860 N/A N/A 5.0% 2/15/2018 Interest rate excludes impact of fee amortization 6.625% Sr Notes 350 350 N/A N/A 6.6% 5/15/2019 Interest rate excludes impact of fee amortization and rate increase from S-4 filing delay

Subtotal - Corporate Debt 1,311 1,311

Total $ 3,251 $ 4,371

Ocwen Financial Corporation? 7

Cost Improvement Initiative Underway

($ in millions)

Framework Opportunity Areas

Expected savings of at least $150 million in 2016 "Automatic" category: savings which are anticipated to vs. projected full year 2015 operating expenses materialize independent of any management action. Examples include:

Potential Savings Range:

Margin improvement in 2016 vs. 2015

Amortization $60 70 Approach Loan-count driven expenses $20 30

Strategic Advisors ~$25

Established internal targets

No FiServ payments in 2016 $18

Implemented a rigorous Risk Assessment program One-time 2015 expenses $15 25 to assess potential impact of changes on borrowers, regulatory requirements, internal controls and gAction Requiredh category: savings dependent upon finances management action. Examples include:

Identified two categories of savings opportunities Servicing expenses $50 100

"Automatic" and "Action Required"

Employee costs $25 50

Weekly meetings led by CEO & CFO Consulting & Legal $15 30

Infrastructure $10 20

Intend to execute key decisions before end of 2015

The Company is executing a comprehensive cost reduction initiative, however there is no guarantee that it will be able to meet the potential savings ranges highlighted above

Ocwen Financial Corporation? 8

Residential Mortgage Lending Driver of Future Growth

Creating a commercial and operational foundation to enable Ocwen to grow into a top 10 originator with innovative, high margin products

Approach Retail Build-out

Aligning loan fulfillment process across channels, Establishing on-line presence focused on ease of driving quality, speed and cost productivity consumer use and document automation

Improving pricing, cycle time, service and lead Actively hiring and on-boarding sales talent and generation performance equipping them with training, coaching and metrics... rapid results feedback and development

Creating a network of third-parties to allow for nimble pricing and product distribution Driving Lean Six Sigma into process designs for lead generation, distribution, monitoring and consumer

Filling-out product suite to drive partner loyalty, follow-up; "Big Y" = speed to close increased share of purchase market and new product pipeline Including all presently available loan programs with real-time competitive pricing comparisons to drive lead

Executing long-term investments in technology, conversions branding and process re-engineering

Aspiration: Libertyfs proprietary technology + agile pricing + Lean Six Sigma process discipline = speed and cost advantages = Ocwen as Top 10 originator

Ocwen Financial Corporation? 9

Ocwen Investment Thesis

Proven leader in homeownership preservation through loan modifications and lending to seniors; leader in the U.S. Treasury Home Affordable Modification Program completing 20% of all HAMP modifications(a)

Leader in reverse mortgage lending and building a strong foundation for forward mortgage and alternative lending

Turbulence of last ~18 months has helped create a stronger company with intense focus on the borrower experience, regulatory compliance and Ocwen s internal risk and compliance operations

Well capitalized non-bank mortgage servicer that meets all current and proposed capital standards

Actively reducing leverage with proven history of generating substantial cash flow from operations

Experienced Board and Management team with proven track record and commitment to customer service and compliance

Embedded value in Reverse Mortgage Future Draws, MSRs and Deferred Servicing Fees not fully reflected on balance sheet

a) Source: Second Quarter 2015 Making Home Affordable Program Performance Report by U.S. Department of the Treasury; includes 10

Ocwen Financial Corporation? acquired loans

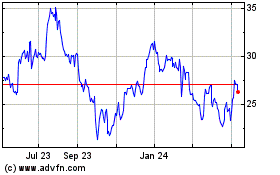

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024