CEOs Sanguine on M&A Prospects in Spite of Markets Dive --Update

January 22 2016 - 11:53AM

Dow Jones News

By Dana Cimilluca

DAVOS, Switzerland--Prospects for deal-making remain bright, the

chief executives of some of the world's biggest companies said, in

a sign that market turmoil may not derail the

mergers-and-acquisitions boom.

The heads of Cisco Systems Inc., AT&T Inc. and Novartis AG

indicated they or others in their respective industries will likely

continue hunting for deals, even after stock and other markets

dropped precipitously this year.

"I do think this is going to be a year of increased

consolidation," Joseph Jimenez, CEO of drug company Novartis, said

in an interview at the World Economic Forum's annual event here.

Novartis itself is targeting smaller deals, of around $2 billion to

$3 billion, he added.

Chuck Robbins, chief executive of Cisco, the acquisitive

networking giant, said the recent market swoon presents a buying

opportunity.

"Frankly, for us, as someone who has leveraged M&A activity

as we've expanded into other markets, when valuations become more

realistic as a strategic buyer, then that's positive for us," Mr.

Robbins said in an interview here.

The opportunity extends to venture-capital-funded tech

companies, he said, the number of which sporting billion-dollar

valuations has surged in recent years.

"If you look at particularly the private market in Silicon

Valley, it had gotten fairly rich," Mr. Robbins added. "These

things are always cyclical and I think that we've seen the cyclical

side where the markets have gotten a little tougher and it's

created some downward pressure on some of those valuations."

He wasn't specific about any companies Cisco, which has a $116

billion market value, may be targeting, though he said data

analytics and security are areas of interest.

Meanwhile, AT&T Chief Executive Randall Stephenson in an

earlier interview also sounded a note of optimism. AT&T, the

largest U.S. telecommunications company by revenue and also one of

the biggest corporate acquirers historically, notched some $85

billion of takeovers last year, including the completion of its $49

billion combination with satellite-television provider DirecTV, two

deals in Mexico and the purchase of $18 billion in wireless

spectrum for video use, he said.

"The industry is going through a lot of change and when an

industry goes through change, the parts move around and M&A

does tend to happen," Mr. Stephenson said. "The industry hasn't

finished changing. It's going through some serious and significant

changes on both the media and content side as well as the

distribution side."

Healthcare was the most active sector for M&A last year,

followed by technology, with companies in the industries striking

$704 billion and $615 billion of deals, respectively, according to

Dealogic. In all, companies around the world struck about $4.7

trillion of mergers, more than in any other year. Bullish comments

from chiefs in industries that have been the most active in M&A

could bode well for deals at a time when steep declines in stocks,

commodities and other markets have raised questions about whether

the M&A boom is sustainable.

Not every corporate chieftain is expected to continue to prop up

the M&A market. Bill McDermott, chief executive of SAP AG, said

the big software maker's focus is on integrating prior acquisitions

rather than striking big new ones.

"We don't need big-scale M&A," Mr. McDermott said in another

interview here, citing the complexity and cost of large deals.

"Even if there was a great target out there -- and there isn't one

for us--you have to make sure there's mindspan for it."

Sam Schechner and Rebecca Blumenstein contributed to this

article.

Write to Dana Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

January 22, 2016 11:38 ET (16:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

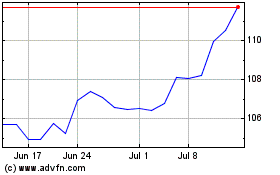

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

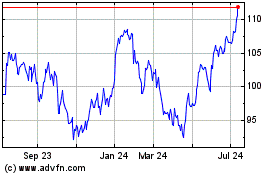

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024