U.S. Stocks Fall as Oil Keeps Sliding

December 07 2015 - 3:53PM

Dow Jones News

By Dan Strumpf And Riva Gold

U.S. stocks fell Monday, led lower by a selloff in energy shares

as oil prices plumbed new lows.

The Dow Jones Industrial Average lost 149 points, or 0.8%, to

17698. The S&P 500 dropped 0.9%. The Nasdaq Composite declined

0.9%.

Energy companies posted the sharpest losses among major sectors,

with energy stocks in the S&P 500 shedding 4.1%.

Crude-oil futures in New York lost 5.5% to $37.77 a barrel

following last week's meeting of the Organization of Petroleum

Exporting Countries. The cartel ended its meeting with no agreement

to cut production.

In the Dow, Exxon Mobil and Chevron posted the sharpest

losses.

"Oil down in the $38 range is the bulk of what you see

equity-market weakness from," said Michael Antonelli, equity sales

trader at Robert W. Baird."You've seen a lot of people over the

last three or four months looking for a low in energy, but it just

remains elusive."

Stocks rose sharply last Friday after a stronger-than-expected

U.S. jobs report helped cement expectations that the Fed will start

raising rates at its Dec. 15-16 meeting.

The Dow industrials rose 2.1% to cap a tumultuous week, pushing

the index back into positive territory for the year.

On Monday, stocks in Europe pared their earlier gains. The Stoxx

Europe 600 Index edged up 0.5% after rising more than 1% earlier in

the session. Stocks there fell late last week after the ECB

announced less aggressive stimulus measures that left many

investors disappointed.

ECB President Mario Draghi sought to reassure investors on

Friday that the central bank would "no doubt" step up its stimulus

program if needed. The comments came after European markets closed

for the weekend.

The losses in European stock markets on Thursday and Friday

"reflected a massive overreaction" to ECB policy, said Ben Kumar,

investment manager at Seven Investment Management, noting the bank

still cut rates and extended its stimulus program.

"I think everyone believes payrolls data Friday was the last

thing that could change the Fed's mind," Mr. Kumar said. "We're all

set for a rate rise."

The euro was down 0.3% against the dollar. It had surged after

Thursday's ECB announcement.

Shares of Chipotle Mexican Grill Inc. fell 2.4% after the

restaurant chain said late Friday that its recent E. coli outbreak

would cut deeply into sales and earnings from the current

quarter.

Keurig Green Mountin Inc. shares soared 73% after the maker of

coffee pods and machines agreed to be bought by an investor group

led by JAB Holding Co. for $13.9 billion, a sizeable premium.

While ultralow interest rates have boosted equity markets in

recent years, investors have been reassured by comments from Fed

Chairwoman Janet Yellen suggesting monetary policy in the U.S. will

tighten at a gradual pace.

"The Fed is still pretty dovish," said Sanjiv Shah, chief

investment officer at Sun Global Investments. The jobs report left

investors thinking that the U.S. economy was doing reasonably well,

Mr. Shah said, but noted that Ms. Yellen has signaled policy will

still normalize slowly.

Japan's Nikkei 225 Stock Average joined the rally on Monday to

close 1% higher.

Concerns about Chinese data due later in the week and a fall in

energy stocks kept a lid on gains elsewhere in Asia. Australia's

S&P/ASX 200 ended 0.1% higher and the Shanghai Composite added

0.3%.

Gold declined 0.8% at $1,075.30 an ounce.

Write to Dan Strumpf at daniel.strumpf@wsj.com and Riva Gold at

riva.gold@wsj.com

(END) Dow Jones Newswires

December 07, 2015 15:38 ET (20:38 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

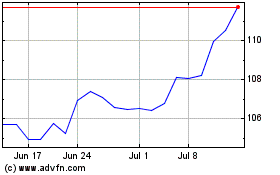

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

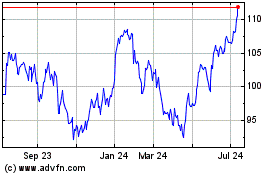

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024