NRG to Reduce Debt, Cut Costs

September 18 2015 - 11:20AM

Dow Jones News

Power producer NRG Energy Inc. on Friday unveiled a series of

moves to cut down on debt, buy back shares, and raise cash through

an asset sale, as the company faces pressure over its expensive

clean-energy businesses.

NRG said it has agreed to sell a 75% stake in its portfolio of

wind farms to its majority-owned affiliate company, NRG Yield Inc.,

for $210 million. NRG has been able to "drop down" projects with

long-term, predictable cash flows to NRG Yield.

Separately, in an investor presentation, NRG said it plans to

spend $1.3 billion on reducing debt and buying back shares through

2016, including $250 million in share repurchases this year.

It also plans to cut $150 million in costs starting next

year.

Shares of NRG, down 31% this year, fell 3.7% to $18.47 a share

in early trading. NRG Yield shares ticked up 0.6% to $14.96 a share

after losing 34% of their value this year.

NRG, the nation's largest independent power producer, has

recently moved to adopt a greener business model in recent

years.

Once known for coal and nuclear generation, NRG is now a leader

in the development of renewable power ranging from gigantic wind

farms to rooftop solar panels on individual suburban homes.

But the company's corporate structure has grown complex and its

balance sheet bloated, while its "green" businesses have been

expensive.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 18, 2015 11:05 ET (15:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

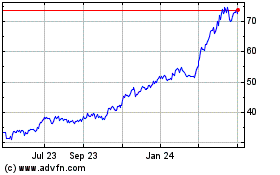

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Aug 2024 to Sep 2024

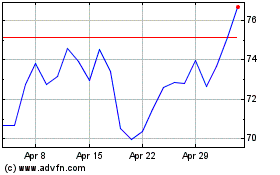

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Sep 2023 to Sep 2024