Novartis Warns on Profit as It Boosts Investment in Heart-Failure Pill Entresto -- Update

July 19 2016 - 4:36AM

Dow Jones News

By Denise Roland

Swiss pharmaceutical company Novartis AG cut its profit guidance

for the year as it ramps up investment in its new heart-failure

drug to offset falling sales of cancer blockbuster Gleevec.

Joe Jimenez, chief executive, said he had made a "hard decision"

to boost investment in Entresto by an additional $200 million this

year, a move that could cost the company 1-2% of core operating

income.

"This is absolutely the right thing to do," he said. "There are

two big catalysts for this company over the next two years in terms

of growth. One is Entresto...and I'm not going to let any

constraints minimize the peak sales potential of that brand."

Mr. Jimenez said the extra spend would mostly go into building a

sales force targeting primary-care physicians, who "will need more

education about Entresto."

The company updated guidance to say core operating income could

fall by a low single digit percentage, having previously said it

would be broadly in line with 2015. It held revenue guidance

steady, saying sales would be broadly in line with 2015.

The heart-failure drug, which launched a year ago, got off to a

slow start, reflecting doctors' hesitation to switch stable

patients onto a new medicine and delays in securing reimbursement

from health insurers in the U.S.

But growth is picking up as more insurers have agreed to cover

the drug, and after cardiology associations in the U.S. and EU

updated their prescribing guidelines to recommend Entresto as the

preferred drug in certain patients. Sales of Entresto were $32

million in the second quarter, and Novartis expects the drug to

generate $200 million in revenue for the full year.

Basel, Switzerland-based Novartis said net income was $1.8

billion in the three months to June 30, 3% lower than in the year

earlier period. Core net income, a measure that strips out one-time

gains or losses, fell 5% to $2.9 billion, while revenue dipped 2%

to $12.5 billion, beating analyst expectations of $2.8 billion and

$12.3 billion respectively.

Stripping out the negative effect of the strong dollar, net

income and sales were flat, and core net income was down 2%.

Novartis is under pressure from falling sales of its

best-selling cancer drug Gleevec, which has faced competition from

a cheaper copycat in the U.S. since February when it came off

patent. That dragged sales at the company's innovative medicines

unit down 1% at constant currencies to $8.4 billion, despite a 23%

increase in revenue from Novartis' new drugs.

As well as Entresto, Novartis is counting on Cosentyx, its new

drug for psoriasis and certain rheumatic diseases, to play a key

role in driving growth. That drug generated $260 million in the

second quarter, which Mr. Jimenez said was significantly ahead of

expectations. Another bright spot was Gilenya, for multiple

sclerosis, which increased revenue 17% at constant currencies to

$811 million in the quarter.

The company is also investing heavily in turning around its

eyecare unit Alcon, which is struggling amid intensifying

competition in the contact lens market. Sales at Alcon were $1.5

billion, down 1% at constant currencies, due to lower sales of

contact lenses and surgical equipment.

Sales at its generic drug business Sandoz were up 3% at constant

currencies to $2.6 billion as strong volume growth more than offset

lower prices.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

July 19, 2016 04:21 ET (08:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

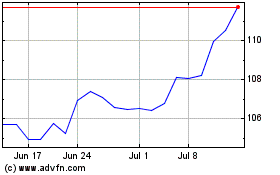

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

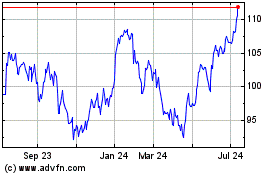

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024