Low Electricity Prices Dim Power Plant Operator Profits

November 04 2016 - 11:47AM

Dow Jones News

By Cassandra Sweet

Low electricity prices are making it less profitable to be a

power plant operator.

Companies that sell electricity to utilities, such as Dynegy

Corp., Calpine Corp and NRG Energy Inc., reported slim profits or

losses in the third quarter compared to the same period a year ago,

as they continue to be battered by wholesale power prices that have

fallen in recent years along with prices for natural gas.

Average wholesale electricity prices have dropped 15% this year

to $29.70 a megawatt-hour, according to a Wall Street Journal

analysis of power market data from the Energy Department. That is

43% below the 2014 average.

On Friday, NRG reported a quarterly profit of $393 million,

compared to $67 million a year earlier. After adjusting for a $266

million increase from asset sales and other one-time items, net

income declined $203 million, due to lower energy margins and costs

related to paying down debt. Revenue was $3.95 billion, down from

$4.43 billion a year earlier.

"Our generation business performed well during some very

challenging market conditions," NRG Chief Executive Mauricio

Gutierrez said during a conference call Friday with analysts.

NRG's shares traded up 10% higher Friday morning at about $11.10

after its results beat analysts' expectations, but are down 5%

year-to-date.

Dynegy on Tuesday posted a quarterly loss of $249 million, on

$1.18 billion of revenue, compared to a $24 million loss on $1.23

billion in revenue a year earlier. Calpine last week reported net

income of $295 million, up 8% from the previous year, on revenue of

$2.36 billion, but its profit for the first nine months of the year

net was just $68 million, down 76% from the previous year.

"It's an adverse environment because of the low gas prices, and

it's aggravated by the growth of renewables," said Hugh Wynne, an

analyst at investment research firm SSR LLC in Stamford, Conn.

Dynegy, which owns about three dozen coal and natural gas-fueled

plants across the U.S., aims to navigate the low prices by buying

plants and streamlining operations. It is also ramping up lobbying

efforts with state and federal regulators, and lawsuits, to

preserve competition in the power markets, Chief Executive Bob

Flexon said.

Those efforts include opposing a plan New York officials

approved last August to provide subsidies to money-losing nuclear

power plants to keep them operating.

"You've undermined wholesale price formation because out-of-the

money assets are given billions of dollars to stick around," he

said of the subsidies. Shares of the Houston-based company have

dropped 38% year to date, to about $8.39 on Friday.

Exelon Corp. has been faring better than some rivals since it

also owns regulated utilities. They have more stable profits,

because utilities can pass on their costs to their customers in the

form of higher rates and can usually rely on a guaranteed rate of

return on their investments. Shares of Exelon were trading Friday

at about $32.83, up about 18% this year.

But while the company last week posted a higher third-quarter

profit overall, its ExGen commercial power generation unit reported

net income of $236 million, 37% less than a year earlier.

"We're not happy with the outlook that we see at ExGen," Exelon

Chief Executive Christopher Crane said last week during a

conference call with analysts.

Power plant owners that don't own utilities, such as Dynegy and

Calpine Corp., have had a tougher time.

Calpine, which owns several dozen gas-fired power plants, peaker

plants and geothermal power generators, narrowed its full-year

guidance range for adjusted earnings before interest, taxes and

other items to between $1.8 billion and $1.85 billion, from $1.8

billion to $1.95 billion. Calpine's shares are down about 21% year

to date, at about $11.43 Friday.

"The wholesale power markets have disappointed in 2016," Calpine

Chief Executive Thad Hill said during a conference call with

analysts last week. He added that he expects wholesale prices will

begin to rise as early as next year in some areas, as more

companies shut unprofitable power plants and electricity supplies

get tighter. "There is a reason to believe in recovery."

Write to Cassandra Sweet at cassandra.sweet@wsj.com

(END) Dow Jones Newswires

November 04, 2016 11:32 ET (15:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

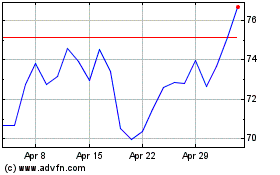

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Aug 2024 to Sep 2024

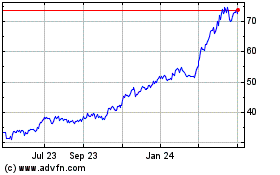

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Sep 2023 to Sep 2024