Global Stocks Edge Lower Ahead of U.S. Interest Rate Decision

January 27 2016 - 5:10AM

Dow Jones News

Global stocks mostly edged lower in line with oil prices

Wednesday ahead of the Federal Reserve's first monetary policy

decision of the year.

While no change to interest rates is expected later Wednesday,

the bank's policy statement will be closely parsed to see if recent

concerns around China's economy and falling oil prices have

affected its assessment of the U.S. economy.

The Federal Reserve raised benchmark interest rates in December

for the first time in nearly a decade after ultra-easy monetary

policy had boosted asset prices for several years.

Futures pointed to a 0.8% opening loss for the S&P 500.

Changes in futures don't necessarily reflect market moves after the

opening bell.

The Stoxx Europe 600 was down 0.2% in early trade, as falling

oil prices added to investors' cautious tone.

Brent crude oil was down 1.4% at $31.35 a barrel.

The fluctuating oil price is adding to general uncertainty in

markets, said Michelle McGrade, chief investment officer at

brokerage TD Direct Investing. "Everyone is a little more fearful"

this year, she added.

Earlier, the Shanghai Composite Index closed down 0.5%,

recovering from steep early losses.

Japan's Nikkei Stock Average rose 2.7% as Asian bourses caught

up with Wall Street's gains in the previous session.

A rally in oil prices on Tuesday boosted U.S. indexes, offering

some reprieve from the sharp losses seen earlier in the month.

Stocks around the world have increasingly moved in lockstep with

oil, with many starting to read the low oil price as, in part, a

gauge of the health of the global economy.

The S&P 500 is down nearly 7% this year, despite Tuesday's

gains.

"I'm absolutely perplexed by it," said William Hamlyn,

investment analyst at Manulife Asset Management, which manages $294

billion in assets. "People see oil prices falling and think

deflation," he said, but he believes many companies, especially

airlines and consumer-oriented sectors in Europe, should benefit

from the fall in oil.

In corporate news, Swiss drug giant Novartis AG reported a 57%

drop in net profit for the fourth quarter, weighed down by its

eye-care unit. Shares were down 3.4%.

Meanwhile, late Tuesday, Apple Inc. said iPhone sales grew at

the slowest pace since their introduction and forecast a decline in

revenue in the current quarter. Shares fell in after-hours

trading.

In currencies, the dollar was little changed against the yen at

¥ 118.2490, while the euro was up 0.1% against the dollar at

$1.0870.

Gold was down 0.2% at $1118.40 an ounce.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

January 27, 2016 04:55 ET (09:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

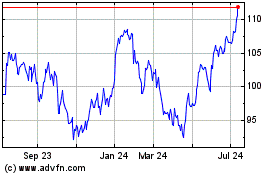

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

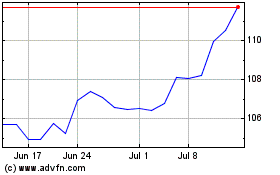

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024